Many doctors who work for a not-for-profit institution or the government have access to a 457 plan. It is possible that this is why I am often asked, “Hey, Jimmy, should I invest in my 457 plan?” It seems like this should be an easy answer. Unfortunately, that’s not the case. While a 457 plan has some great features – like being able to use a 457 in early retirement without the 10% penalty a 401K experiences if utilized before 59 1/2 years old – whether you should use it or not is complicated. It’s just not as easy as whether or not you should invest in your 403(b) or 401K.

If you are asking if you should use your 457, this is the post for you.

What is a 457 Plan?

Just like any other retirement plan, this comes from the part of the IRS tax code that bears its name. In this case, that is section 457 for deferred compensation plans. A “deferred compensation plan” allows you to make pre-tax contributions and will allow your earnings to grow tax-free while in place. You “defer” this compensation until some point in the future.

There is an important distinction, though, and I am going to make it early. There are two ways you can qualify for a 457.

The first is that you work for the government and are provided a governmental 457. The other way you can have access to a 457 is through a non-governmental employer, which grants you access to a non-governmental 457.

While the governmental and non-governmental 457s have some similarities, there are also some very important differences. This post will help you sort it all out and give you a clear answer on whether you should use your 457 plan or not.

The following are some details that are similar to both a governmental and non-governmental 457 (NG-457) to help you determine if you should invest in your 457.

All 457 Plans Have These Features

For 2023, the contribution limit for 457 plans is $22,500. For some over the age of 50, you may be able to contribute more (typically if within three years of the retirement age for your plan).

Another feature of all 457s is that they may be transferred from one 457 to another (governmental to governmental; non-governmental to non-governmental). However, the receiving plan must accept transfers.

You must take distributions from your 457 by April 1st following the year of your retirement or by age 70.5 years old (whichever happens later).

Governmental 457s Versus Non-Governmental 457s (Reference IRS publication)

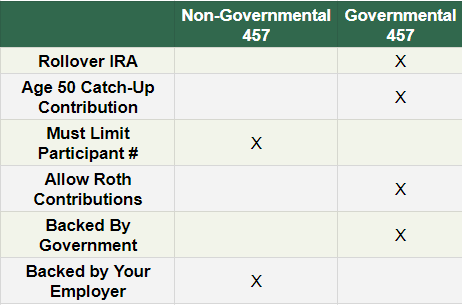

While some of the similarities discussed above do exist, governmental and non-governmental (NG) 457s also have some major differences:

Here are the major differences between governmental and non-governmental 457 plans from illustrated in the graphic above:

- Governmental 457’s may be rolled over to eligible retirement plans (i.e. Rollover IRA’s). NG-457’s cannot be rolled into an IRA.

- Age > 50 catch-up contributions are only available for governmental 457s.

- NG-457’s are “Top-Hat” plans and must limit the number of people who can participate to “groups of highly compensated employees or groups of executives, managers, directors or officers.”

- Governmental 457’s often allow Roth contributions. NG-457’s do not allow Roth contributions…otherwise, this would be a great way to avoid the possible tax consequences of bad distribution options, which are discussed more below.

- This is the most important difference: Governmental 457s are backed by the US government (NG-457s are backed by individual institutions and are available to creditor’s upon legal action or bankruptcy).

On that last point, here is the exact wording from the IRS on non-governmental 457s:

“[Non-governmental] Plan assets are not held in trust for employees, but remain the property of the employer (available to its general creditors in the event of litigation or bankruptcy)….Employees are lower in priority than general creditors in the event of legal claims against the employer.”

To put this plainly, this means that if your institution goes bankrupt or litigation trouble, your hard-earned retirement money is available to creditors. Said differently, they can take that money and give it to someone else.

This is very different from your typical 401K or 403B which is not only protected from employer litigation but often protected even in most personal litigation (i.e. medical malpractice cases).

Should I Invest in My 457 Plan?

There are certain tax benefits associated with participating in a 457. This includes being able to contribute pre-tax money to decrease your overall tax burden. The gains also grow tax-free. Your only taxation occurs when you take it out. This is similar to your standard (pre-tax) contributions to a 401K and 457.

If you have a governmental-457, this is backed by the government. If the government defaults, the entire global economy would collapse.

This provides some comfort for those with a governmental 457. In fact, I would argue that you could view a governmental 457 as a second 401K or 403B. It’s just as safe and provides many of the same benefits. Congrats, if you have one! Don’t think twice. Use it.

For example, my wife was previously employed as a full-time educator. So, while she had access to a 401K, we preferentially placed our pre-tax investments into her governmental 457, which can be used in early retirement, unlike a 401K.

Non-Governmental 457’s Are Not the Same: What You Should Consider

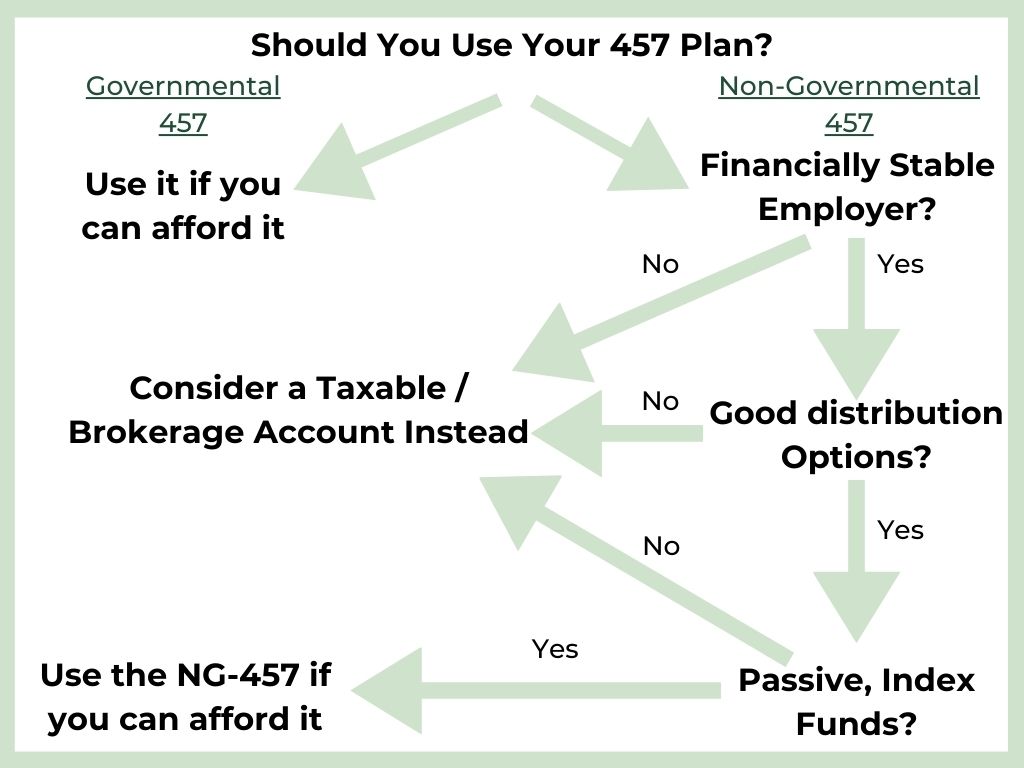

We have already highlighted some of the differences between a governmental and a NG-457s. If you have a governmental 457, go contribute if it has good investment options. It really is that simple.

On the other hand, If you have a NG-457, you need to make sure your specific plan doesn’t have the following three problems before participating. Going step-by-step through this will help you answer whether you should invest in your 457 or not.

Remember, you are comparing investing in a NG-457 to a taxable/brokerage account where you’ll be paying taxes on the gains. So, if any of the following steps look problematic, I’d recommend you consider investing in a taxable account.

Step #1: Employer/Institutional Finances

Remember, your NG-457 money is available to creditors.

Combine this with the fact that most of us do not have inside information on our employer’s financial situation, it makes for an uncomfortable and potentially sleepless situation.

Before you contribute to your NG-457, you should be intimately familiar with your employer’s financial situation. What’s their bond rating? How much cash on hand do they have? Have there been any recent changes that would lead you to believe there are financial troubles?

If so, it is time to avoid your NG-457 plan. If you feel that your employer’s financial situation is healthy as a horse, then proceed to Step #2.

Step #2: Check the Distribution Options

Distribution options are sometimes terrible inside of a 457. You cannot contribute via Roth to non-governmental 457s. Therefore, if your distributions are less than optimal, you may have to foot a huge tax bill if you leave your employer.

For example, many 457 distribution plans require you to take the lump sum upon leaving. That’s a huge loss to taxes. Who wants to pay taxes on an additional $250,000-500,000 when you retire or leave your employer? Particularly if it bumps you into the next tax bracket.

That’s what happens if you are forced to take the lump sum. So, if the lump sum is the only option, consider using a taxable account instead.

However, if your plan allows you to take your distribution over a number of years, this is preferable in order to decrease the tax burden you might experience.

In order to know the specific options your 457 offers, request the plan documents and read them thoroughly. They are required to provide them should you ask. Make sure you understand exactly what is being offered.

Step #3: Check the Investment Options

Some 457 plans only have high-expense ratio funds, and nothing else. If this is the situation, don’t feel forced to take advantage of the tax savings just to turn around and invest in bad funds.

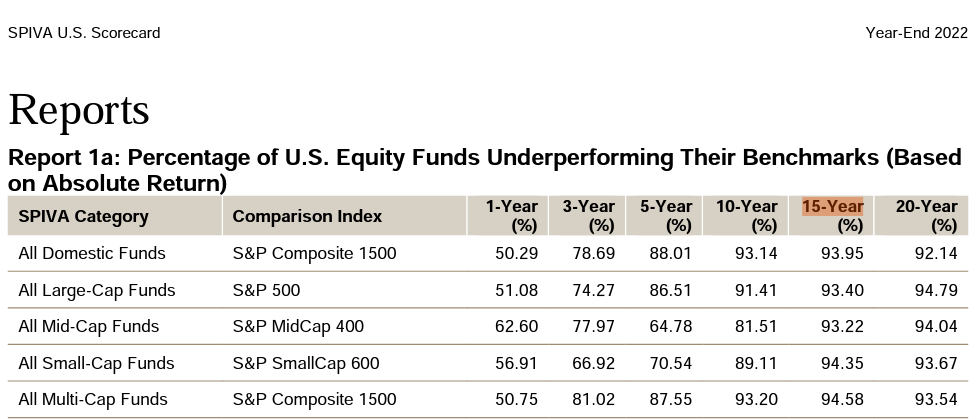

For example, let’s say that your 457 plan only offers actively managed mutual funds with an expense ratio of 1% (you can think of this as what it costs to “manage” the fund). Let’s compare this to a passively managed index fund which has an expense ratio typically 0.1% or less.

That’s a 0.9% difference. Let’s say that you plan to invest $22,500 per year for 30 years. If you were to get 8% with an index fund an expense ratio of 0.1%, you actually get 7.9% returns annually. Your annual investment of $22,500 would turn into $2.5 million.

If, instead, you invested in actively managed mutual funds, this would reduce your returns by 0.9% (the difference between the active and passive funds). Instead of $2.5 million, you’d now have only $2.125 million.

This is why passively managed index funds have been shown to beat actively managed funds more than 90% of the time after just 10 years:

For this reason, if your 457 plan only offers expensive actively managed funds, just take your $22,500 home, pay the taxes, and invest in a taxable brokerage account instead.

However, if your plan has low-cost index fund options, and the first two steps haven’t tripped you up, it’s definitely worth considering the use of your NG-457 plan.

Take Home: Should I Invest in my 457 plan?

If you have a governmental 457

The answer is easy. If you have the income, then you should participate. You can view this as an extra 401K/403B.

After you fill up your 401K/403B, the governmental 457 should be the next retirement space you fill up. If you have room after that, then a stealth (HSA) IRA and backdoor Roth IRA are your next bets. Then a taxable account. Governmental 457’s make life easy.

If you have a non-governmental 457

All of the following assumes that your 457 has good options in which to invest (i.e. low expense-ratio passively managed index funds).

The answer becomes more complicated. The one thing that I can tell you that no one would disagree with is that you should be intimately familiar with your employer’s 457 plan. Ask for it. They are required to give it to you by law.

Depending on your goals, you may want to consider contributing to your other investment accounts available to you first (e.g. 401K/403B, stealth (HSA) IRA, cash balance plan, backdoor Roth, etc) before you consider a non-governmental 457.

That said, if you are happy with your employer’s financial situation, the NG-457 offers good investment options, AND the distribution options are reasonable… then this may be a good way to fill the gap before age 59.5 when you can access your 401K/403B.

Hi TPP! This is a great review of 457’s and the distinction between the governmental and non-governmental variety.

I would also like to note the potential advantage of withdrawing from your 457 account penalty free (unlike 401k or 403b) if a person separates from their employer early. This could be useful for early retirees who want to access their money before 59 1/2.

And I totally agree with you… if you have a governmental 457 available, it’s a no brainer… do it! Just like you, my wife contributes to her governmental 457 (she’s a state prosecutor). Between maxing out this account and her 401k, it’s allowed us to save a lot for retirement (and shelter a lot from taxes). In fact, her entire paycheck earlier this year (pre-maternity leave) was used to fund both accounts so we will be minimally taxed on her income :).

Absolutely agree Dr. McFrugal! I plan on using my 457 to gap my early retirement and have a post on covering that gap coming out in the next couple of weeks actually. Great minds think alike!

And congrats again on your beautiful baby!

Yes! The penalty-free, easy withdrawal options of my 457 make it an important part of my FI plan!

Thank you for explaining the difference between G and NG 457 plans! I am a teacher and have a governmental plan, but my investment options are not ideal–the providers I can select from are all insurance companies that have high or hidden fees and probably surrender charges. Providers are AIG Retirement Services (VALIC), National Life Group, Nationwide Insurance Company, Orion Portfolio Solutions, Pacific Life, Security Benefit Group, or VOYA Financial.

Do you take the same stance as you do for the NG 457 in that I should just pay my taxes instead of going with a provider that charges high fees?

That is a tough spot to be in, though I understand. My wife is a teacher, too.

In NC she has access to a 403B, 401K, and a 457. I would preferentially fill up the 403B and 401K FIRST before ever considering a 457 like the one you described, even if it is governmental.

If you’ve already done that (or don’t have those options) I would preferentially fill up a Roth IRA before investing in that 457. Then, I’d dig into the various funds offered and avoid ones with loads and high expense ratios.

I’d also consider buying a steak dinner for whoever decided your retirement options where you are asking them if they could make low cost index funds available 🙂

Of course, I don’t know your exact situation. So, the above are all just ideas to consider.

TPP

Wow! 403b, 401k, and 457?! I should consider moving to NC 🙂 Seems like you guys value teachers more there than here in CA. I have been urging CalSTRS to lobby my district to add CalSTRS as a provider but they are all dragging their feet. Maybe it’s time I offer the steak dinner 😀 or try reaching out to Vanguard and Fidelity first.

Thank you for your thoughts on the order of plans in which to contribute! I currently max out my 403b and Roth, but have not touched the 457 for fear of getting caught in a trap.

Thank you 🙂

I went back and forth, literally, in the past 5 years. Some years I did and some I didn’t contribute to my non-govt 457. I am privy to the financials and we are super solvent so I’m not worried. However, I’m leaving this year and will need to take a distribution, leave it or take it over 5-10 years. My new employer has non-govt 457 but doesn’t accept transfers.

It’s got about 36K so I’m just gonna take the lump sum next year. Taking over 10 years makes more sense financially but I don’t want to keep track of it over 10 years. I’ll take the tax hit 2018. I’m going down a bracket with the new code and new job so it’s not terrible.

In retrospect I would not have contributed. They plans are not transparent and the rollover options are unknown until new employment is secured. However, if I retire early the 456 is the first money to take. As I might RE, I will be doing another 457 next job. Tax tail wagging? Maybe… but my bracket is soooo high I can’t help myself.

Yeah, that’s exactly what I plan to do with my 457. Use it to bridge the gap to 59.5 when I can use my 403B. Have a post coming up on bridging this gap.

It is tough to decide because no one knows what the future holds. Will you change employers? Will your employer’s financial situation change?

Like poker (and life) you just have to make the best decision you can with the information you have at the time. You can’t judge your result based on the result.

Very informative post. I have the option to contribute to a 457 plan as a library employee.

Awesome. Do you take part in it? Why (or why not?)

After looking at the expense ratios, I opted to contribute to a Roth IRA instead. I cannot recall the exact percentage but I know the ratios were pretty high.

Got it. Makes sense to me.

I’m now maxing out my governmental 457, as a State govt employee. The tax benefits have been great, and it allows me to painlessly saved 30%+ of my income straight off the top. The biggest benefit is the ability to access the money penalty-free before 59.5, since many government employees are retired from service long before that age (police and fire, especially). I wish I could roll it over to Vanguard but I don’t see where they host 457 plans, so I’ll keep it with Voya.

It’s great that you can roll it over at all since it’s a governmental. My non-governmental 457 is not allowed to do that.

Have you looked to see if other big companies outside of Vanguard (Fidelity, Schwab, etc) allow 457 roll overs?

I, too, love the fact that you can access it in early retirement without getting hit with the 10% penalty.

Well I haven’t researched it much at all because my plan does not allow in-service withdrawals or rollovers, but I am separating from service to take a new job soon (within a few weeks!) so I will be looking into it more very soon. I literally just got the offer between posting the earlier message and your reply 5 minutes later 🙂

Well that’s great news. Congrats on the new gig!

How did you like your 457 plan with Voya? I would like to contribute to my governmental 457, but I generally don’t trust life insurance companies for investing. Did you experience high or hidden fees or surrender charges? Was it better overall to contribute and take the fees instead of not contributing at all to a 457? Thank you and congrats!

The 457 with Voya had cheaper options than my current 457 plans in a local government with ICMA-RC and Nationwide, so I’ve left my money there. For example, I have a Target Date fund with 0.16% fees in Voya, but the cheapest S&P500 fund at Nationwide is 0.54% and Russell 3000 fund is 0.92% at ICMA-RC.

Good to know! Thank you!

I would also add pausing if the investment options are just terrible. Its been a while since I’ve looked at a 457, but sometimes they are provided to governmental entities by insurance companies, causing some high all-in fees that can eat away at what were your up front tax savings. Its not always a good idea to invest in every tax free plan available.

Completely agree. Good point.

A couple of questions I’ve had a hard time finding answers to:

1) What if your company is bought out by another company and the acquiring company doesn’t have a 457 or decides not to continue it?

2) I’ve asked our HR person about timing of distributions if I leave the company and she replied that I can choose the distributions to start at any date, not necessarily the date I leave the company. But this seems to run counter to this article. What’s the right answer? Is it plan-dependent?

1) not sure about this one, but given that your 457 was being run by a company of some kind (TIAA, Transamerica, etc) I imagine you’d have similar options to when you left the employer. Otherwise it might be plan dependent.

2)I think it is plan dependent. I do know that some employer’s will let you keep your money in the 457. This would not be appealing to me as I would be pretty far away from what is happening there after I leave. I would want to take the money a

s soon as possible while minimizing my tax burden. The entire time it is there it is available to creditors.

Nice post! It was interesting to see the comparison as well as what to watch out for with non-governmental 457 plans.

I have a government 457 plan, and I’m currently in year 2 of maxing it out. I’m in the over 50 group that didn’t contribute enough in the past. Being able to now put in $37,000 per year is fantastic!

Nice! That catch-up contribution is great for people in your situation. Smart move there.

Thanks for stopping by!

Seems like the best reason for ng-457 is early retirement. But I was surprised to read about rule 72(t). That rule seems to make the ng-457 less valuable, but I do hold one of these 457 and just cannot help using it as a tax deduction. I paid 21% in effective tax this year. I see that as a 21% instant ROI. My company is very large though, so that helps me sleep a little. And for those that will talk about my taxes in retirement…I would direct you to WCI. Because I expect to be very judicious in my withdrawal method and pay very little, see his article.

https://www.investopedia.com/terms/r/rule72t.asp

That seems like a reasonable way to look at it. I think if you have good investments and distribution options a 457 is very reasonable (if you believe your company isn’t going under).

Thanks for the post. Got super excited when I found out my first job would have a 457, but WCI’s article and yours kinda deflated the balloon. I don’t know what the funds are yet, but non-governmental and lump sum as the only distribution option seems to make it a non-starter for my personal situation. Too bad.

Sorry to be the bearer of bad news, but glad you won’t get slammed with 40% taxes when you finish your career at that employer!

TPP

I put in max ng-457 contribution for several years and have 200k in there. I stopped contributing about 2 years ago. Plan to retire at 65 in two years and was going to take out as lump sum the year after just because of the creditor exposure. From a tax standpoint I should probably withdraw over 5 years, but not comfortable with 10 years which is also available. Also cognizant of current tax structure that will probably change after 2024. So I go back and forth between lump sum and 5 years. Since I plan to delay Social Security until 70, the 5 year plan sounds more rational to bridge 65-70 along with some taxable accounts. I will have to assess the financial health of the company when time comes. I didn’t contribute for several years because of risk but then I was hit with AMT and just wanted to reduce my taxable income.

Thanks for the info! Helpful!

FYI, the three year catch up is double the annual max contribution, so $38k for 2019. My husband is doing this in his government 457 plan.

38k would be a sweet tax shelter there!

Great post. When I got my first job, I called HR to ask about the ng-457. The person literally told me not to invest. 2 years later the hospital was millions in debt, laying off physicians, and looking for a buyer. It was a stressful enough time without having to worry my money would go to their creditors. And hospital closure seems to keep happening across the US, so I don’t even consider them an option!

That’s pretty bad! Seems like staying away was a good choice!

TPP,

I apologize if this is a silly question:

I am a VA CRNA, how do i find out if the TSP (thrift savings plan) is classified as a 403b or a 457? If it is a 403b, how would i go about opening and funding a 457?

Thank you for the advice. I love the blog and the podcast. So glad that i listened to your episode on ACCRAC.

Thank you in advance,

JSB

Hey Jason, always good to hear from a fellow anesthesia professional!

My understanding is that the TSP is the VA’s version of a 401k or 403B, though it takes rollovers from any qualified Roth 401k/403b/gvt 457 plans.

I am not military myself and a quick search couldn’t find the answer. In your shoes, I’d reach out to HR (or the VA equivalent) and ask about it.

I know that in the civilian world, you have to sign up for it separately since it is not available to all employees (this is why the NG version is called a “top hat” plan).

Glad you are enjoying the podcast! Make sure to tell your friends about it!

Jimmy / TPP

Hi TPP,

I don’t have a 457 plan, but contribute to a non-qualified deferred compensation plan, which seems very similar except I’m not subject to a $19k contribution limit. I’ve contributed hundreds of thousands to the plan each year to reduce my income enough to qualify for the child tax credit (4 kids * $2k credit). It’s a little bit of the tax tail wagging the investment dog, but plan to use the money as a bridge until 59.5.

My understanding is that if you set up your distribution for at least a 10-year payout, you can be taxed in your state of residence as opposed to where you originally earned the money. So if you work in a high tax state, like California and then move to a no tax state, like Texas or Washington or Nevada (etc.) when you retire, you could avoid a significant state income tax burden.

Qualifying for $8k in immediate child tax credits and potentially avoiding state income taxes down the road, in addition to lowering my current federal income tax bracket make it easier to stomach the risk of my very large, highly-rated employer, non-governmental plan.

All that being said, I would definitely sleep a lot better at night if I could find some way to buy insurance on that pool of money.

I contributed to my “non-Governmental” 457 up to about a year of salary. I see that as my own “severance package.”

I’m not contributing above that now – given the financial instability out there. Bankruptcy risks are low, but not zero.

That’s fair. I’ve thought about that, too, with everything going on. I may not be a market timer, but I am not against “hospital-timing” for investments.

I just want to say that I really appreciate this post. I’m a Prof at a University and I have both 403 and 457 plans, which I contributed to both last year, along with an IRA contribution as well. I wanted to double check that my strategy was reasonable, and I’m convinced now so thanks! I also learned that I can link my 457 to a brokerage account, to choose my own mutual funds as the 457 plans options were limited, and so I’d definitely encourage others to look into this option too.

Happy to help! It is a great option if the features are right!

Thank you all!

I have two 457 plans both non-governmental and both with big balances. I’ve been contributing to a 457 non-governmental plan for 20 years now. Unfortunately I was not aware of so many details. COVID among other events has burnt me to a crisp and I am doing everything I can to become financially independent and back off somewhat.

Do you have a recommendation of an individual to consult on this situation and others? Thank you so much!

Sorry you are going through that!!

Yep. Sure do have people I recommend.

https://thephysicianphilosopher.com/financial-advisors/

I work for the State of CA and have a governmental 457 b, which I contribute to exclusively. I have the option to also contribute to a 401 K but chose the 457 b as it has the benefit of no penalty for early distributions. You mentioned that you would contribute to the 401 K first, then the 457. What is your reasoning for contributing to the 401 K first? Thanks!

Hey Ilneana, what you said is partially true in reality.

For Kristen (my wife), who has a GOVERNMENTAL 457, we fill that up preferentially for her given the protection it has and the ability to withdraw in early retirement as you mentioned.

For me, my 457 is NON-governmental. So, it is not afforded the same protection as Kristen’s. In this situation, I preferentially fill up my 403B first, and don’t even max out the 457, though I might start doing that in 2021 once we make it through this COVID fiasco having an idea of where my hospital stands financially.

There is a huge difference between governmental and non-governmental 457 plans as outlined in the post.

I am a teacher and trying to figure out if the 457b plan is worth investing in or just sticking with a taxable account. My effective tax rate is 15% and although I have access to low cost index funds (VTSAX) there is a net administration cost of .35% in addition to $50/annual service fee. Those fees seem somewhat high. It feels like it might not be worth it or am I thinking about this wrong. Thoughts?

Hey Laura,

0.35 isn’t nothing. That’s true. How does that compare to the 401k or 403B available to you? And do you want to be able to access the money prior to age 55?

Thank you so much for your input! I will have to check the 403b fees. It would be nice to have access to money prior to age 55, but if the 403b is cheaper than I will probably go that way and invest anything extra I have in a taxable account.

I am a PGY1 at a state hospital. From my understanding it is governmental backed although I do know my hospital has lost revenue from COVID.

I have maxed out my Roth IRA and my residency allows Roth 403b and 457b plans without an employer match. I’m thinking of contributing to the Roth 457b next (as Roth IRA is maxed) as it allows early retirement contributions. It seems unlikely I will work for this hospital post-residency and I will have left the employer and then can access the funds in about 4 years as an attending if I’d like towards a mortage. Being so early on in my career, any thoughts on contributing to the Roth 457b next vs filling up the Roth 403b as many have done above?

I am a PGY1 at a state hospital that offers a Roth 403b and Roth 457b. After maxing out my Roth IRA, I want to contribute to the Roth 457b next with the idea that when I graduate residency and leave the employer, I can access my contributions and earnings w/o an early withdrawal fee like a Roth 403b plan would incur OR I can roll it over to a Roth IRA without it counting towards the rollovers that year and regardless of income limits that year after graduating residency.

Since it is a state hospital, it is governmental backed and less likely to have the 457b employee contributions be subject to creditors in the case of financial catastrophe (which it did financially suffer during COVID). Do you agree with my decision to go roth 457b first vs roth 403b for a good plan for tax free earnings and/or a way to contribute more to a Roth IRA?

Great post! Helpful for me to consider since I have been using my nongovernmental 457. I have what seems to be a stable employer (asked to see the financials for our group and looked like good reserves, made through pandemic well thus far), good options with a number of low cost well diversified mutual funds and good distribution options (can choose to distribute over multiple years). Has been helpful at least for now since it is saving on income based federal loan payments (until PSLF) since I just consider my marginal tax rate as 10% higher if I didn’t utilize this tax-advantaged space. Caveat, only makes sense because ALL 3 – good employer, good investment options, good distribution options.

Great post and comments. I am 56 and today I called to withdraw my gov’t 457…they told me the balance as of today and I told them I wanted a full payout..

They told me they withhold standard 20% for federal and do not withhold state unless I ask them to…I mentioned I have been in the 12% tax bracket for 2021 (making less than $81,050) and how do I get the extra 8% difference back…they told me when I file income taxes it will come back…in my state the tax rate is 6% so I assume maybe 2% will come back.

Anyway, the DC agent walked me thru the on screen process and I was presented with 3 options (wish I would have gotten a screenshot of them) but she told me to choose “major investment” the other icon was a house and maybe an icon for “unforeseen emergency”.

I provided my creds and banking info for a direct deposit, they told me it would take 3-5 days to deposit. Great.

Then I receive an email from an insurance company I have never dealt with telling me they need more information. Apparently they are the plan service or something, who knows.

WHY would an insurance company contact me?

WHAT further information would they need? It is my money and none of their business what I do with it.

DO I have to talk to them since they have never been in the relationship with the DC agency and myself.

I wanted to include details so others can see what someone taking a lump sum withdrawal is facing.

THANK YOU!