When I was in college I had the opportunity to see the Eagles play in Greenville, SC. Growing up, the Eagles were my dad’s favorite band. I listened to them regularly, which explains why I know every word to most of the songs on their Greatest Hits Album. Yet, they made a proclamation in 1980 (long before my time in college from 2004-2008) when the band broke up that they were never getting back together. Actually, Don Henley said that the band would get backtogether when “hell freezes over”. After their 14 year hiatus, they appropriately named the tours the Hell Freezes Over tour. I saw them play on one of these campaigns.

The Physician Philosopher Net Worth series is a little bit like that tour. Last time I posted on my net worth, I said it would be my last because I didn’t want to flaunt anything publicly that wasn’t privately helpful for my readers. With a resounding response, that post received emails, comments, and otherwise overwhelming support for the net worth updates to continue.

A Quick Update on The Last Two

Years

This is the next installment of the Physician Philosopher Net Worth updates. To read my previous Net Worth Updates click the following links.

- This post discusses some of my numbers and goals when I first started this site in November 2017.

- Here is my first quarterly net worth update written six months after I started my job as an attending (numbers from January 2018)

- Second Quarterly Net Worth Update (4/27/18)

- The One Year Out from training Quarterly Net Worth Update (7/30/2018)

- 15 Months Out from training (10/2018)

- 18 Months from finishing fellowship (1/2019)

- 21 Months Out (4/2019)

- Two Years Out from training (07/2019)

The Last Two Years in Numbers and Pictures

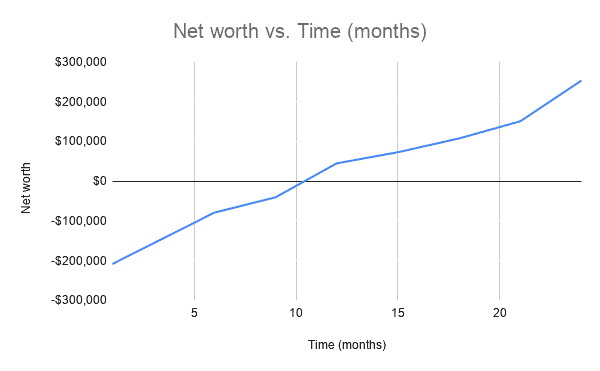

If you don’t feel like clicking through those, our net worth started at negative (-) $208,000. This is how our net worth has changed at each of those time points:

- Six months out, it had improved to (-) $78,819.

- By 9 months out we were at (-) $40,270

- We finally had a positive net worth one year out at +$45,000

- At 15 months, we had reached $73,000.

- It took us 18 months to get to a six figure net worth: $107,718

- After 21 months, we were sitting at a net worth of $150,820.

- With the 24 month update, we shot up to $252,974.

In graphical form, it looked like this for the past two years:

Where are we now? Read on to find out.

27 Months After Fellowship: Assets

Since the release of my book (which you should purchase, by the way), I have been non-anonymous on this site. I have always found that transparency is helpful. So, I hope as we progress with this series, the following is seen as encouragement that you can do this, too.

Here are my assets and the dollar amount for each category. All of this is as of 10/27/2019.

| Asset Class | Investment | Amount 10/27/19 |

| Emergency Fund | Slightly more than 3-Months of Expenses (high yield savings account) | ~$32,000 |

| TPP 403B | Vanguard Total Bond Index Fund | $13,293 |

| Vanguard Institutional (Large Cap) Index Fund | $47,532 | |

| Vanguard Mid-Cap Index Fund | $27,359 | |

| Vanguard Small-Cap Index Fund | $27,399 | |

| Vanguard Total International Stock Index Fund | $20,851 | |

| Mrs. TPP 457 (governmental) | NC Fixed (Intermediate Bond) Index Fund | $3,518 |

| NC Large Cap Index Fund (Black Rock) | $12,843 | |

| NC Small/Mid Cap Index Fund (Black Rock) | $12,853 | |

| NC International Index Fund (Black Rock) | $7,529 | |

| Mrs. TPP 401K/403B | Various Stock Index Funds | $13,118 |

| My Back Door Roth | Vanguard Real Estate Index Fund (VGSIX) | $14,871 |

| Mrs. TPP Back Door Roth | Vanguard Total Stock Market Index Fund (VTSAX) | $14,568 |

| (New) TPP NG-457 Plan | Vanguard Institutional Index Fund/Total Bond Fund (50/50) | $3,036 |

| (New) Vanguard Taxable Account | VTSAX (coming soon) | $300 |

| 529 For Kids (3 529’s combined) | 90% stocks/10% bonds – Index Funds | $17,085 |

| Home | Equity (Fair Market Value = $469,000) | $19,000 |

| Total Assets |

$287,155 |

Comments on our assets

A couple of new things happened this quarter.

First, I started investing in the non-governmental 457 at Wake Forest where I work. Only time will tell if that was a good decision, but I read back through my Should I Invest in my 457 post – and then decided to proceed with the decision now that our non-mortgage debt is gone.

Second, I started a taxable (i.e. brokerage) account at Vanguard. I decided to invest in VTSAX over VTI (the ETF total stock market fund) because VTSAX allows me to invest in partial shares, and it is easier to automatically invest in this fund. The plan is to start sending about $500 per month into this fund. I’ll fund the remainder of the $3,000 later this month to start investing in VTASX, which has $3,000 minimum.

Our Annual Savings Goal

Our annual investment goal remains between $115,000 and $125,000 with a goal of having around $2.5 -$3.0 million in assets by the time we are 45. We get to this annual savings number by investing in the following accounts:

- $45,000 in my 403B

- $12,000 in my non-governmental 457

- $19,000 in Mrs. TPP’s governmental 457

- $15,000 in Mrs. TPP’s 403B/401K

- $12,000 in our Backdoor Roth IRA (here is a tutorial for your first Backdoor Roth IRA, if you need it)

- $3,000 required pension for Mrs. TPP

- $3,000 Health Savings Account (plan to spend half each year, which is conservative)

- $6,000 in a brokerage account

Adding this together amounts to $115,000.

If we add an additional $10,000 to our brokerage account through bonuses or side hustle money (which should be easily done), then we will hit $125,000. If we don’t, we still reach our annual savings goal. This is the beauty of a backwards budget! All of this additional money will go into our taxable/brokerage account.

Debts: 27 Months Out

Here are my family’s current debts.

| Class | Amount of Debt |

| Home Mortgage (~$449,000) | |

| Total Debt (excluding mortgage) | $0 |

Some Comments on Our Debt and Spending

Most of our bonuses and additional income from side hustles went towards paying off our car loans in the last six months. That money from here on out turns into additional investments and enjoyment. What has traditionally been The 10% Rule may well turn into the 20% rule.

Speaking of which, we are hosting Christmas this year at our house. So, my frugal gene took a big hit when we realized that that we wanted a few things we don’t have in order to make this family gathering better. This includes a new custom table and chairs (~$4,750), and a pull-out sectional couch (~$1,600) for the basement.

In times past, this kind of spending would have stressed me out because of our debt. Now, it doesn’t. We get to enjoy spending the money (so long as we are meeting our savings goals!).

After those expenses, additional money will be placed 1/3 each towards paying the mortgage down, investing more, and enjoying vacations and trips. After all, money can buy us happiness when spent on experiences rather than things!

Net Worth

Net Worth = Assets – Debts

$287,155 – $0 = $287,155

**For the purest out there, if we were to include the house in our debt, we would also include the full value on the home on the assets side. This would result in the same net worth.

Our net worth continues to rise consistently. Here is how that shakes out in the big picture.

- We improved our net worth by over ~$34,000 in the last quarter! This is despite a $6,000 AC unit replacement cost and some family trips.

- Since I finished training (when my net worth was -$208,000), we have improved our position by $494,974 in only 27 months. Next update, we should crack that $500,000 net worth increase in only 2.5 years.

- If we keep this pace up, we will be sitting at $1,000,000 in net worth by age 37 or 38.

- We no longer “live on half” as Physician on FIRE prescribes. That said, we are still putting away around 30% of our gross base salaries. With out debt gone, we will probably do the same with any bonus money or side hustle money from this blog.

This should serve as proof that living like a resident after training works if you make a plan and stick with it!

Take Home

Going forward, our goal will be to find contentment in our current life. We are now in the steady stages of wealth accumulation. Though this is automatic, our focus is on the path to financial independence. We want to enjoy this journey along the way through Partial FIRE.

Share your awesome financial news! What goals have you accomplished this year? How did you do it? Leave a comment below.

can you explain how you can put $45,000 in your 403b? I though the limit was $39,000.

Max is 56k into 403B annually. This comes from 19k max for employee contribution (plus another 6k if over age 50 for catch up). The rest can be matched or contributed by employer up to max.

So, employers can contribute up to $37k.

My 45k consists of 19k from me and 26k from my employer.

Amazing progress. So few doctors know or track their net worth that they can’t see progress. You are role modeling a path.

You are clearly on the right track. Thanks for sharing your details to provide light for others to follow.

Thanks, Wealthy Doc! I’ve always appreciated your encouragement!

So glad to see this continue! What an awesome example for others to follow!

Happy to see you guys progressing in such a shirt time. Gives me so much to look forward to when you set your goals and stay at them.

This is awesome, TPP! I love how you are saving and making wealth accumulation automatic. It frees your mental energy and time some that you can live your life and spend money on the things that you truly enjoy.

I was wondering if you were thinking about diversifying into real estate at some point. My investments are almost entirely in equities / bonds / stock market just because it’s so easy/simple/passive/automatic/boring. Like WCI says, good investments are typically boring investments.

Personally, I was thinking more about diving into real estate a little for the added diversification and to experiment and keep things interesting. But we’ll see… I kinda like how how I’m doing now, so why change it…

Thank you so much for your transparency! I agree with the “e-mails, comments, and otherwise” that this series is an outstanding exercise. I am only one year out of fellowship (wife still in fellowship for another 2 years) and we are making similar strides. All of my projections are 20-30 years down the road so I appreciate seeing how rewarding these strategies can be in only a few short years! Keep up the good work!