Before we jump into one of the most popular posts each quarter, I wanted to point out a great opportunity for you to grow your own net worth! The Passive Real Estate Academy goes on sale TODAY and the doors are only open until August 9th. If you have wanted to get real estate exposure without being a landlord, this course will teach you one of the best ways to do that! Don’t miss out. Click here for more information about the Passive Real Estate Academy.

Click Here for More Information on the

Every three months, I post my net worth on this site. This has proven to be a hotly anticipated post by readers. While I considered squashing it at two years, the outcry from readers was loud enough to encourage me to keep posting these numbers publicly.

There are a few major reasons for these updates.

First, I want to dispel the myth that money is a taboo topic that we should not openly discuss. This is important in my role as an educator of future medical professionals. Second, posting net worth updates holds my family and me accountable. Third, it proves that you, too, can make financial mistakes and still obtain your financial goals.

My mistakes have included forbearing on my student loan debt during training (If your Debt to Income Ratio is <1 click here to get a cashback bonus by refinancing here), getting hosed by an insurance agent, and many more. Then, I became a DIY investor and started crushing it. And you can, too.

Each update starts with a summary of the previous updates and then we dive into our assets and debts as they currently stand. Finally, the newest updated networth is posted at the end.

A Quick Update on The Last Two Years

This is the next installment of the Physician Philosopher Net Worth updates. To read my previous Net Worth Updates click the following links.

- This post discusses some of my numbers and goals when I first started this site in November 2017.

- Here is my first quarterly net worth update written six months after I started my job as an attending (numbers from January 2018)

- Second Quarterly Net Worth Update (4/27/18)

- The One Year Out from training Quarterly Net Worth Update (7/30/2018)

- 15 Months Out from training (10/2018)

- 18 Months from finishing fellowship (1/2019)

- 21 Months Out (4/2019)

- Two Years Out from training (07/2019)

- 27 Months after finishing fellowship (10/2019)

- Our net worth at 30 months out can be found here (1/2020)

- 33 Months After Training (4/2020)

The Last Three Years in Numbers and Pictures

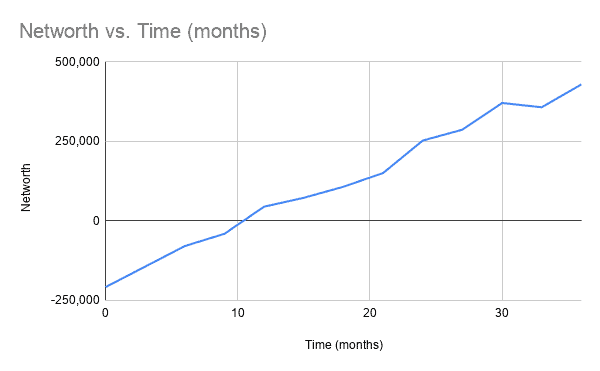

If you don’t feel like clicking through those, our net worth started at negative (-) $208,000. This is how our net worth has changed at each of those time points:

- Six months out, it had improved to (-) $78,819.

- By 9 months out we were at (-) $40,270.

- We finally had a positive net worth one year out at +$45,000.

- At 15 months, we had reached $73,000.

- It took us 18 months to get to a six figure net worth: $107,718.

- After 21 months, we were sitting at a net worth of $150,820.

- With the 24 month update, we shot up to $252,974.

- At 27 months, our net worth was $287,155.

- 30 Months out, we were continuing strong at $371,058.

- At 33 months out, the drop in the market finally came… $357,605

Three Years Out???

In graphical form, it looked like this for the past three years.

Three Years After Fellowship: Assets

Since the release of The Physician Philosopher’s Guide to Personal Finance , I have been non-anonymous on this site.

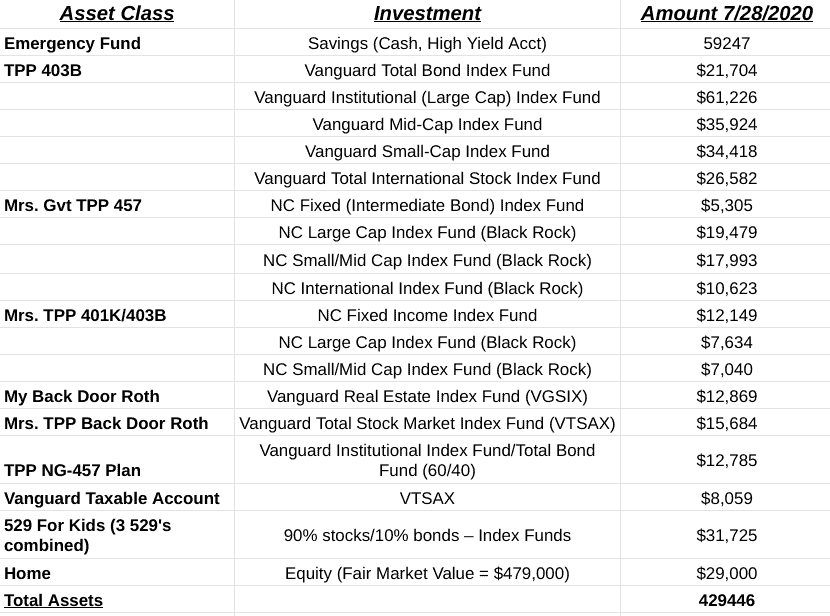

Here are our assets and the dollar amount for each category. All of this is as of 7/28/2020.

Comments on Our Assets

Our Annual Savings Goal

Our annual investment goal remains between $115,000 and $125,000 with a goal of having around $3.0 million in assets by the time we are 45. This doesn’t include any “passive income” (i.e. it is not passive) we have coming in through The Physician Philosopher or the Money Meets Medicine podcast.

We get to this annual savings number by investing in the following accounts:

- $45,000 in my 403B (this includes employer matching)

- $12,000 in my non-governmental 457

- $19,500 in Kristen’s governmental 457

- $19,500 in Kristen’s 403B/401K (we will max this out in 2020 for the first time)

- $12,000 in our Backdoor Roth IRA (here is a tutorial for your first Backdoor Roth IRA, if you need it)

- $3,000 required pension for Kristen

- $7,100 Health Savings Account

- $6,000 in a brokerage account

Further Reading: Don’t know the difference between a governmental and non-governmental 457 (or whether you should invest in yours)? Read this post on everything you need to know about 457 plans.

Adding this together amounts to $124,100, which is within our target annual savings rate. All of this is automated out of our paycheck each month outside of the backdoor Roth IRA.

If you add in the $1,250 we put into our kid’s 529 plans each month, our total annual savings is actually $139,100.

Previously assuming a conservative 6% average annual growth in the market, we were going to crack $1 million in assets by age 37. We have now shaved off a year and look to do that around age 36 due to high returns.

We will now reach $2.5 million by age 42 and $3 million by age 44.

Don’t know how to perform a Backdoor Roth IRA – Click here for a step-by-step Backdoor Roth IRA tutorial at Vanguard.

Debts: 30 Months Out

Here are my family’s current debts.

| Class | Amount of Debt |

| Home Mortgage (~$450,000) | |

| Total Debt (excluding mortgage) | $0 |

Some Comments on Our Debt and Spending

First, let’s talk about some spending! That’s the fun part of money, right?

Kristen and I decided to finally do our much-needed (seriously, think rotting wood) deck renovation after about two years owning our home. We are putting down maintenance-free, material (read: expensive). This money could have gone toward paying off our mortgage, but you have to live a little in this life, too. I’ll write a dedicated post about this at some point.

Speaking of mortgages…being debt-free outside of our mortgage has been simply amazing. I don’t regret for a second paying down debt that could have been leveraged into the market.

We did, however, refinance our house in the last quarter. Our previous interest rate was around 4.75%. It is now at 3% on a 15-1 ARM. This lowered our monthly payment by $400. And guess what we did with that?

Nothing. We kept our payment the same to pay the house off earlier. Now, we are making the same payments and paying off an extra ~$5,000 in equity on our house each year.

Net Worth

Net Worth = Assets – Debts

$429,446 – $0 = $429,446

**For the purest out there, if we were to include the house in our debt, we would also include the full value on the home on the assets side. This would result in the same net worth.

We finally let the purse strings (really) loose with a deck renovation. Despite this, our net worth continues to climb. We saved up for this purchase, refinanced our home, and continued to pound money into the market. Seems like a winning formula.

Summary:

- Our net worth improved $71,841 in the last quarter. That’s a pretty big gain due to continued savings and market gains.

- Since I finished training (when our net worth was -$208,000), we are up ~$637,500.

- We are on pace to have 1 million in net worth by age 36. Our FI number should get be accomplished at age 43-45.

- We no longer “live on half” as Physician on FIRE prescribes. That said, we are still putting away around 25-30% of our gross base salaries (and a lot more than 30% of our take home).

- Additional money going forward will go toward enjoying life and paying off the mortgage early.

This should serve as proof that living like a resident after training works if you make a plan and stick with it!

Take Home

Make a plan. And stick to it. That’s the moral of the lesson so far.

Oh, and enjoy spending some money along the way. It is good for you. Just make sure you save first and spend second!

Going forward, our goal will be to find contentment in our current life. We are now in the steady stages of wealth accumulation. Though this is automatic, our focus is on the path to financial independence. We want to enjoy this journey along the way through Partial FIRE.

That’s our story. What’s yours? How did the market drop impact your net worth and investments? Leave a comment below.

TPP

Congrats on your progress!

My net worth is still very much in the red but working hard to change that and your example is inspiring!

I just transitioned from fellowship to an attending job and am proud that I increased my net worth by thousands during that transition when me and my wife were making no money! https://prudentplasticsurgeon.com/how-i-increased-my-net-worth-between-graduation-and-starting-my-attending-job/

Looking forward to growing together!

The Prudent Plastic Surgeon

Always awesome to see this! It’s amazing to track your progress and set a vision for docs coming out of training and seeing what’s possible. Congrats Jimmy!!

Congrats, Jimmy!

Curious, what rate of return are you using for your future projections? And is it a nominal return or expected “real” return (ie after inflation)?

I personally use 4% to be conservative with our current high market valuations and future inflation as well.

Usually 6% nominal.

Curious how you get to $43k in your academic 403b, is it profit sharing? Because even with a 1:1 match of your max contribution ($19k for 2019) you’d be at $38k and I don’t know many places that would match that amount. I wish mine did…

Your employer has two options. They can match a certain percentage of your income that you contibute and they can also conribute on their own. My employer does both.

You’re very lucky to have figured this out as early as you did! I feel like we are in a similar position to you now, but it took us 6-7 years of spinning wheels (living in a pricier area, not focusing on savings rates, not maxing out tax-advantaged savings) before we finally figured out what we were doing wrong (a lot).

NOW we are very similar to you in our savings numbers and percentages. Need to do the back door Roths and open a taxable, but otherwise very similar. (Oh plus we do not own a home – I know, we’re weird like that, but I actually love not having that asset to think about or maintain).

That is awesome TPP. Since finding out about FI last November 2018 when my daughter was born, we have been saving at an increasing rate every year. In 2018, the rate was 23%, 2019 was 43%, and so far for 2020 it’s 53%. In June I paid cash for a van and it felt amazing. We just have one one $7k student loan left to knock out. We also refinanced this year to a lower rate but I opted for higher monthly payments to pay the house off sooner before my kids are out of high school. I almost want to just shotgun it but we’ll see. This year we will maybe crest the $100k in savings ?I love that you’re open with your finances, it makes it a lot easier to understand how people have their finances organized. Good luck and stay healthy!

Great job on the Net worth. Looks like most of your net worth is in your retirement accounts, which makes FIRE tough as you cannot pull them out till age 60, consider investing more money in taxable accounts. Good Luck!

I am wondering why you choose an ARM vs a 15 year fixed rate mortgage? A fixed would have had a lower rate at that time, I am guessing 2.5% or so. You could roll the closing costs into a fixed rate refinance as well. I hear about people choosing ARM’s often but have never understood the why behind it.