Money Meets Medicine Podcast

MMM 51: Why You Shouldn’t Listen to Financial Gurus

There’s a plethora of terrible financial advice in the world. It’s hard to know who to listen to. There are a lot of people who are only doing it for their own gain.

No one cares more about your money than you. Learn how you can find financial advice that actually works for you!

Today You’ll Learn

- Why there’s a lot of financial advice you shouldn’t listen to.

- That a lot of financial advisors are in it for the money.

- Why you should do your homework before you take any money advice.

- Why you should go with fee-only planners.

- And more!

Share:

Jimmy Turner 0:00

If I had $1, for every time I heard a popular financial guru give advice that is really bad for doctors. I'd be super rich, almost as rich as you could be. If you listened to the rest of this podcast episode, let's go.

Ryan Inman 0:19

Welcome to the money meets medicine podcast where we talk all about the personal finance topics you had wished you learned in medical school. I'm your host, Ryan newman. And here's your co host, who got the book total money makeover as a wedding gift, and uses it as toilet paper, Dr. Jimmy Turner, actually,

Jimmy Turner 0:36

I don't use it for toilet paper, that would be really mean, it's too scratchy. It just didn't work. I'm just kidding. So this show, I really want to just drive in a few specific things. I'm going to go back just to give some perspective on this. But if anybody's read my site, listen to this podcast that I have four key criteria to recommend a financial planner to a physician, whether it's a friend of mine, or someone reading my site, which is that they need to be a flat fee only fiduciary. And then the fourth one is that they need to have extensive experience working with physicians. And the reason for that is because our situation financially as physicians is very unique, often complicated, and it's not the same as a lot of people for a variety of reasons. And so, this show, we're going to talk about some common financial advice you might hear from financial gurus, we're not going to name them, but we're going to throw out some things you've probably heard before. And they explain to you why you as a physician, maybe shouldn't follow this advice and should consider following a different path because of the very unique circumstance. And so that's the lens with which we want to take the show. So as you listen in, if there's a certain guru that you recognize, and that's like your person or your thing, like, just take it from that perspective that we're trying to help teach you about the specifics of your physician finance situation, and we want to help you figure some of that stuff out.

Ryan Inman 1:52

Before we jump into the show. Let's hear from today's sponsor, it's a month into 2021 and you're finally ready to commit to this year being better than last but you're stuck in the weeds of charting. You spend your evenings catching up on notes and messages when you can leave work with a clean slate and enjoy an evening to connect and recharge. Dr. Philby, Shea is a pediatrician, a podcast host, a father of five who's heard from so many physicians like you who are ready to step out of the day to day grind. The never ending charts meetings messages, in reclaim your time to focus on what only you can do. He's put together a six week course called on time MD for physicians who need more time. In this course physicians of all specialties and employment status can learn the time management strategies that have been tailored specifically for the unique demands that physicians face. On Time MD walks through time management strategies in the exam room and your inbox, your EHR, in meetings and so much more. The most popular module is called How to delegate without dumping, and teaches physicians like you how to delegate tasks to your staff in a way that doesn't make them feel like they're getting dumped on, but instead inspires them to work on your behalf to the common goal of patient care and getting home at a reasonable time. listeners of money needs medicine can save 15% on time MDS course, by using the code 2021 to zero to one. at checkout. The course comes with a guarantee that if in six weeks, you haven't reclaimed at least three hours per week, you get your money back, no questions asked. Don't let another year go by doing things the same way. Now's your chance with ontime. md to reclaim your time for good. Go to doctor podcast network.com slash on time MD. o n t i m e M d to get started today. The link is also in the description of the podcast player that you're listening to us on right now.

Jimmy Turner 3:48

Alright, Ryan, so I'm interested to hear your take as a financial planner who works with physicians on some of the common things that we hear from financial gurus throughout the land that give us advice. They write books, they have shows, they have radio hosting things, they have all sorts of stuff. And they're all blasted over media. And is there advice applicable to doctors?

Ryan Inman 4:11

Yeah, that's a good one. So I'm going to step back for a second and give this even a bigger disclaimer. Because if you think about it, written books, have podcasts or blogs, or in other forms of media, everything you just said. Now, we are not some of these big gurus but that that literally is us speak for yourself. We've speak for you. So we've both written books. We both have podcasts, we both have all this stuff. And I want to start at the very beginning and say you shouldn't take advice from anyone on the internet that doesn't know your specific situation. And we see this crap in like disclaimers and some of them go through their disclaimers and they do the bare minimum they make it legal ease, and they run it at like five x speed. So you don't actually like pay attention to it. Whereas I think you and I we have a very nice disclaimer at the end. Yeah, and we Talk about it in the beginning, like, oh, by the way, this isn't investment advice or anything. And we're not just saying that because my compliance because I am a registered investment advisor, I'm sec registered, I'm in all 50 states. And so part of it is, I actually have a license that I have to protect and say this. But we also state don't listen to anyone including us. We don't know you, we don't know anything about you. I don't know what is going to work for you in who you're listening, and what would work for someone else. We don't know those things. You have different risk tolerances. We could go as far as you have different beliefs on, can you accrue interest or not. We have different religious beliefs, we have ways that some people gift to religious organizations versus some people who would never do such a thing. There's so many differences across all of us, even though we're all in medicine, or married to medicine, that we can't capture all of it. So like super high level, don't listen to anyone, unless they truly understand your finances. This means don't go and crowdsource information on Facebook, or some other social media, don't just watch a YouTube video of someone and go, Wow, that's a great investment idea. I'm gonna go do that. Don't turn on CNBC, and look at what the talking heads are saying and go, Oh, that's where the markets going. This is how the economy's doing, I gotta do it. It's not specific financial planning advice. And it is not good. So like, that's my high level one.

Jimmy Turner 6:29

And I'll just piggyback on this to say that we know exactly what Ryan saying from the medical community where you have the patient that comes in and they're like, Hey, I asked my my forum, what they thought about my medical diagnosis, and this is what they said that I should do what he says I'm dying, Is this correct? Exactly. And so we as physicians know exactly what Ryan's talking about. When people come in with their Web MD article or their quote, unquote, research that they've done, ie talked to their friends, it's so true, just like you can't give medical advice, when you don't know, someone's specific medical comorbidities, and exactly what's going on in their world, and the medications and treatments that they've tried that have or haven't worked, like, you can't give medical advice to someone without knowing that information without examining them without examining their life. And so it's the same way with personal finance. So this show, that doesn't mean don't listen to it, it's general education, what it means is that you can learn from this, and then your specific situation, you know, where you could go and get help from, to sort through that using the general education that you get. And so I think that it's going to be really fun talking through a lot of this, because I think there's a lot of this, that people are gonna be like, Oh, I know who that is. And so in a way, you get to listen, and try to guess, who we're talking about, and then also hear what we think about it.

Ryan Inman 7:38

Yeah, there's a few notable people that we might be discussing some of what they might think that doesn't mean they're bad people, it doesn't mean that their advice is bad for everything, it just means that we don't necessarily agree with it. We're gonna try not to say names or anything like that, but just come from the lens of personal finances personal, and physicians have very unique needs very unique needs from the financial space, and that most of the world just doesn't understand it. They just don't. And that's part of why you have a target on your back, because some people understand that you have no financial education, and you have really high incomes. And you're really trusting, because that's just what doctors do. And there's some people that understand nothing about what you've gone through, and are going to be like you took out how much in loans to do this. You're ridiculous, like you're screwed, which is absolutely not the case. I think we can jump in Jimmy. And I think one of the biggest ones that we hear is around the extreme hatred of debt.

Jimmy Turner 8:37

Yeah, and I'll jump on this one real quick. Because for those of you that don't know, my background, I went through bankruptcy as a kid, I made lots of mistakes with my student loans. And so I too, personally have an avid hatred for debt. That said, My avid hatred for debt is balanced with an understanding of behavioral finance and the psychology of money. And so that doesn't mean that I just attack my debt at all costs without considering anything else in my financial life. And I mentioned that because there's advice out there that actually tells you to do just that, that you should focus on only your debt, in the beginnings of your financial journey. And for for doctors, that's really troubling advice, sometimes, often,

Ryan Inman 9:14

actually, most of the time it is. And so when we look at different forms of debt, I don't think there's any such thing honestly as good debt versus bad debt. Debt is just debt, there's debt you would likely not want to ever carry and there's debt that will help you get to maybe some of the goals that you're trying to achieve. But debt is debt, it isn't a financial instrument. you're leveraging up what you have, you don't have the money to do it. So you're going to use other people's money, whether they're good or bad, in order to achieve whatever it is, that could be, hey, I can't afford to this purchase this brand new TV, but I really want it now therefore I'm going to throw it on my credit card and I'll figure it out in a few months. That's probably not the best thing to do. And I am full agreement with the gurus out there that say, hey, that kind of debt is horrible because they Is that sucks and you don't need to be doing that. Just don't spend that money. Wait until you saved it up in cash to do that, but if we look at it and say, hey, how come you took out $300,000? To become a physician? That's horrible. How could you ever think that was a good idea? It's like, well, it was a good idea. Because if we relate it back to business, you have bought a business that has an income stream. Now that income stream is technically in your head. So you want to make sure that you protect said income stream, which you would do with disability insurance. And with Term Life Insurance, right? If you have people who depend on you, you need to have that protection. Absolutely. If you can't work, and then income stream stops, you need to protect that because you took out a debt to buy a set income stream, but view your student debt as a business. If you spent $300,000, in a medical school education, to earn $300,000, that is a hell of a deal. You bought a one to one ratio on your student loans versus your income. And in any business, I think I've talked about on air, if I'm going to go buy a financial planning business, and I look at that if I buy a financial planning business at a two to one ratio, right? If they make $500,000, as a firm, that valuation is probably a million dollars to buy that ongoing revenue. If we did that, in terms of doctors, that would mean like if you borrowed 300,000, you only need to make $150,000, to make that a smart business decision. So view your medical school debt, as you bought a business, it is not the debt of like the equivalent that you took out a bunch of personal loans at 15%.

Jimmy Turner 11:40

And I think that's the front end view of debt, like in terms of some debt being an investment that you're hoping to get an ROI or return on investment for later on. And the other important consideration here is how to treat your debt. Once you're done with training and you start paying back your debt, because there is financial advice out there that says that you should pay off all of your non mortgage debt before you even start an emergency fund, which is a really interesting thing. Because, you know, I think that I can get there with like credit card debt, like yeah, if you have 17% APR credit card debt, absolutely, you should pay that off before your emergency fund. And the reason why is because that kind of debt is an emergency and interest rate above 10, or 12% is an emergency financially. And so yeah,

Unknown Speaker 12:19

you should use your emergency fund.

Jimmy Turner 12:21

So absolutely pay that off before you have an emergency fund. But don't tell me if you have 3% student loans, that you shouldn't save up a three to six month emergency fund before you start hammering away at those that doesn't make any sense because it's not like you can add on to your student loan debt. If you have a huge emergency expense come up, like where that goes is back on the credit card, which as I just said, is an actual emergency. And so I think having a more nuanced view of this. And really where a lot of Guru financial advice gets in trouble is that they try to generalize this advice to the masses, because that's what makes them money. And it's easier to teach when you can pitch a single idea as opposed to a nuanced idea. Because the second you get into nuance, the message gets lost. And so I think from a marketing perspective, I understand why they have these, like bold, this is what everybody should do sort of stuff. But from an individual perspective for people listening to this podcast, that's also why you shouldn't apply it to your life, because it's not personalized for you.

Ryan Inman 13:15

Well, and that's I think, coming back to why we even exist, right? If what we're doing that Mmm, and financial residency and the physician philosopher, like we are taking very nuanced piece, and we are presenting this as the stuff that you could do or should do. It doesn't mean that we're right, because it's not gonna be applicable in every situation, right? Everyone is still different. But essentially, if you take the big guru, and they're trying to hit the masses, we're not trying to get them out. We're trying to help physicians, right in the mass of physicians, and this is applicable to you. Does that mean that what I just said about buying a business? Right, and using student debt? Is that applicable to the brand new graduate that just got a Bachelor's in history? No, it's not even remotely close to the same thing. They didn't buy a business. They took on debt to acquire some knowledge that they're hoping that they can go and find a job and you use that out in the world. That is absolutely completely different than what I just talked about with med school loans, and using this to buy a business. So when we look at some of the guru advice out there, around should you be paying off this debt or all of your debt or how did this work? And how does it all interrelate? They absolutely don't get student debt. And there's tons of bad advice even by financial planners who don't understand student debt of like, well, PSLF is going away. Just refinance rates are at historic lows and go do this. I've seen so many physicians that have taken advice from other people that are one don't know their situation, but two that they thought were really smart financial planners, refinanced and screwed themselves out of hundreds of 1000s of dollars that would have been forgiven for loan forgiveness. It's just guru, that person that advisor, whatever it is, and some of these advisors are on major platforms like CNBC, and TV They don't understand it because it's so nuanced. It's not applicable to the masses. So we're coming back to that same concept of like, it may be as good advice for someone, it's just not likely good advice for you.

Jimmy Turner 15:13

And I'll piggyback on that and say that I've actually heard one of these financial gurus, I know that you've heard this video clip two, but basically rail on a physician for their view on debt and their consideration of public service loan forgiveness. And because this person had such an avid hatred of debt basically told this guy who had a debt to income ratio of like, at least two, I remember exactly what the numbers were, but like someone that should absolutely be considering public service, loan forgiveness, and basically said, You can't trust the government, you need to go and refinance that debt. You need to eat ramen for 12 years and pay it off. And it was like, Whoa, all of that advice, it

Ryan Inman 15:47

would literally destroy that person's life.

Jimmy Turner 15:50

Yeah, exactly. their financial world is about to go into ruin. Because this person is giving the same advice that they give to someone who just graduated high school and started a job at the local store. As to this doctor who has $400,000 in student loans, the advice to those two people is going to be different. It has to be different if it's any good. And so I remember watching this thing and just being blown away by the advice I was being given on public service, loan forgiveness. And clearly this guru didn't know anything about the public service loan forgiveness program, it was amazing to like, watch this, like a YouTube video.

Ryan Inman 16:21

Most people don't know a lot about public service loan forgiveness, the calculator that I've built, literally, I mean is like 20, tabs deep. And when we run it, it literally takes two hours to two and a half hours for the whole thing to process. There's so many inputs and so many things. Most people have never dove into what that is how that works. They just go debt bad, don't do it refinance. Lower, right, lower payments, lower this, and just eat ramen, horrible, horrible idea.

Jimmy Turner 16:49

If you'd like ramen, go eat ramen, and I'm not anti ramen, I just want to be clear,

Ryan Inman 16:52

no bias on ramen, ramen is delicious. Let's switch gears because we just went from like anti debt, everything. There's another girl out there that is basically saying, leverage up to the max, but use the debt in order to buy assets. And the more debt you take on, the more assets you buy, the more successful you will be. And this person has a massive following on specifically real estate. And it's just keep plowing it in and there is part of this, that makes complete sense, right? If you own more real estate, and if you need debt, obviously to buy that real estate. But if you at some point, stop, and then you pay off properties. Now you've got potentially cash flowing properties, the thing I hear the most, hey, let's buy 10 homes, right, you need leverage on all 10. And then you use basically the extra payments per month on each 10 you pay off one loan, then you snowball it. And eventually all 10 are paid off. That is not a bad strategy. If you want to be a landlord, this is like the most concentration your portfolio. I don't necessarily agree with it for every single person. But it's not a horrible strategy. And I don't blame this guru for talking through this. But they don't stop there. They basically say never pay off the homes, keep leveraging up keep doing these things. never buy a primary residence because it's dead money. Well, we've talked about that. It is dead money, it just sits there. But at some point, you want to retire. And at some point, you can't have payments on your primary home.

Jimmy Turner 18:19

This really feels like people gambling in Las Vegas and like getting money from a shark and then paying another shark off and then paying another shark off. Eventually, one of those people is going to come back and ask for the money. You can't keep doing that forever, and not expect for someone to finally call the money that

Ryan Inman 18:35

you owe banks won't actually call the money. That's the thing, it is going to be the economy that's going to force prices down. And at some point, the gig is up at some point, if you leverage to the max, something will fall that is absolutely outside of your control. And you have no parachute. What happens? What happens when your parachute doesn't open? You're dead? Right? Well, what happened to this guru? Is they filed for bankruptcy. But what saved this guru, which is I don't think very talked about that much. What saved them was all the books, all the courses, all the affiliates, all this other stuff that they made money with, save their butt. So all the stuff that they had been pitching, even though they practice what they preached, which by the way led to bankruptcy, what saved them from not basically eating ramen, because we're picking on Robin today was that they were selling all of us, you know, I'm saying us in the world, their philosophies, through their books, through their coaching through their courses through their affiliates of different services that are good.

Jimmy Turner 19:32

I think it's really important to mention, because what I found, and we've talked about this in transparency, I think was episode eight Ryan, even though we've decided on how the media and other people, bloggers podcasters get paid to produce content. And what I'll always tell you whether it's a figuring out which financial planner to use or where to get your advice or where to learn about personal finance, is to follow the money. And with that particular guru, they went bankrupt recommending the system that they had that they recommend. Other people and what saved them was all the money they were making, giving that same bad advice to other people. And so it's an interesting thing, or one of the other gurus people pay them to be a recommended advisor for them. And they have some shady practices. But if you follow the money, and the conflicts, you'll eventually get around to what the person's ultimate outcome is like, what are they trying to do? And is it in your best interest? And the answer is usually no. And so when you follow that you follow the Commission's you follow the fees, you follow the affiliates, you follow the bankruptcy or what have you, and you follow that money to its natural conclusion. Most of the time, you're going to come away realizing that advice was never meant for your benefit, it was meant to make the other person money. And so that is why personal finance is personal, right? Nobody cares more about your money than you. And that's the way it always be

Ryan Inman 20:45

the way it should be. Yes, I sometimes find that's not true. But that's the way it should be. Sometimes I feel like clients Hello, like you need to care about this, not just us. But let's switch gurus in this, to me is several gurus wrapped up into one media package, if you will. And I'm more referring to people that are I call them talking heads on news outlets, I won't even pick on the news outlets. But to me, they're out here. And they're touting that they're professionals that this is what they do for a living. And we know the whole idea of active managers versus passive managers, right? passive investing is investing in low cost highly diversified index funds that track an index, not necessarily picking something to beat said index, and you're diversifying across all sorts of stocks, bonds, whatever it is. And then you've got the active crowd, which that Nobel Prize winning research states that 90% of the time in the first 10 years, like the index investing is gonna beat this active crowd, not every time. And I think a lot of people get that wrong. It's 90%. It's not 100%. So maybe you could pick stocks and beat that maybe you could find a manager that beats that. One in the news right now is Ark, they had like a 400 or 500% return some ridiculous thing over five years, because they're heavily invested in two things. Tesla, and Bitcoin.

Jimmy Turner 22:09

shocker. Yeah.

Ryan Inman 22:10

So guess what? They have seen billions of dollars inflow into these things to the point where I have friends that are texting me, should I invest with these? I'm like, oh, gosh, no, please, don't chase returns, because we don't know. Maybe Tesla and Bitcoin, they run for five more years. And these managers look brilliant. But what if they don't? What if they crash back down to realistic pricing and managers that made hundreds of percent return now all of a sudden lost 50%. While maybe the broad market had earned money, you don't chase performance. But when you turn on the TV, and you see people talking about, and again, I'm going to label this really quickly, this is not investment advice. I'm gonna mention some names. I don't care. Please don't own any of these. I don't own them, other than as they're an index fund. So I guess talking with that we do all on them. But it's not investment advice. Alright. So if I get on TV, if I'm flicking the channel, and I see someone yelling, bye, bye, bye, right? We joke or sell, sell, sell. And we're looking at He's like, Amazon is the greatest thing in the world. So if we turn on the TV, and you've got someone that's yelling, or they're yelling, you, when you look at that, and you're going, Well, what are they talking about? And it's like, well, it's Apple, or Amazon, or the next Netflix or whatever it is, like they're doing some analysis they're doing and usually they're disclosure like, Hey, we own this, or, hey, we're invested in this, or, hey, we have no position in this. That's fine. Most of everyone in the whole world, though, takes that as specific, relatable investment advice. Oh, well, if they're talking about this on TV, it must be really important. It must be the new latest and greatest thing. This is Tesla 2.0, right? It's gonna beat Tesla's returns or whatever. And all of a sudden that FOMO or fear of missing out kind of kicks in. I actually think that part of the run for Bitcoin from 20 to $40,000, which is where it is, it did that by the way in a month. I think part of that was the media actually gave it a ton of attention. All Time highs for Bitcoin is the ticker goes through on every frickin channel. I mean, stimulus checks were coming and I think the FOMO occurred. And this is again, not a specific person, let's say but a conglomerate of people that when you turn on the TV, they don't know you. They don't know anything about you. They don't know how much money you saved. They don't know how much money you earned. They don't know how much money you're actually making from a high level. They know literally nothing about you just like everyone else. That's Jimmy and I podcasts, blogs, books, whatever. They don't know you. They don't know your situation. So is buying Amazon after its run up hundreds of percent a smart idea. We don't know. Maybe it is maybe five years from now it goes up. But guess what, if you own passive index funds, you already own some Amazon.

Jimmy Turner 24:54

Based on the show. I think people should be buying stock and Robin probably

Ryan Inman 24:57

just straight Robin. It's all Robin It's all Bitcoin pay me in Bitcoin, right? We're seeing a whole world was talking about some of these things. But just to come full circle to finish out this thought is that if you're turning on the TV to get investment advice, you're doing it wrong. If you're turning on a podcast to get investment advice, you're doing it wrong. If you're opening a blog, I don't care if I wrote it, Jimmy wrote it or the pope wrote, it doesn't matter. You're getting investment advice somewhere, you're doing it wrong. Now you can get ideas you can read through, you can learn about these things and understand expense ratios, and what makes up all these different pieces and how to build a portfolio. But if you're gonna say, hey, look, here's my five top portfolios, or here's my top five investment picks, you're doing it wrong, you've got to design your own. And you have to understand what you're investing in and your risk tolerance, and no one can help you with that, or give you the right answer other than yourself,

Jimmy Turner 25:54

just to go back to something we mentioned earlier, because it may not be obvious to everybody listening exactly what is so different about doctors. Oh, no, I didn't write down any of this. But like off the top of my head, some three or four things that are just so different about you, compared to the average, Jane or Joe, right, the amount of student loans that you carry way different, the fact that you can't really start saving until your early or mid 30s. Very different, right? The fact that you go from making an average median income in the country to multiples of that overnight July, when you finish your training is very, very different, right. And so all of those things, like for example, that last one just puts you at this great opportunity to get sucked into the Diderot effect, right where you buy one thing, because you make a lot of money overnight. And then the rest of your life has to look like that one thing like that happens to doctors, it more than just about anybody, outside of maybe professional athletes and entertainers who make it big, and then have the same thing happened to them. And so in some ways, doctors financial lives are similar amongst each other. But they're all very different amongst the rest of the country in terms of their experience with money. And even within that pool of doctors, like Ryan's getting at, there's personalization, lots of it, there's a

Ryan Inman 27:06

ton of it. I mean, I've worked with hundreds and hundreds of physicians, hundreds. And I can tell you that no two people have been alike. Now there's some commonalities, right. But even within specialties, one anesthesiologist versus another, you still have different viewpoints, different things different, you know, Jimmy gives to church and one dozen, that has a very prolonged impact on financial planning over a 30 4050 year period. If you're giving $2,000 a month, every single month, one physician does that. That's fine. That's what they believe in. That's important to them. Great, let's do that. versus the other. That's like, I'm not giving $2,000 a month until I hit retirement. And then I'll add to this Donor Advised fund and giveaway $5,000 a year, whatever it is, that has very profound different impacts on planning. Everyone is so different. Even within the physician community I've seen literally hundreds of we've built hundreds of plants, like people are just different, have different priorities, different concerns, have different upbringings different relationships with money.

Jimmy Turner 28:08

I think that's actually really interesting to think about is how your experience of money like mine, going through bankruptcy as a kid has absolutely impacted the way that I view money. There's no way that it couldn't. And I've had to do plenty of mindset work on my own. I actually just talked about this on the physician philosopher podcast on episode that's coming out soon is that exact thing that the money mindset people have is often dictated by their prior experiences. But your thoughts about it going forward don't have to be. And this is really kind of the take home of his episode is that financial gurus give very rote advice that is meant for the masses, and not for any one individual. And so it's a one size fits no one kind of approach that in particular, physicians need to be on the lookout for. Now,

Ryan Inman 28:55

if we looked at everything that gurus are talking about, and you did literally nothing and you just blew all your money. Or you said, Hey, I'm gonna go read this book that I and Jimmy might honestly think is crap. But if it got you to save some money, then absolutely, by all means, go buy the book, don't even art books. I'm talking like any of these givers books, because if it's gonna get you to better your financial selves and increase better habits and just overall pay attention to your money, then by all means, go do it. But understand that not everything that they say, is gospel, not everything that they say is good. Yeah, you shouldn't listen to anyone it sounds silly, but like, even Jimmy and I right here, don't take what we say is, well look, Ryan works with hundreds of physicians and he knows what he's talking about. Oh, look, Jimmy is a practicing physician and in studies this in his off time, and he's super nerdy. I'm just gonna do with these two guys say because they've got some great experience. That's our experience. And it's we can talk about generalities, but like I still don't know who you are, what you're doing, what's important to you what your goals are, your relationship with money. It just We don't know.

Jimmy Turner 30:01

And we probably should have led the show with this right now.

Ryan Inman 30:03

Yeah, 30 minutes in, hey,

Jimmy Turner 30:04

let's leave the show that, hey, hey, this is for the real listeners of Mmm, if you're still with us, you are actually with the vast majority usually are at this point. But if you're still with us at this point, just to say that if you found the financial community and personal finance and started educating yourself, because of one of these financial gurus, books, I think that's awesome. I think it's great that you're here. I think that is a wonderful stepping stone that got you here. You know, we're not trying to throw shade at anybody, for any inappropriate reason, we just want you to realize that you need to make your personalized financial decisions yourself, potentially with the help of other people, like a trusted financial planner, or whoever you want to seek out for this advice. But it needs to be tailored and personalized for you. So if you came through the path of reading one of these books, or listening to a radio show, or whatever, like we're not hating on that we think it's great that financial education is getting out there. But just be careful what you apply to your own life.

Ryan Inman 30:58

Absolutely. The second guru that I talked about that went through bankruptcy, his book is one of my favorite books of all time, because I just like the story and the thought process, and it gets people thinking different. But if you truly take it word for word, you're screwed. But if you can take it and apply and go, Hmm, those are really interesting thoughts. And I want to continue those thoughts. And now I'm going to take a little bit from here and there and everywhere, and then mold it into your own thought process, it becomes really valuable and powerful stuff. But if you take it for the gospel, you're in trouble, as shown by they filed bankruptcy. So hopefully, this was helpful. I mean, Jimmy, and I like drifting on this stuff. And we can see the value of these gurus that get people interested in finance, we just don't want you in includes us as well just don't take it for face value and go like well, they said it so it's good for me. Now, do more research understand, are people getting paid to do this stuff is this what they truly believe is this what actually works is this what applies to you pick and choose bring it all together in this nice big melting pot of ramen, and then build out your own personal customized financial plan. With all these things you've researched and studied, to really build it and make it unique to yours, not just what one guru or several gurus think. And please, whatever you do, don't just turn on the TV and go up. That's investment advice. I'm going to take it because you're probably gonna lose money. Before we end up, please be sure to use that 15% off code for Dr. Phil whooshes course. That's called on time, MD. Phil's a great guy. And I know that he's put together an awesome thing. And Taylor is actually going through the course which is kind of cool. But to gain control of your life, your focus your time. Check out on time MD by going to Dr. podcast network.com, slash on time, MD. That's o n t, Im E. md. And make sure you use the code 2020 120 to one at the checkout.

Jimmy Turner 32:52

Thanks for listening, everybody. We appreciate you being here. Make sure to tell your friends and family about the show. We love having you here. If you have questions, send them our way. We're always happy to include him Jimmy at money meets Madison calm or Ryan at money meets Madison calm. The good ones go to me the bad ones go to Ryan, we will see you next week.

Ryan Inman 33:08

All right, let's hear that important disclaimer before we get out we gotta get her paid. We got to shove money in that Roth IRA. Jimmy can't forget the disclaimer, actually. It's really important. We joke about that, but it is really important in this whole show is pretty much a disclaimer. But let's hear it again just in case.

Jimmy's daughter 33:28

Dr. Turner is a practicing anesthesiologist. Mr. Inman is a fee only financial planner, you should know that this show is not personalized financial advice free. In fact, it shows only for your general education and entertainment purposes. So keep listening to learn how to become a yourself and Joker or go find a great fee only financial planner like Mr. Edmund to create a personalized financial plan for you

Sign up to receive email updates

Enter your name and email address below and I'll send you periodic updates about the podcast.

TPP

You might also be interested in…

Following the Financial Crowd

Have you ever left a sporting event, following the crowd, and suddenly realized you were walking the wrong way? What if I told you this phenomenon has a name, and it impacts your money, too?

Understanding our own behavior when it comes to finance is essential because it helps us mitigate wrong-for-us decision making around money. Unless you know these roadblocks exist, you can’t do much to stop them from derailing your financial goals.

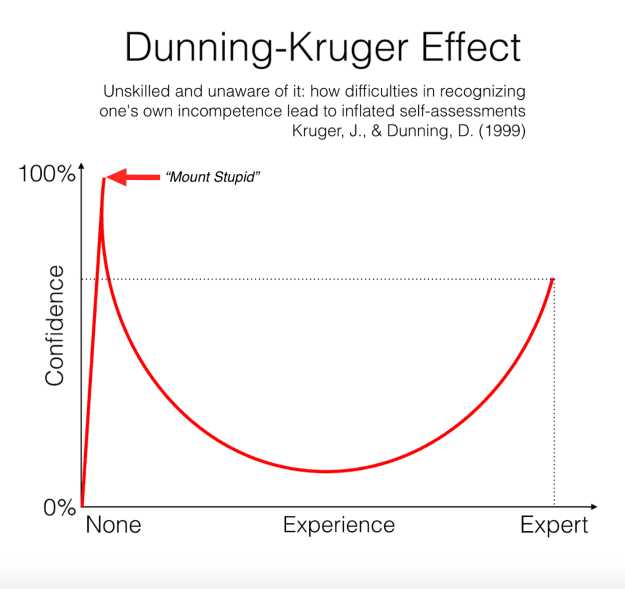

Last week, we shared why human behavior matters for our financial lives by taking a look at the first 5 out of 10 psychological phenomena that can (and do) affect your personal finance goals: greed, fear, ego/overconfidence, loss aversion, and analysis paralysis.

This week, we’re diving back into behavioral finance (one of our favorite topics) to share five more types of unchecked human behavior that can sabotage your journey to building the wealth you want.

Greed, FOMO, and Bad Investments

Despite our best intentions, certain emotions can keep us from building wealth. After many years arming physicians with the information they need to achieve financial wellness, I had a significant realization.

Information is one thing – behavior is another.

As the saying goes, money is 80% behavior and only 20% math.

Not only do I want to share important information about personal finance, I also want to help you recognize how certain behaviors can (and do) affect your finances.

Drawing from one of the classic books about investing, let’s go over five common behaviors that could be keeping you from achieving your financial goals.

How Doctors Can Get Good Financial Advice

Many doctors and high-income professionals hire financial advisors for any number of reasons. Either they’re too busy to handle their finances themselves, they don’t really know how to invest, or they want an expert on their side to make sure they’re on the right track.

So allow me to say from the start: I’m not against financial advisors, but I am against doctors (or anyone, really) being overcharged for bad advice.

There’s no shame in asking for help – you just want to get the help you need at a fair price.

You should be equipped enough to vet and evaluate your financial advisor so you’ll know whether they’re working well on your behalf. How can you be as confident as possible they’re acting in your best interest? This episode will help you find out.

Are you ready to live a life you love?

© 2021 The Physician Philosopher | Website by The Good Alliance

0 Comments