Find a job you enjoy doing, and you will never have to work a day in your life. ~Mark Twain

When The Physician Philosopher first started the tag line was “Wealth & Wellness.” Why? Because I think that there is an intrinsic link between financial freedom and physician wellness.

There are a variety of reasons that doctors feel burned out (or morally injured). Yet, almost all of the reasons that we experience the burn can be chalked up to a single cause: A lack of autonomy.

That lack of autonomy may look like an electronic medical record that was clearly built more for billing than patient care. It could look like the administrator or hospital who won’t love you back. Perhaps it is the insurance company that won’t let you provide the care you know would serve your patient best. Or maybe it is the lack of work-life balance that you want where you feel forced to choose between being a good partner/spouse, parent, and physician.

This is why I’ve always felt that financial independence was a potential escape hatch to the burned-out doctor. It provides a way to take back our autonomy.

From this view, I’ve realized a few things about personal finance that will allow you to find that financial freedom sooner so that you can live the life you want.

1. Financial Independence Should Have a Hybrid Approach

There seems to be a great debate in the personal finance world.

Should you use a more traditional passive index fund route (and a high savings rate) to achieve financial independence? Or should you pursue additional income streams to replace your income needs in order to be financially free from other income sources?

As in all things, moderation is key.

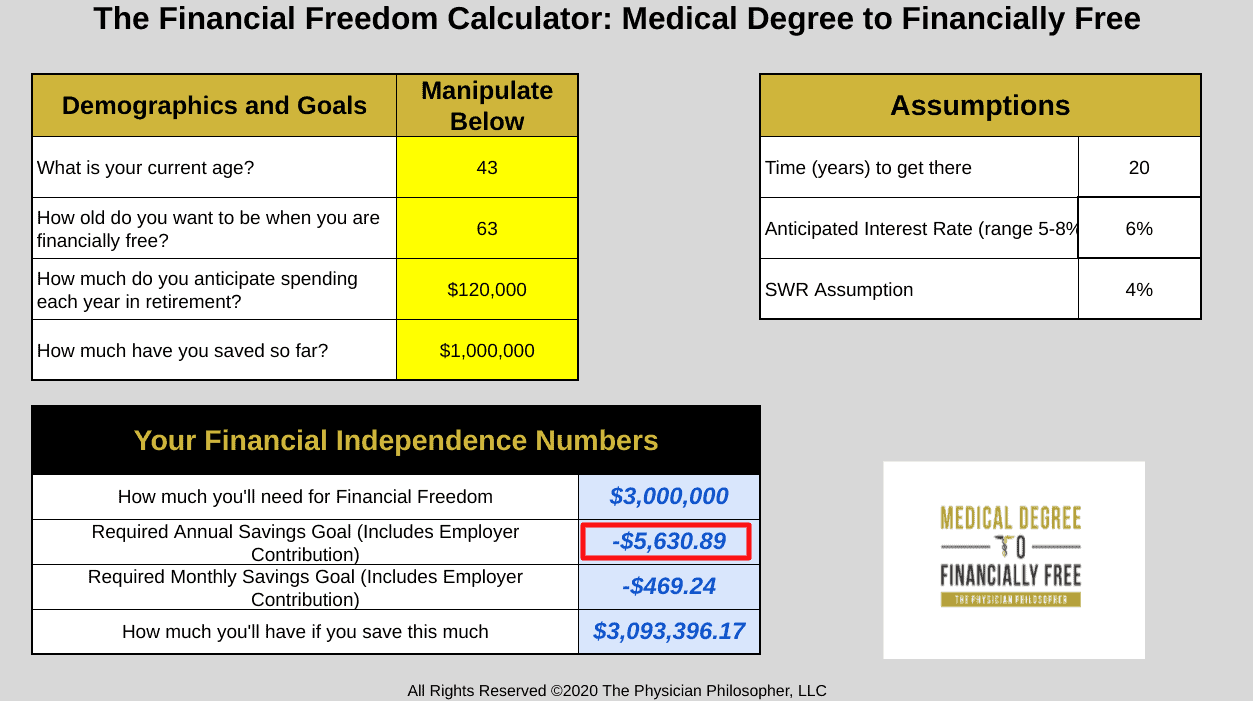

Let’s say that you plan to spend $120,000 each year in retirement. According to The 4% Rule, this would require you to have $120,000 / 0.04 = $3 million in order to claim financial independence, or the point at which you’d no longer have to work to earn a paycheck.

However, if you found an additional (non-clinical) income source that produced $40,000 per year, then you would only need $80,000 per year to come from your “nest egg”. Therefore, you now would only be required to save $80,000 / 0.04 = $2 million.

In other words, for every $40,000 you produce in non-clinical income that will carry into retirement, that might save you $1 million in savings that you no longer need.

A hybrid approach using both philosophies is key.

Note: It is important to mention that any additional income stream you are counting on in retirement needs to be dependable, proven, and something that you are both willing and able to carry into retirement.

2. Save Enough to Get to Your Goals Quickly

While I think it is important to work on additional streams of income (more on this below), I also think that it is vital to save enough money to get to your goals quickly. The sooner you do, the sooner you can fight the causes of your burnout.

Believe it or not, you don’t have to get all the way to financial independence to find financial freedom. That can be experienced early on while you are well on your way to your final number.

Why?

Because money and time have an interesting relationship. Given the importance of a high savings rate early in your career, if you stuff away a lot of money early on you may not need to save as much later. This allows for a tremendous amount of financial freedom even if you aren’t quite there yet.

Here is what I mean.

If you save a million dollars in the first 10 years of your career (assume you finish training at 33) and then never save another dime for the next 20 years of that career, here is how much money you would have left at thirty years in practice even if you only get a paltry 6% interest on your investments:

If you want access to this calculator, sign up for The Physician Philosopher mailing list

You’ll notice that the required annual savings number is now negative. Why? Because you could actually SPEND some of your money saved and still get to your goal of $3 million by age 63.

The reason for this is that the cool million that you have saved is going to gain interest over the next 20 years. This will result in obtaining your number even if you saved nothing else.

With this knowledge, you might consider pursuing Partial FIRE through part-time work, or cutting out the aspects of your job you don’t like. This is one of the many ways that financial freedom can help you battle burnout.

It also speaks to the importance of a high savings rate early on in your career. This is one of the many reasons I suggest a 30% WAR (wealth accumulation rate), particularly early on.

3. Don’t Depend on Your Physician Income Alone

Having an income stream outside of my clinical practice has allowed me to reduce the potential for worsening burnout early in my career. While a high savings rate alone may have allowed me to cut back ten years into my clinical career, it is my side-income that allowed me to do it only three years after I finished training.

The reason is that I can replace my clinical income with side income and maintain the same annual savings goal. Diversified income streams mean very real freedom.

Most of my non-clinical income comes from The Physician Philosopher. Even that income stream is diversified, though. My business earns money in a variety of ways (the blog, podcast, my book, one-on-one coaching with physicians).

While my business is now creating significant money for my family and me, you may not be interested an additional 20 hours per week to break even for the first year and a half like I did.

Instead, your non-clinical income may come from different sources. Here are some common examples:

- Real Estate

- Life, Career, and Money Coaching for Physicians

- Chart reviews or medical expert witness work

- Writing a book for Physicians

- Paid Medical Surveys

- Public Speaking

- Paid Research

Whatever your source of non-clinical income, know that it will require work. Yet, with that work comes the potential freedom of not being entirely dependent on one income source. This may be the greatest financial tool to beat burnout.

4. The Arrival Fallacy is a Very Real Threat

One of the tragic truths of a burned-out doctor is that we often feel trapped in that burnout. How does this happen?

It starts in training.

You endured brutal hours and patient encounters that produce secondary PTSD and compassion fatigue. The attending physicians we work for may lay into us, and the hospitals make us feel like just a number. You endure all of this with statements like,

“One day when I am an attending physician this will all be worth it.”

Then, you become an attending physician and find out that’s not quite true. You can have the same feelings and sentiments as an attending.

The statements change, but the truths we tell ourselves remain the same,

“Someday when I become a partner (or full-professor), it’ll be worth it.”

These “Someday” or “One Day” statements are called an Arrival Fallacy. The idea is that when you reach the next milestone, things will get better. The problem with this sort of view is that your happiness is completely dependent on the end result.

With a focus only on the end, you cannot enjoy the journey.

However, the ugly truth is that even once you “arrive” at your stated goal, it rarely produces the long-term satisfaction you thought it would. This goes for career goals, promotions, making more money, and much more.

This is why it is important to enjoy the journey.

That’s what it is all about, and that is exactly what financial freedom allows you to find – a career that you love. As Mark Twain said at the intro of this post, “Find a job you enjoy doing, and you will never have to work a day in your life.”

Learn how to enjoy the journey along the way. This is key to fighting burnout.

5. Fight for Yourself So that You Can Fight for Others

Many people in life view me as a bit of a bulldog after seeing me stand up for others who are not able to stand up for themselves. My view in life has a heavy dose of justice attached to it.

Ironically, I’ve had to learn to apply this own sense of justice to my own circumstances. The reason is that my entire life I’ve been a respectful, people-pleaser. I’ve always been concerned with what people think, and whether they will like me or not.

However, I’ve learned one vital truth as it relates to financial freedom and burnout. People will continue to ask more and more of you until you finally say no. This is what eventually produced my Hell Yes policy where I say “no” to anything that doesn’t make me say “Hell Yes!”

It was through The Physician Philosopher that I learned that if I don’t fight for myself, I won’t be able to fight for other doctors who are desperately trying to find their way out of burnout.

In fact, in a recent webinar where I promoted my course Medical Degree to Financially Free, I was called out for being one of the bloggers who is starting to sell products. In times past, I would have apologized to the person in order to de-escalate the conversation so that I could please them.

Instead, I’ve learned to tell myself the truth.

Doctors NEED financial freedom so that they can escape their burnout and misery. And I believe that I can teach that to them. Therefore, in order to help the most doctors, I have to grow this business.

To do otherwise might leave a burned-out doctor feeling trapped and without options.

That simply isn’t acceptable to me. I want every burned-out doctor to have hope.

This is why I’ve learned – through financial freedom – to say “no” to anything that doesn’t help me accomplish this goal. I’ve learned to fight for myself so that I can fight for others.

However, that becomes much easier once financial freedom provided me the option.

Take Home

Financial Freedom and burnout are intrinsically linked. While it is beneficial to take care of business through a high savings rate and looking for non-clinical income, we must also learn to enjoy the journey and to fight for ourselves along the way.

If you do this, you might find yourself less burned out and in a situation where you don’t have to work a single day in your life because you love what you do.

How has financial freedom impacted your burnout? What lessons have you learned in this journey? Leave a comment below!

TPP

Great post Jimmy! I completely agree with all of your points, especially #5. You provide an incredible service to other physicians and I have personally benefitted from it many times over. 99% of those services are free, no shame in supporting your passion and mission!

Great article and although I wasn’t physician, with a few word tweaks everything applied to my engineer career. Burnout is a huge problem in many high stress professions, especially those that have a high impact of error riding on one’s back. It’s easy to think advancing higher and higher in our career/title will be better but it just adds even more to our burnout factor. FI is the more worthy goal.