Humans are not usually rational. It is a hard pillow to swallow, but you are better for it if you can accept your irrational nature early on in the behavioral finance series. If you think you are entirely rational, this post will prove to you the false nature of this belief. Humans depend on a process called framing in order to make decisions. And it impacts most of our decisions. Framing even impacts your medical decision, your business decision, and it framing even impacts your financial decisions.

Here is a basic example of framing that relates to medical professionals. When a patient is faced with radiation versus a more successful surgery for lung cancer and they are told that there is a 90% chance of survival, over 75% of patients will proceed with the surgery.

Here is a basic example of framing that relates to medical professionals. When a patient is faced with radiation versus a more successful surgery for lung cancer and they are told that there is a 90% chance of survival, over 75% of patients will proceed with the surgery.

However, if they are told that there is a 10% chance of death following this necessary surgery – which you might notice is the same statistic said differently – only 55% proceed with the necessary surgery.

This is the power of framing. Even though there is a 10% chance of mortality either way, framing alters our decision. And framing impacts our financial decisions, too.

Classic Example of The Framing Effect

Being a high income earner does not guarantee financial success. In fact, being a high-income earner often hampers our ability to find joy and satisfaction with our wallets.

There are so many examples of this effect.

I’ve chosen a few powerful examples to prove the point if the opening example didn’t do so. After we discuss these, we will dive into how you can use this to make better financial choices.

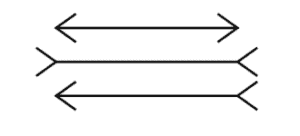

Muller-Lyer Illusion

Here is a classic example of visual framing. You read that right. It works on our eyes, too.

Which of the following images has a longer horizontal line?

Which of the horizontal lines is the longest?(Source:https://en.wikipedia.org/wiki/M%C3%BCller-Lyer_illusion)

Which of the horizontal lines is the longest?(Source:https://en.wikipedia.org/wiki/M%C3%BCller-Lyer_illusion)

If your eyes led you to believe that the the middle line with outward arrows is the longest, you have been deceived. This is an example of visual framing. It is a famous example, though there are others, too.

In fact, even after you prove this to yourself by putting both your hands up and ignoring the arrows on the side, it is still difficult to convince ourselves while looking at the image.

This is the Muller-Lyer illusion. If you’d like to see some other awesome examples of visual framing, here are some more examples (check out the slides) that have to do with colors.

Framing Without Pictures

The Israeli psychologists Kahneman and Tversky are credited with showing the impact of framing in psychology and decision making. Their work later extended into personal finance. In fact, it was their work that led Richard Thaler to eventually create the field of behavioral economics.

Here is the classic experiment that they posed to their survey participants, which was called “The Asian Disease Problem”.

People were told that they must choose between two different treatment methods (Treatment A and Treatment B) for 600 people who had contracted a deadly Asian disease.

First, they were told the following about Treatment A versus Treatment B for the 600 people impacted by the disease:

- Treatment A: Saves 200 lives

- Treatment B: A 33% chance of saving all 600 people, 66% possibility of saving no one.

Which one would you choose? Pick one now before reading on.

If you were like most other people, when the problem was framed this way 72% of people chose Treatment A.

Then, Kahneman and Tversky performed the same study, which asked the same question, and people were given two other treatment choices:

- Treatment C: 400 people will die

- Treatment D: A 33% chance that no people will die, 66% probability that all 600 will die.

Based on our introductory example, you may have guessed the result. When the problem was framed “negatively” where people’s death became the focus, people chose Treatment D 68% of the time.

In other words, when people were given the same exact choices (with the same outcomes said differently), Treatment A was chosen 72% of the time when framed positively and Treatment C (the same choice) was picked only 22% of the time when framed negatively.

How Framing Impacts Financial Decisions

Framing is related to our abilities as people to accept risks and rewards. We will discuss this further in another BFS post, but the point is so important here that I don’t want to fail to mention it.

You might assume that people would prefer to win $5 for doing the right thing, than to receive a $5 penalty for failing to do the same action. It’s the classic carrot versus stick argument.

Unfortunately, psychology has repeatedly shown that we are more motivated by avoiding the stick (the $5 penalty) than we are by the carrot (the $5 reward). In other words, naturally humans fear loss much more than they anticipate reward.

How does this carrot-stick mentality impact our financial well-being?

It impacts our ability to withstand losses in our investments.

You are much more likely to notice a drop in the market and to perform a corrective action (selling your shares) than you are to enjoy a ride up a bull market. With improving returns, you are far less likely to sell those same shares.

Despite knowing that a 10% correction occurs (on average) every 1.5 years, people universally think about selling their funds and stocks when the market drops. Even if they realize that this is one of the biggest financial catastrophes (e.g. buying high and selling low) you can make with your money.

Our human nature is bent on wrecking our financial lives. You have to know that. Otherwise, you can’t fight against it.

There is Hope in Framing

We can also use our knowledge of framing to flip the script. That’s half the battle.

We can do this through educating ourselves about the market (I’ve written a handy book on personal finance that can get you started). The other half of the battle is using the power of framing to put a positive spin on smart financial decisions.

For example, when the market drops – as we should expect it will – we can frame this positively by saying, “Hey, the market has continually gone back up. So, this drop is actually an opportunity to buy my index funds on sale! Sweet.”

It may seem silly, but it is powerful. This positive framing will encourage us to continue to do the right thing, which is to continue to buy when the market is down (as opposed to selling it all, which will result in financial ruin).

Here is another example. What about the passive versus active mutual fund argument that exists in personal finance?

If we frame this positively, we would say that greater than 90-95% of index funds outperform their actively managed counterparts in a fifteen year investing period. Framing it this way will encourage you to participate in passive index funds, which is the right move so 90-95% of the time.

Take Home on the Framing Effect

Psychology has a profound impact on our financial decisions – whether we like it or not.

When information is presented to you, always look at both the positive and negative frames. They matter.

If you are presented with a negative frame, flip the script and see if that changes your opinion on the topic at hand.You are more likely to buy meat that is 80% lean than meat that is 20% fat. Even if it is the same situation. Your job is to make sure you are looking at both sides.

Now that you know the framing bias exists, you may view many of your decisions differently. This bias impacts patient care, politics, and even your wallet.

Have you heard of the framing effect before? Has it impacted your work or financial decisions? Leave a comment below.

TPP

Behavioral psychology has always been fascinating to me. We like to think that we are independent thinkers but there are so many innate behaviors that are present that the majority of us respond in quite predictable ways based on how information is presented to us, i.e framing.