One of the hardest investing concepts to grasp for hardworking medical professionals who spent years busting their rear to get to where they are is that – sometimes – it is okay to be average. In fact, getting average market returns is a sure fire way to get to your financial goals.

Yet, the idea of being average seems repulsive to people who worked hard to become the cream of the crop.

In this post, we are going to discuss why a lazy portfolio might be best for your financial success. Then, at the end, I am going to give several examples of what these lazy investment portfolios look like.

What is a Lazy Portfolio?

A lazy portfolio is an asset allocation that is easy to maintain. It is the sort of account that you can throw money into automatically, rebalance once every year or two, and not have to think about daily.

This offers major advantages, as we will discuss below, from a behavioral finance standpoint.

There are several reasons that a lazy portfolio allows you to put minimal effort into it:

- These portfolios often contain a bond allocation that you do need to change throughout your investment career. Typical bond allocations range between 25-40%.

- Given the small number of assets that are held within each lazy portfolio, it is very easy to keep up with what you have.

- Each lazy portfolio listed below takes a passive index fund approach to investing. This means that you don’t have to spend time and energy (i.e. not lazy) unsuccessfully picking winning stocks.

- Rebalancing back to your desired portfolio is pretty painless given the low number of investments in the lazy portfolio.

Advantages of a Lazy Portfolio

Given the time-benefit of investing in a lazy portfolio, it begs the question – is a lazy portfolio as good as an active portfolio?

The answer is yes. The reason lies in both better returns and a better behavioral finance strategy that allows you to find success.

Here are a few reasons that lazy portfolios shine when compared to a more active investing strategy.

1. Passive Is Better Than Active

It is well-documented at this point that a passive index fund strategy is superior to an actively managed fund.

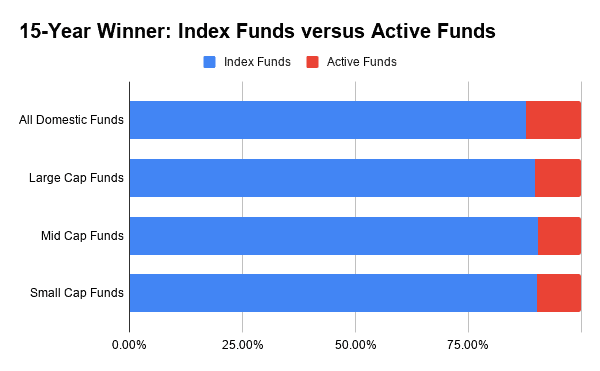

The SPIVA scorecard keeps a running track of how often the index outperforms various actively managed funds. Every year, spiva-us-mid-year-2019, index funds put their active counterparts to shame by outperforming them more than 90% of the time over a 15 year period.

As you can see above, being lazy pays off in the end. Why put time and energy into picking the “right” actively managed fund if you have a 90% chance of picking the wrong fund? It just doesn’t make sense to put more work in to get worse returns.

This is the first reason to stay lazy, my friends.

2. Checking Your Portfolio More Often Leads To Worse Results

In a landmark paper on myopic loss aversion – written by the economists who would create the field of behavioral economics – the authors showed that myopic loss aversion can be a big problem if you are looking for financial success.

What is myopic loss aversion? It is the combination of two ideas.

Loss aversion, which we have previously discussed on The Physician Philosopher here, is the fact that humans hate losing about twice as much as we like winning. In fact, unless the potential reward outweighs the risk of loss, people will tend to avoid investing in something.

The myopic portion of myopic loss aversion means that people like to look at things very closely and more frequently.

The end result of this paper is that people who are more myopic are less likely to take long-term risk, because they are checking in on their portfolio more often. Less risk in the investing world means lower returns.

So, if you truly want greater returns, you need to be able to ignore your investments. And a lazy portfolio makes it easier to do this.

3. Better Use Of Your Time

You are a high-income earning professional. Every hour you spend picking stocks is an hour you could have used to work on a side hustle or pick up an extra shift. This marginal benefit on your time is huge.

In fact, this is the same reason that I outsource several things at our home now. After cutting my own yard for 10 years, someone else now does it. It takes him 30 minutes with his awesome lawnmower and multiple hands at work. It would take me 3 hours. I pay him much less than what I earn in 3 hours of work.

The same goes for cleaning the house. I no longer sweep and then clean our wood floors. We pay for a cleaning service to come every two weeks to help us with that. While they are working, I can focus on writing a blog post or monetizing my business.

The same can be said of actively picking stocks. The time you waste doing that could be spent elsewhere. Particularly given that lazy strategies tend to outperform active strategies.

Examples of Lazy Portfolios

Alright. So, I’ve sold you on the idea that a lazy portfolio is likely better for you. What exactly does a lazy portfolio look like?

The answer, as always, is that it depends.

Some lazy portfolios have only two funds, while others can have as many as four to six funds in the portfolio. The reason for having more than one example is that many employers don’t offer the two or three funds in the lazier portfolios. So, you might have to utilize a larger number of asset classes.

Here are four classic examples of lazy portfolios.

The One Fund Portfolio

The one fund portfolio really goes by a different name. They are called lifecycle or target date retirement funds. I’ve written previously about the pros and cons of Target Date Retirement funds here.

Target date funds are the ultimate lazy portfolio.

The take home is that, if available to you, you can put all of your money in the same target date fund and it will automatically rebalance the fund for you each year based on your age. This is a huge plus.

It also comes with some downsides, though. It has a higher cost (i.e. higher expense ratio), a higher international exposure, may not contain all of your assets forcing you into one of the other three lazy portfolios outlined below, and TDF’s often offer a more conservative portfolio than some would prefer.

That said, if you are looking for easy, lazy, convenient, and truly “hands off” a Target Date Fund may be the only single fund lazy portfolio in existence.

Two Fund Portfolio

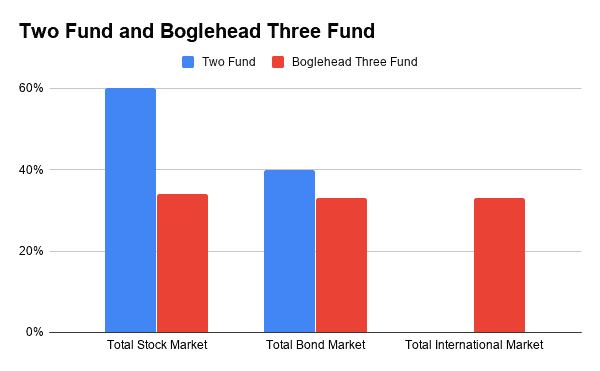

The two fund portfolio is as simple as it gets. It involves having a total stock market index fund (60%) and a total bond market index fund (40%).

Examples of total stock market index funds: VTSAX, FSKAX, SWTSX

Examples of total bond market index funds: VBMFX, FTBFX, SWAGX

It is truly the laziest portfolio you can have. That provides some upside, of course.

The downside is that it doesn’t have any international exposure and is overly conservative for my taste. I probably won’t be in a 60/40 portfolio until I am in my 60s. Right now, I am 90% stocks and 10% bonds.

The Boglehead’s Three Fund Portfolio

Compared to the Two Fund Portfolio where 60% of the fund is in the Total Stock Market Index Fund and 40% is in the Total Bond Market Index Fund, the three-fund portfolio splits your asset allocation into thirds. Comparing the two side by side would look like this:

Using this fund adds minimal work while it also increases your international exposure for diversification.

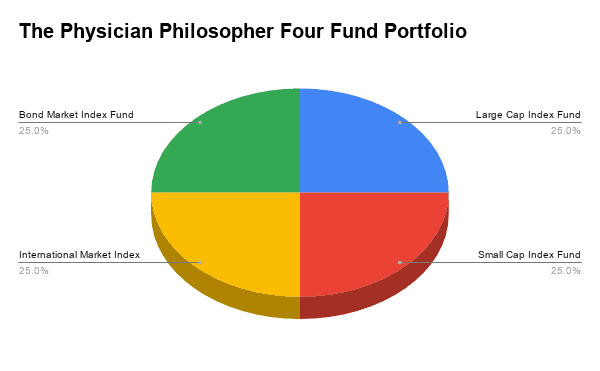

The Bernstein No-Brainer (Four Fund Portfolio)

This is the lazy portfolio will work if your employer doesn’t offer the options mentioned above. It was created by Bill Bernstein, a retired neurologist turned financial advisor.

The Bernstein No-Brainer consists of breaking your portfolio consists of breaking your portfolio into four 25% allocations. This includes a large cap (S&P 500) index fund, a small cap index fund, the total bond market index fund, and a European stock market index fund.

This seems more complicated, though, which is the opposite of a lazy portfolio. Why would you ever entertain this idea?

Because many employer’s don’t offer the funds necessary for the two or three fund portfolio. On the other hand, many employer’s do offer index funds broken up into the various asset class sizes, though that likely doesn’t include a European specific index fund.

So, The Physician Philosopher modification of the Bernstein No-Brainer looks like this:

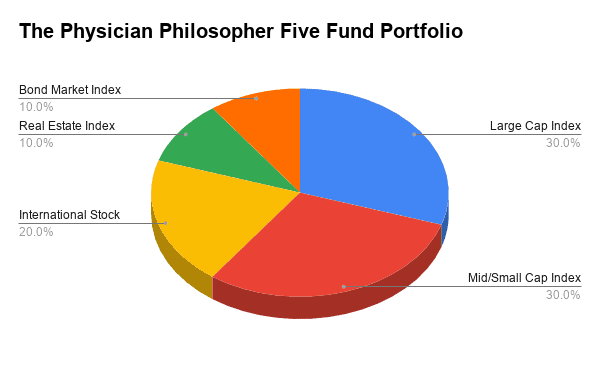

The Physician Philosopher Five Fund Portfolio

The astute will notice, however, that I don’t necessarily prescribe to the funds listed above. Instead, I actually have a five fund portfolio. The reason for this is because I do want some real estate exposure in my portfolio.

So, if you truly want to emulate what I am doing to grow our net worth, you’d need to add REIT’s as a fifth class. This does complicate things, and may not be necessary for you, but this is what our portfolio looks like in real life:

- 30% Large Cap Index Fund

- 30% Mid/Small Cap Index Fund

- 20% International Index Fund

- 10% Bond Index Fund

- 10% Real Estate Index Fund

I could likely stick with the portfolio shown above indefinitely, but I’ll probably ratchet it back after age 45-50 where I would be sitting at 15-20% bonds instead of only 10%. The additional 5-10% would come from my 30% allocation groups (The large cap group and the mid/small cap group).

Other than that, it only requires me to rebalance my portfolio once each year.

Take Home on Lazy Portfolios

The lazy portfolios mentioned above come with many benefits and are not very challenging to portfolio. While being lazy in the workplace doesn’t produce the results you may want, being lazy in the market is both easy and ideal.

And, don’t forget to track your portfolio! I use personal capital to track mine.

Do you use a lazy portfolio? Which one do you prescribe to? Is there another variation you’d like to share? Leave a comment below.

What are your thoughts on the “permanent portfolios”? These include Ray Dalios all weather fund, the golden butterfly, etc. The allocations are against the grain but the long term results are tough to beat especially if we are at the end of the economic cycle. Portfolio charts.com has an impressive web site discussing these portfolios.

Presumably by permanent you mean you never have to change the allocation? I’ll have to check out your reference when I get a minute.

I think my risk tolerance will change as I age. So if that is what permanent means, I’m not a fan

Ray Dalio’s all weather fund is incredible. way better performance and stability than this fund over the long run

It’s great that you elaborated on how target date funds will rebalance the fund for each year. Since I don’t know too much about investing, I want to add to my portfolio this year and diversify my portfolio. I’ll have to get a professional investor to advise me with my investment options.

That, or you could take my course, which will help you figure it out:

Thephysicianphilosopher.com/course

I outsourced all the yard work to my farm raised wife at her request. I was a legend at work because of that.