Fire is a passionate and unforgiving substance. It keeps you warm, heats your meals, and provides light in the dark. When wielded carefully, it is a force to be used for good. Financial FIRE (Financial Independence Retire Early) is no different. We all remember what it was like when that FIRE lit up the dark cave in which we previously lived.

It was a true light bulb moment.

Yet, we must understand that like any other fire, financial FIRE must be wielded carefully. If we share it with everyone we come across, some conversations will likely result in combustion.

Where does the heat come from when we discuss FIRE with colleagues, partners, or friends?

It comes from the three components that allow us to achieve FIRE and then embolden us to want to talk about it:

1) Having a high Wealth Accumulation Rate (> 25-50%).

2) Investing efficiently with the money we save.

3) Living a frugal life and keeping your expenses low.

Before you discuss FIRE with everyone you meet, bring a FIRE extinguisher before talking with the following four groups of people.

Group 1: The Joneses

It’s hard to keep up with the Joneses.

The Joneses have it all! Awesome cars, the house, private school for the kids, designer clothes, and they eat lavish meals and travel on the regular. They fly first class, of course.

Why does this crew get burned by FIRE discussions? Because it’s hard to achieve FIRE when you are upside down in debt, which is normally the case for most Dr. Joneses.

This may come as a surprise to you, but spending money does ≠ wealthy. If you are in training or a newly minted professional, read that last sentence again.

In fact, spending a lot of money on stuff usually means the exact opposite – people are failing to build wealth.

The Joneses’ net worth is usually and unsurprisingly very low.

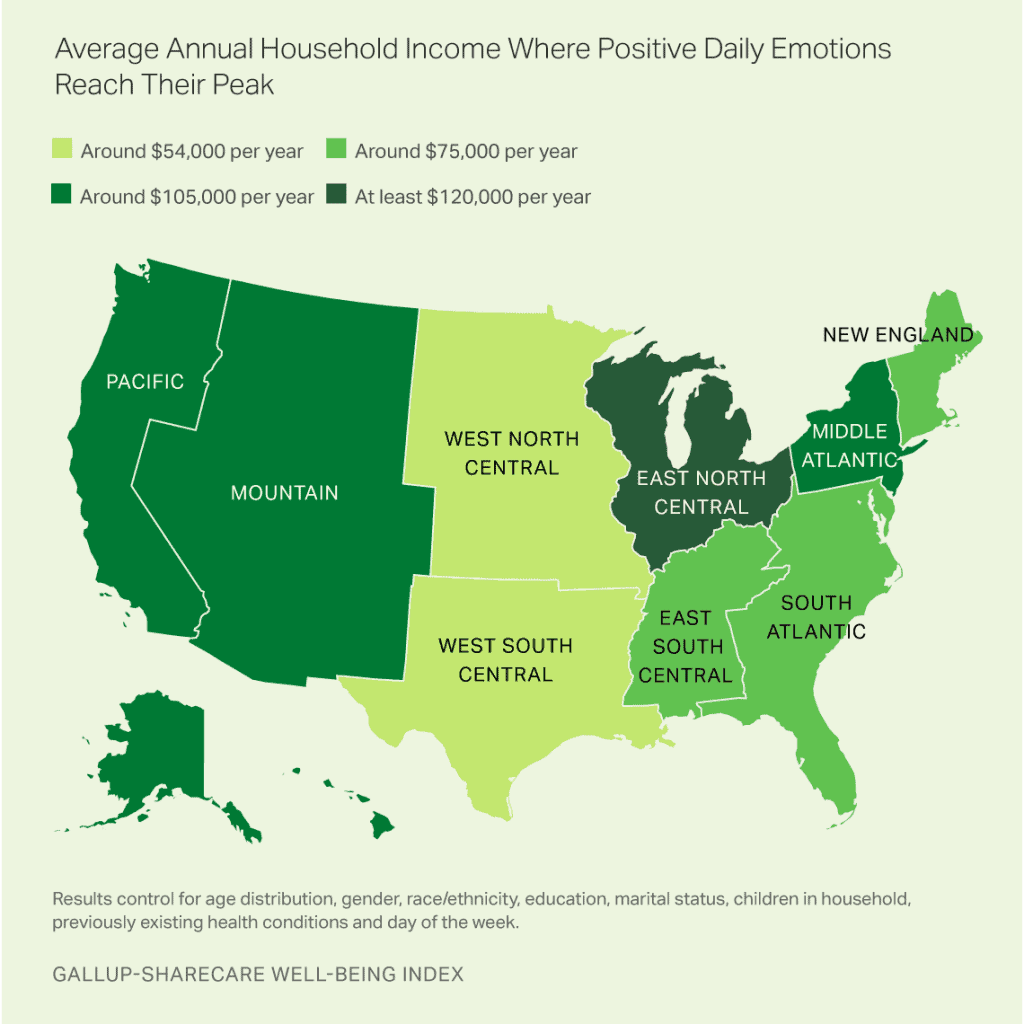

This group of people will get upset with you if you discuss frugality in front of them. They’ll tell you to “live a little!” They support the notion (despite the study shown below) that spending more money makes you happier.

Someone much wiser than me once said it would be easier for a camel to pass through the eye of a needle than for the rich to reach the promised land. It’s tough for the rich.

They’d have to give away all of that stuff that doesn’t build wealth first!

Group 2: The Inefficient Investor

This group could be subdivided into a few others.

That division would include: the person with a “financial guy,” those that are “too busy,” and the ones who think they have it all figured out and, yet, are investing in individual stocks, actively managed funds, or some extreme portfolios. Either way, they don’t understand that index funds are king.

We can argue the merits of using someone else to help with your finances, but the truth is simple. If you can learn to do it yourself, it’ll save you money. That’s unless you don’t have the mental fortitude to stick to the plan in a down market.

If you save $50,000 per year and gain 8% in the market, a 1% AUM (assets under management) will cost you around a million dollars in a typical thirty year career. It can cost you much more in retirement.

Let that sink … millions lost over your life. Still think you don’t have the time to figure this stuff out?

Oh, and using actively managed mutual funds with an expense ratio of 1% will do the same thing when compared to index funds. It’s the same math.

Doing both (the AUM financial advisor and actively managed funds) really puts you even further behind the eight ball.

Investing can be quite simple (and efficient), if we want it to be.

The investing efficiently side of the FIRE argument (typically in low cost index funds with expense ratios <0.1%) really burns the inefficient investor.

When the discussion starts, they will stop you short and tell you they simply don’t have time to work this stuff out. The irony is that they would have a lot more time after they retire early if they would just put in a small amount of work now.

Sharing FIRE concepts with this group is unlikely to change their mind, and much more likely to tarnish your friendship.

Don’t get burned.

Group 3: People ahead of you on the journey

This one should be obvious.

If you are sharing how you plan to FIRE when you are 45 and the person you are talking to is 65, then there is a high chance for that conversation to go south!

No extinguisher would be powerful enough for this conversation. Just avoid the conversation when possible.

Just be considerate and avoid having a FIRE conversation if people substantially older than you are around. It’ll save you the pain and loss of friendship.

Group 4: The moral imperative group.

I’ll readily admit that I focus much more on the FI (Financial Independence) than the RE (Retire Early) aspect of FIRE.

So, this group doesn’t get all hot and bothered by my financial discussions as often as the other groups. However, it’s still an important group to mention.

When I get to my FI number, I’ll simply cut out the parts of my job that I don’t love. That should happen around the age of 45. Maybe sooner. But the current plan is to keep working until 50.

If you have similar plans, you should know that there is a group of people who feel you are doing something morally corrupt by leaving the workforce early. Particularly if you have a job in medicine.

You spend ALL of those years obtaining specialized training in order to help people. Wouldn’t you feel bad if you just gave it all up and stopped helping?

What will all those people do? Who is going to fill your shoes?

The simple answer is that I plan on cutting back, not quitting all together. I have some specific things I’d like to retire to, and some of them include still doing medicine for people who really need it. Likely on the mission field.

If you really do plan to retire early, FIRE topics will turn heads and create some judgement. Be prepared to answer how you will contribute to society if you plan on leaving the gig early.

It’ll save you from pulling the pin on that extinguisher.

So, who SHOULD I talk with about FIRE?

You should discuss FIRE with people coming behind you on the path or currently on the path next to you. This may prevent them from making many of the same mistakes that others have.

Otherwise, they end up being one of the Joneses with lots of stuff, but little wealth.

It also helps them make a strong plan to build wealth by shedding the debt they have, preventing further accumulation of debt, and saving efficiently.

Financial independence is important. For me, I feel like I can truly be a better doctor when my financial situation does not feel like such a burden.

My family and I have a plan, and I know if I stick to it that we will get to our goals.

Once financially independent, I get to practice the parts of medicine I want to because I choose to and not because I have to. That’s a sure way to job satisfaction.

That’s powerful!

Take Home

The take home here is simple. Be careful who you share your FIRE with. It may kindle a spark in our younger medical trainees or younger colleagues, but will often light your relationships at work on FIRE in the groups described above.

It is hard keeping such a powerful secret to yourself, but sometimes it is worth it. Find the right outlet. You’re currently reading mine.

Otherwise, share FIRE at your own peril and be ready and willing to become a FIRE fighter.

Have you ever shared FIRE and gotten burned? What would your advice be to others on this topic? Who told you about FIRE and how do you initially receive the idea? Leave a comment below.

TPP

Great stuff. You definitely have to be careful discussing FIRE at work.

Yeah, it can be touch and go when you do.

Hello TPP,

My own husband laughed at me when I first told him about FIRE. He said “why would anyone want that?!’” When I “retired” about 12 years ago, I told literally NO ONE. I just stopped booking at the clinics and that was it. I am a Canadian family doctor so it was pretty simple.

Absolutely no one wants to hear about frugality when you are an MD. Many times you will be laughed at. I recall once mentioning in an OR that I took books out of the library. The operating surgeon stopped operating and started laughing at me and describing in great detail how dirty books were from the library. Of course I shot back “look dude it’s not like I’m licking the library book”. Like good grief already.

The physician blogging arena is very healthy. I certainly did not have these when I FIRE. I do enough work to keep my license active. I look at my current work as my way to give back a bit to the patients. I barely make any income from it on purpose.

Take good care of your precious FI plans TPP. Sometimes when you have something precious, others may want to take it away from you. The concept of FI is more precious than ounces of gold.

Completely agree. This online community and those in hiding while in public are supportive. Otherwise, it’s a toss up whether you’ll get laughed at or yelled at.

I need to heed that last advice! When I first found out, I wasn’t bashful about sharing it at all. Hence the experience for this post.

I err on the side of stealth wealth simply because it’s hard to tell which category the person your talking too falls in.

I am starting to agree with you there. Except with my trainees. They need to hear it so badly. I share away with them. Just about no one else, though, outside of close friends.

FIRE is such a touchy subject. I find it is easier to talk about it with my online friends. In real life, most don’t want to hear it!

Speaking the truth, brother.

I haven’t shared my semi-FIRE with many, just my closest friends and my Mom. And with my friends I still danced lightly around the money-talk. Money is sooo darn taboo.

“When I get to my FI number, I’ll simply cut out the parts of my job that I don’t love. That should happen between 42 and 45. ”

Exactly my situation. Stopped being a manager and just working 2 hours a week now. It’s awesome. I hope I can keep the situation going but my job still has rules.

Yeah it’s a tough spot. I got excited and want to share it with everyone. Then, realized it probably wasn’t wise unless someone asked that fits these scenarios.

A lot of truth in this article. I was fortunate in that while I was working towards FI, basically the rest of my entire department at work were all on the FIRE train. I’m still not sure if that had more to do with the personality type the job required or the really poor work culture that was driving people to look for a way out.

At any rate, we had lots of excellent conversations and email chains over the years. Iron sharpening iron. But outside of that group, it’s been pretty touch and go with discussing the topic with folks in the real world, even family.

I have some close friends that I can discuss this with. Definitely not everyone I work with, though!

That’s a blessing to have had that

I am much more cautious talking about personal finance with people in real life. There is to much emotion wrapped up in money and it’s very easy to offend people. I pour my energy into my blog and commenting on other like-minded PF blogs. Much more fun that way.

Agreed. It’s complicated in life and it seems that personal finance gets a little too personal in that space.

Online there is room to disagree and be okay with that. It seems like more of that in real life would be a good thing if it could only be cultivated.

I have brought up the topic with all kinds because it is so exciting to me. I try not to emphasize the retire by a young age part of it. I tell people I came across the savings rate chart that tells you how much to save if you want to retire in a certain number of years, emphasizing that we can choose how frugal we want/need to be depending on our situation. For older people it is good news because they can make a lot of progress in the final decade or two of their career even if they feel behind now. So far the conversations have all gone okay, but they are very delicate. At least 3 of my friends have begun investing in retirement accounts after talking with me, so I think it was worth it.

I have shared The Simple Path to Wealth and Early Retirement Extreme books, and several blog posts with friends and family. I am sensitive about any piece that implies people should have started earlier of shouldn’t have indulged in a luxury. It is all about empowering those whom you would like to hang out with more after FI!

That’s a great way to go about it. Focus on the positive aspect and avoid stepping on the potential bombs. Super smart!

Great post. I learnt early on not to talk about FIRE to many of these groups. I just talk about it to my partner and close friends, definitely never talk about it at work.

Often what I hear are things like, live in the moment, live a little, you can’t take it to the grave, ect. I have learnt that it take an extraordinary long conversation to change these peoples views. But when I do find someone truly interested in eh subject it is amazing to see the FIRE in their eyes.

Completely agree.

That FIRE in my residents eyes is what pushes me to keep spreading the word. They are so hungry for this stuff. It’s like giving starving man water for the first time in months. Except, in this case, they never knew water existed.

The thirst for more information once the light is turned in is almost insatiable.

We are quite transparent in our FIRE plans. Therefore, we share our blog with our friends and families. If interested, they can reach out to us, otherwise, we don’t take the initiative for fear of offending people. They already know what we’re thinking from reading our blog 🙂

Very true.

P.s. I am open with my friends about our plans. Maybe someday we will be open about the blog, too!

Not sure I completely agree with you about point number 3.

Older people can often be extremely supportive of someone wanting to go an alternate way. It depends on whether they’re open-minded and like to see others succeed.

Those qualities are clearly not dependent on age. There are some miserable so-and-so’s in their 20’s, and some free spirits in their 90’s.

Suss people out before launching into the FI/RE world.

You know, you may be right. I still think it’s kind of obnoxious to be talking about financial independence at a young age in front of people that probably haven’t achieved it.

But you are certainly right that some crummy and miserable 20 or 30 something’s certainly exist!!

Thanks TTP for the insightful article. I completely agree with the dose of caution you are encouraging. I agree, talking about the subject of money much less FIRE can be very tricky. However, the benefits of continued delayed gratification cannot be overemphasized especially to our younger colleagues and those in training. Keep up the good work and know that there those of us who do love talking about this stuff all the time 😉

Some of us are more inclined than others! It can be challenging to balance this conversation, but it is nice when we run into like minded people who are pursuing financial freedom!

I’m pretty transparent about my financial philosophy and plans with anybody who asks. This includes people at work (colleagues, ancillary staff, and whoever is interested).

I think there is a way to talk about finances in a gentle, compassionate, empathetic, and respectful way that is less likely to offend people. I try to take that approach.

In general, I just try not to sound judgmental or elitist when talking about finances. People’s finances are personal. If the Jones like their lifestyle, then fine. As long as they know the tradeoffs and downsides of living such a lavish lifestyle, they can have the freedom to live however they want. But if they come complaining to me that they live pay check to pay check and can’t afford certain things, and they as me for help… then I’d offer to help. I’ll talk about scaling down and living a little bit more simpler and frugal.

I take a similar approach to the other groups, but it is slightly different depending on the individual you talk to. Bottom line is… you have to know your audience. 🙂

Completely agree, actually, about being tactful and picking the right message for the current audience.

Still, I’ve found that some people simply don’t want to hear about this stuff. They are usually in the periphery of a conversation held with someone else and not the person with whom I’m directly talking to (who is often asking me a question). Tough to balance in a public arena.

Great article. Most residents need to have a rotation to understand #1.

#3 is a big one in all arenas – Private practice, large group, and academic. No employer or cohort is interested in short timers. FI, on the other hand, is something people freely talk about and getting to there to allow for options — especially when talking about balance and burnout — just skip the -RE part if you’re really doing that.

I agree about the short timers. It’s one of the reason I focus heavily on FI and not really at all on the RE.

This is an important topic to consider. You’ve definitely got to be careful in how you broach the subject, and with whom. This could be a good way to lose friends or have really awkward conversations if you’re not careful.

– Brent

http://www.TheScopeofPractice.com

Yep. It can become awkward in a hurry if we don’t know how to have this conversation properly.

These days, everyone knows I have an interest. So, I just let them bring up finances. I usually am not sitting around for very long until someone else brings it up or asks me a question

Great post. I think we have a similar trajectory and plan, actually.

I suspect that the moral imperative for practicing medicine as a hot button shifts with the age group and geography.

I think that it is stronger with the more senior crowd because they experienced medicine differently. I say this because I have watched the nature of practice shifting from self-regulated profession to a more directed commodity-type job over the past 15-20 years. When a doctor was more of a respected, hard to replace, and individually valued member of a self-regulated profession – there was increased power, but also responsibility. Like Spiderman. If doctors get the message that “we make the rules and you follow or you are easily replaced” (I have heard those exact words before) then the perceived moral imperative changes. That was actually part of what triggered me to consider FIRE. If the public decreases the value of doctors contributions, then it is unsurprising that docs may shrink the value of medical practice when weighed against other aspects of their lives and opportunities to contribute also. It is a natural consequence. We can make big contributions to our families and communities outside of medicine that compete for our human capital. I also think that the strength of this hot button increases for doctors working in underserviced areas for the same reasons – they are not seen as commodities and still have more of that linked power and responsibility.

-LD

I agree. There is certainly a generational difference. At least stereotypically. Some older docs don’t see it the same way as our older peers. But it sure does feel like most do.

Either way, times are a changin’

I normally completely avoid the topic. What do you do when they start asking you about it? A close family member asked me this weekend “are you on a five-year plan or something?”. It caught me off guard and just came up randomly in conversation and I skillfully put out the flash fire. But I mentioned it to my wife and she said they aren’t stupid. We spend enough time with them for them to know something isn’t adding up with our income vs. spending.

Max

If someone asks, I answer them truthfully. I’ve always worn my heart on my sleeve.

That said, if people don’t ask, I also don’t bring it up at this point. People at my work know that I love teaching personal finance. so, if they don’t ask… They probably don’t want to talk about it.

Thank-you PP. I just WISH I read this before my “reveal”. I; like you have lightly treaded water with friends that you have described. But now since I gave my ~14 week notice- all has gone to hell. It’s unfortunate- just as you wrote I had very very close friends (one of which is already retired and the partner not yet retired). They CAN NOT believe I would even fathom retiring early from medicine. How dare I put my expensive house up for rent or even consider selling to downsize. Blasphemy! I literally have not spoken to them after a really horrible conversation. It’s so sad. Other conversations have been less devastating but similar. I promote frugality and having priorities strait and most respond by saying I’m judging them and they can’t POSSIBLY do what I have done. Then I get the people who are in complete denial- “fmrwelfrchld you will be right back to work in a matter of months; it’s your identity. What will you do when you are not a doctor?”……. and so on and so on.

So now- I try NOT to focus on my financial plan and how I actually got here but respond by saying “yes, we plan to travel and volunteer”. This is not how I expected it to unravel. I am SO glad I read this article because I can truly relate. At least I can be honest with the FIRE folks online. Thank-you for that.

Yeah, FIRE is a tough message to share. It can be offensive for people who don’t get it.

I was in a meeting with my chair recently, and when I told him my family and I save north of $100,000 per year his eyes got big and he said, “You really do practice what you preach, don’t you?”

This stuff is so foreign to the vast majority of people. Share with caution!