Editor’s Note: I have very strong opinions on insurance after my own personal experience. That’s why today I wanted to share with you this guest post from Physician’s on Fire, because it is one of the few great ones out there on term life insurance advice.

When you’ve got the goal of early financial independence (FI), your finances dictate a different approach to life insurance than that of the average person. This is a good thing.

The only life insurance that makes financial sense for most people is term life insurance, but there are occasional uses for cash value life insurance for a small percentage of individuals, and I’ll touch on those below.

Some people have no need for life insurance of any form, and the needs for the FIRE-minded folks will decrease in a speedier fashion as compared to those who aren’t super-saving for retirement.

With a declining need for coverage, one can ladder multiple policies. Dropping the coverage altogether once FI has been achieved is another consideration for the FIRE crowd.

A FIRE-Minded Approach to Life Insurance

The Purpose of Insurance

Insurance exists to allow people to share in the financial impact of detrimental events. For a relatively small monthly fee, you are protected from financial ruin if something awful happens to you or the things you own.

In reality, your monthly premiums are used to pay for other people’s calamities and the overhead and profit of running an insurance company.

It makes sense to insure anything that it would be difficult to live without or replace without financial assistance. Insurance also helps protect you from damage inflicted not only on things you own, but by things you own, like your truck, slippery sidewalks, or unfriendly canine.

For these reasons, it’s important to insure your income with true own-occupation disability insurance, insure your home against damage, insure your automobiles, and it’s generally wise to add an umbrella policy over the home and auto to protect against costly litigation.

Life insurance is a little bit different. If your life ends and your death certificate is signed, that life can’t be replaced or repaired, no matter how good your doctors are. The financial impact of your unfortunate demise won’t be felt by you, either. You died, remember?

However, the lack of you on this planet will have an impact on those of us that remain among the living. If any of us are financially dependent on a living you, then it makes good sense for there to be an insurance policy on your life.

Who Needs Life insurance?

We’ve established that life insurance is important when others are dependent upon you and the income you provide. If you have a partner and/or offspring to which you provide financial support, insure yourself.

If not, you probably don’t need life insurance. Term life insurance provides a lump sum of money to your beneficiaries if you die. While cousins, nieces, and nephews might be grateful for a consolation prize if you were to die unexpectedly, they were probably not counting on much money from the living version of you, so life insurance would be unnecessary.

Single people with no kids, parents, or anyone else financially dependent upon them do not need life insurance.

Who else has no need for life insurance? The financially independent.

The point of this stuff is to make sure your remaining kin can maintain a comfortable lifestyle in your absence. If you have achieved financial independence — meaning you’ve got enough money to live your desired lifestyle indefinitely without earning another cent — term life insurance is redundant.

The Limited Uses for Cash Value Life Insurance

Whole, universal, and variable life insurance policies and the myriad variations on them are different forms of cash value life insurance. Most of them are expensive to own, lucrative (for the agent) to sell, complex to understand, and inappropriately marketed and sold to people who would be better off keeping insurance and investing separate.

Dr. Jim Dahle, The White Coat Investor has detailed 8 potentially appropriate uses of permanent life insurance, including reducing estate taxes, combining it with a charitable trust, pretending you’re your own bank, providing “key man / woman” insurance for a business, and additional asset protection for very high earners.

He has also written extensively on the many inappropriate uses of cash value life insurance and has debunked the many myths used to sell the products.

Finally, Dr. David Graham, the FI Physician, has shown how cash value life insurance can be used as a buffer asset to help protect again sequence of returns risk.

How to Determine Your Term Life Insurance Needs

Assuming you have people dependent upon your income and you’re among the 95% to 99% of people who will be better off with term life insurance, we need to decide how much coverage you should have.

Most life insurance calculators base your needs upon your salary. Like any retirement calculator that uses similar criteria, this makes sense only for those living paycheck to paycheck or saving a meager amount of it.

What you actually need, whether it’s to retire or to allow your heirs to be financially unburdened, is a sum of money that affords a desired lifestyle. Your salary is only relevant to the extent that your lifestyle is dictated by your salary, but it’s best to uncouple those if you want to achieve true financial freedom.

Financial independence requires something in the range of 25x to 30x your anticipated annual spending in retirement.

For term life insurance to make your remaining family financially independent, the lump sum payment should, when combined with assets already saved for retirement, leave them with 25x to 30x their anticipated annual expenses in your absence.

Basically, life insurance needs = FI number – retirement assets.

As your retirement assets grow, and the gap between your savings and FI number decreases, you need less life insurance.

Laddering Life Insurance Policies

The declining nature of life insurance needs as one’s net worth grows makes a clear case for having laddered policies.

When you layer two, three, or even four policies of different term lengths, you can easily set up coverage that decreases as you age.

$3 Million Initial Coverage Need, 20 Years to FI

For example, if your FI number is $3 Million and you expect to achieve that within 20 years, buy a 20-year policy with $2 Million in coverage and a 10-year policy with $1 Million in coverage.

If you die in the first ten years, your heirs get $3 Million. The benefit drops to $2 Million after 10 years, at which point, if you’re on track, you will have already amassed a million dollars in retirement savings.

Let’s price this out, assuming I’m a 30-year old man in excellent health, which describes me well at the time that I acquired a term life insurance policy of my own. The policies for a woman would cost a bit less since women are statistically less likely to do dumb and dangerous things to put their lives in peril as compared to dim-witted men like me.

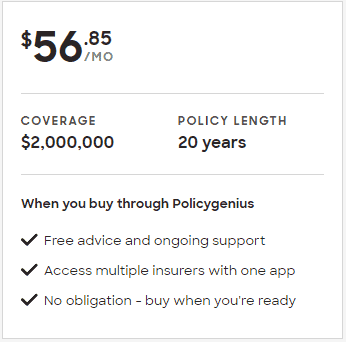

First, we get a 20-year $2 Million policy. 30-year old me can get that for about $57 a month.

Add a 10-year $1 Million policy for another $19 a month.

For this laddered policy, you’ll pay about $76 a month for the first 10 years and $57 a month for the final 10 years. The total paid over two decades, assuming you keep both policies for their entire terms, would be $15,914.40.

Essentially, you’d be betting just shy of $16,000, paid in installments over 20 years, that 30-year old you won’t live to see age 50. If you lose the bet, you’ve kept your life. Win the bet, you’re now dead, but your grieving family will be a multimillionare grieving family. That’s how term life insurance works.

As a comparison, the commission a salesman earns when selling you a cash value life insurance policy can easily exceed $16,000.

What if you didn’t want to bother with laddered policies and went with a single policy with a $3 Million death benefit over the entire 20-years?

In this case, you’d pay $81 a month. That’s $5 a month extra for the first 10 years and $24 extra over the final 10 years. The total in premiums paid would be $19,521.60 or $3,607.20 more than you’d pay with the two laddered policies.

$5 Million Initial Coverage Need, 25 Years to FI

Let’s say you have a bigger FI number and plan to take longer to achieve it. You’d like an initial benefit of $5 Million and plan to accumulate that sum of money 25 years from now.

This may seem like a lofty figure, but keep in mind that inflation will erode purchasing power over time. With 3% inflation, the Rule of 72 tells us that things will cost twice as much in 24 years. $5 Million in 25 years is akin to $2.5 Million today, assuming average inflation.

You could ladder 25, 20, 15, and 10-year policies to achieve your goal, dropping $2 Million, $1 Million, and $1 Million in coverage at the 10, 15, and 20-year marks. You can actually get policies in increments of $100,000 or $250,000 but we’ll use multiples of $1 Million in this example for simplicity.

Your laddered policies might look like this:

- 25-year $1 Million policy

- 20-year $1 Million policy

- 15-year $1 Million policy

- 10-year $2 Million policy

Such a setup gets you $5 Million in coverage for the first 10 years, $3 Million from years 11 to 15, $2 Million from years 16 to 20, and $1 Million in coverage for the final 5 years.

With four different policies, if you are making more rapid progress toward your financial goals, you have the flexibility to stop payment on one or more policies while keeping others in place.

It makes sense to have the shortest term policy be the higher value — as you get older, your investments start making money for you on a grander scale. As they say, the first million is the toughest.

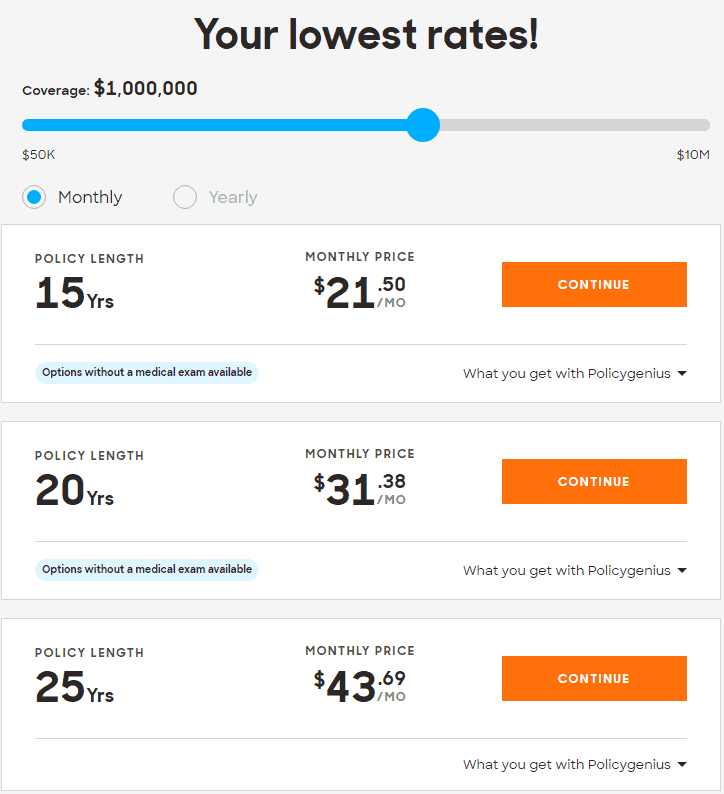

Let’s see what these policies will cost 30-year old me.

We’ll start with the 10-year $2 Million policy, which will run $33 a month.

Add on the three $1 Million policies for 15, 20, and 25 years at $22, $31, and $44 per month apiece.

Over 25 years, you’ll pay a grand total of $28,485, assuming you make it to age 55. If not, your heirs get somewhere between $2 Million and $5 Million, depending on when you kick the bucket.

Your monthly premiums would be as follows:

- $129.71 for the first 10 years with $5 Million in coverage

- $96.57 from years 11 to 15 with $3 Million in coverage

- $75.07 from years 16 to 20 with $2 Million in coverage

- $43.69 for the final five years with $1 Million in coverage

If you’d like a different setup, just alter the policy term(s) and death benefit(s) until you find a setup that makes sense for you and your family.

What would it cost to simply maintain $5 Million in coverage for all 25 years?

You’re looking at about $241 a month for 300 months. The total of this coverage adds up to precisely $72,153. That’s a “premium” of $43,668 in premiums paid over the 25 years as compared to laddering policies.

Laddering pays, especially over longer timeframes.

$3 Million over 10 to 15 Years

The most affordable option, and it’s the one I took, is to achieve financial independence in a short time frame. If you’ve got a 10 to 15 year timeframe with a goal of $3 Million, you can get by with full coverage for $46 to $59 a month.

The 10-year policy will cost you a grand total of $5,492.40. Stretch it out to 15 years and you’ll pay $10,544.40 over those 15 years.

Note that the further away your FI goal is, the more of an impact inflation will have. A shorter time to FI means a lower nominal dollar amount for your goal.

Again, these rates will be a bit cheaper for women, and the rates will also vary based on your health status, smoking history, employment status, and location.

Check the rates offered to you in a minute or two with our trusted partner PolicyGenius. They offer quick quotes and a marketplace to complete the transaction if you so desire.Check Rates @ PolicyGenius

When you’re comfortably FI, feel free to let the policy lapse if you feel it’s truly redundant and unnecessary. You might sleep a little better at night knowing you’re worth more to your dear loved ones alive than if you were dead.

I am way past the need for life insurance, way past FI. But my wife still maintained a term life policy on me that will expire after this year as I’ll age out of term life availability. But because, in the last two years I’ve had a couple of major health risks that could have ended me, but thankfully are in the rear view mirror now, she kept the policy because betting on my dying was a good mathematical bet when you compared the premium costs to the death benefit and the known odds of me dying during surgery or shortly after at the given mortality rate for the procedure. Morbid, sure, but in this case I knew what the percentage odds of death were, usually people don’t know that. If you do and you have existing term life in place then by all means check the odds versus the cost and payout and it might be a great bet to keep in place even if you don’t need the money.