The coronavirus scare had several different ramificaitons on the recent WCI Conference in Las Vegas. One such impact led to a keynote speaker staying home. This provided an opportunity for me to speak in his sted. When Jim Dahle asked me what topic I’d like to cover I waxed and waned between behavioral finance topics, happiness economics, or maybe a talk on burnout. However, many of these topics were already being covered. Then, the market decided to take a nose dive – and the topic became obvious. I would talk on how to stay the course during a bear market.

If you missed my talk, you will have a chance to purchase the videos of the conference talks. However, if you haven’t had the chance to do that, here are several of the key points I discussed in that talk – which hit home for many.

What is a Bear Market?

A bear market is typically defined as a period of time (usually at least 2 to 3 months) where the market stays at a 20% loss from the previous market peak. Since 1926, the bear markets that have occurred have lasted from 6 months to a little less than 3 years.

Bear markets can occur with or without a recession. So, they do not have to coincide. When they do, it can get particularly gruesome. The two most notorious bear markets in the last 100 years are the bear market of 1929 and the most recent one in 2008/2009. If you are reading this, there is a chance that one of the two worse bear markets is still fresh in your mind.

Why is a Bear Market Scary?

In order to prevent or fix a problem, we must first understand the problem. Bear markets are scary for many reasons, but I want to mention three in particular.

1. We Hate Losing Money

We hate losing money. We hate losing about twice as much as we like winning. Because of this, we will go to great lengths to avoid losing money through a process called loss aversion.

Here is an example. If someone offered you a 50/50 coin flip where – if you won – you’d win $1,000 and – if you lost – you’d have to pay the other person $1,000. Would you take it? Think about it. Would your answer change if you’d still stand to win $1,000 but would only lose $750 if you lost? What if it was for a $1,000 win and $500 loss?

Most people won’t accept the first or second bet. By the time it gets to a 2:1 ratio, things change. This seems to be the barrier at which most people think it is a reasonable thing to do. Why? Because we hate losing about twice as much as we like to win. So, the bet has to pay us these sorts of odds before we will consent.

2. Losses Cause Myopia

When we are losing money it becomes difficult to ignore. Even if we recognize that none of the money is truly “lost” until we sell it, the loss still feels real. And this loss causes us to pay more attention. Like an accident in slow-motion, we just can’t avert our eyes. I’ll prove it to you…

This myopic loss aversion causes problems in the stock market. When we see things tumbling down, we pay more attention. When we pay more attention, we are more likely to make changes that will negatively impact our finances. More on that below.

3. Market History Drop Out

The final reason that bear markets seem so scary is that when it comes to history, most of us would get an “F” on our final exam. We don’t spend much time learning it. So, when the market drops for the first time in a long time, it feels like, “This is the one that is going to ruin us all!!!!!”

Yet, if we understand the relentless upward trend of the stock market since its inception, these “giant” drops would feel a little more like a mole-hill instead of a mountain.

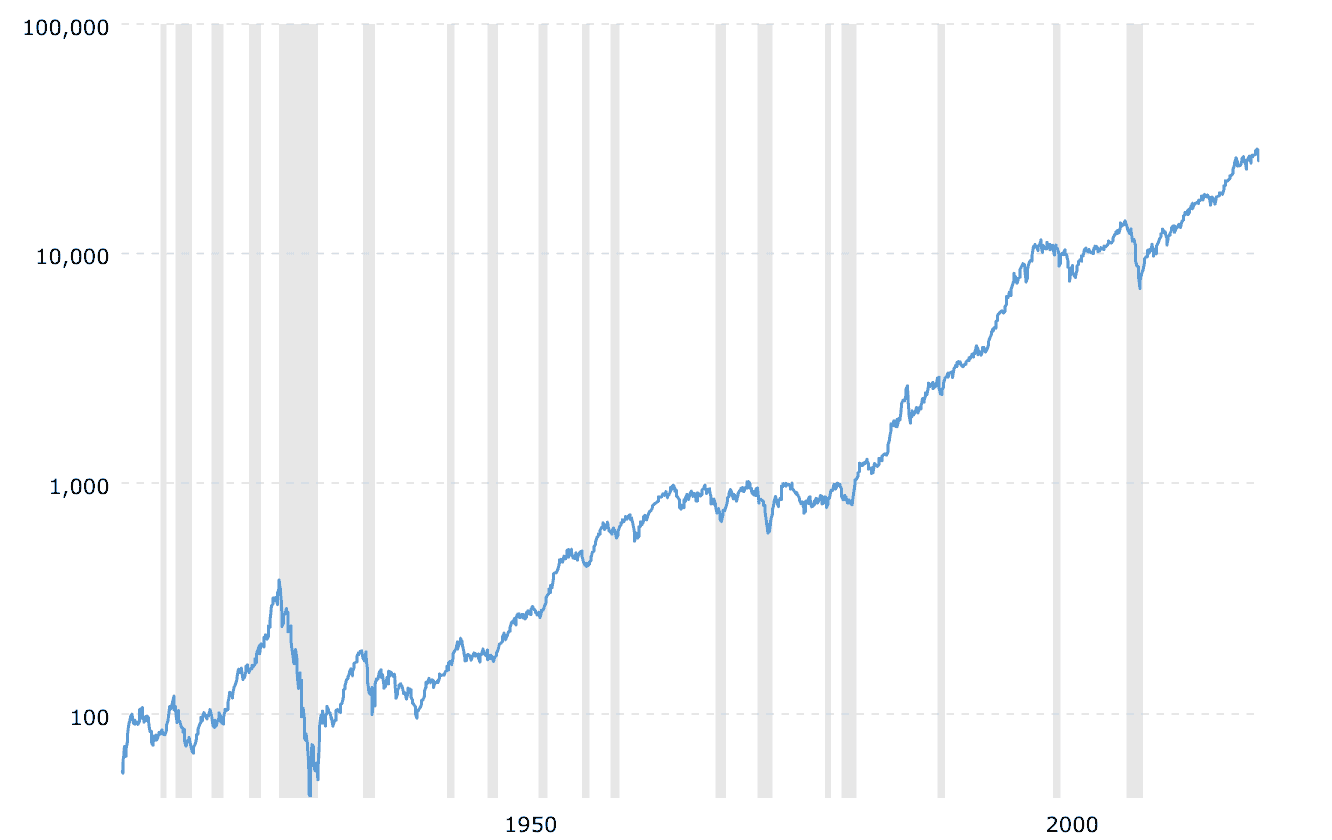

Here is the Dow-Jones for the last 100 years. The small grey bars are periods of bear markets and/or recessions. You’ll notice the dip, but in the grand scheme of things the market takes a relentless upward trend to the right.

We should not wonder if a bear market will happen. We should expect it. It happens on average once every 3.5 years.

What Can We Do During a Bear Market?

Now that we understand the reasons behind our fear, it is time to discuss some things that we can do during a bear market that won’t ruin our financial lives. You’ll notice below that none of these methods involve moving to cash, selling all of your investments and staying out of the market, or anything else that looks like a state of panic.

1. Stay the Course

The best thing you can do during a bear market is stay the course. Particularly with your planned monthly investments. Just keep doing what you are doing and view this as an opportunity to “buy stocks on sale”.

If you can frame this financial situation properly, you will reap great benefits. And, if you can’t and jump out of the market, you are likely to miss one of the best days in the market.

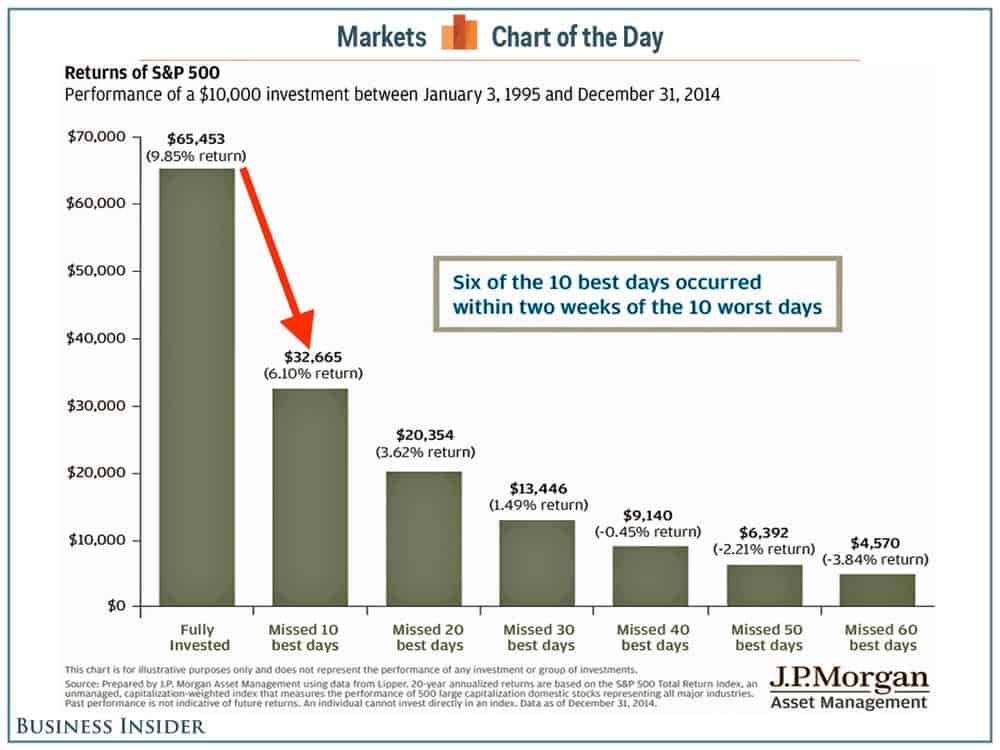

These “best” days will cost you greatly, too. Check out this study done by Business Insider where they showed just how costly it was to miss even just 10 or 20 of the the best days over a ~7,000 day period (20 years):

The take home here is pretty simple. Staying the course is the best choice. If you don’t, you’ll likely miss those best days and it will cost you dearly.

2. Hibernate Like a Bear

Another reasonable option during a bear market is to act like a bear and hibernate. Turn off all the stock market notifications on your phone. Don’t read the news (your health might improve with this one, too). Laugh at others when they ask you if you can “believe what the market is doing?!?!?”

The best ways to accomplish this are to start using a lazy investment portfolio that is easy to ignore. Another way to hibernate like a bear is to pay a friend to change all the passwords on your investment accounts and tell them they will have to give you the money back if they divulge the new passwords to before the market recovers.

Seriously. Sounds crazy, but you’d end up doing better because you stayed the course by ignoring all of the noise. This reduces the myopia we often have in a falling market.

3. Pay Down Debt

While you can “stay the course” with your typical monthly contritbutions, doing the same with a large bonus may seem too hard to swallow.

Fortunately, there are other things that we can do with our money during bear markets. For those who have refinanced their student loans (hopefully, through The Physician Philosopher Student Loan Refinancing page) – you could put extra money towards this debt. If you have auto bills or a mortgage, you could do the same there.

4. Tax Loss Harvest

There is one “active” opportunity to take part in during a bear market called Tax Loss Harvesting. The gist is that you can sell an investment for a “paper loss” by immediately purchasing another investment so long as it is not “substantially identical”. For every $3,000 loss for married couples ($1,500 single), you can deduct $3,000 from your annual taxes.

If you have a large loss, don’t worry. You can roll your losses into future years. For example, if you lost $9,000 on paper, then you would have the opportuity to say that you lost $3,000 for 3 years and take advantage of the full $9,000.

For tutorials on Tax Loss Harvesting, check this one out –> Tax Loss Harvesting tutorial at Vanguard.

Take Home

When it comes to dealing with a bear market, the going can get tough. Yet, with a little digging, we can uncover what causes all that unease. Then, we can actively combat the loss aversion, myopia, and lack of knowledge on market history.

It turns out that the why behind money (i.e. behavioral finance) matters infinitely more than the “how to” of money. Keep first things first.

How do you encourage yourself to stay in during a bear market? Do you have any special tricks or things that you do during down periods? Leave a comment below.

0 Comments