One of the most common questions people often think about doctors, but are too afraid to say out loud is, “How much money do doctors make?” I always find this question interesting, because people are curious how “rich” doctors must be. Apparently, the disparity between wealth and income confuses more than just the physician community. In today’s post, I’m going to tell you how much doctors make, and then I am going to proceed to tell you why that number doesn’t really matter.

Let’s dig in as we discuss physician incomes, our debt burden, and the personal finance failures that often lead to a high-earning physician living paycheck to paycheck.

How Much Money Do Doctors Make?

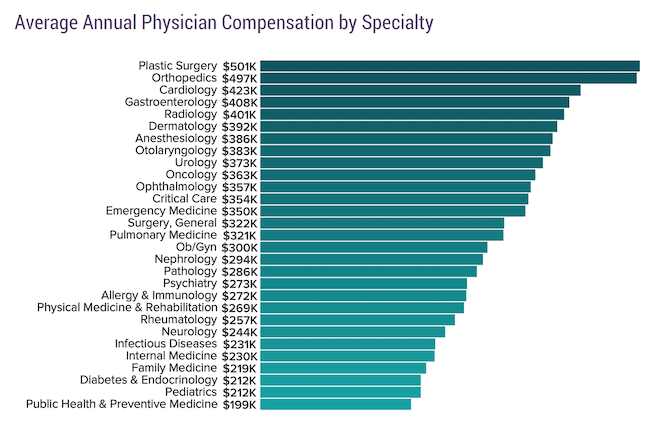

In a self-reported survey of more than 13,000 physicians and 29 specialties, doctors were asked how much money they make annually. The answer:

Source: Medscape Physician Compensation Report 2022: Incomes Gain, Pay Gaps Remain

This comes from the 2022 Medscape Physician Compensation Survey where the average physician salary is between $260,000 and $368,000. The reason for this wide-ranging average is that some physicians (e.g. primary care physicians) might earn ~ $200,000. Yet, other specialties earn north of $500,000 (e.g. plastic surgery).

Wealth and Income

I commonly ask audiences when I provide lectures, “What does it mean to be wealthy?” Usually, people respond with income thresholds (e.g. “Someone who makes more than $150,000).

Despite this notion, many physicians are not actually wealthy despite earning the multiple six-figure numbers mentioned above. (Remember, Wealth = Assets – Debts). A case in point is that despite a high income, many physicians live paycheck to paycheck despite their high income.

The problem in medicine is no different than the problem in the NFL or NBA. When the sudden increase in monthly income increases after training, most people have a similar reaction – they spend it all.

This isn’t unique to physicians. For example, Shaq spent $1 million of his signing bonus in a single day. Physicians are as inclined as professional athletes to spend every single penny.

This psychological phenomenon has a name. It is called the Diderot Effect, and it affects entertainers, professional athletes, and physicians alike.

Why Physicians Spend All of Their Money

In 1765, Denis Diderot was a well-known French philosopher and author of encyclopedias.

Despite his fame, he was on the brink of poverty. It was at this time that Catherine the Great, the Russian empress and lover of books, heard of Diderot’s plight. Having a soft spot for authors, she decided to buy his library for what amounted to about $150,000 in today’s dollars.

With a daughter who was soon to be married, Diderot was over the moon. Now, he could afford to give his daughter the wedding she deserved. Yet, Catherine the Great didn’t just provide money. She also gifted Diderot a scarlet robe.

This scarlet robe would serve as a Trojan horse in Diderot’s financial life.

As he looked at himself in the mirror wearing a robe befitting a prince, he noticed the remainder of his surroundings. His furniture was now out of place. Someone who owned a scarlet robe could not sit on such lowly chairs. The old rug was not nice enough either. The feet of someone wearing a scarlet robe should walk only on a rug from Damascus!

In the end, Diderot’s brush with fortune and fame (and a scarlet robe) led to what is now called the Diderot Effect. It is this same effect that haunts anyone who experiences a rapid rise in fame or fortune today.

In fact, Diderot would later go on to warn others of “the contamination of sudden wealth” in his essay called “Regrets on Parting with My Old Dressing Gown.”

Money is Simple, But It Isn’t Easy

While the sudden accumulation of wealth that occurs between training and becoming an attending physician makes the “right” financial decisions difficult, this doesn’t make personal finance complicated.

Truthfully, personal finance is simple. Here are the steps:

- Earn a decent paycheck (all doctors make good money).

- Protect your income through own-occupation disability insurance (ideally through a Guaranteed Standard Issue plan in training – reach out to us at Attend if you don’t know what this means).

- Spend less money than you make.

- Use the difference between what you earn and what you make to build wealth.

Don’t put words in my mouth, though. Despite the simplicity of the four steps outlined above, personal finance is NOT easy. In fact, it is really hard.

The reason isn’t the complex math, it is the behavioral finance behind it all that makes it difficult to do the right thing with our money. Even low-income earning physicians can be wealthy, if they know how.

Doing the Right Thing Isn’t Easy

The problem for most physicians (and many other people) is that we feel that we deserve to spend every dime of the money we make. After all, many of us spent our twenties missing weddings, funerals, and vacations to create our career. In addition to this, we started behind the eight-ball by waiting until our 30s at the earliest to earn our first attending paycheck.

After four more in medical school, 76% of us finish with student loans that average to more than $200,000 in debt. This debt compounds at 6-7% interest over three to eight more years spent in residency and/or fellowship.

By the time we finish all of our training, many have accumulated north of $300,000 in student loan and consumer debt.

With a net worth that is about $300,000 less than a newborn baby without a penny to her name, you’d think this group of people would aggressively pay down their debt.

Instead, we use that big paycheck like Denis Diderot to buy even more debt in a house, cars, private school for the kids, and designer gadgets and gizmos.

It turns out that spending less money than you make is not as easy at it seems. We all know that we should do these things, yet we don’t. It’s part of being human to know what we ought to do, and then to fail to do it.

Behavioral Finance Matters

This is why behavioral finance matters. We have to get the number one enemy – ourselves – out of the way. Here are 5 practical steps to get started on that journey:

- Spend some time thinking and talking with loved ones about how you would design your ideal life. If you don’t know how, then use these three questions.

- Take care of your asset protection & emergency fund.

- Figure out how much money you need to save annually to live the life you designed in step (1).

- Automatically set your paycheck to be dumped into savings accounts until you get to the amount you need to retire by the age you want. Fill up your tax-advantaged space first (401K, 403B, governmental 457, HSA, backdoor Roth IRA, etc). Send any remaining money you need to save to get to your goal in a taxable account.

- Spend every other dime with zero regret.

Following the steps above will get you to your goals. And, if you automate your savings, then you will never see the paycheck in your bank account and – if you do – it won’t be there long. This prevents the temptation to spend it all like Diderot because it’ll be broken into your savings account before you even notice.

Not only does this get you out of your own way to save what needs to be saved, but it also helps you realize how much money you have to live on after your financial goals are met first.

Take Home

Physicians earn a lot of money, but it is all for naught if we don’t use it to build wealth.

Personal finance isn’t complicated, but it sure is hard if you don’t get out of your own way. This is why behavioral finance matters. If you know your “why,” or the reason behind your decision to save that money, then it becomes much easier to accomplish.

We must realize that our high physician income will not lead to a high net worth if we do not use the money we earn to build wealth. This will only happen when we figure out the important things first.

Otherwise, we are left spending the money we make and hoping that we will have enough left in the end to retire someday when we realize we want out.

That was an interesting fact that US physicians make more than everyone except Canada. I actually thought Canadian physicians were typically underpaid compared to the US counterparts because of Healthcare being provided free to everyone through the government. I wonder if it takes into account currency exchange rates or if it is indeed absolute more earnings than the US.

Another interesting fact is that survey of Millionaires often show that occupations considered low paying such as teachers often represent the top 3 jobs while physicians typically are not included in the top 3. It shows that income is not the final determinant of wealth but behavior is.

My wife and I have been having these conversations about what we want life to be like now/later and how much to save.

Setting up the savings goals and seeing what is left fundamentally altered how much we intend on spending on a home.

By prioritizing a decent savings rate and working part time we came to a house budget that is far below our peers in the area we live in. But that is ok and I think we will be the happier for it.

Great post! I’m thankful that we found the FIRE community before we got too far down the rabbit hole of consumption. You may remember that our focus is on knocking out our debt before we focus too much on investing. We’ve finished my law school loans and should finish Mr. TMG’s med school loans in a few years. Then, we’ll dump all of the extra money we’ve been putting on loans into investments. We live on substantially less than we make because of our debt payoff strategy, and I don’t anticipate that changing much once we’re finished.

Having the right perspective is crucial. When you learn that buying stuff doesn’t bring contentment, you realize a ton of freedom. Living on less can mean being happier in the end.

Great post! I completely agree, I think the concept of delayed gratification is such a foreign concept in today’s world. I think the important concept is to be able to effectively live on a budget and save money at any income level.

My wife and I lived off a single income for 8 years (4 years of medical school and 4 years of residency). During this time we made ~40-45k a year and still were able to save money for a down payment, etc. Sure, we don’t have super expensive cars, toys etc, but we own our house.

Great ideas about automating your savings and thus never tempting you to spend money you should be saving!

Thanks!

Learning to live on a budget can be tough, but it is certainly the right thing to do. Once you have an idea, I think it’s okay to just track spending and reach your savings and givings goals. Whatever is left can be spent however we want if the big picture items are taken care of first.

I think young physicians fall into the trap of spending debt too easily. In undergrad and medical school a lot of us are using debt to not only pay for tuition, but to also pay for living expenses. I know plenty of resident docs who were living the high life in a high rise condo in Los Angeles or in Santa Monica beach. They just get too comfortable with debt. To them, it’s like monopoly money. And “at some point” in their future life, they will eventually pay it off.

This is dangerous. It’s not monopoly money. It’s real money and that debt just keeps growing and growing the longer you put it off and delay paying it.

For many docs, this behavior carries over as they become young attendings.

Very unhealthy behavior with respect to behavioral finance.

Only the fortunate ones like us don’t fall into this trap. And hopefully we can help others not fall for into the behavior debt death trap as well.

I am a pre-med with this same mentality. I have worked my way through school for all my other living expenses and used my loans solely for tuition. It has cost me MANY late nights, early mornings, exhaustion, physical and mental health issues, including isolation and depression, not to mention my lower grades vs. those who were not working.

This article and your comment have really, really, made an impact in me and I thank you for that!

So glad that it helped!!! Keep your head up! 🙂

Buy growth stocks in your 401, then buy stocks in a private acct., Finally, buy a reasonable house, used cars, and send ur kids to public schools!

Most plastic surgeons and ENT doing nose balloons are approaching 1m a year.

As an old doc, I see the new ones come into town and be shown houses that are far more expensive than the one we bought when we were out of debt and after 5 years of practice. I tell new docs to buy cheap houses or rent– they can always move up, but an expensive house may force them to stay in a practice situation they are un. happy with. Also any luxury once sampled becomes a necessity, while moving to a larger, nicer hope makes one feel like life has gotten better

Completely agree. Bigger house = bigger expenses. We are finding this out all too well recently after moving. We waited two and a half years after finishing residency to move, and paid off our student loans before doing so.

If we didn’t have that new cash flow, it would be a lot tighter and much more stressful financially.

Great philosophy on savings until you squirrel away everything and die of cancer at 40 anyway, having enjoyed no worldly offerings. Gotta be a balance.

I’m not squirreling everything away. I live a great life, actually. I am married to the best woman I know, have three great kids, and a job that I (for the most part) love. We live in a wonderful neighborhood, just bought our forever home, and I drive a great car.

We took all of these changes in step, and only after making smart financial decisions that allowed us to pay down $200,000 in 19 months while increasing our net worth by $250,000 in one year.

Sounds like balance to me. Anyone that sees it differently, likely needs to learn the art of contentment.

OK – I’m feeling beyond overwhelmed as a doc, primary breadwinner, mom of two, and need to do something similar. How in the world did you do that in 19 months?!?!?!

As I sit here wishing I had chosen any other career path but medicine..

Don’t beat yourself up. Life is really hard sometimes. It sounds like you have two questions, really.

First, how did I balance everything (my wife works full-time, too, and so I help out a lot with childcare responsibilities, cleaning, cooking, etc – not implying it is the same, but it is hard as hell to balance all of this stuff)?

1) I instituted a Hell Yes Policy where I said no to anything that didn’t make me say Hell Yes. (This resulted in a lot of no’s at work so I could say yes to my wife and 3 kids)

2) I put the tough work in to get financial success early on so that we could afford for me not to work as much after the first two years.

3) I now have a bunch of time off as I’ve slowly worked to cut back my clinical time in order to maximize my time where I want it.

As for the financial part:

1) we lived on half of our take home pay.

2) we paid $5500 per month towards student loans scheduled.

3) according to the 10% rule I talk about on this site, we put 90% of any extra dollar we earned outside our normal paycheck towards our student loans…

We ended up averaging around $10k per month.

Then we bought the house and turned that 10% rule into a 20 or 30% rule. We spend less than we earn every month now after paying all of our non-mortgage debt, and the freedom that the cashflow brings in this situation is very real.

… But we put the work in for those first two years, and only had a minimal lifestyle inflation during that time.

Keep your head up. You can do this. There is no one out there that can be the mom, partner, and doctor that you are. Remember that you are valuable, hard-working, and intelligent.

Also, remember that all of us struggle. You aren’t in this alone.

And, the most important variable in the equation to retire early is marriage!

If you get married, stay married!

If you are not sure, remain single!

Live below your means.

Never listen to those who say that debt is good for tax purposes!

Live debt free and simply!

Debt free and simply. Now that is a recipe for success. Completely agree.

TPP

I always told my residents to think about retirement the day you start practicing. You need to max out your retirement every year. Stay married to the same spouse. You can invest in fast cars, great houses or french art, but divorce will be your biggest hit to your pension. My observations have been that those who live in huge houses and drive great sports cars usually have the smallest net worth.

I just wrote a post about that last night. People constantly feel the need to compare themselves to others. In our consumerism world, that is a terrible habit because the people who “have” the most often also “have” the least. Big spending usually equates to a very small net worth.

TPP

It’s simpler than most admit to Avoid the truly ridiculous stuff(Ferrari’s etc). Save 20% of your income monthly. Invest in some age appropriate diversified stuff. Bear in mind that the public views us as well to do, so you are not really permitted to take advantage of taxpayer subsidies. Yes, you will probably have to pay tuition at a college. The only thing that really matters is not to get sick, shortening your career at the end. Yeah, avoid divorce. Most other things don’t matter much.

If you get the big stuff right, then you usually find financial success. The problem is that with each increased step in lifestyle inflation, it becomes more and more challenging to be “okay” with living more simply. It is much easier to just stay there after training, and slowly inflate the lifestyle once you can afford it and still meet your financial goals.

Any of us whose parents or grandparents survived the depression and spoke about those difficult years, as mine did, made it clear that saving money, earning interest on that money and never over spending is critical to one’s lifelong solvency. The only issue this raised as I finished college was a lack of a credit rating. No real problem; just pay cash.

Truly sage advice from your parents and grandparents. Corrections and recessions happen. It is a part of what markets do. It seems that too many people have a memory that is far too short.

TPP

The appetite for consumer goods having been suppressed for years, the beast is suddenly liberated by a large paycheck and becoming a better credit risk. Like a person wading into quicksand young Drs. find themselves even more mired in debt and some never get out. I know of people in their 60s who have made north of $300000/yr for 25 years but cannot write a $5000 check. They have nice homes, boats, kids in private colleges and belong to the country club.

As with everything, the key to sustainable happiness lies in moderation. In medicine, we already don’t start earning a “real” salary until we are in our 30s. How long is it reasonable to delay gratification? Buy a nice house and a nice car. You deserve it. Take a nice vacation every year. Just don’t go hog wild. While we earn a good living, we are not the super wealthy. Also, learn to manage your own money. Don’t pay fees to financial advisors or brokers who don’t care about your money the way you do. With a basic amount of market knowledge, you can do just as well or better than any of these people. Only true wall street insiders whose primary goal is to get really rich can do better. If a broker who charges a 1% commission can’t beat the S&P 500 by 1% every year, you are just as well off putting everything yourself into an index fund and calling it a day.

Couldn’t agree more with that last sentence!

Elementary school teacher is a highly desirable job for young women; those whom can afford to do it disproportionately are married to high end men. No surprise many end up wealthy.

Think Laura Bush.

The skew in remuneration by specialty is largely a result of Medicare negotiations. If one looks at the percentage of our total population which has any lifetime encounter with a particular specialty will quickly show the absurdity of the disparities. For example, the percentages which encounter either an internist or a pediatrician in a lifetime, as opposed to those who see a plastic surgeon. There is simply no defense against such a view! And, length of training has no relevance here – many of us have trained for 5-7 years in a medical subspeciality, a period rivaling any of the other areas.

I am surprised that specialty has such wide disparity. Particularly for a pediatrician $200k vs a plastic surgeon $500k. I figure more people are visiting ER docs, OB/GYN’s and pediatricians than plastic surgeons.

However, I did read in the book American Plastic that many families (even some living in trailer parks) were using credit cards to pay for plastic surgery for their daughters to the tune of $7,000! Just insane. Instead of building wealth they were going into debt. It just goes to show that behavior and perception are more powerful than just about anything cause you can blow through just about any paycheck and end up in debt for any number of reasons.

I’m a plastic surgeon in solo private practice. I am now at a point in my career where I do mostly aesthetic surgery, but I still do some reconstructive procedures as I don’t want to lose those skillsets. I also work one or two days a week at a national outpatient liposuction clinic called Sonobello. I am continually astonished by the number of people on Medicaid and other forms of public assistance who will move heaven and earth to finance liposuction! They claim they don’t have money to pay for many basic necessities in life, but they find a way to pay for plastic surgery!

I feel Physicians (IM, FM, Ped etc.) are getting paid less as compared to compensation like 2 decades ago. EVEN A FRESH UNDERGRAD TODAY in CompSci IS MAKING $140-$150K starting salary. It is very stupid that doctors are paid so less as compared to the amount of time and money they spend in getting their degree. These Undergrads reach total earnings of $200K in first 3 three of their jobs with stick options etc.

I think the main culprit is Wall Street. IT companies are listed there and are filthy rich today like Amazon and Google and can pay very good salaries to 21 year olds but most hospitals and medical practices are non profit or not listed on Wall Street to make the money to pay their employees. Moreover, Federal Reserve and all QEs are there to prop up the stock market. Moreover, the insurance companies are busy slashing payments to doctors and increasing profits for wall street to have more money for their CEOs.

More people will stop choosing medicine as a career in future if the salaries are not fixed soon. Same is the situation with PhDs. B-School profs make it good but all others are paid really low. Avg B-School profs make close to 200K in starting salary and they are not even real doctors. Just publishing some BS papers that no one reads and add no value to society. But they add scam value to wall street.

What a shame.

The reason doctors don’t make the money they deserve is that doctors don’t stand up for themselves. They also have no true advocates. They refuse to strike. They refuse to unionize. They won’t stand up to the hospital administration. For years I’ve heard a lot of tough-talk in the physician’s lounge, but when there’s a chance to complain during a medical staff meeting with the hospital CEO present, there’s not a word of protest. Physicians have ALLOWED their pay to be cut. I hate to say it, but most are just big fat pussies.

Behavior is important but do not underestimate income. Also beware of being too simplistic in terms of index funds and their behavior.

I 100% agree that living within or below your means is fundamental to financial security but making 800K a year vs 200k a year makes a big difference. The data on MD salaries in my mind is worthless as is the MGMA system for calculating MD incomes and WRVUs. I ran a 100+ employee private practice cardiology group as well as being employed by a hospital system and income models and reporting for MDs is very flawed.

I have a background in economics and finance and have been practicing for 20 years. I can tell you that all things being equal it is better to have a higher income.

We currently live in a world of no inflation, low interest rates, full employment and equity and real estate markets that have shown year after year gains for the last 8+ years. Capital gains tax are low as are income tax brackets. It will not always be this way. As an example the only way to make a dent in the deficit will be raise taxes, inflation or probably both. Don’t be tricked into thinking the you will see 25% yearly growth in your portfolio every year.

I think what you have done is amazing and eliminating debt and keeping expenses down will only serve you well keep up the good work!! I would advise you not use the last two years to project your net worth 3-4 years from now as so many things can change and do so quickly. We think of MD income as being insulated from the economy but I can tell you running a private practice in 2009 when a lot of people lost their jobs, had no insurance, and the hospitals were struggling was a lot different from today. There were months we did not know if we could meet payroll let alone pay ourselves and we owned our own cath lab, imaging and were making close to 7 figures working 4 days a week before the crash.

I would also suggest that investing is not as simple as buy and hold three index funds and max out your retirement plans….

One risk no one is talking about is the possible bubble effect of the mainstreaming of low cost index funds. We really only have index fund data dating back to 1975. Most of this was when indexing made up a small minority of invested capital. All of the modeling you and your WCI crew as well as the real proponents, the Bogleheads, have done uses historical market data but fails to take into account that index funds may not behave like the “market” when under stress. By definition an index buys the market which includes poorly performing companies. This creates a false demand for poor performing stocks just for being part of the market and props up their price. While this is fine when the demand for bad stocks is not driven by indexing but no one really knows how they will behave with a major correction as the percentage of ownership is held by index funds has skyrocketed. An index ETF or Mutual fund has to have a buyer for all of the individual equities in the fund if there are no buyers for the fund itself. No one knows what downward exponential cascade this may have on index fund prices when there is a major downturn and there are no buyers for either the fund itself or the undesirable stocks that were supported by an index model. Looking at how the S and P index did in 2008 may not reflect what VOO (Vanguard ETF) does under the same stress. Is there going to be an index bubble? I have no clue but there is probably a reason Warren Buffet is sitting on so much cash. There are a lot of other factors related to indexing and how the weighted structure may mask the real risks of the fund. I am not advocating active management because I do not believe the managers do any better although I do own a lot of BRK stock.

Anyway, I think your approach of living below your means, paying down debt is great and should be taught in every public high school if not sooner. It has served me and my family of 4 well over the last 20+ years and with a close to 10 figure net worth at the age of 52 it has been the best recipe for success.

jlo

Love this post.

Behavioral Finance Education is critical in the process of curtailing consumption as a our high income right, and helps prevent living paycheck to paycheck as a norm. It doesn’t have to be that way.

I am still working full time as a family doctor, but I am financially independent due to applying the principles mentioned.

It feels good to not have to worry about the economic fall out of this COVID-19 pandemic. Financial adjustments will be needed, but my personal finances are in a position to weather the storm.

Such a great post and I couldn’t agree more. Incomes does NOT equal wealth and building wealth is the goal. I am a young plastic surgeon and consumerism is an epidemic within the specialty (I know it is in others as well but I believe even more so in mine). Graduating residents with mountains of debt feel the need to buy a doctor house, expensive car, and new suits to meet their perception of a “successful” plastic surgeon. Show me how much you save and how you invest, not how much you make. That’s what is important. I share my experiences trying to go from poor to prudent as a plastic surgeon here: http://www.prudentplasticsurgeon.com .

Thanks again for the post!

I’m not a physician and neither is my wife, but my wife’s sister and her husband just finished MD and PT school. We are 2 years younger than they are and we both did an extra year to get Master’s degrees in our fields, and have been working full time for 1 and 2 years. We paid off a modest amount of student loans low/mid 5 figures, and have accumulated just over a 6 figure net worth combined since starting full time employment (no kids yet).

Conversely, our brother and sister-in-law spent that time going through Medical school and PT school. Residency is just starting for the MD, and he will earn less than either of us earns currently until he becomes an attending physician (3 years minimum in internal medicine). My sister in law will be able to start full-time as a PT this fall and make about what each of us does starting out. Additionally, they are starting their careers, as many do, with a large sum of student loans to pay off (fortunately smaller than most docs, since they had no undergrad debt and lived very modestly during school).

All this to say, MD’s have a 7+ year long, difficult, waiting period before earning anything, whereas the rest of us (if we make good financial decisions), who only need 4-6 years of higher education, have a big head-start to accumulating wealth and getting promoted to higher paying positions within our fields. In my opinion, MD’s, PT’s, DO’s, etc. work incredibly hard for, and deserve high salaries.

You are completely correct. It is as easy as eating healthy and exercising. And while the principles of wealth building are easy (living below your means) and it is pretty easy for doctors to build substantial wealth by mid-40s, the allure of upgrading your lifestyle can be tempting if you were poor for so long and you saw your non-med friends enjoying their 20s/30s. I know some people that bought beamers as soon as they started residency. :X. You can probably get away with a lot of lifestyle upgrades and not worry too much about your financial future in the higher-paying specialties. But if you aren’t…

Btw, this article breaks down the income of doctors with Medscape 2020 data and by locality, specialty, and mean hours worked. https://prepformedschool.com/how-much-do-doctors-make-in-an-hour/

Is there a website that allows physicians to (volunteer) share salaries based on specialty and location to improve transparency?

There is a huge rat race among US doctors originating from the Indian Sub continent (in particular Pakistani doctors). There are lots of those doctors in debt when they begin their practice and they continue to be in debt because they feel that they have to keep up with the Jones’. This is a huge problem. I am from Pakistani background but I work in finance. We have a lot of doctors in our community and thus wealth management is a typical topic between me and my fellow Pakistani. It absolutely amazes me how many young doctors (mid thirties) are in debt to their necks because they have a million dollar home, drive a big BMW (wife has fancy SUV) and then lots of them have a kid or 2 (private school?). They make good money but at the end of the month, it’s all gone. Some of them admitted that it is “expected” from the community though most of them fall into this trap without really thinking about it. Before Corona came around, we do meet a lot (weddings, dinner parties, Ramadan parties etc) and appearance matters, if not among males, certainly among some females. Most of them lead a flamboyant life style but have built op very little in terms of wealth. I tend to believe that American (white?) doctors tend to have less of a problem with “financial appearance”, correct me if wrong. I am happy I am not a doctor. I don’t have to work 60 hours a week and I still have a decent life with enough money for ordinary stuff.