Savings Rate

The first ingredient in the Live Like a Resident pudding is a large serving of savings rate. Your savings rate is the main determinant of your initial success in investing. Later on your money will start to work for you once you’ve saved a substantial amount. Why is this initial savings rate so important right after you finish? Let’s perform an experiment to prove the point.The 2 Million Dollar thought experiment:

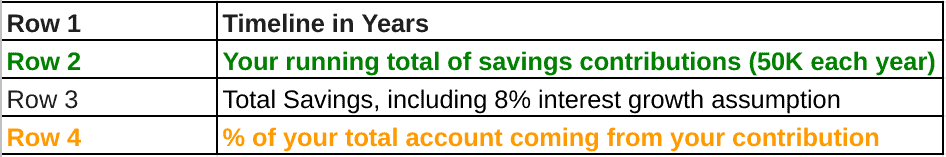

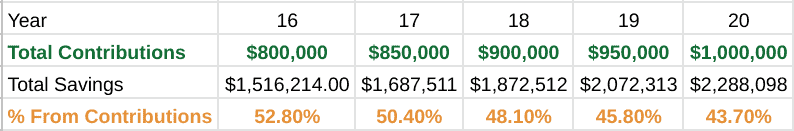

Your goal in this thought experiment is to get to $2 Million Dollars. Here are the assumptions. You save 50K annually each year and earn 8% interest growth (we could assume less, it’s just the number I chose). Given these assumptions, it would take you 19 years to get to that goal (you’d actually be sitting at $2,072,313 at the end of year 19). To understand the following numbers, here is the key to the following tables: The First Decade

Here is what the first ten years would look like:

The First Decade

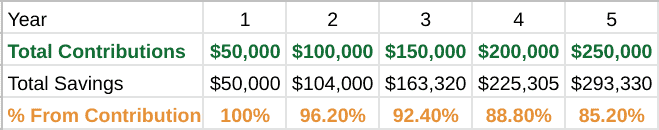

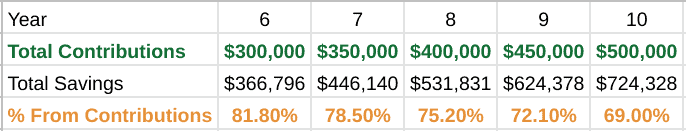

Here is what the first ten years would look like:

Even after ten years of savings, your annual savings rate (that $50,000 you save each year) accounts for ~70% of the entire total of your accumulated savings.

Why should you care?

Even after ten years of savings, your annual savings rate (that $50,000 you save each year) accounts for ~70% of the entire total of your accumulated savings.

Why should you care?

- This means that the major determinant of your retirement nest egg in your early years is your savings rate (it accounts for 70% of your savings at 10 years).

- With these assumptions, you have not even gotten half way to your goal of $2,000,000 in TEN years of saving. In fact, you stand at less than $800,000.

- Remember, though, you have to add another 1.2 million dollars in 9 years and you only saved $800,000 in TEN?

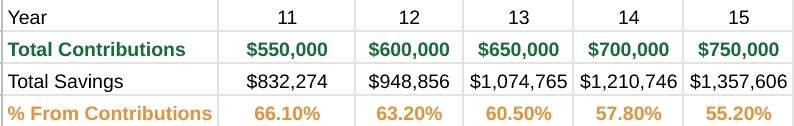

The Second Decade

In the chart, you’ll notice that year 17 is the break even point where the total amount saved coming from your contributions starts to dive below 50% of the total value and compound interest starts taking over as the predominant factor determining your total savings.

The take home here is that the further along you get, the less your savings rate has to do with your total accumulation. This is because your compounding interest begins to really shine from all those hard years of saving early while you lived like a resident.

This is one of the many ways that the rich get richer. Once you’ve saved “enough” your compound interest starts working overtime for you.

In the chart, you’ll notice that year 17 is the break even point where the total amount saved coming from your contributions starts to dive below 50% of the total value and compound interest starts taking over as the predominant factor determining your total savings.

The take home here is that the further along you get, the less your savings rate has to do with your total accumulation. This is because your compounding interest begins to really shine from all those hard years of saving early while you lived like a resident.

This is one of the many ways that the rich get richer. Once you’ve saved “enough” your compound interest starts working overtime for you.

Saving Early Matters

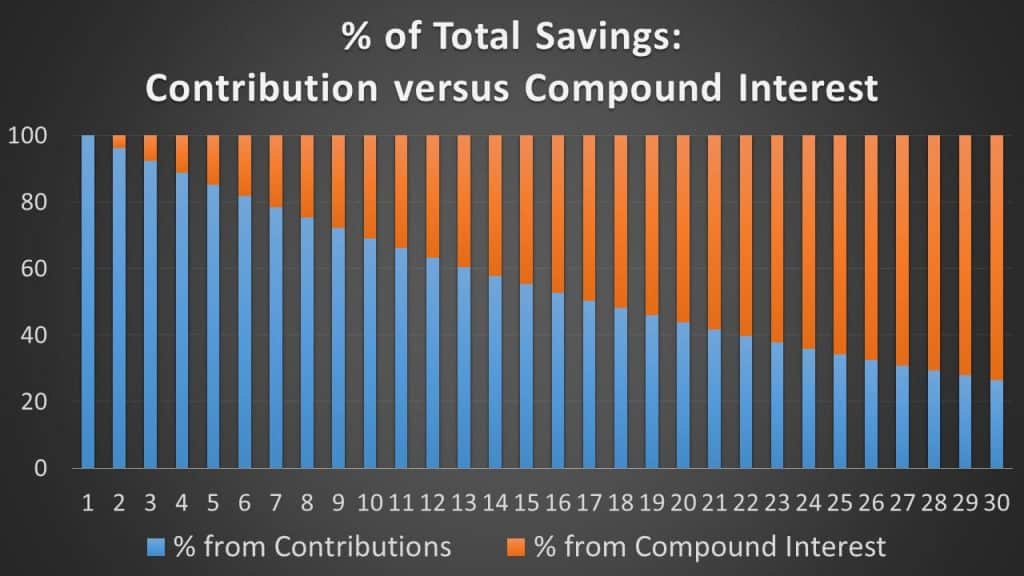

For those that prefer visual representations, the following figure may explain it better. The blue bars are the % of your total savings that comes from the money you have saved (i.e. your contributions). The orange bars are the % of your total savings that comes from compound interest. Time in years is on the X-axis, percentage of your total savings is on the y-axis. Note that the first year you start investing the entire bar (100%) is blue, because all of your savings came from your contribution from that first attending paycheck. As noted earlier, in year 17 these two points (the blue bar and the orange bar) are even at 50%. From that time point forward, compound interest is more responsible for your total savings than your contributions.

What happens if we extend the math further? Well, after 30 years, this savings plan ($50,000 per year for 30 years) was started, the total savings would be $5,641,161.

Of this total, 73.5% would be due to compound interest (or $4,164,161) and only 26.5% would be from your contributions (a total contribution of $1,500,000, or 30 years at $50,000).

You read that right. You contributed 1.5 million dollars over 30 years and made over 5.6 million dollars. THAT is the power of living like a resident and earning compounding interest.

As noted earlier, in year 17 these two points (the blue bar and the orange bar) are even at 50%. From that time point forward, compound interest is more responsible for your total savings than your contributions.

What happens if we extend the math further? Well, after 30 years, this savings plan ($50,000 per year for 30 years) was started, the total savings would be $5,641,161.

Of this total, 73.5% would be due to compound interest (or $4,164,161) and only 26.5% would be from your contributions (a total contribution of $1,500,000, or 30 years at $50,000).

You read that right. You contributed 1.5 million dollars over 30 years and made over 5.6 million dollars. THAT is the power of living like a resident and earning compounding interest.

What accomplishes a large total savings is having a high savings rate in your early years, and a high savings rate is best accomplished early in your career by living like a resident when you finish.

Grindin’ Debt

Of course, your savings rate is only part of the living like a resident mantra. Your savings rate could be even higher than $50,000 per year if you didn’t have those pesky student loans. This is why it is so important to consider refinancing your student loan debt or pursuing PSLF early! And, if you don’t know what to do, then get a student loan consult! The sooner you have a plan, the sooner you can take the next steps. This is important because the % of your money put towards debt and your savings rate help determine your Wealth Accumulation Rate (WAR). The higher your WAR, the faster you’ll be obtaining your financial independence. After all, after you live like a resident and that debt is paid off you can then put that money towards others important things, including:- A higher savings rate that will allow you to reach your financial goals faster. If you had started out investing $75,000 per year, you would have reached the 2 million dollar mark by year 15 instead of year 19. That could save you four years.

- You can make a big purchase, such as a bigger home, with the increased monthly cash flow (though I don’t encourage you to think about money in terms of monthly payments).

- Invest more in your kid’s 529 or perform your first backdoor Roth IRA.

- Use some of that money (via The 10% Rule) to enjoy a little more of life. Maybe take that vacation you’ve been waiting to take.

A Pound of Earnings

One of the big advantages that you have coming from residency is that you are “used to” living and working like a resident. If you can keep that work pace up for even an extra 12 to 24 months following residency, you’ll likely make a lot more money. That is one of the ways that I paid off $200,000 in student loans in 19 months after I finished training. This additional work could be through locums tenens work, picking up extra shifts, or working a side hustle or three. For example, some ways that I’ve earned additional income since finishing training include my side hustles include picking up extra shifts, performing medical malpractice expert witness work, and my The Physician Philosopher blog. The point is that when I finished training, I was used to working resident hours. Keeping that going really helped us achieve our financial goals sooner.Living Like a Resident

Take Home:

Many readers will already understand these principles, but for anyone early in their career, I hope this serves as a solid reminder. What you do in those first few years after you finish is fundamental to your financial success. If you need help figuring more of this stuff out, then I encourage you to go and purchase The Physician Philosopher’s Guide to Personal Finance. It’ll teach you the 20% of personal finance doctors need to know to get 80% of the results.What did you do right after you finished? Did you buy the big house and the nice cars? Did you put the extra money towards grindin’ debt or investing? If you had a time machine, what would you do? Leave a comment below.

I’m almost 2 years out of residency and still live like a resident. My husband and I worked aggressively to pay off our student loans last summer. I did pick up a lot of extra shifts last year as we also had our wedding as well. This year, I’m just doing the required shifts. Instead of buying, we are renting a 600 sq studio. We made great efforts to choose the location of our studio so I could give my car to my younger brother. We utilize travel hacking to travel lavishly for a fraction of the price. Our loved ones think we spend a lot of money but they don’t believe us when we tell them that our saving rate is >50% living in Chicago. A lot of our friends still haven’t touched their loans yet.

Sounds like you “get it” and made some really wise choices. Those choices are going to pay huge dividends as you reach financial independence decades earlier than your colleagues. Keep up the strong work!

P.s. What kind of travel hacking do you think makes the biggest difference?

While not a resident, I can decidedly see similar trends among the other PhDs at work. Being paid in Scandinavia, most of them succumb heavily to lifestyle inflation (a PhD pays roughly three times a regular student stipend). The cafes and cafeterias on campus are especially well visited to award yourself for a long day in the lab.

Why, oh why do people spend upwards of $3 for a regular black coffee in the cafe, when there are coffee machines and coffee/tea all over campus???

I think this is more of a human phenomenon, I just see it in my residents. People are consumers and will spend what they make until they realize there is a better way.

P.s. I agree that the best tasting coffee is free coffee!

Excellent post. When your investments start making more than you save, that’s escape velocity. And that’s when your wealth takes off. But it takes a lot of prep work in the kitchen before then. All residents and early attendings need to read this.

Getting that velocity going is the hard part for sure. We just need people to continue to spread the education to those following behind us.

Great post. Savings rate is a big one as it lays the foundation for compound interest, and it’s something that you can control (unlike investment returns). Most docs make enough to be able to max out their tax-advantaged accounts and pay extra toward their student loans.

Thanks! And I think you are exactly right and that’s what I do. I max out my retirement space and throw everything else at my loans for now.

We bought the big house and doctor stuff. After a few paychecks melted away without touching debt or retirement I freaked out. Thanks to some good books (I’m a fan of William Bernstein) and websites like WCI We made serious changes including a job change. Never looked back. Wish I would have read this post about 7 years ago.

Thanks for the comment.

That’s exactly why I am trying to get the word there. I work with residents and medical students daily and try to advocate for these changes in my daily life as well given that there are two topics we learn nothing about in training that are so important: Wealth and Wellness.

Hopefully, this post will prevent someone from making the same mistakes you and I did along the way! Glad you’ve righted the ship.

I can’t remember who called the living like a resident years a ‘financial fellowship.’ I like that analogy too. It drives home the point you are making about savings rate. Having a >50% savings rate is essential to hit financial independence quickly.

The other part of what makes living like a resident so important is that you avoid early career lifestyle creep and can slowly change your consumption. The 10% rule you mentioned can really help you feel like you are being properly rewarded for your hard work but not at the expense of future you.

Completely agree.

I’ve heard of the financial fellowship, too, but am not sure who coined it.

We have definitely put more than 50% towards building wealth between our debt and investments.

The 10% rule makes the heart happy so that you don’t mind doing all of that.

Thanks for commenting, Kpeds!

Your information is right on! I’m in primary care which notoriously doesn’t “pay a lot”. But I worked hard 2 years out of graduation, lived cheap, traveled on CME and piggy backed vacation trips to them to save money, and I’m solidly at year 3 on your savings and investment chart. The freedom is 100% worth it. 3 years out I can now live “like a doctor” and also keep saving with compound interest!

That’s awesome! Congrats on the reuslts. I have found said financial goals and achieving them to be extremely satisfying.

Keep it up!

Another excellent post, TPP! Love the graphs. Great to see further proof that we’re doing the right thing.

Thanks, Dr D!

I couldn’t agree more with this article. I am 3 years out of residency and have been living like a resident since day one. I was done paying off student debt amounting >330k in 17 months and have been throwing over 85% of my net income into retirement and taxable account once debt was fully paid off. I have upgraded to a nicer apartment but still drive the same 10 year old Honda Civic I drove while a resident. I thoroughly enjoy the simplicity of my life and the safety net my aggressive savings provide me.

Great advice, I’m a second year attending and currently paying off debt aggressively, and investing 75k yearly into pre-tax and taxable accounts.

Once I’m done with student debt in the next 6 months, I’ll be able to supercharge my savings and add around 150k yearly. Looking forward to that juicy compound interest!

That is impressive! Keep up the strong work,Jay!

Yes,

Nice analysis.

Early savings help a lot. I actually learned a lot about that from WCI’s first book.

I never “lived like a resident” outside of residency but I did maximize my retirement savings and I bought real estate. I also invested in our business and surgery center. So it all turned out well.

In retrospect, I should have spent less time trying to maximize my ROI and simply saved more.

I love this post as it really unpacks the behavioral downstream behind living like a resident. The enlarged household income as an attending can aggressively be used to both pay down debt and to save money. Your graphs nicely point out the power of sticking with a saving plan, which is then accelerated by compounding interest.

All of this is predicated on a willingness to accept a few more years of “delayed gratification” during our early attending years. Unlike most professions, we are conditioned for this behaviorly, so it’s just a matter of being coached to do it. I wish someone had coached me with the same advice during my residency.

Me and my fiance are about down with training, I am foot and ankle, she is CRNA, and we have discussed our plans to live like a resident for a few years following in order to pay off student loans (3 year plan, will work hard to pay it down sooner), increase our real estate (I have my license so makes life a little easier), and try to get ahead in 3 years time. We do not have any kids but I have 1 year left with fellowship so we are sticking to our plan of living like a resident, saving about 15% of our pre-tax income, we want to increase that number to 20% within a 1 year times, max out Roth IRA and continue contributions to 401K and just knock out student debt. It seems like a fair aggressive balance between investing, paying off debt, and living like a resident.