What is a Brokerage Account?

A brokerage account can be created for free at most brokerage firms. I recommend that you seek brokerage companies with low-fees and great index fund options (e.g. Vanguard brokerage accounts or Fidelity brokerage accounts). Our family chose to open a Vanguard brokerage account. What exactly is a brokerage account, though? It is an account that you create at a broker, which is a company that serves as an intermediary between you and your investments. In these accounts, you can then choose to invest in stocks, bonds, and index funds (which are the king of investments). While you directly own your investments, and they are protected, the company helps you access these funds.Why is a Brokerage Account also called a “Taxable Account”?

The money that you put into your brokerage account is post-tax money from your take-home paycheck. While your contribution will grow tax-free (it has already been taxed), you will potentially owe capital gains taxes on the money you earn from your investments. These are known as capital gains tax, and these taxes can be minimized in a brokerage account if you are creative. Ideally, you’ll hold the funds for more than one year, which places you into the (typically) much lower long-term capital gains taxes. If you sell your investments to make money and it has been less than a year, then those gains will receive short-term capital gains tax (i.e. taxed as additional annual income at your tax bracket). Because post-tax money is placed into this account, and you have to pay capital gains on any earnings that you experience, this account is also called a “taxable” account. While the name of this account sounds unappealing, it is still a great investment tool.Why Should I Open a Brokerage Account?

The taxation that is experienced in a brokerage account can be avoided in other more tax-advantaged accounts, like your 401K/403B or Backdoor Roth IRA. With the increased taxation, why would you open a brokerage account? Here are four reasons to consider opening a brokerage account. The most obvious reason to open a brokerage account is that you need to in order to meet your annual savings goal. For example, in order to get to our family’s annual savings goal, we have to fill up all of our tax-advantaged space (403B, 457 plans, Roth IRA, and HSA). Even after that, we have not met our annual savings goal. So, the only place this money can go in order to make our annual number – and still be invested in the market – is into a brokerage account.The second reason to open a brokerage account is that the money inside this account is more easily accessed than retirement accounts. For example, you are likely to experience penalties and fines on any money withdrawn from traditional retirement accounts prior to 59 and 1/2. While there are ways to avoid these penalties, a taxable account is much more accessible. The third consideration is a bit related to the second. Because the money inside a taxable account is more easily accessed prior to age 59.5, this account is also an important account for anyone considering early retirement. If all of your money is placed into tax-advantaged retirement vehicles, and you retire at age 50, you have to cover that early retirement gap til age 59.5 somehow. A taxable account can prove to be an important tool in that process. The final reason to open a brokerage account is that it also offers certain tax-advantages (despite not being known as a “Tax-advantaged” account). Though it is outside the scope of this post, you should be aware of Tax-Loss Harvesting. This allows you to reduce your taxable income by $3,000 each year. If you lose more than that within a taxable account, you can carry it over each year to continue to reduce your taxable income by $3,000 each year until you’ve claimed all of the losses.Further Reading: Have a 457 plan? You should read this post on investing in 457 plans before you take part.

Where Should I Open a Brokerage Account?

So, you now know why you should open a brokerage account. You found one of the reasons mentioned above appealing. Where should you open a brokerage account? As I mentioned before, my family uses a Vanguard brokerage account. This is mainly for two reasons. First, our Backdoor Roth IRA is there. More importantly, the structure of Vanguard is uniquely structured to benefit the investors. Many other brokerage companies have conflicting financial interests to make the board of the company happy. In Vanguard’s case, this conflict doesn’t exist. Why? Because Vanguard is owned by the investors and operated “at cost”. This means there is no board to make happy. The only people they aim to make happy are the investors. Jack Bogle, the creator of Vanguard (and index funds) was truly brilliant. Vanguard was created in 1975. This structure remains unique in the brokerage industry to this day. If you want to know how to open a brokerage account at Vanguard, don’t forget that there is a step by step guide at the bottom of this post!What Investments Should I Use in My Brokerage Account?

Determining what to place in a brokerage account can be a difficult question to answer. It depends on your goals, investment philosophy (here is mine), and goals. Despite the complexity, there are some general rules to follow. Due to the tax transactions that occur inside of a brokerage account, you typically want to place your most tax-efficient funds inside of a brokerage account. What constitutes tax-efficient? This would include investments that do not create dividends (think Berkshire Hathaway), annual income (e.g. REITS and bonds). If bonds must be a part of your brokerage account portfolio, you could consider municipal bonds or tax-advantaged bond index funds offered at Vanguard. Of course, there is a corollary to all of this. If possible, you should place your tax-inefficient investments (bonds, REITs, etc) inside of your tax-advantaged retirement accounts. For simplicity, I often teach people to utilize tax-efficient index funds like the Vanguard Total Stock Market Index Funds inside their taxable account. In fact, this is what my family does as you’ll see below.Should I use ETFs or Index Funds in a brokerage account?

Any long-time reader will know that I am a big fan of index fund investing. It is simple, effective, and low-maintenance. However, when I went to open my taxable account shown below in the step by step guide to opening a brokerage account, I had a problem. I wanted to create the account with about $500 with the plan to put $500 more in each month. However, when I went to invest in the VTSAX fund I wanted, I was reminded that it has a $3,000 minimum. This dilemma sent me to find out whether I should invest in the Exchange Traded Fund (ETF) version of VTSAX, which is called VTI. Why? Because the minimum investment is the cost of one share of VTI.You’ll see below that I decided to pony up the dough and purchase the $3,000 of VTSAX upfront. Why would I choose VTSAX over VTI? Let me lay it out in bullet point format:Further Reading: Have you considered opening a Backdoor Roth IRA? Find the step-by-step guide to a Vanguard backdoor Roth IRA here.

- I’m a fan of simple investing. VTSAX allows me to automatically purchase partial shares of VTSAX. ETFs at Vanguard do now allow for the purchase of partial shares. For example, say I put in my monthly $500 and the ETF price was $150. I could only purchase 3 shares. However, in VTSAX, I could purchase 3.33 shares. This allows me to get all of my money invested each month.

- VTSAX is purchased at the end of the trading day because it is a mutual fund. ETFs are purchased just like regular stocks. So, when you make a purchase the price may change. With the issue of the partial shares mentioned above, you want to make sure to allow for this discrepancy.

- I am an automatic investor. This account will receive $500 each month after my paycheck. VTSAX is very easy to automatically invest in each month through my Vanguard brokerage account. And, again, I don’t have to worry about the issue of the partial shares each month.

- The expense ratio of VTSAX and VTI is the same. VTSAX is simpler to invest in, and so there is no advantage here for VTI.

How to Open a Brokerage Account: Step by Step Guide.

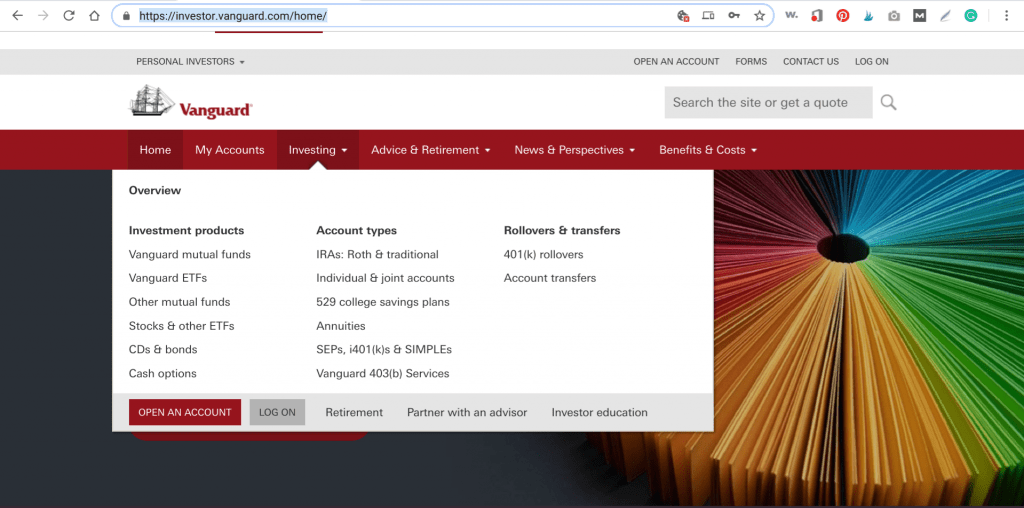

After reading all of that information, you are now primed to open a Vanguard brokerage account. Here is your step by step guide on how to open a brokerage account. If you wander over to Vanguard, this process won’t take long.1. Click on “Open Account” under the Investing Tab:

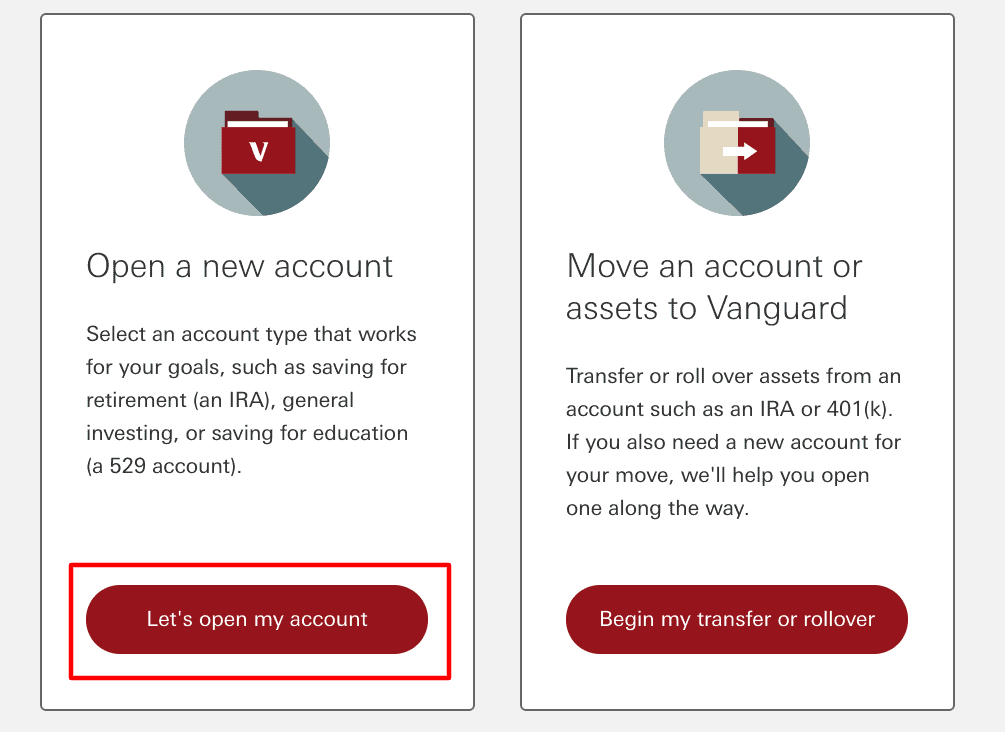

2. Open a New Account

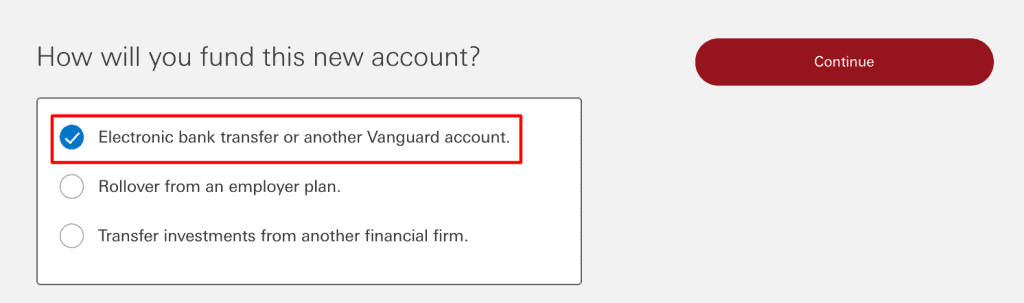

3. Transfer Funds

The next step involves transferring funds. If you don’t have an account at another brokerage company, then you will need to select the first option as shown below:

4. Open an Account (or Log In)

The next screen is pretty self-intuitive. If you already have an account at Vanguard (like a Backdoor Roth IRA), then just sign-in. If you don’t, then go ahead and create an account.5. Collect Information You Need

In the next step, you will need a few things, as directed by Vanguard. This includes:- Routing and Checking Account Number for Funds Transfer (go find a check, the information is included on the bottom)

- Your current employer’s name and address

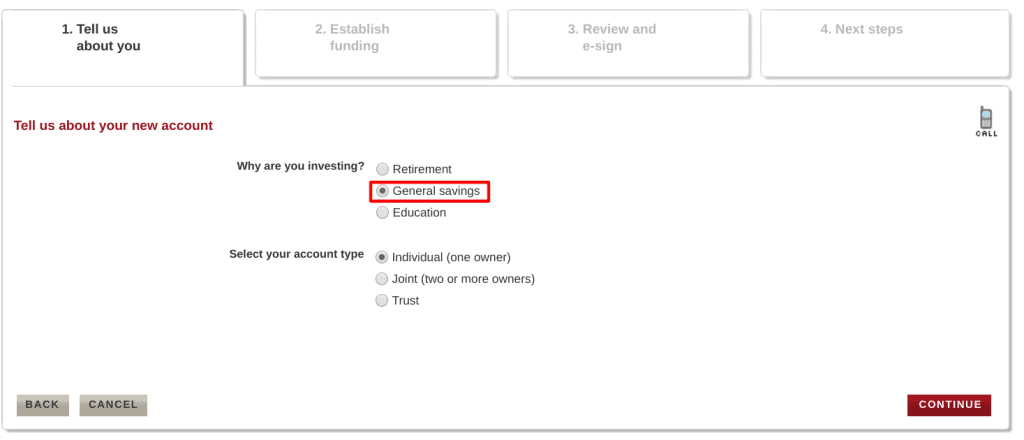

6. Tell Vanguard About You

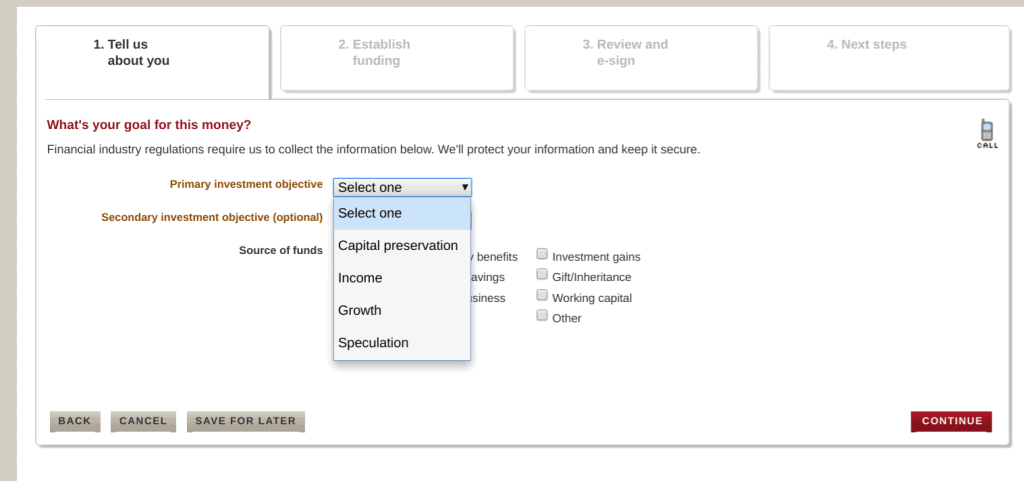

First, you’ll be asked about the purpose of the account. To open a taxable account you will select”general savings” (even if this is being used for “retirement savings” it is not a “retirement account”). Also, select whether this account will be owned by an individual or jointly (e.g. with a spouse). Next, you’ll click to “open a new account”. This will bring you to the screen below. You’ll notice that you have four investment objectives.

Next, you’ll click to “open a new account”. This will bring you to the screen below. You’ll notice that you have four investment objectives.

- “Capital preservation” is typically for investors with a short investment timeline. Typically this is for those in or nearing retirement.

- “Income” is meant for those who intend to create income from their investments (e.g. stocks producing dividends or from REITs).

- “Growth” is the right selection for anyone who has a long investment timeline. In other words, if you are in the accumulation phase and not nearing retirement.

- “Speculation” is an option, but no one reading this site should pick it. If you want to gamble, go to Vegas. There is a reason index funds are king.

You also need to select the source of funds and then tell Vanguard your personal information. I’m not going to show you mine. So, no screen shot for that one!

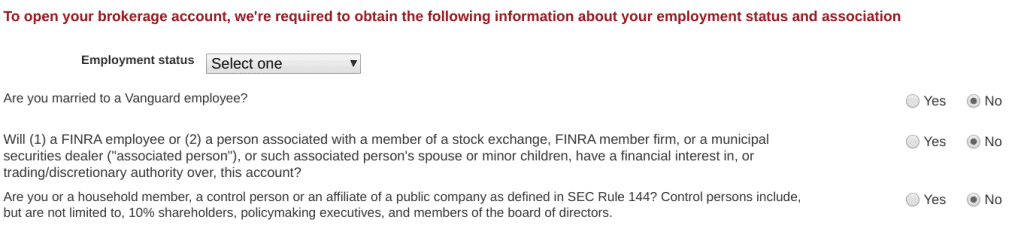

Next, you’ll need to give information about your employment status. They’ll also ask you about your income. Finally, answer the three questions about being married to a Vanguard employee, if you (or your household) is a FINRA employee, or if you are a control person for a company.

You also need to select the source of funds and then tell Vanguard your personal information. I’m not going to show you mine. So, no screen shot for that one!

Next, you’ll need to give information about your employment status. They’ll also ask you about your income. Finally, answer the three questions about being married to a Vanguard employee, if you (or your household) is a FINRA employee, or if you are a control person for a company.

7. Perform an Electronic Bank Transfer

The next step is to fund the account. Your options include an electronic bank transfer, check, or to “add money later”. After this step, you’ll review and sign everything to create the account.8. Go to Your Account and Buy Funds

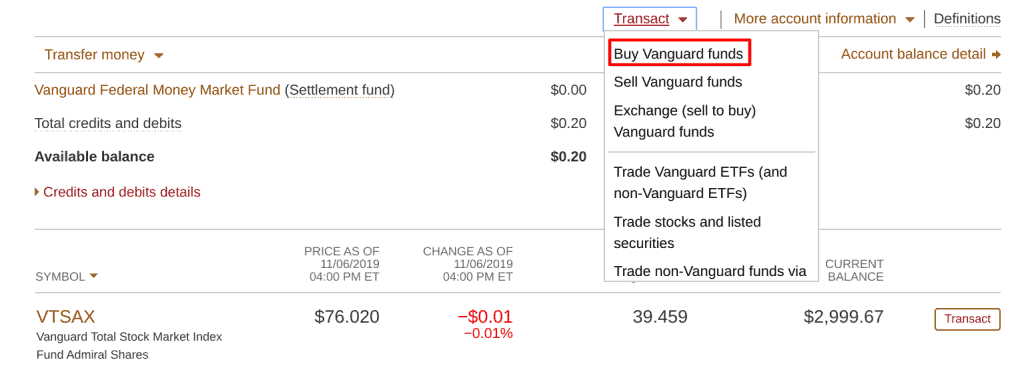

When you go to your account overview, you’ll now notice that you have a new Vanguard Brokerage Account. If you have trouble finding this, go to the home page. Then hover over “My Accounts” and click “Account Overview”. Initially, the funds will sit in your “Settlement Fund” until they clear from your bank. For me, this took about 1-2 days in most cases. After that point, you’ll be able to purchase funds. In order to do this, you need to navigate to the “Transact” down arrow and then select “Buy Vanguard Funds” as shown below. You will select the fund you want. After this point, the transaction will occur according to the type of asset you select as described above (ETF versus index fund)

Once the transaction goes through, you will have successfully created and funded a Vanguard brokerage account. Then, you’ll be able to direct others to this blog post when they ask you how to open a brokerage account!

You will select the fund you want. After this point, the transaction will occur according to the type of asset you select as described above (ETF versus index fund)

Once the transaction goes through, you will have successfully created and funded a Vanguard brokerage account. Then, you’ll be able to direct others to this blog post when they ask you how to open a brokerage account!

9. Track Your Net Worth

Take Home

Opening a brokerage account at Vanguard made sense to us. Hopefully, this step by step guide on opening a brokerage account was helpful for you. If it was, make sure to share it with your friends if they are considering opening a Vanguard brokerage account, too.Was this information and tutorial helpful? Is there anything I didn’t cover that I should have? Leave a comment below and I’ll make any necessary changes for the next reader!

What do you do with dividends in your VTSAX taxable account?

Do you reinvest them automatically in the fund or take them out somewhere else? How does this step work? Thank you!

I reinvest them automatically, though I’d need to turn this off if I ever wanted to do tax-loss harvesting I believe in order to avoid a wash sale.

Jimmy / TPP

Can you get cash out for personal use from yourVTSAX act

yes, if you needed to.

Once you opened the account, how often do you invest? Weekly, monthly?

I invest monthly and it automatically goes into an index fund (VTSAX in my case).