When my journey towards financial independence (FI) started two years ago, achieving FI seemed like a great idea. I could sense the freedom that it would provide. The thought of getting out of debt and making wise financial decisions really got me going.

When my journey towards financial independence (FI) started two years ago, achieving FI seemed like a great idea. I could sense the freedom that it would provide. The thought of getting out of debt and making wise financial decisions really got me going.At some point – likely around the time my wife started back full time and my fatherly responsibilities at home tripled – things changed. The idea of getting to FI as quickly as possible started to pull at me in a negative way.

Today, I want to discuss three ways that financial independence can harm us, if we are not careful. Don’t worry, we might end on a positive note.

1) FI Magnifies Bad Parts of Work

We know from research that there are three components to creating a satisfying and fulfilling work experience. This includes feeling competent at your job, receiving meaningful support from your work place, and having autonomy on the job.

Two of these three (autonomy and support at work) are constantly under attack in medicine. For this reason, it should come as no surprise that 42% of physicians are burned out. This number is probably pretty high in a lot of other work places, too.

Like anyone else, I’ve always noticed the parts of my job that are less than enjoyable. However, it was not until I realized that there was a way out through financial independence that the negative experiences in my job really started to annoy me.

I have another 10-12 years until FI. The path I was on at work was unsustainable. While this was initially a negative experience I learned through a focus on FI, it also taught me how to better manage my time.

For example, I’ve started working towards controlling the aspects of my job that I can by choosing to focus on the good things about my workplace, and working to rid myself of the things that are less than ideal.

My time is limited, and so – when asked to join something new – I’ve started saying “no” to opportunities that do not make me want to say, “Hell, yes!” This includes new committees, research projects, or endeavors that are often offered to young faculty, like me.

2) Missing Today by Living for Tomorrow

Dave Ramsey often says, “If you will live like no one else, later you can live like no one else.” The first part of this is meant to say if you aggressively pay down your debt (like no one else does) someday you’ll be able to live it up (like no one else is able to).

While this idea may be great for the common person earning an average salary, I think this advice is crap for physicians and other high-income earners.

Getting to early financial independence is made up of three crucial components: earning as much money as possible, being frugal with the money we earn, and then investing the difference between what we make and what we spend.

You might note, as many have, that the two big variables under most people’s control are earning and frugality. Increasing our take home pay and cutting out the things we spend our money on can produce a rapid FIRE (Financial Independence Retire Early) scenario.

However, picking up more shifts, working an additional job, and cutting away all of life’s expenses comes at a cost. If we do all of this just so that we can “live like no one else” someday, it can actually be unhealthy.

The trick is to earn and save “enough.” That enough is a delicate balance of allowing ourselves to live a little today (which might – gasp – involve spending money) while making smart financial decisions that will prepare for tomorrow.

It doesn’t have to be a choice. As long as you aren’t making massive financial mistakes, you can often have your cake and eat it, too. Any long-time readers know that the tool I use most often to accomplish this is The 10% Rule.

3) The Tunnel Can Seem Too Long

Let’s be real for a moment.

For most doctors, we finish medical school with an average of $200,000 in student loans. 21% of us also have credit card debt. We get to watch this compound during residency while we are powerless (outside of REPAYE’s magical ways) to stop it.

Then, we finish at an age between 32 and 40 while our college counterparts have been earning a decent wage for the past 10 to 15 years.

Staring at an uphill financial battle once we finish is just the start. Unless you are debt free graduating residency, it will likely be another 10 to 15 years (even for the financially minded) to get to financial independence.

Looking for the off ramp – which seems 5,000 miles away – right when we get on the attending physician highway can cause issues. It feels like a goal that we can never achieve and a moment that we will never realize.

Honestly, it can feel depressing.

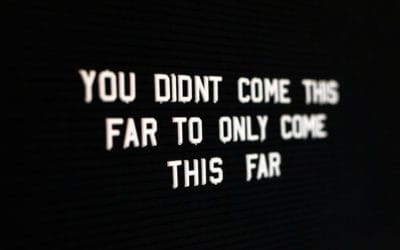

Instead of focusing on the exit, let’s enjoy the open road while we put on a podcast and enjoy the ride. Choose to focus on each step along the journey (and not the destination). Take some time to enjoy it.

Like Emerson said, “It’s not the destination. It’s the journey.” Learn to take your journey to FI in stride.

Take Home

Spending some time in the sun helps us create a healthy Vitamin D level. Too much time, however, can produce second degree burns.

Moderation is the key to life, and financial independence is no different. Too much time and energy spent focusing on FI can produce resentment and discouragement. However, with a touch of moderation, we can harness the true value of FI without being burned by it.

Choose today to live in the moment while you make smart financial decisions that will prepare you for tomorrow. You don’t have to choose one or the other. Choose them both.

What do you think? Can focusing too much on financial independence cause problems? Leave a comment below.

TPP

I agree with this wholeheartedly! Finding the balance between enjoying the now and planning for the future is essential but difficult. We’ve gotta make sure chasing FI doesn’t just become obessively chasing the dollar.

Thanks for the support! It’s all about that balance. Finding it can be tough, though.

Well said TPP.

I am glad that I discovered the FIRE movement relatively late (age 41 or so) in my career. If I had discovered this as early as residency, I would probably create even a larger situation for burnout than I did.

I know a lot of residents take up extra shifts, work after hours to make money which is great but it also takes away from time with family and time to decompress. If you don’t give your body/mind adequate time to recharge in an already hectic schedule, you will slowly cause the burnout flame to get stronger and go into a death spiral.

Moderation is indeed key, can’t put delayed gratification off forever, because your time is never promised. Have to compromise and have some fun now and hopefully be around to have fun later.

Yeah, discovering FIRE early can be great. But it can also be all-consuming, which early on is not the greatest thing. Particularly, if we are surrounded by people who are not chasing after the same thing. Fortunately, I don’t have an eye on retiring super early and simply want to use the FI part of FIRE to better my family’s work-life balance. Because, like you said, recharging is important!

TPP, I feel you.

The narrative you describe can have a pleasant surprise ending: Entering medicine leads to burnout leads to asking how much longer you have to keep working in medicine until you can opt out completely leads to discovering financial literacy leads to discovering financial independence leads to cutting back leads to fewer aggravations in medicine leads to unexpectedly liking medicine by doing less of it, more humanely because suddenly it resembles the job you thought you’d be doing all along.

Some folks benefit the most by starting the glide path early, creating a job that is sustainable and nourishes them.

That’s the job we all want. Financial independence is one of numerous levers to enable our landing or creating that work opportunity.

By pursuing FI, you remove a large barrier so the life you lead more closely resembles your ideal life.

Powerful stuff, but tempting enough that it can cause you to feel impatient with the present (The Mad FIentist has written movingly about his experience with this deprivation mentality).

Thanks for exploring the dark side.

CD

I agree. And maybe once I’ve made that glide path a bit more concrete, I’ll be able to feel that way! I think that once I “cut back” to full-time, I’ll have the balance I’ve been looking for over the last six to twelve months. You are right, though. The path to financial independence is what allows this balance, if the power of FI is applied appropriately.