Editor’s Note: If you are wondering what your taxes are going to look like as a single doctor, then this guest article today is for you.

I recently took a deep dive into the finances of four imaginary but realistic physicians in A Tale of 4 Physicians 2021: The Impact of Lifestyle on Financial Independence. All are married and have total household salaries of $340,000. A reader chimed in: “What about us single primary care physicians?”

That’s a good question, reader. Your finances as an unmarried individual filing taxes a single filer while earning significantly less than a specialist or a dual-income household will look a lot different.

Specifically, I was asked to look at a doctor earning less than $200,000 with student loans to tackle. According to a recent Medscape Compensation Survey, even the lowest-earning primary care physicians (pediatrics and preventive medicine are tied for the distinction) earn an average of $232,000.

We’ll look at not one, but four single physicians with salaries well below the mean of $230,000 to $250,000 for most primary care specialties, and we’ll see what it will take for them to reach financial independence as quickly as the higher-earning married doctors previously discussed.

A Tale of 4 Single Primary Care Physicians

For this exercise, each of our single primary care physicians will have a salary of $195,000.

While a salary just shy of $200,000 is nothing to sneeze at, it is on the low side for a doctor and could represent a primary care doc in an academic institution or any physician who is working part-time.

These four physicians are given profit sharing and a potential 401(k) match for total monetary compensation of $210,000 annually, with up to $15,000 of that being pre-tax money placed directly in the 401(k) as an employer contribution.

While their employer does offer a 457(b), it’s a non-governmental plan with no low-cost index fund options, and their employer’s finances were rocked by COVID. Knowing that any “contributions” are actually considered to be deferred compensation until collected years later and potentially subject to creditor risk if the hospital system is unable to meet its financial obligations, these physicians opt not to invest in the plan.

With high-deductible health insurance plans, they can put up to $3,600 into an HSA in 2021, and, not having any tax-deferred IRA money in their names, they can also do the backdoor Roth each year.

That is, of course, if they have enough money left to do so.

After years of delayed gratification, it can be challenging to continue to live like a resident, and these 4 physicians take different approaches to spending.

We meet them early in their careers. They have begun to lay down roots in their respective communities, and have worked long enough for their modest retirement saving to match what began as their not-so-modest student loan debt. Their net worth is approximately nothing.

Start receiving paid survey opportunities in your area of expertise to your email inbox by joining the Curizon community of Physicians and Healthcare Professionals.

Use our link to Join and you’ll also be entered into a drawing for an additional $250 to be awarded to one new registrant referred by Physician on FIRE this month.

Meet the 4 Single Primary Care Physicians

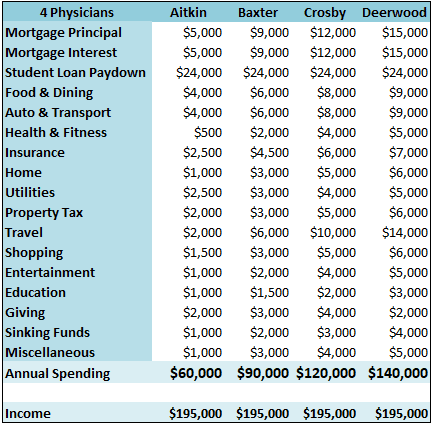

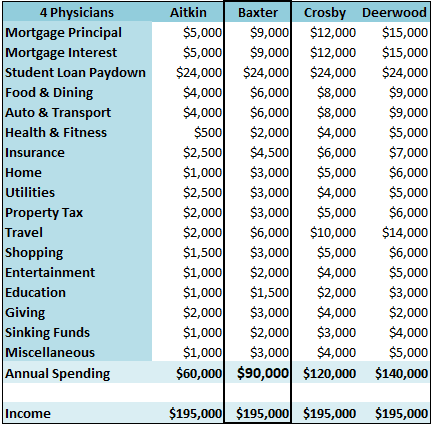

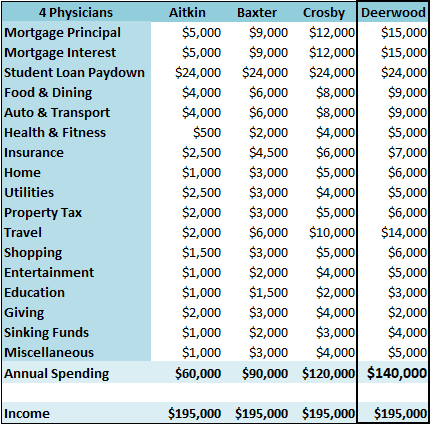

The Budgets of the 4 Physicians

Dr. A

Dr. Aitkin realizes she can’t afford a significant upgrade in her lifestyle after residency, and she chooses to practice in a relatively low cost of living area while driving the same beater that got her to rotations in med school.

With a mortgage payment of a little over $800 a month on a $150,000 home, split evenly between interest and principal, and $2,000 a month in student loan payments, about half of her $60,000 annual budget goes to debt service.

That leaves her with $26,000 to spend over 12 months, or a little over $2,000 per month for everything else. It may not be that easy, but as an individual, she’s actually lived on less for years. If not for the peer pressure of higher-earning and bigger-spending docs all around her, it might not feel like that much of a challenge to manage this budget.

She even finds a way to support her favorite charities with $2,000 a year. When Sarah McLachlan talks and shows her all those sad animals on TV, she can’t just look the other way!

Dr. B

Dr. Baxter doesn’t see the point of sacrificing his twenties to become a physician only to maintain that same ascetic existence as a physician in his thirties.

On the other hand, he realizes that he’ll never have the income of the dermatologists and orthopedic surgeons and lives his life accordingly.

He drives a reliable Honda home to a cozy, low maintenance 2-bedroom townhome in a college town, the life of which revolves around the University and tertiary care center at which he works and teaches.

With a travel budget of $6,000 a year, he takes one domestic trip and one international vacation each year. He also uses his CME fund to travel to more exciting cities for conferences, staying a day or two before or after to score a nearly-free vacation.

Altogether, it adds up to $90,000 or nearly half of his $195,000 salary. How does this bode for Dr. Baxter’s future? We’ll find out soon.

Dr. C

Dr. Crosby wishes her budget could look more like that of Dr. Aitkin or Dr. Baxter, but having grown up in “The Cities” with family throughout the metro area, it made good sense for her to take a job at “The U” and make the city her home for good.

Unlike her friends up north, she wasn’t able to find a suitable home for under $300,000, but she did find a decent condo within walking distance of the metro transit line, parks, and running trails.

Like the others, she’s paying $2,000 a month towards her student loans, but just about everything else costs more. Her $10,000 travel budget gets her to Mexico or the Caribbean twice each winter. She learned in residency that one trip south just wasn’t enough.

The “Giving” portion of her budget includes gifts for family all around town, as well as charitable giving, highlighted by fundraising she does for the Special Olympics before taking the Polar Plunge through a hole cut in the ice.

Add it all up and she sees $120,000 go out the door each year.

Dr. D

Dr. Deerwood thinks it’s cute when Dr. Crosby complains about the cost of living in her city. You see, Dr. D moved to a windier city to experience bigger city life, and for better or worse, he’s paying for it.

He figures he’ll eventually move on to a better paying gig. He might also one day start spending less, but as a single dude, he tries hard to maintain a certain image, an image that requires him to spend a little beyond his means.

In reality, he’s not spending that much more than Dr. C and he’s not even getting as much for his money in most respects. He’s got a studio condominium near the loop and it seems like half of his food and dining budget is spent at happy hours. He has a good time when he has time off, but saving for the future is something he plans to do sometime in the future.

With $140,000 spent annually on a $195,000 salary, he’s living more or less paycheck to paycheck.

The Path to Financial Independence for the 4 Single Primary Care Physicians

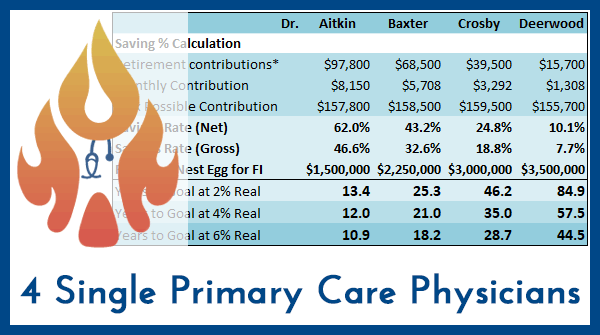

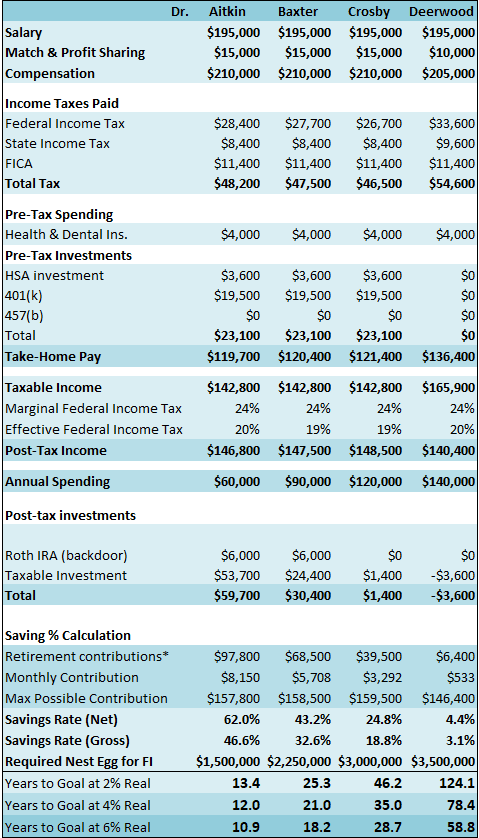

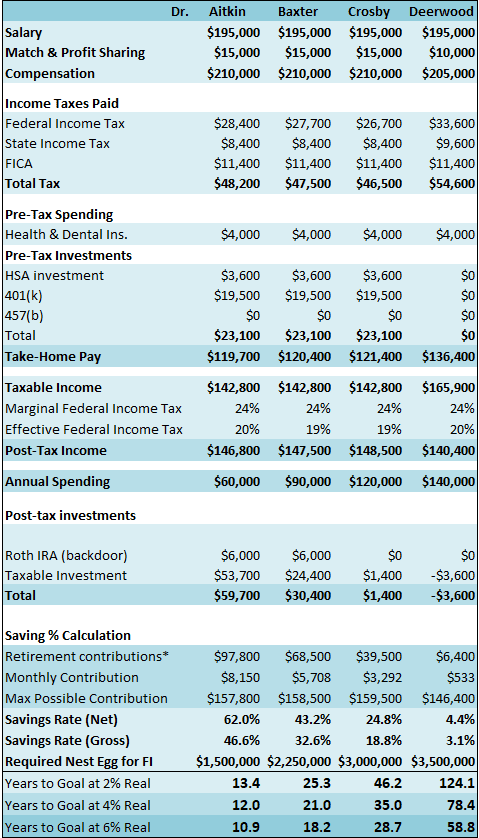

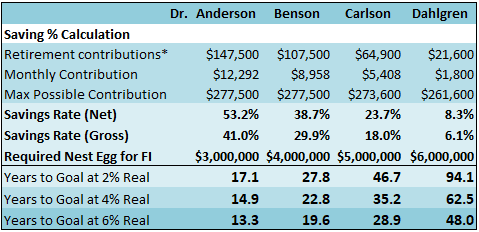

Take a minute or three and study the table above. The financial futures of these doctors is spelled out, assuming they maintain their income and spending rates indefinitely.

Dr. A

With inflation-adjusted returns of 2% to 6%, Dr. Aitkin will reach financial independence in 11 to 13 years. With an annual spend of $60,000, she’ll have 25 years’ worth of spending for a 4% safe withdrawal rate with $1.5 Million.

It’s worth noting that neither Dr. A nor any of her friends will have student loan payments forever. Eventually, those will end with forgiveness or be fully paid off, freeing up $2,000 a month, allowing her to increase her lifestyle significantly. She could also refinance her student loans in the interim to lower her monthly payments and create a little more breathing room.

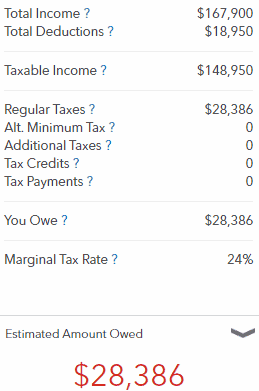

One interesting twist with the single physicians is that they’re able to itemize their deductions. With a standard deduction of $12,400 in 2021, half that of their married counterparts, most of their mortgage interest and charitable giving benefits from a tax deduction.

After deducting $19,500 for her employee 401(k) contributions, $3,600 HSA contributions, $4,000 in pre-tax health insurance premiums, the $10,000 max for combined state income and property taxes, plus mortgage interest and charitable giving, she’s got $148,950 in taxable income.

She pays about $28,400 in federal income taxes, $8,400 in state income tax in a middle-of-the-road income tax state, and $11,400 in FICA (Social Security and Medicare) taxes.

When you add in the $15,000 in 401(k) contributions made on her behalf by her employer, she’s putting $97,800 toward retirement annually, or just over half of her stated salary of $195,000.

When calculating her gross savings rate, the employer contributions are included in both the numerator and denominator, giving her a gross savings rate of 46.6% and a net (after-tax) savings rate of 62%. You can calculate your savings rates in a similar fashion here.

The taxes owed were calculated via TurboTax’s free web app TaxCaster. Would you have believed taxes on a nearly $200,000 salary could be this low? It’s true, and the physicians with bigger mortgages actually pay a bit less, as they have higher itemized deductions thanks to more money spent on mortgage interest.

Dr. B

Dr. Baxter won’t be financially independent in his forties like Dr. Aitkin, but with 18 to 25 years to the $2.25 Million goal, the “Retire Early” part of FIRE is still achievable.

Putting nearly $6,000 a month towards retirement gives Dr. B a 32.6% gross savings rate and a 43.2% net savings rate. If Dr. Baxter could cut expenses to about $80,000 a year, he’d have a savings rate that would meet my live on half challenge that all but guarantees financial independence within two decades.

Dr. C

Dr. Crosby, with $120,000 a year in spending and debt service, is able to max out her 401(k), getting the full match from her employer. She also maxes out an HSA at $3,600 in 2021.

You’ll notice, however, that there’s not enough left over to contribute to a backdoor Roth IRA, and she puts just $1,400 or a little more than $100 per month into a taxable brokerage account.

Altogether, the nearly $3,300 a month in retirement savings give her a savings rate of about 19% gross and 25% net. This comes very close to a common recommendation for physicians to save 20% of gross income towards retirement.

Note that with realistic expectations of 2% to 6% real returns (equal to ~ 4% to 9% nominal returns assuming 2% to 3% inflation) over 3 to 4 decades, it will take 3 to 4 decades to become financially independent.

Again, it should be noted that the student loan payments won’t be with her forever, and if she wisely puts some of that monthly $2,000 towards retirement when her balance is paid off or forgiven, Dr. Crosby can shave at least a few years off of her FI timeline.

Dr. D

Our dear Dr. Deerwood had better like doctoring because, without any changes in his circumstances, true financial independence will be difficult to achieve. He’s looking at a 60 to 124 year path, which is tricky to navigate fully when the path starts in one’s early thirties.

Student loan payments, taxes, and spending take up just all of his $195,000 salary and then some. Sadly, he’s using credit cards the wrong way, racking up a little bit of debt that will snowball into something much larger if he lets this go on much longer.

His taxes are quite a bit higher than those of his counterparts. By not contributing to his 401(k) or HSA, he’s missing out on a tax deduction that would reduce both his state and federal income taxes. This faux pas costs him about $7,000 a year.

By not contributing to a Roth IRA or taxable account, he’s got no after-tax money invested, which means his taxes will be higher in the withdrawal phase if he ever does get to enjoy any kind of retirement.

All hope is not lost, though, for Dr. Deerwood. He can find a way to earn more money. He could also take a cue from Drs. Aitkin, Baxter, or Crosby, and spend less. Or both. No one’s going to tell him what he ought to do, but he should reevaluate his situation and see if there isn’t something he can do to alter the equation in his favor.

With a lifetime of good but not great earnings, he’s still earning enough to hit the maximum Social Security contribution every year for 35+ years. That will give him the highest Social Security benefit possible, a benefit that could support more than a third of his current level of spending. So he’s got that going for him, which is nice.

Comparing 2 Sets of 4 Physicians

As compared to the 4 married households with higher incomes from our previous case studies, these four single primary care physicians have different household finances.

They earn less, but their student loan burdens are the same. They don’t set aside as much for retirement, but as they’re only saving to support one person, their required nest eggs to reach FI are substantially lower.

They’re not saving for their kids’ college in 529 plans, but they’re not benefitting from child tax credits, either.

Interestingly, but not surprisingly, their times to FI don’t vary much. If you compare Dr. A, B, C, or D in one scenario versus the other, they’re on fairly similar tracks.

It all boils down to savings rate. The higher the savings rate, the quicker one is financially independent and has the option to retire early or do whatever he or she wants to do with the rest of his life.

Life Happens

These examples are realistic as a snapshot for four individuals in one particular year. Over the years, some line items in the budget will swell while other shrivel. If the status quo is maintained for the most part, things can average out.

In reality, the status quo is almost never maintained. Some of these single physicians will partner up and perhaps marry. Their spouse may earn more than them, less, or nothing at all. Our married physicians may find themselves divorced someday.

Single or married, some may choose to have children or adopt. Both can be expensive but very worthwhile propositions.

Family members get sick. Physicians become burned out, disillusioned, or disabled. Desires change, and with them, spending habits will be altered, as well.

Still, it’s important to establish a baseline and to project what sort of a financial picture will best help you reach your goals. That’s my goal with these posts. When life happens, make adjustments as necessary with future goals somewhere in the back of your mind.

Being primary care or part-time physician relying on a sole income does present some unique challenges, and the budget will be smaller out of necessity, but financial independence remains a goal one can strive for.

0 Comments