Money Meets Medicine Podcast

Tax Loopholes for Doctors

How Doctors Can Reduce Taxes

We obviously are not accountants (or maybe not so obviously, so we need to mention that now). This is just for educational purposes, but definitely, an important topic to discuss given the number of doctors out there looking to for tax loopholes for doctors (aka save money on your taxes).

The First Thing About Tax Loopholes for Doctors

There are no real loopholes for doctors, but there are great ways to reduce your taxes. The first thing to reduce your taxes as a doctor is that you want to make sure to max out your tax-advantaged accounts.

Some great accounts to max out every year include your:

- 401K/403B

- 457 (if it is a governmental 457 or a good non-governmental 457)

- Health Savings Accounts

- Some states offer state tax advantages if you use their 527 as a citizen of that state.

- Backdoor Roth IRA and Megabackdoor Roth (these equate to saving money in taxes later)

Note: You likely have a 401K or 403B set up (and hopefully are maxing it out), but you may not have a 457. If you need more information about a 457 so you can decide if this investment vehicle is right for you, you can learn more about it here.

The Second Thing About Tax Loopholes for Doctors

Once you have maxed out the accounts mentioned above (if you didn’t do that for this tax year, start planning now to do this for the upcoming year), you want to look at how you can get more than the standard deduction.

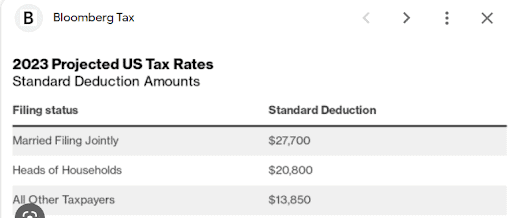

Here are the 2023 standard deductions:

How do you do this? Choosing to itemize your taxes will help you reach this goal to to get more than a standard deduction (a tax loophole for doctors, you could say).

There are many things you can itemize on your taxes, but we wanted to share some of the typical itemized savings for high-income earners. The three most common are SALT – limited to $10,000 per year, mortgage interest, and charitable deduction/giving.

SALT stands for State and Local Tax deduction. A few years ago they put a maximum of the amount you can write off per year, but it is still important to write this off! You can deduct what you have paid in certain state and local taxes. This SALT deduction includes property, income, and sales taxes.

Tax Loopholes for Doctors: Tips And Tricks

Now there are some additional tips and tricks to reduce your taxes as a doctor. These tax loopholes for doctors will help save you money.

Alternating Charitable Giving

We mentioned this above as one of the areas you should itemize, but really wanted to expand on it here. If you are giving charitable donations that put you over itemized deduction, but remaining tax deductions won’t put you over then you can alternate years.

So, say, for example, you are married and have no mortgage (you are renting or the house is paid off), and you donate $20,000 per year to charitable giving.

If you simply donated the $20,000 per year and had a SALT tax limit of $10,000 – over a 4-year period you would be able to deduct $30,000 x 4 = $120,000 from your gross income.

But let’s say you ALTERNATE charitable giving years and do double the charitable giving in years 2 and 4, and take the standard deduction in years 1 and 3. Then this is what it would look like:

Year 1 = Take standard deduction = $27,700

Year 2 = You double up on charitable donates for two years → SALT $10,000 + $40,000 in charitable giving = $50,000 deduction

Year 3 = Standard deduction = $27,700

Year 4 = You double up on charitable donates for two years → SALT $10,000 + $40,000 in charitable giving = $50,000 deduction

So, now instead of reducing your gross income by $120,000 over a four year period, you are now reducing it by $155,400. That’s an additional $35,400 that won’t be taxed.

The main point here? Depending on your tax situation, alternating charitable giving every other year may reduce your gross income and tax liability.

Tax Loss Harvesting

If you have a taxable or brokerage account, whenever the market goes down, you have the opportunity to take a “paper loss” on your investments if you sell them and immediately buy something that is not “substantially identical.”

So, for example, in 2022, I sold my VTSAX total stock market index fund and immediately purchased the S&P500 index fund.

Because of this, I reduced my tax liability by $3,000 in 2022. This is called Tax Loss Harvesting because you are switching to another fund that still fits your goals but is not identical.

Some important things to know about tax loss harvesting is:

- Money is never out of the market, so no timing involved

- The maximum you can reduce your taxes is by $3,000 per year, but it carries over to following years

- You need to be aware of WASH sales which will decrease the benefit of doing tax loss harvesting so make sure to read up on that or consult your accountant

All of this is to say that, you can use your brokerage account to reduce your taxes.

Before we totally sum up the ways you can save money on your taxes, I wanted to note one more tax loophole for doctors that you might be able to use. If you run your own business or own real estate that you rent out, there are other great ways to reduce your taxes as a physician.

We won’t be diving into real estate here, but there are entire podcasts just on real estate that can support you, like the Real Estate Professional Status. You will learn about the short-term rental loopholes and how accelerated depreciation on real estate investments can help you reduce your taxes.

There you have it. All of the tax loopholes for doctors that you can utilize to reduce your taxes this year.

Subscribe and Share

If you love the show – and want to provide a 5-star review – please go to your podcast player of choice and subscribe, share, and leave a review to help other listeners find The Physician Philosopher Podcast, too!

You might also be interested in…

Following the Financial Crowd

Have you ever left a sporting event, following the crowd, and suddenly realized you were walking the wrong way? What if I told you this phenomenon has a name, and it impacts your money, too?

Understanding our own behavior when it comes to finance is essential because it helps us mitigate wrong-for-us decision making around money. Unless you know these roadblocks exist, you can’t do much to stop them from derailing your financial goals.

Last week, we shared why human behavior matters for our financial lives by taking a look at the first 5 out of 10 psychological phenomena that can (and do) affect your personal finance goals: greed, fear, ego/overconfidence, loss aversion, and analysis paralysis.

This week, we’re diving back into behavioral finance (one of our favorite topics) to share five more types of unchecked human behavior that can sabotage your journey to building the wealth you want.

Greed, FOMO, and Bad Investments

Despite our best intentions, certain emotions can keep us from building wealth. After many years arming physicians with the information they need to achieve financial wellness, I had a significant realization.

Information is one thing – behavior is another.

As the saying goes, money is 80% behavior and only 20% math.

Not only do I want to share important information about personal finance, I also want to help you recognize how certain behaviors can (and do) affect your finances.

Drawing from one of the classic books about investing, let’s go over five common behaviors that could be keeping you from achieving your financial goals.

How Doctors Can Get Good Financial Advice

Many doctors and high-income professionals hire financial advisors for any number of reasons. Either they’re too busy to handle their finances themselves, they don’t really know how to invest, or they want an expert on their side to make sure they’re on the right track.

So allow me to say from the start: I’m not against financial advisors, but I am against doctors (or anyone, really) being overcharged for bad advice.

There’s no shame in asking for help – you just want to get the help you need at a fair price.

You should be equipped enough to vet and evaluate your financial advisor so you’ll know whether they’re working well on your behalf. How can you be as confident as possible they’re acting in your best interest? This episode will help you find out.

Are you ready to live a life you love?

© 2021 The Physician Philosopher | Website by The Good Alliance

0 Comments