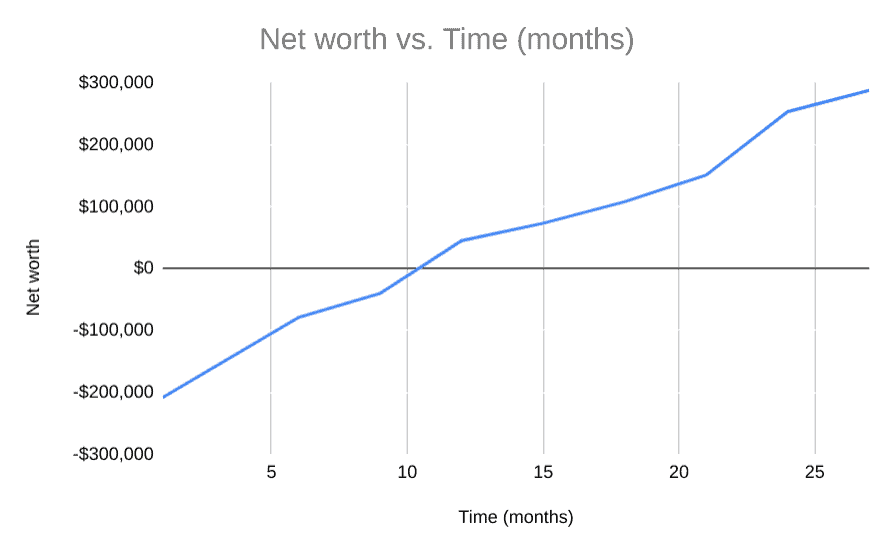

I have a confession to make. I HATE traditional budgeting, zero-dollar budgeting, and line-by-line budgeting. In fact, my family has never had a line-by-line budget. Despite this, we have been able to pay off $300,000 in debt and increase our net worth by $500,000 in two years (see below). How is that possible? The answer is that we used a cash flow plan.

It is not that a traditional budget won’t work. Giving every single dollar a job is a highly effective way to find financial success. Yet, it is also a highly successful way to stress both me and my marriage out. I’m just not a detail-oriented person. When I started becoming financially literate, I was bound and determined to find another way to achieve our financial goals.

It all started by working backward toward our goals utilizing a cash flow plan.

Working Backwards

This site isn’t called The Physician Philosopher for no reason. I am an abstract thinker who enjoys making complicated topics simple. That’s what led me to cash flow planning.

In the beginning, my wife and I sat down and discussed our financial goals.

For example, we decided that we wanted to pay off our student loans really early. This was our most important goal in large part because I hated being cash-strapped to monthly payments since I can’t get physician disability insurance.

So, we worked on creating SMART goals that set a timeline and a method to pay off our student loans. The goal was to pay off our student loans in 24 months. With a student loan debt burden of $200,000, this would require a monthly payment of around $8,500.

After we refinanced our student loans to get a cashback bonus, we committed $5,500 of our monthly cash flow toward our student loan debt. Then, we decided to place additional bonus money toward our student loans to meet the rest.

With a lot of drive and determination, we were actually able to pay all $200,000 off in only 20 months; averaging $10,000 per month toward that goal. And we did it all without a traditional line-by-line budget. Why? Because I HATE budgeting.

The Reasons I Hate Budgeting

There are many reasons that I hate budgeting.

First, I am not a detail-oriented person.

That’s Kristen’s strength, which is the reason she handles our day-to-day bills. Otherwise, I’ll forget. It turns out there is a reason that my nickname at work is “Dory” (yes, the forgetful fish). Line-by-line budgeting requires a detail-oriented nature, and that just isn’t me.

Second, traditional budgeting causes stress.

It stresses me out wondering if we “have enough money left” for x, y, or z. I want to be able to spend my money however I want. My wife is the same way. We realized early that – through cash flow planning – if we took care of our big picture financial goals we could spend whatever was left however we wanted.

We did all of this without having to scrutinize my expensive golf habits or Kristen’s daily Amazon purchases. Guess how many financial fights you have when those talks aren’t necessary? As long as you are accomplishing your big picture goals… none. We almost never fight about money.

Finally, I also hate budgeting because is time-consuming

We all have a limited number of hours in our life. I’d like to spend as many of those hours as possible improving physician financial literacy in others – and as little as possible on my own personal finances.

Zero-dollar budgeting sometimes requires you to look at your budget weekly. At the very least, you are supposed to budget once per month. This is very time-consuming.

Instead, I just look at our checking account each month to make sure we aren’t hitting zero. I might also look at our credit card bills when they come in and make sure they are within a certain range. That’s about as “into the weeds” as I get with our personal finances.

We are able to do this because our other financial goals happen automatically because we pay ourselves first when our paycheck first comes in.

Cash Flow Planning in MD to Financially Free

Creating a cash flow plan is the purpose of Medical Degree to Financially Free. Here is the outline of the 5-step process students are taught:

- Determine Your Why for Cash Flow Planning

- Creating the Cash Flow (including where it should go!)

- Protecting Your Cash Flow

- Paying Down Debt with Cash Flow

- Investing with Cash Flow

Like the process I mentioned above, the course works in a logical – yet backward – order. The cool part is that it is highly effective without getting stuck in the weeds of a traditional budget.

Don’t take it from me, though, take it from the Beta Members who took the course…

What Students Said About MD to Financially Free

You might think that it is “too good to be true” that you don’t need a budget. If you hate budgeting like me (and even if you like budgeting), this would be helpful for you.

Like I said, don’t take it from me though. Take it from the 100% of students who took the Beta course and recommended it to you. This is what they had to say about MD to Financially Free.

Dr. Seth Camhi, a primary care sports medicine physician in his mid-career said,

The Medical Degree to Financially Free has been a GAME CHANGER for me. I feel like I have a clear plan of where I am and where I need to go.

Dr. Jeff Bank, a 2nd year Gastroenterology fellow, had this to say,

I highly recommend this course! The amount of financial knowledge I gained in a short amount of time has been hugely valuable and is going to save me tens of thousands in the long-term.

I appreciated Jimmy’s engaging teaching style and the dynamic way in which he presented information in a whiteboard fashion. He explains concepts in a way that both beginners and experts can glean useful knowledge. My major takeaway was learning how to take concrete steps towards building wealth in a systematic fashion through the cash flow waterfall. I examined our current cash flow and made changes so that we can reach the goal of a 30% wealth building rate. Knowing our why provided the motivation to make these changes and will allow us to sustain these habits long-term.

This course was more engaging than other financial courses I have taken. Jimmy makes concepts personal and practical, so you can find the way in which they apply to your financial life.

It wasn’t just physicians who took the course, though! Other doctors did, too.

Here is what Chris, a 3rd year soon to be DMD, said about the course,

I think this is a course that could easily increase one’s net worth by hundreds of thousands of dollars, regardless of their financial background and prior knowledge.

I had previously read some finance books and took another course (Fire Your Financial Adviser), but MD to Financially Free focused on cash flow versus writing your own financial plan. The videos were engaging, concise, and comprehensive. The live office hours helped to set this course apart from similar offerings.

Dr. Turner’s understanding and personal experiences about personal finances allows you to figure out how to prioritize cash flow in an efficient way to achieve financial independence. He breaks it down in a simple and effective manner. Dr. Turner proves that you can change your life financially in a little over a month.

Take Home: Do You Hate Budgeting?

If you’ve never started your financial journey because you hate budgeting or have tried budgeting and seen it fail, don’t worry! There are other options that are less intrusive, stressful, and detail-oriented…but equally effective.

If you want to learn how to create a cash flow plan tailored to your situation that will help you pay down your debt, invest efficiently for your goals, and help you find the financial freedom you deserve – click here to enroll in Medical Degree to Financially Free. The course will only be on sale until June 10th.

Are you a line-by-line budgeter? Or have you graduated to cash flow planning? Leave a comment below.

Definitely not a true “budget” type of person. I have tried it all, budgeting on my phone with day to day payments, setting a monthly budget goal and sticking to it (lasted about 1 month), and using excel sheets to break down by income and separate into specific budget plans. None of that worked, until, as you mention, budgeting backwards. Paying myself first, whether it is investing, paying off debt, saving, etc., that seems to be the one type of budget plan that worked for me and my family and we have stuck to it for about 2 years of residency and I was able to increase my investment strategy since I knew a portion of my income would be dedicated to that, I knew our grocery and monthly living expenses already since it was pretty repetitive and I established a 3 month emergency fund early so I didn’t have to worry about that. After all that, I was able to pay more down in debt (remainder of income) and before I knew it I saw + cash flow in my portfolio, greater debt pay down, and 0 credit card debt (which I never want to pay 1 dollar in CC interest). That is the type of budget plan I like.