I was listening to the Doctor Money Matters podcast the other day and someone else’s voice came on, the voice of Dr. Cory S. Fawcett, the author of The Doctor’s Guide to Eliminating Debt. He is a retired general surgeon who was sharing his story about how he bought a book (Debt Free and Prosperous Living) for a friend to help him eliminate some debt. But first, he wanted to read it to make sure that it was good enough to lend to a friend.

Little did he know, that book would lead him on a journey to pay off all of his debt in less than six years. This also led him to write a book specific for doctor’s called The Doctor’s Guide to Eliminating Debt. Today, I’ll review Dr. Fawcett’s book and tell you if I think it’s worth the read.

If you’d like to learn more about Dr. Fawcett you can do so by visiting his website.

Basic Outline

The book starts with Dr. Fawcett sharing his journey. He has a story similar to the Allegory of the Cave. He figured out what real life was like, and then he came back to the cave to try and free everyone else. It’s a great story that is full of “you can do it to” encouragement.

He continues with good story telling and examples to discuss the balance of finances (taking care of your past, present, and future self). He then discusses some common causes of debt accumulation including our culture’s numbness to it all. We have normalized debt, and Dr. Fawcett helps us realize that.

The story continues with talking about bad advice and how it’s easy to listen to it. Yet, when you write the numbers down and do the cold hard math; it just doesn’t make sense.

Following this, he naturally tells you to live within your means and to learn to pay down your debt and to stop spending money you don’t have. If you can’t afford it, a bigger house just makes you more house poor. This is similar to Jonathan Clements mantra that people who spend a lot of money are unlikely to be wealthy.

How exactly do we get out from beneath our crushing debt? Dr. Fawcett talks specifics on how to attack your debt. More than that, he spends the rest of the book talking about what to do when the debt is gone. Crossing the finish line is no good if you don’t know what to do when you get there.

Otherwise, you’re like the dog chasing a car who finally catches up with it. Not a good place to be.

What I love about this book

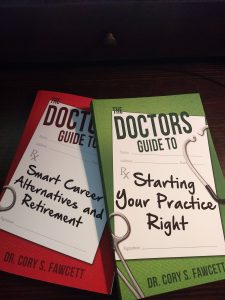

I told Dr. Fawcett that I was reading his book on debt and planning to write a review. He was kind enough to ship me the other two signed with some words of encouragement. He is a stand up guy.

There are two things that I find most important in personal finance: 1) Filling the knowledge gap and 2) showing it can be done. The Doctor’s Guide to Eliminating Debt teaches both of these crucial lessons.

Honestly, my favorite thing about this book is how well it drives home the point that debt is something to be openly and honestly hated. If you don’t loathe, detest, and abhor debt… read this book. It will only be good for you. Seriously.

Just as important, it shows you that paying off your debt can be done. He uses real life examples to show you how the debt can vanish. You just have to make a solid plan, and stick to it.

This book also asked me a really important question that I’ll probably spend an entire post answering: What are you retiring to? When you cross the finish line of retirement, what are you going to do next? These are such important questions that not enough people think about prior to retiring.

Don’t be the dog chasing the tire that finally gets caught up in it when he catches it. The game isn’t about just getting to financial independence, its about what you do when you get there.

Oh, and the book is a really short read. I am a really slow reader and it only took me a few hours to read.

Should you buy this book?

If you have read Dave Ramsey and his philosophy on snowballing debt, then you may not find an all together new method of paying off debt. At the end of the day, just make a plan and stick to it. Your debt will “get gone.” But that’s not why you should buy this book….

The reason to buy this book is to provide perspective. Perspective that medical students, residents, and young medical professionals desperately need.

I find that these sort of perspective books (another great one in this avenue is How to Think About Money…you can read the review of that one here) are really important to your success.

After all, you cannot fix a problem if you don’t realize how big the problem is first. It’s just like an iceberg.

I also like Dr. Fawcett’s simple and easy going way of talking about a tough (and sometimes dry) topic.

You should buy this book, if you…

…like an easy read that hammers home some important points.

…don’t loathe, detest, and abhor debt.

…feel the need to keep up with the “Dr. Joneses” by buying the car, the house, and put the kids in private school

…don’t understand why paying down debt is so important to getting to your goals faster

This is a series of books. Being the person that I am, I read the second book first. The other two books in the series are The Doctor’s Guide to Starting Your Practice Right and The Doctor’s Guide to Smart Career Alternatives and Retirement. I’ll be reading book one next with another book review to come.

Take Home

Go buy the book. Its an easy and enjoyable read that will provide the right perspective towards debt.

I’d love to hear others’ thoughts on this book if you have read it. What was your favorite part? Anything you disagreed with? What is your perspective on debt? Leave a comment below.

TPP

I love Cory’s books. I’m in the middle of reading one right now!

Me too. I am reading his first book in the series now

Great books. Just finished ‘Starting Your Practice Right’. It’s a nice roadmap for residents and early attendings. He gives good advice and points out all the common pitfalls on the way to wealth and financial independence.

Yeah, I’ve really been enjoying it so far.

Thanks ThePhysicianPhilosopher for your kind words about my book. I hope it will change a lot of lives for the better. I’m looking forward to what you have to say about my other books. I love your analogy about the dog catching the car. That is a great word picture for the unhealthy pursuit of ‘things.’ What will you do when you get them?

Keep up the good work,

Dr. Cory S. Fawcett

Prescription for Financial Success

Thanks for stopping by! I will make sure to recommend it to my residents as well.

I’ll try to stop as many as I can from chasing cars, too!

TPP