Have you ever wondered, “How do I make my first Backdoor Roth IRA?” Look no further if you need a step by step tutorial with pictures for your first Backdoor Roth IRA contributions, this post is here to help. We will run through how it works at Vanguard, though it is likely similar at other investment companies as well.

After following some other tutorials on performing a Backdoor Roth IRA, I unfortunately ran into several snags. It was my very first time and most of the tutorials that I found were for people who already had a Roth IRA set up.

It was not straightforward at all, but performing a backdoor Roth IRA conversion is vital to building wealth for high-income earners.

What is a Backdoor Roth IRA?

Before we get to the step by step process, let’s make sure that we don’t leave anyone behind. A “Roth” investment is a post-tax investment that grows tax-free and will never be taxed again. It is the last money many people touch in retirement, and it is the best money to leave to heirs as a Stretch Roth IRA.

However, if your income is too high (more on that below), you cannot place money directly into a Roth IRA. So, you must first contribute the money to a Traditional IRA -which can be done regardless of your income – and then convert it to a Roth IRA. Since conversions have no income limit, there is no problem with this move.

This loop hole (contributing to a Traditional and converting to a Roth) is called the Backdoor Roth IRA.

When Should I Contribute to a Backdoor Roth IRA?

The answer is pretty simple. After you have maxed out all of your pre-tax retirement space, a Backdoor Roth IRA should be your next step!

Today, we will discuss exactly how to set up your first Backdoor Roth IRA at Vanguard. If it’s your first time performing a Backdoor Roth IRA, you may want more information after reading through this post on how to perform $24,000 in one year (if married) or $12,000 (if single). If that’s you, read my post on contributing more than $6,000 per person in your first year.

Necessary Items to Note Prior to Starting Tutorial

The contribution limits to an IRA increased for 2019 is $6,000 annually for a single person, which means it is $12,000 for a married couple. You can still contribute $6,000 for a spouse who does not earn an income.

For starters, check to see if you make too much to contribute straight into a Roth IRA. This is directly from the IRS for the 2019 tax year:

| If your filing status is… | And your modified AGI is… | Then you can contribute… |

| married filing jointly or qualifying widow(er) |

< $193,000 |

up to the limit |

|

> $193,000 but < $203,000 |

a reduced amount | |

|

> $203,000 |

zero | |

| married filing separately and you lived with your spouse at any time during the year |

< $10,000 |

a reduced amount |

|

> $10,000 |

zero | |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year |

< $122,000 |

up to the limit |

|

> $122,000 but < $137,000 |

a reduced amount | |

|

> $137,000 |

zero |

A few other things:

First, you do have to pay tax on any money you make while your money sits in the traditional IRA account when you convert it to the Roth IRA. Unfortunately, I was paid a dividend from the settlement fund because it took me too long to figure it out. Hopefully, this tutorial will prevent this for you.

Second, do NOT elect to withhold taxes when you make your conversions. Vanguard defaults to this, but some other websites do not and suggest you withhold 10%. Don’t do it.

Finally, wherever it is an option you should likely choose to reinvest the dividends earned from the account.

Step by Step Tutorial for First Backdoor Roth IRA

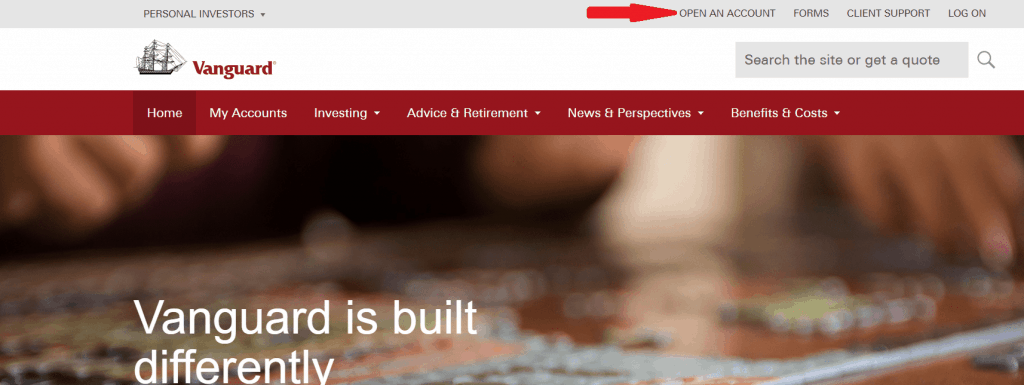

Step 1. Navigate to Vanguard Website

The first step is the most intuitive. Head on over to the Vanguard personal investor website.

Step 2A. Open an Account

Locate the “Open Account” at the top of the screen (Red Arrow).

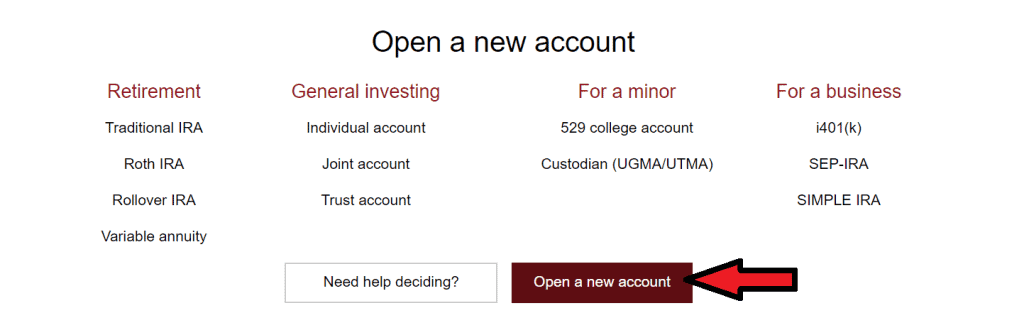

Step 2B. Click “Open a New Account” for a Traditional IRA

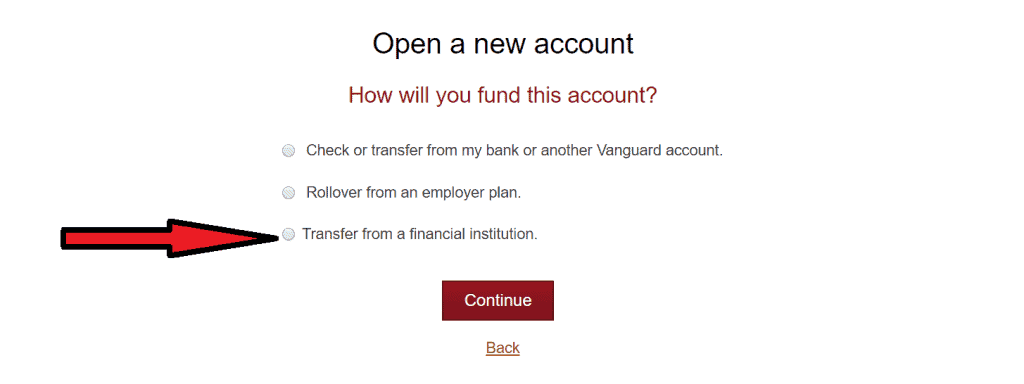

Step 2C. Choose Funding Source for Backdoor Roth IRA

Most people will choose to wire money from their bank (Red/Black Arrow show in image below). However, if you are doing something different, then select the appropriate option for you.

Step 3. Fund your Vanguard account

Step 3. Fund your Vanguard account

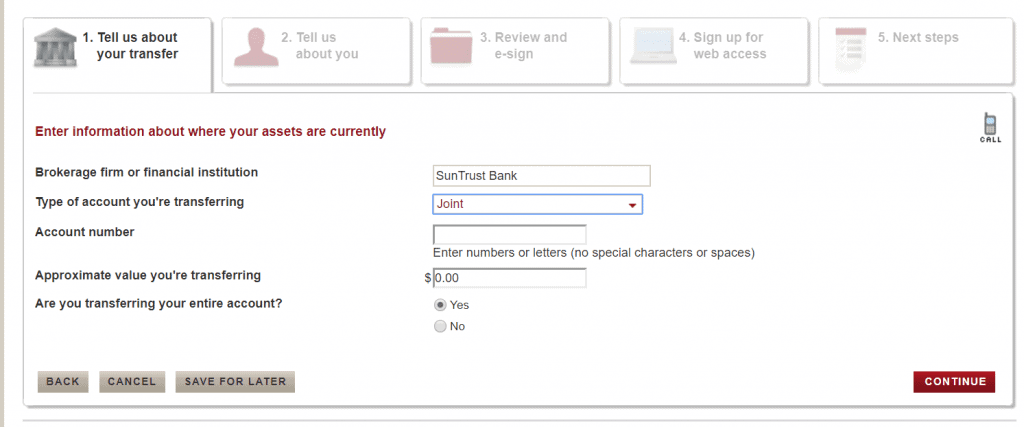

The next few step towards your Backdoor Roth IRA is very intuitive. You can either 1) send vanguard a check or 2) give them your financial information.

Fill out the remaining appropriate information. When you type in (and select) your bank. Then select “individual” and it will look like the image below. Fill out this screen and the next four screens thereafter. Again, this part is intuitive. It also involves personal information, which is why you won’t see a screen shot from me!

Step 4. Review and Sign & Wire the Money

Use your banking account and routing numbers from a check to wire money to Vanguard. You will have selected a traditional IRA during the process. Go over everything one last time (Review) and then sign the documents.

Step 5. Register for an account

Make a username and password, etc. This gives you web access to your Vanguard account.

For me, this is where the Backdoor Roth IRA process started to get confusing.

Your money gets transferred to a “settlement fund” inside of your traditional IRA. The settlement fund is in the Vanguard Federal Money Market Fund.

This settlement fund will hold your money (i.e. prevent you from using it) that you wired from your bank account for up to 7 days. You cannot do anything with your money until it clears. You simply have to wait. Sorry. If you try before it has cleared it will tell you that you have “no available shares.”

This settlement account is a Brokerage account. This is a controversial topic on the Bogleheads forums. Some say that it may be a good thing because it simplifies the amount of tax paperwork you receive. Others say it has made the process unnecessarily complicated. As far as I am concerned, it is what it is.

Important Note: At this point, you have NOT opened a Roth IRA account into which you can convert your traditional IRA funds through the backdoor.

Step 6. How Long Should I Wait to Convert a Backdoor Roth IRA?

Any post on the backdoor roth IRA would not be complete without mentioning the Step Transaction Doctrine. Some people feel that you should wait some amount of time before you convert your traditional IRA money to Roth IRA money. Why? Because you need to show that your original intent was not to contribute to a Roth IRA since high-income earners are forbidden from doing this.

Personally, I think this is nonsense. I convert from the traditional to the Roth IRA account as quickly as it will let me. There is a ton of precedence here. In addition, recent law basically highlights how backdoor roth IRA’s are okay in the government’s eyes.

Why Should I Ignore the Step Transaction Doctrine?

First, no matter how long you wait the Step Transaction Doctrine says that multiple steps taken in a financial decision can be viewed as a single step. Therefore, if you don’t qualify via the rules above, then you shouldn’t qualify even via a Backdoor method regardless of how long you wait.

Second, Backdoor Roth IRA’s have been occurring since the rules changed around 2011. It is widely publicized and no one has ever mentioned or publicized being audited or fined by the IRS for completing this widely known mechanism for funding a Roth IRA.

Finally, If you are deciding to do a backdoor Roth conversion this year, you are likely going to do it next year. And the next year. And so on. So, how can you justify that you “didn’t plan” to perform the Roth conversion in the first place when you have done it for multiple consecutive years. Clearly, this has become a pattern for you. Again, even if it was for one year, the step transaction does not protect you.

With all of that said, I would wait as little time as possible, because you want to avoid your traditional IRA from making money (which apparently includes dividends… don’t ask me how I know).

If you make more than $1, your 8606 tax form becomes less clean, but it isn’t the end of the world.

Step 7. Open a Roth IRA for your Backdoor Roth IRA Conversion

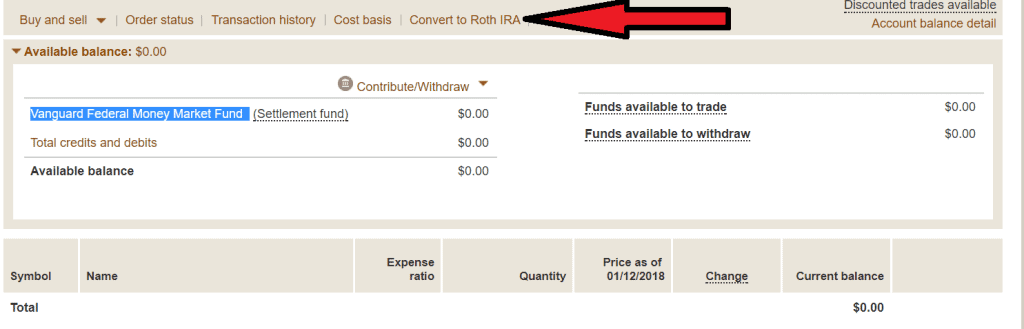

This is the key part that is not intuitive on Vanguard.

If you click the “convert to Roth” button (red/black arrow shown below) and have not opened a Roth IRA account at Vanguard it will tell you that you have “no account” available to make this transaction. It doesn’t tell you why. It just tells you that you can’t convert to Roth because you have no available account.

[Note my traditional IRA shows zero funds because I have already performed the conversion at this point]

In order to avoid this very annoying screen, you need to do the following:

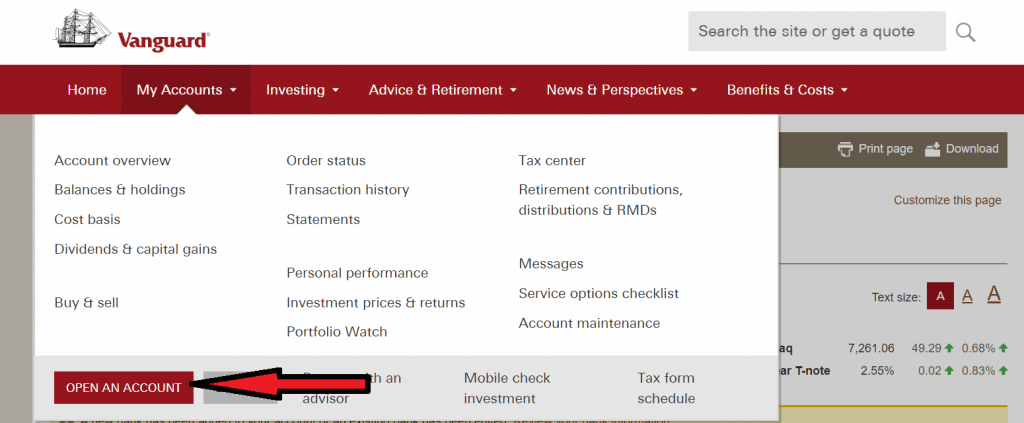

- Click “Open an Account” under “My Accounts” as shown in the image below (red/black arrow)

- You will go through a similar process (select that you are already registered at Vanguard) that you went through above to set up another account, except it will be a Roth IRA this time and will be a lot faster this time because Vanguard already has most of your information.

- The key to this step is to NOT fund the Roth IRA. Make the selection to “add money later.” In other words, open a Roth IRA account with Zero dollars in it.

Step 8. Now convert to Backdoor Roth IRA

This is the part where you actually answer the question, “How do I make my first backdoor roth IRA?” Unfortunately, you have to do all of the steps listed before in order to do this.

After you have both a traditional IRA account (with hopefully $6,000 in it), you can now convert to your open (but not yet funded) Backdoor Roth IRA account. This will transfer the money into an identical Vanguard Federal Money Market Settlement Fund. In other words from your traditional IRA Settlement Fund to your Roth IRA Settlement Fund.

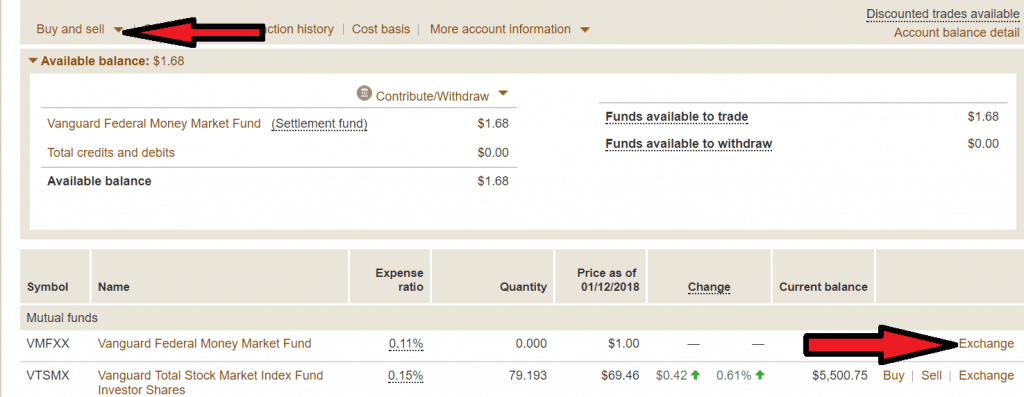

Step 9. Exchange the funds to a Mutual Fund

Now, you can finally select the “Exchange” function and choose the fund of your heart’s desire once it is in the Roth IRA account settlement fund. This can be done through either of the red/black arrow functions (Buy/Sell or Exchange). They both accomplish the same exchange function. Once you have selected this the next screen is intuitive. Transfer “all shares” to your chosen fund. In my case, I chose the Total Stock Market Index (and later changed it to a REIT index fund)

[Unfortunately I made $1.68 on dividends because it took me 10 days to figure out this process because of its non-straightforward process. This is why I set about writing this lengthy post].

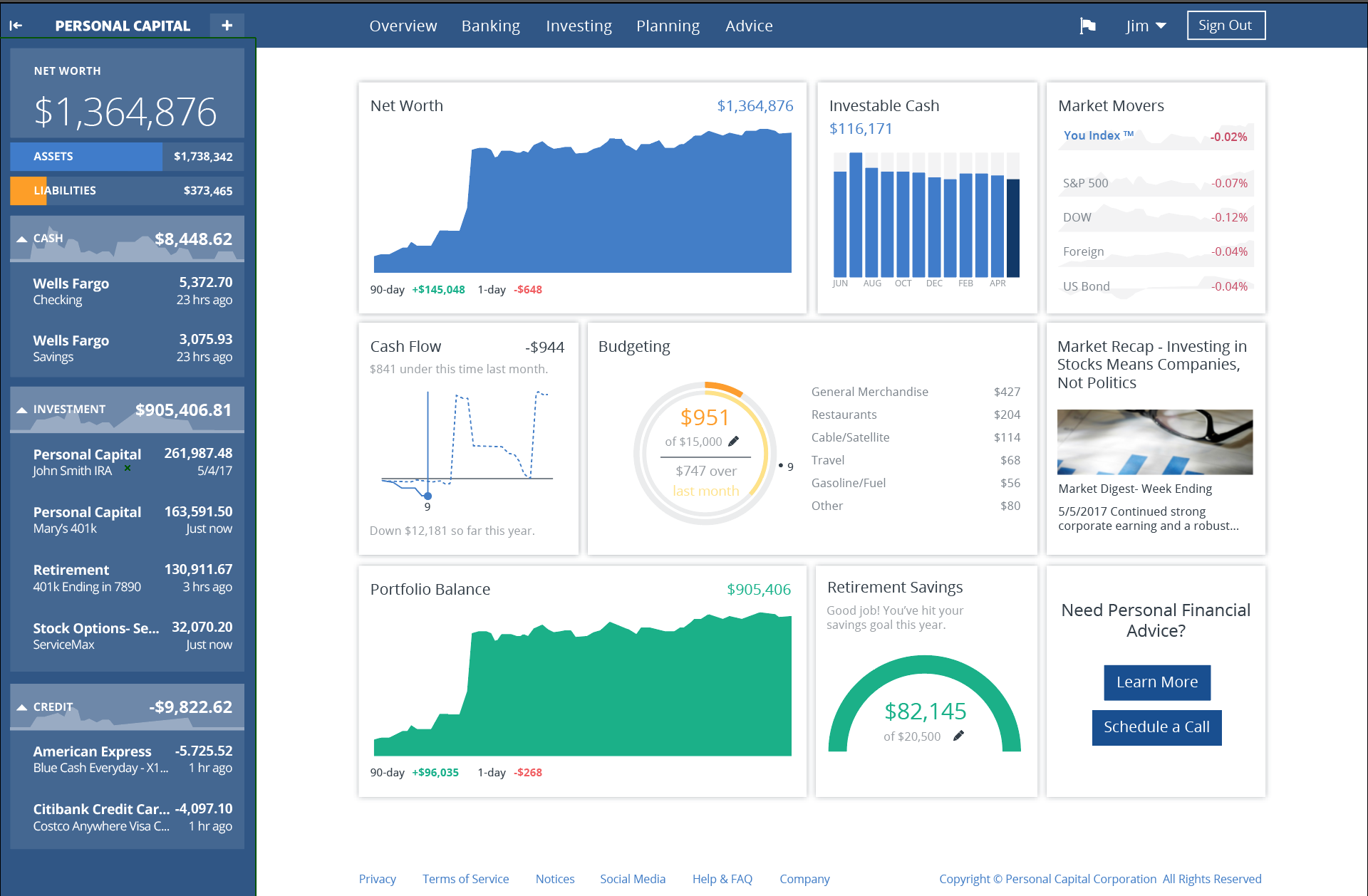

Step 10. Download a Net Worth Tracking Program

I think that following your networth is really helpful. It provides encouragement for you to stick to the plan. The one that I use and like the best is Personal Capital.

You can add all of your assets (retirement accounts including backdoor Roth, 401K/403B, cash/savings, etc) as well as any debts you may have (like your mortgage or car loans….oops).

Either way, find a program that works for you. I think it really does help.

(Optional) Step 11. Rinse and Repeat if Married

If you are married, now repeat this process for your spousal Roth IRA conversion.

Take Home: First Backdoor Roth IRA

I hope that this Backdoor Roth IRA guide was helpful!

I had a hard time figuring this out on my own and ended up making money prior to my conversion because it took too long. Don’t forget to report your contributions on tax form 8606 (tax form in April for tax year for contributions) and your conversions on your 8606 (in actual calendar year conversion was performed)! Any accidental gains are reported on your 1040 for the appropriate tax year.

Feel free to check out my other post, which covers how first time backdoor Roth’ers can contribute and convert $12,000 per tax person ($24,000 for a married couple) in one calendar year.

Hopefully, you could now give your own Backdoor Roth IRA tutorial.