Myth #1) I’ve Made Too Many Financial Mistakes!

Failure can be a great master or a great teacher; it is up to us to choose which it will be. Many doctors shy away from sharing about money with their trainees because they feel like they’ve made too many financial mistakes. They feel like they are a terrible example to follow. Who are they to offer financial guidance? Yet, time and again I’ve heard people tell me that some of their favorite personal finance posts to read involve the ones where we admit to our financial mistakes. “Oh, you bought whole life insurance and surrendered it after you realized it wasn’t good for you? What do you mean it was a terrible idea not to fill up your 401K prior to being 10 years out from training? You can’t get disability insurance because you applied when you shouldn’t have?!?!?” These conversations may be challenging for doctors in practice because it means they have to admit mistakes. Yet, this shouldn’t prevent us from teaching money. In fact, it should encourage us to take on this tough topic.Myth #2) I Don’t Know Enough

When I first started giving financial talks, I had a serious case of imposter syndrome. Surely, someone was going to ask me a question that probed the depths of my knowledge only to find out I was a fraud. It turns out that is extremely rare. The truth is that doctors and doctors-in-training usually have very little financial literacy. Most that I talk to don’t even understand the difference between a stock and a bond. While you may anticipate someone asking you about the in’s & out’s of tax-loss harvesting or small/value factor tilting, you are much more likely to receive a question about whether they should (obviously) pay off their 19% interest credit card or invest money in the market. If you are reading this site, chances are that you know far more than you realize. Aim to teach only the basics, and refer your learners to others when needed. They will appreciate both your honesty and your humility.Myth #3) It’s Not My Job

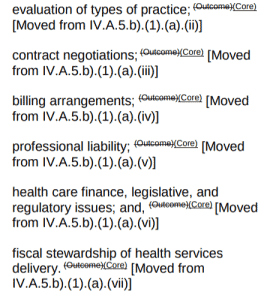

This one is my favorite. Some attending physicians think that it isn’t their job to talk about financial topics. Here are two arguments against that sort of thinking. First, we know that stress outside of work can lead to poor comprehension and performance at work. According to the American Psychological Association, money is the #1 cause of stress in American households.“Regardless of the economic climate, money and finances have remained the top stressor since our survey began in 2007. Furthermore, this year’s survey shows that stress related to financial issues could have a significant impact on Americans’ health and well-being,” APA CEO and Executive Vice President Norman B. Anderson, PhD, said.Learning medicine is infinitely more complicated than learning money. Yet, if our residents are constantly worried about whether they can afford their next credit card bill or student loan, how much medicine do you think they’ll be able to learn? Second, the ACGME common program requirements for anesthesiology now require practice management topics – like contract negotiation and fiscal stewardship – to be taught in training. Debt management and teaching personal finance will not be far behind.

Myth #4) That’s What a Financial Advisor is For!

Can we be honest for a moment? Most people in the financial industry aren’t looking out for you. Don’t believe me? Read this. In my own life, I’ve met severalMyth #5) Residents Don’t Want to Learn Personal Finance

Most attending physicians won’t even talk about how much money they make as doctors. This is despite the fact that the resident they are talking to might be offered a contract to become their peers in just a few short years. What information are you saving them from by avoiding to discuss something as silly as a salary? Yet, if you open that can of worms, you will find great interest. Similarly, if you bring up student loans, investing, or where to get financial advice – you will find that your residents are more than interested. You often won’t be able to stop them from asking questions. At least, that is my experience with every single financial lecture I have ever provided.Take Home: Teaching Personal Finance

Now that the myths are out of the way, let’s get real for a moment. Our trainees need us to be open and honest about teaching personal finance. If you are a resident reading this post, I encourage you to ask tough questions from your attending physicians. Ask them if anything is negotiable in an academic contract. Consider asking them about the benefits provided by their employer or group. Perhaps you could even ask them if they have any advice about paying off your student loans. For the doctor out in practice, I dare you to open up personal finance topics to your students and residents. Share some of your stories to open up the topic. Maybe a prior financial mistake or success you’ve had? “Can you believe it? I finally paid off my student loans. It feels great!” If you are bold enough to venture into the world of personal finance education, you will find it both rewarding and fulfilling as you help future generations of doctors live with a little less stress. You might also find that they are better able to focus on your other teaching, too.Did you discuss personal finance in training? Who were you able to talk openly with about such a taboo topic? How did they make it easier to discuss? Leave a comment below.

The residents I have talked to are way ahead of me when I was in their shoes.

Keep talking about it and break the Taboo!

I always feel like I don’t know enough to give advise but after a few moments I find that what I know is practical based on experience and will at least inspire someone to begin their own personal finance education.