Every three months, I post my net worth on this site. This has proven to be a hotly anticipated post by readers. While I considered squashing it at two years, the outcry from readers was loud enough to encourage me to keep posting these numbers publicly.

There are a few major reasons for these updates. First, I want to dispell the myth that money is a taboo topic that we should not openly discuss. This is important in my roll as an educator of future medical professionals. Second, posting net worth updates holds my family and me accountable. Third, it proves that you, too, can make financial mistakes and still obtain your financial goals.

Each update starts with a summary of the previous updates and then we dive into our assets and debts as they currently stand. Finally, the newest updated networth is posted at the end.

A Quick Update on The Last Two Years

This is the next installment of the Physician Philosopher Net Worth updates. To read my previous Net Worth Updates click the following links.

- This post discusses some of my numbers and goals when I first started this site in November 2017.

- Here is my first quarterly net worth update written six months after I started my job as an attending (numbers from January 2018)

- Second Quarterly Net Worth Update (4/27/18)

- The One Year Out from training Quarterly Net Worth Update (7/30/2018)

- 15 Months Out from training (10/2018)

- 18 Months from finishing fellowship (1/2019)

- 21 Months Out (4/2019)

- Two Years Out from training (07/2019)

- 27 Months after finishing fellowship (10/2019)

The Last Two Years in Numbers and Pictures

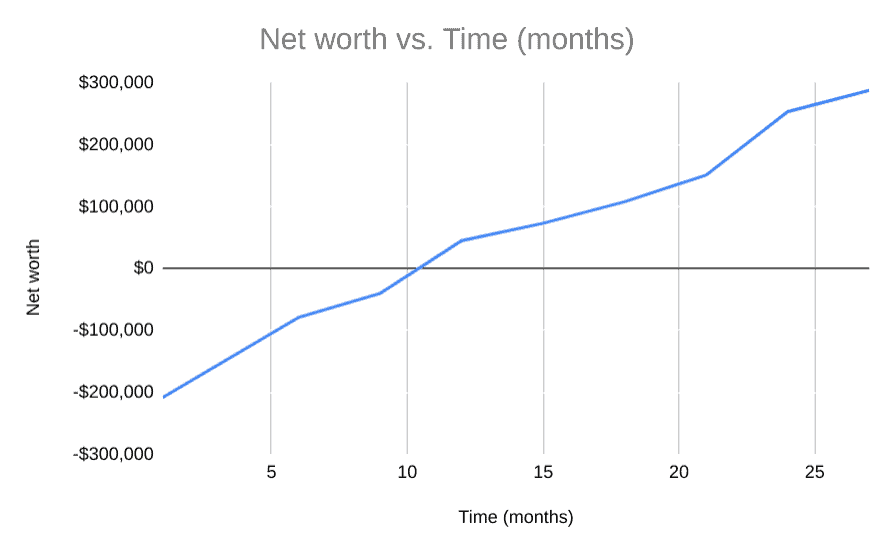

If you don’t feel like clicking through those, our net worth started at negative (-) $208,000. This is how our net worth has changed at each of those time points:

- Six months out, it had improved to (-) $78,819.

- By 9 months out we were at (-) $40,270

- We finally had a positive net worth one year out at +$45,000

- At 15 months, we had reached $73,000.

- It took us 18 months to get to a six figure net worth: $107,718

- After 21 months, we were sitting at a net worth of $150,820.

- With the 24 month update, we shot up to $252,974.

- At 27 months, our networth was $287,155

In graphical form, it looked like this for the past two years:

Where are we now? Read on to find out.

30 Months After Fellowship: Assets

Since the release of my book (which you should purchase, by the way), I have been non-anonymous on this site. I have always found that transparency is helpful. So, I hope as we progress with this series, the following is seen as encouragement that you can do this, too.

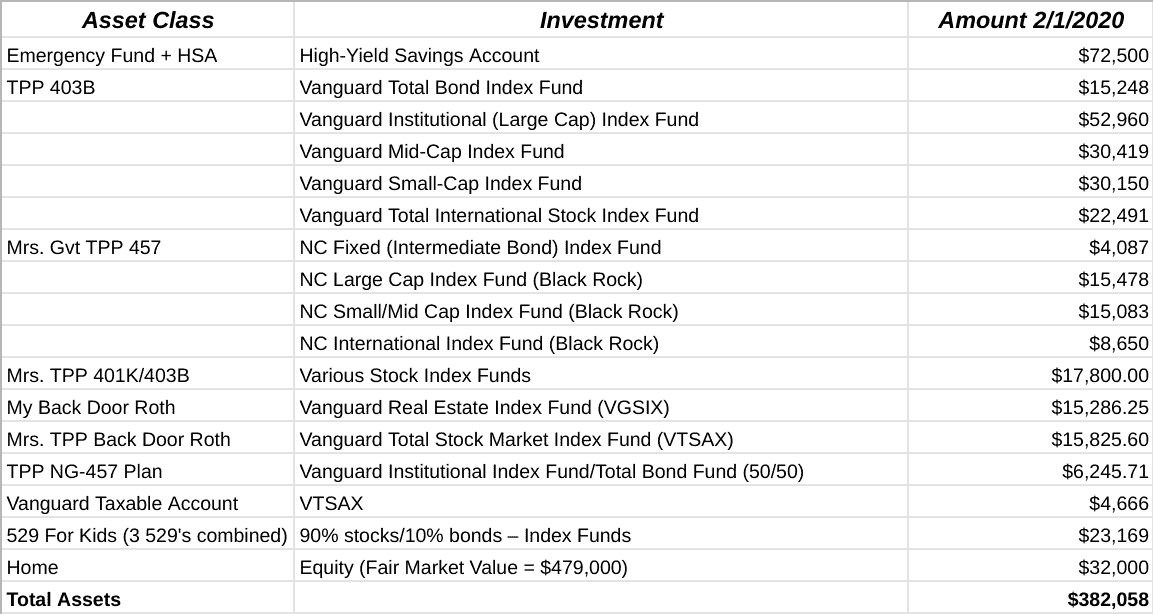

Here are my assets and the dollar amount for each category. All of this is as of 2/1/2020.

Comments on our assets

We finally cracked $300,000 in assets this quarter. Assuming that we don’t experience a bear market, we should crack $500,000 by the end of the year, which is insane.

Because we spend less than we make each month, we are getting a little heavy in liquid assets. However, we have a couple of big trips coming up this year, including a family reunion to Disney World and a destination wedding to California in July. In my mental accounting model, this money has already been spent for those trips, even though that hasn’t actually happened yet. This explains why our cash in savings is much higher than in times past.

Additional money coming in above our annual savings goals will now be split three ways: Charitable giving, Travel, and paying off our mortgage early.

Our Annual Savings Goal

Our annual investment goal remains between $115,000 and $125,000 with a goal of having around $2.5 -$3.0 million in assets by the time we are 45. This doesn’t include any “passive income” we have coming in through The Physician Philosopher or the Money Meets Medicine podcast.

We get to this annual savings number by investing in the following accounts:

- $45,000 in my 403B

- $12,000 in my non-governmental 457 (though I may increas this to $19,500 given our increasing cash flow)

- $19,500 in Kristen’s governmental 457

- $19,500 in Kristen’s 403B/401K (we will max this out in 2020 for the first time)

- $12,000 in our Backdoor Roth IRA (here is a tutorial for your first Backdoor Roth IRA, if you need it)

- $3,000 required pension for Kristen

- $3,550 Health Savings Account (plan to spend half each year, which is conservative)

- $6,000 in a brokerage account

Adding this together amounts to $120,550, which is within our target annual savings rate. All of this is automated out of our paycheck each month outside of the backdoor Roth IRA, which happens in a single transaction in July when I receive my annual bonus.

If you add in the $1,250 we put into our kid’s 529 plans each month, our total annual savings is actually $135,550. With our current assets, and assuming a conservative 6% average annual growth in the market, we should crack $1 million in assets by age 37, and we will reach $2.5 million by age 43.

Debts: 30 Months Out

Here are my family’s current debts.

| Class | Amount of Debt |

| Home Mortgage (~$446,923) | |

| Total Debt (excluding mortgage) | $0 |

Some Comments on Our Debt and Spending

Being debt-free outside of our mortgage has been simply amazing. We are crushing our financial goals.

Given that our monthly spending is always less than what we bring in, spending money is guilt-free at this point. I no longer scrutinize every single dollar that comes into our bank account. This led us to buy a trampoline for the kids, a peloton for my wife and me, and we also expanded our kids extracurricular activities as my oldest has really jumped into gymnastics with both feet.

Given that we are automatically saving more than our annual savings goal, I plan to take square aim at paying off our mortgage early. We currently owe $447,000 on the mortgage. If we put an extra $50,000 towards our mortgage each year, we would pay the house off in only 7 years after purchase (or 6 years from now). At this point, that seems like a pretty reasonable goal.

Net Worth

Net Worth = Assets – Debts

$382,058 – $0 = $382,058

**For the purest out there, if we were to include the house in our debt, we would also include the full value on the home on the assets side. This would result in the same net worth.

Our net worth continues to rise consistently. Here is how that shakes out in the big picture.

- We improved our net worth by over ~$94,903 in the last quarter! This is despite Christmas spending, but largely due to market gains, increasing our emergency fund, and appreciating equity in our house as we pay down the debt.

- Since I finished training (when our net worth was -$208,000), we have improved our position by $590,058 in only 30 months.

- If we keep this pace up, we will be sitting at $1,000,000 in net worth by age 36 or 37. We will hit our FI number at age 43.

- We no longer “live on half” as Physician on FIRE prescribes. That said, we are still putting away around 30% of our gross base salaries. With out debt gone, we will probably do the same with any bonus money or side hustle money from this blog.

This should serve as proof that living like a resident after training works if you make a plan and stick with it!

Take Home

Going forward, our goal will be to find contentment in our current life. We are now in the steady stages of wealth accumulation. Though this is automatic, our focus is on the path to financial independence. We want to enjoy this journey along the way through Partial FIRE.

Share your awesome financial news! What goals have you accomplished this year? How did you do it? Leave a comment below.

Why do you budget to spend half your HSA money? Why not just cash flow the expenses and keep the money tax advantaged?

Great work so far!

Great question. The answer is not as great.

Math favors what you are saying. And I might actually start doing that this year, though last year I didn’t. Planning to save half (and actually saving more) seems like a better problem to me.

Also, I am definitely not one of those people who are organized enough to save receipts to get reimbursed at a later date.

All that to say, I think you have the right perspective, but I would be dishonest if I didn’t say that I spent half the money last year…. Cause I did ?

You could argue that the HSA should be the first place to fill up because it is triple tax advantaged. But even if you do not go that far it is easy to argue that you should max that out before taxable investing. Unless you need the taxable money for a different purpose.

Either way you are saving plenty to meet your goals!

My employer gives $800 in free HSA contributions. My paycheck pulls $200 every month bc I have it set up this way. I’ve stuck with that because it “dollar cost averages” the investment out over the entire calendar year and then it’s easy bc it comes out pre-tax from the paycheck.

However I had a thought the other day. If I didn’t have it set up to pull from the paycheck, technically I just just fully fund it with my entire $2750 from the start of the year to let it potentially grow longer. Then I just note that I put that money in post tax when I do my taxes and get the deduction for HSA contrib.

Thoughts?

edit to add. Numbers above are rough and rounded but I do always ensure to Max it out each year in case that was confusing.

This is the classic lump sum versus DCA question. all things being the same (i.e. it doesn’t mess up your match/contribution from your employer) doing the lump sum beats Dollar Cost Averaging.

Thanks for the input. I guess it all comes back to “time in the market” is better than “timing it!”

Congratulations on your success! Well done.

I like net worth posts. But I find a very interesting thing happens as net worth and/or income hits 7 figures, which it will pretty quickly for you. Nobody thinks posting it is cute any more. First world problem for sure, but because of it I think there’s an upper limit on bloggers posting their net worth. They all seem to stop shortly after hitting $1 Million. Which I suppose means that you can’t just dispel all the taboos about money, even on a site like this one aimed at higher earners. People just don’t like to learn that someone else has or makes an order of magnitude more than they have or make.

I mean, think about how you (the reader of this comment, not necessarily the blogger) would feel to know that someone increased their net worth by $5 Million last year or even last quarter? Or took in a million bucks last month? There’s a reason people just shut up about money after a while.

I guess time will tell! You certainly have more experience in that regard than I do!

I think transparency is a good thing, but as soon as it seems like bragging, I’ll probably stop. That’s not the point of the posts.

Personally, I would applaud people for their success, but envy hasn’t really ever been one of my vices (I have many others, don’t worry ?)

WCI is probably right about how a wide audience will feel.

However I am not jealous and I love seeing these bc 1. I love calculations rather than just talking about theory and 2. It’s incredibly motivational and inspiring as someone else recently out from training!

I also liked that it reminded me once I’m closer to this situation then I can be more purposeful with charitable giving goals.

Keep up the sharing as long as you feel comfortable doing so!

Great work, Jimmy!

And yes, I agree that the goal should be to find contentment and fulfillment in life.

Money comes and goes. For high earning professionals like us, it comes quite a bit easier compared to most people. And fortunately for mindful people with relatively frugal lifestyles (like us), it doesn’t go as easily too.

Contentment is not as straight forward to figure out. Weird how it can be so easy to fill our money buckets, but sometimes it’s hard to fill our own cups.

Thanks, DMF! completely agree.

I’d be curious in seeing what a monthly budget looks like for your family, and roughly what your gross income is. Very impressive!

Gross family income, including all sources, is around 450-500k. I’d guess we spend around 10-12k per month if you include the mortgage.

Maybe I’ll write a post up of our typical monthly spending at some point.

Does your 10-12k spending including your investment contributions?

No.

$3k mortgage + 7-9k in spending

After I started automating everything I stopped tracking spending as closely. It would be interesting to go back the last six months and track things more carefully.

I’d have to break it up into our typical monthly spending and then spending with each quarterly bonus though.

This is great!! You gave me inspiration to pay off my student loans off within one year or residency!! It’s been 7 months and I am 120k of 250k done (the new tesla set me back a bit). Looking forward to being where you are soon!!

That’s awesome!!!! Keep up the strong work.

P.s. you are allowed to have a little bit of fun while you crush your financial goals, too. Good job finding that balance!

Congrats on more good work!

I love tracking my net worth monthly. I started my first attending job 6 months ago, and it’s been like rocket fuel after years of $1-2k changes per month.

That’s an expensive home, you are losing money on that every year.

Not sure why this got put in trash, but I wanted to respond.

Any house that costs more than zero dollars is money lost every year. That argument doesn’t hold a lot of water. A better question is “how much money am I okay losing each year on where to live?”

For us, we felt a house that was around the value of what we make in a single year for where we live was reasonable. In more expensive cities, people often feel the need to go to 2x their annual income on a home price. Our house ended up costing less than what we make in a year. It’s all about perspective, I suppose.

Second, looking at any individual expenditure is not really helpful. A house worth what we owe would be very unreasonable if we were on a path to never be able to retire because of a low savings rate or we weren’t able to accomplish our other financial goals. This isn’t our situation, though. We will be financially independent in our early to mid 40s. Given that, it’s not unreasonably priced home at all.

I think too many people in this space pinch pennies to be miserable right now so that they can live “some day”. I want to live right now and save enough for tomorrow. I don’t want to choose, if I don’t have to – and that is a wonderful place to be.

TPP

Thanks for sharing TPP, It must be pretty scary to share this detail, but so inspiring for us readers! Great for challenging us to keep up with reasonable savings rates!

Thanks, Aussie Doc!

Yeah, I’m not sure how long I’ll continue it, but the readers really seem to like it. For now, it’ll keep going given the interest.

TPP

This question is mostly related to my lack of retirement vehicle knowledge, but I was confused how you are able to put away $45,000 into your 403B, and an additional $12,000 (or $19,500 you are considering to put in) into your 457. Additionally, how do you put in $19,500 into your wife’s 457 and 403B respectively?

I thought there was a maximum contribution for these accounts of $19,500 per employee? And is your wife dually employed at 2 places, is that how she is able to max out two different accounts?

Just trying to understand these types of accounts better, thanks for all you do!

Hey Chad,

A 403B and a 401K can be treated in similar fashion. In fact, it is probably best (Generically speaking) to consider them the same thing.

You can put $19,500 into both a 403B (or 401K) and another $19,500 into a deferred compensation plan like a 457. That is all from the employee side. My employer matches/contributes some money into my 403B for making my contribution. That ends up totaling $45,000 in total into my 403B. In other words, I put in $19,500 and my employer provides around $35,500.

It is perfectly legal to max out both a 403B and a 457 to the $19,500 into each of those accounts. You cannot, however, max out both a 401K and a 403B at the same time, if offered by the same employer. I found that out because my wife is a teacher and has access to a 401K, 403B, and a 457. So, we chose to max out the 401K and her 457. Her 403B will stay empty.

Jimmy