The Physician Philosopher Podcast

TPP #67: Money Matters: When Losing Feels Like Winning

Editor’s Note: If you are are a physician who wants to find work-life balance in medicine, book a coaching consult with us! We help burned out doctors master their mindset, money, and time so they can create a life they love.

If I could convince you of one thing that would make the biggest difference for you when it comes to financial success, it would be that you are irrational. You heard that right. While you may think you make logical decisions, study after study shows that human beings make irrational decisions. This is why when it comes to money, THE most important aspect isn’t “what to do” with your money… it is how you think about it.

In this post, we are going to talk through mental constructs that will help you be a better investor.

When it comes to investing money in the market, there are a few things that are paramount to success. Let’s take a look at each in turn.

Make it easy to win (Loss aversion)

When I give talks on personal finance, I’ll often perform an exercise. I’ll take out a $100 bill and ask the people in the audience, if they would be willing to make a bet.

In this bet, we flip a coin. Heads they win my $100 bill. Tails, they owe me $100. I then ask them to raise their hands to see how many would take the bet.

When I do this, there are always a few risk takers who raise their hands, but the vast majority keep their heads down. Particularly, if I am talking to residents or medical students.

Then, I raise the odds in their favor. I’ll say, “what if I offered you $150 if you win, but you only have to pay me the same $100 if I win.” A few more hands will go up after I increase the odds in their favor. Yet, it is only when you get to a $200 win for them and a $100 win for me, that the overwhelming majority of hands will go up.

Said differently, until someone stands to win twice as much as they could lose, it just isn’t worth it for most people. This thought experiment actually comes from Daniel Khaneman’s work who has run experiments that people hate losing about twice as much as we like winning. It triggers the fear centers in our brain.

Myopic Loss Aversion

When it comes to investing, loss aversion has a HUGE potential to impact your finances. The reason why is because we pay more attention to potential losses. This comes from our avid hatred for losing money.

This is why when the market goes down, we have a tendency to freak out. Even though none of that money is actually lost (unless you sell your assets), people have a really hard time watching their $1 million portfolio turn into $850,000.

This is one of the many reasons that it actually pays to ignore your investments. Why? Because multiple studies have showed that the more often you check your investments, the more likely you are to see them go down. Then, it is much more likely that you’ll make a change. And, guess what? When you do, you are more likely to make LESS money.

You read that right. Paying more attention to your investments actually leads to lower returns. There is a name for this phenomenon, which is called myopic loss aversion.

This is one reason that I joke with people that if they do not have the discipline to leave their investments alone, then they should pay their best friend to change their password on their investment accounts. And then to promise not to tell them what it is when the market goes down. This is also why I advocate for people having lazy investment portfolios that require them to pay little attention to them.

Framing Paper Losses

One way to fight back against our myopic loss aversion is to frame things differently. Framing is the process of putting a positive or negative spin on things in order to change our decision making.

Remember, you aren’t rational when it comes to decision making. And this has been shown over and over again in a variety of arenas, including medicine. I often tell the story about the study from the 1980’s where they broke patients with lung cancer up into two groups. They told them they had two choices – radiation or surgery.

Both groups were told that surgery had a better chance of long term survival. The difference between the two groups was how they framed the mortality of the surgery. When the patients were told there was a 90% chance of survival, 82% of them chose surgery. This was the positive frame. When patients were told that they had a 10% chance of dieing on the table (the same statistic, only said differently), 56% proceed with surgery.

In other words, the percentage who chose radiation – which had a lower chance of long term survival at five years – skyrockets from 18% to 44%. The only difference was whether the mortality statistic was framed positively or negatively.

The same can be done with your personal finances. When you see the market going down, you can view this as a “loss” or you can choose to view it as an opportunity to “ buy stocks on sale” while they are at a lower discounted price.

Historical Perspective on Loss

You might think that I am trying to feed you magic beans, but I’m not. If you understand market history, you’ll know a couple of things that will encourage you to frame market dips in a positive light.

First, if we look at the market, we know that the trend is an overall upward trajectory when we lose our myopia and take a bigger picture view. The average rate of return over the last 100 years has been 10%. This means that some years it went down by 10% and other years it went up by 20%. It is a bumpy ride, but with an overall positive trajectory.

The second aspect we must understand is that when the market takes a major dip more than 50% of the time these dips are followed by some of the biggest market gains. Said differently, the times when our loss aversion is going berserk, and we want to sell… are immediately followed by the days it is most important to stay in the market.

The Importance of Staying in the Market

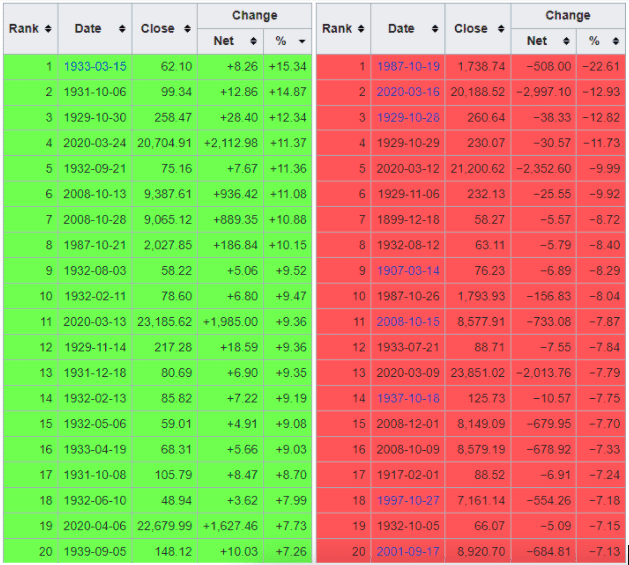

In the above image, three of the largest losses in market history (according to the Dow Jones) occurred on March 9th, 12th, and 16th of 2020. This was right around the time that the pandemic was happening. Many saw this and their amygdalas starting going crazy due to their loss aversion.

Yet, if you didn’t look at the largest gains, this wouldn’t tell the whole story. Three of the largest gains also occurred immediately following these days on March 13th and 24th, and then on April 6th.

So, for all those who gave into their fears and sold. They lost major money as the market recovered quickly. This isn’t new either. When JP Morgan looked at this phenomenon from 1995 to 2014, they showed that 60% of the ten best days in the market occurred within two weeks of the ten worst days.

Working Through Fear

In coaching, we spend a lot of time working with clients on their ability to tolerate negative feelings. Why? Because all of our decisions in life are motivated by our feelings.

We can either let the fear, anxiety, and worry we have in our life dictate our actions. And lead to negative results. Or we can learn how to tolerate them and choose our course despite being anxious or fearful. So, the next time the market goes down… remember the importance of staying the course. And that your brain is wired to make you hate losing.

Don’t let your lower animal brain control your actions. Fear doesn’t have to win. You can stay the course, even when your loss aversion tells you otherwise.

Subscribe and Share

If you love the show – and want to provide a 5-star review – please go to your podcast player of choice and subscribe, share, and leave a review to help other listeners find The Physician Philosopher Podcast, too!

TPP

You might also be interested in…

The Arrival Fallacy

We all have ideas of what happiness looks like. We say things like, “when ___ happens, I’ll be happy.“ This is called the Arrival Fallacy. Today we’re going to talk about to find true happiness.

5 Steps to Lose Weight with Dr. Ali Novitsky

Have you ever wanted to lose weight (or get a six-pack) but it always felt too hard to get it done?

As a life coach for women physicians, Dr. Ali Novitsky shares her insight and expertise to show us how to achieve optimal health with simple strategies backed by science.

Creating Healthy Boundaries with Technology

Business culture indoctrination often means we find ourselves believing we need to hustle 24/7 to get results, but it doesn’t have to be that way.What’s really important about today’s episode is understanding how we can use technology not to worsen our constant availability – which can lead to burnout – but instead how to use that technology to set boundaries.

Are you ready to live a life you love?

© 2022 The Physician Philosopher™ | Website by The Good Alliance

0 Comments