People often ask me for practical advice on getting started with investing. Given the fact that many people have just transitioned to new jobs, I thought I’d give you my approach to figuring all of this stuff out through a technique I like to call Waterfall Investing. However, before I can answer that, we must first answer, “How much money should I be saving each year?”

This post will serve as a Part 1 for a two part series on Waterfall Investing. In order for us to discuss the order in which we should invest, we must first determine how much money we should be saving each year. That’s what this post will cover.

If you want to know more about the 20% of personal finance that you need to know to get 80% of the results, click here to buy the book that will teach it to you.

Introduction to Waterfall Investing

If you look at the main image for today’s post at the top of the page, you’ll notice a picture of flowing water. As the water moves forward, it completely covers each step before spilling over to the next.

This is the same way that you should invest your money. It happens in a step by step fashion. Here is the broad overview in a three step process.

- Determine your annual savings goal.

- Divide this number by 12 to figure out your monthly savings goal.

- Using a backwards budget, fill up your investment vehicles in a step by step format until you reach your monthly savings goal.

Though these steps may seem simple, they do require a little bit of work. We will discuss them each in order.

First, we need to discuss goals. Then, we need to talk about annual spending and how much money you need to save each year.

Name Your Two Investing Goals

In order to figure out an how much money to save annually, you need to know your financial independence number. Then, you simply use an online calculator (this calculator is my favorite) to determine your annual savings goal based on your timeline as discussed below.

I’ll give an example at the bottom of this section on our own personal calculation. Before we get there, you need to know two pieces of information to figure out what your number is and how long you’ll have to get there!

How Old Will You Be?

The first goal is the age by which you want to be financially independent. This is important, because it helps form the timeline. In other words, it tells you how long you have to save the money you need to save.

For example, if you want to be financially independent by age 60 you will not need to save as much money as you would if you wanted to be financially independent 10 years earlier at age 50.

If you aren’t sure of the age by which you plan to retire, I encourage you to go through The Three Kinder Questions as a life planning tool. These questions really helped my wife and me solidify our goals by first realizing what is most important to us.

How Much Will You Spend?

The second piece of information that you need is your planned annual spending after you retire. This will help you to know how much money you need to be financially independent. While early in your career, you may have to make some educated guesses.

We don’t know exactly what this will look like if your FI age is 20 years away. Inflation may impact this number as will your goals and desires as they change with time. That said, look at your current spending and give it your best shot.

Once you figure this out, you will be able to determine your financial independence number. This is classically done by multiplying your annual spending by 25. I recommend that if you plan to retire early (before age 60) that you consider multiplying this number by 30.

For example, if you determine that you are going to spend $100,000 each year, then you need $2.5 to $3 million to be financially independent and retire.

If you don’t know how much you spend annually, I recommend using a program like personal capital or mint to track your monthly spending. Track the spending for a few months and extrapolate.

How Much Money Do I Need to Save?

Now that we know both the age by which you want to be financially independent and your financial independence number, you can start figuring out your annual savings goal.

Here is an example for my family.

My wife and I would like to be able to have about $8,300 per month to use each month. This includes money we plan to give to others, our spending money, and money we would utilize for travel and vacations. Remember, though, we will be debt free at this point! So, $8,000 can go a very long way.

Given this number, our annual spending plan is to be around $100,000 per year. Multiply this number by 25-30 and we need about $2.5 to $3 million to be financially independent. We want to reach this number by age 45.

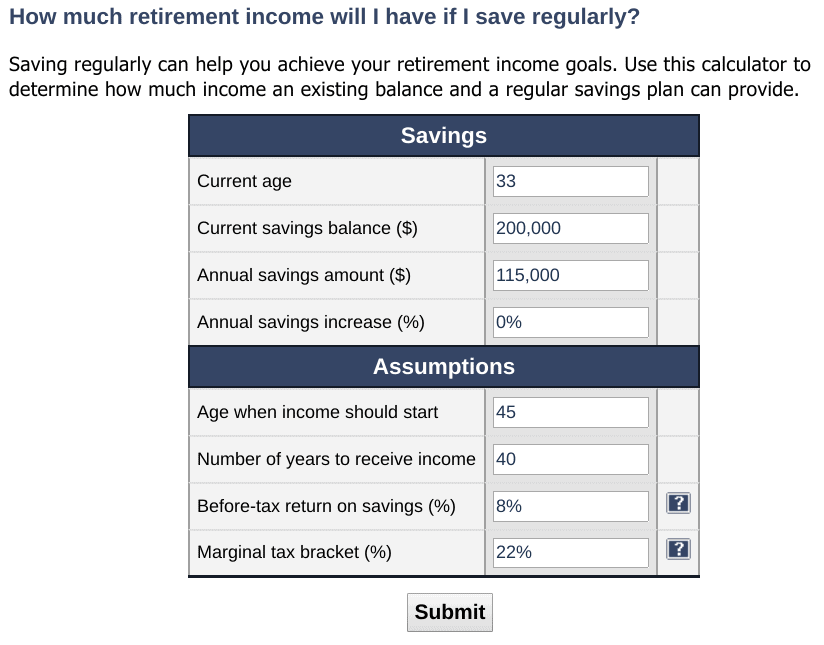

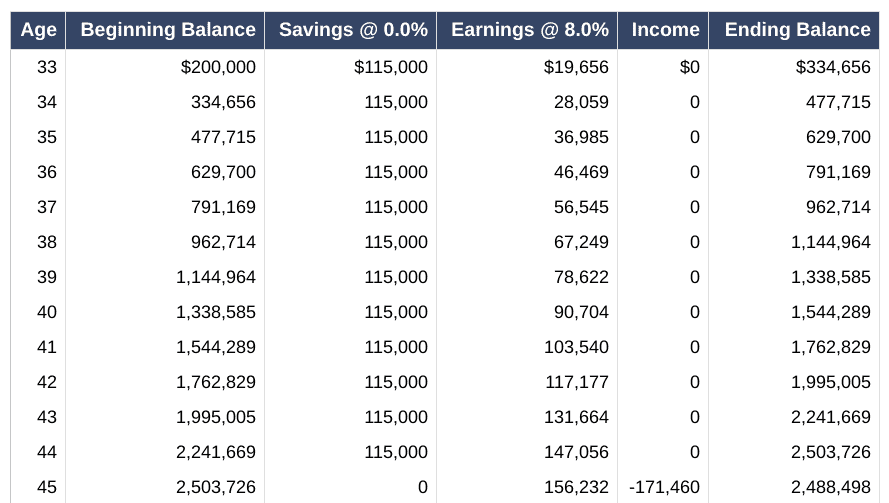

Utilizing a handy dandy calculator, we have determined that in order to get to that goal from our current age of 33, we need to save $115,000 per year given the assumptions seen below.

Our Annual Savings Number

You may notice that I assume an 8% rate of return. If you want to be more realistic (or conservative depending on your view point), you could place 4-6% into the calculator.

With these assumptions, we would become millionaires by age 38. By age 45, we would have enough money to be financially independent. Note, that we are starting with our current savings amount, which is currently around $200,000.

You can see that this will get us to our $2.5 million number by age 45. Ideally, we hope to save more as time progresses, but we also know that we will likely have some passive income streams coming in through something else (real estate, this blog, an invention, etc).

Also, I don’t plan on retiring at age 45. I believe more in FI than in FIRE. So, I would probably consider cutting back substantially at this point and continuing to save, though it would be at a lower annual savings rate.

Take Home: How Much Money Should I Be Saving Each Year?

You might notice that a lot of my financial practices work backwards. The reason is that we cannot know how to get to where we are going, if we don’t know what the final destination looks like. You wouldn’t just hop in your car with an unknown amount of gas in the tank and no idea of where you are going for a vacation, right?

So, first spend some time sorting out your big picture financial goals utilizing the Kinder questions. Then, determine your annual spending habits. After that, you should be able to gauge how much you’ll spend once debt free in retirement. And, finally, this will allow you to determine how much you need to be saving each year to get to that goal by your desired age.

That’s how much money you should be saving each year to reach financial independence.

Did you find this helpful? How had you previously determined your annual savings goal? What questions do you have? Leave a comment below.

Well, maybe. If you are lucky.

Early retirement increases the risk of going broke eventually.

Spending $100K after tax can be more like $143K before. 33 years of expenses then become more like $4.7M

I don’t think I agree.

Taking $100,000 out from assets is a very different thing than making $143,000 and living on $100,000. Some of the money I pull could come from a taxable account, which is taxed at a much lower capital gains rate (or a Roth IRA account if the SECURE act goes through and abolishes the benefits of the Stretch Roth IRA as an inheritance).

I think there are a lot of ways to get to that $100,000 number without getting hit by that much tax.

Also, early retirement only increases that risk if you (1) Don’t save enough before retiring and (2) you experience SORR issues.

Granted,

You and I will be fine. Actually, I have tons of income from real estate and all my retirement money is in either Roth IRA or Roth 401K.

I’m just pointing out that rules of thumb are okay, but often overly optimistic. Plus retirees run into trouble when they don’t consider that money withdrawn from a traditional IRA or 401K are ORDINARY income.

So $143K can become $100K after 24% Fed + 6% state. Add in underestimated spending, inflation and lifestyle creep and reality can be less rosy.

I had only saving $25,000 when l were 55 years old. What should l do to add this money ?

Jimmy-

This process of breaking the concept down into a monthly number makes the whole idea of saving towards financial independence less scary. I use the same technique when doing one-on-one financial coaching. It’s harder to grasp needing to save several million dollars than to decide to save $1000/month. Having that bite-size goal makes a big difference and really gives people hope.

-Brent

http://www.TheScopeofPractice.com

Thanks, Brent! I think this is a great way to think through this stuff, too. In fact, I’ve thought about creating a course where I lay out my system and exactly how I think through these things to set up an automatic path to financial independence. I just haven’t had the time to do it.

I completely agree that “bite-size” goals are important. After all, it is much more digestible that way.

TPP