Dr. Dahle over at The White Coat Investor was kind enough to send me a copy of his new book, The White Coat Investor’s Financial Boot Camp. Today, I’m going to spend some time reviewing the book. By the end, you’ll have a good idea of what I really liked about the book as well as who should buy the book (and who might be okay skipping it).

Disclosure: I am a part of the White Coat Investor Network. While I do not make money if you buy Jim’s book, you should know that he is a part-owner of The Physician Philosopher.

The Origin and Purpose

In 2017, Jim started an email series that he called the Financial Bootcamp series. The purpose of the email series was to get people caught up to speed through a weekly email over a 12 week period. This was the source and origin for this book by the same name.

It seems that the thought process behind the “financial boot camp” stems from the military where those who enlist must undergo a short, but rigorous military training. The purpose of their boot camp was to give them the necessary tools to be successful. The book serves the same purpose.

Given the purpose of the book, you might be able to appropriately anticipate that this book is not meant to be an all-inclusive book that covers everything. The purpose is to catch others up to speed who may not have been exposed to the problems addressed in this book like estate planning, disability insurance, and making a plan for your housing.

It is important to note that the book covers the topics discussed in the email series above in much greater detail. So, while the email series serves as the bones of the book, there is a lot more to it than that.

What is Covered in The White Coat Investor’s Financial Boot Camp Book?

There are 12 chapters in the book. They are wide ranging in their content. Interestingly, Jim doesn’t start with what you want to hear first. He starts with what you need.

Given my straight-laced view on advice, I found this appealing. After his introductory chapters on insurance, he then dives into some of the more captivating topics in personal finance.

Here is the full chapter list:

- Disability Insurance

- Life Insurance

- Spending Plan

- Student Loan Plan

- Boosting Income

- Housing Plan

- Retirement Accounts

- Investing

- Correcting Mistakes

- Saving for College

- Estate Plan

- Asset Protection

As you can tell from the title selection, the topics are wide ranging.

That said, my favorite thing about any book like this – as long as I can say this – is that it is brief and to the point. You won’t have to spend hours upon hours reading this book.

Brevity is the soul of wit, after all.

My Favorite Aspects of The Book

The White Coat Investor’s Financial Boot Camp book also offers a few unique features that I found particularly interesting or helpful.

Here are some examples.

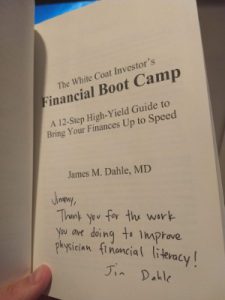

I even got an autographed version of the book!

Jim did an excellent job of including stories that help prove the points the discusses in the book. Unlike most authors, though, he didn’t use his own stories. Instead, he reached out to his community of readers who help contribute meaningful stories about the topics he discusses. This is really interesting, and helps provide some credence to what he is saying.

Another interesting feature about the book can be found at the beginning and the end of each chapter. At the beginning you’ll find a box filled with questions that help you determine if it is not necessary for you to read that chapter. This helps readers focus on the chapters that matter most to their specific needs.

At the end of each chapter, you can find the “missions” that are pertinent to that chapter. For example, after reading the disability insurance chapter, you’ll have a keen idea of what to do next, and the important questions to ask. It is all included in your “missions” that you need to accomplish after each chapter. And, at the back of the book, he ties them all in for a master checklist of missions.

My Favorite Chapters of the Book

I was a bit surprised about which chapters ended up being my favorites in Dr. Dahle’s book. Here are the top three, in order from #3 to #1.

Number 3 on my favorite chapter list is the chapter on investing. This is Jim’s wheelhouse (though, admittedly, he has many “wheel houses”). He does an excellent job breaking down confusing topics into bite sized pieces. This includes a brief experiment on how much you need to save to get to $3 million based on a $250,000 annual salary based on average returns. This discussion is helpful and enlightening.

Number 2 is the chapter on correcting financial mistakes. Yes, you read that right. There is a chapter in this book on what to do if you have done something that the rest of the book doesn’t recommend. I think it is useful not only in the “how to deal” with past mistakes, but also because the fact that the chapter exists means that many doctors make mistakes and can still turn it around! That’s good news for many of us.

My number 1 favorite chapter will likely surprise everyone. It is the chapter on saving for college. I think Jim’s perspective on the “four pillars” of saving for college is both refreshing and practical. It discusses both the philosophy and the steps behind saving for college. I’d buy the book for this chapter alone, if you have kids and are thinking about helping in any meaningful way towards their college education.

Who Should Buy This Book?

This book is obviously targeting people who are starting their journey towards financial literacy. So, if you are well-versed in the personal finance world, then this book might not be for you. That said, being a physician finance blogger, I know a lot about this stuff and still learned a good amount from this book.

If you fit into any of the following categories, I highly recommend this book for you:

- Physicians-in-training (medical students, residents, and fellows)

- Early career medical professionals (physicians, PA’s, CRNA’s, dentists, NP’s, etc)

- Those who start reading personal finance blogs, and feel like they don’t have it together

- Anyone wanting to make sure that they haven’t missed a crucial step at the beginning of their career

Take Home

The unique perspective (with “skip this” intro questions and missions to end each chapter) and reader input makes the book a great read. It’ll be a solid book to get you caught up, if you feel left behind at the beginning of your career.

Click here to purchase the Financial Boot Camp Book on Amazon

Have you read the book? What are your thoughts? What did you like/dislike about the book? Leave your comment/review below!

I look forward to reading the book. I will buy it through an affiliate link if you have one so that you can generate some revenue for your mission. I like your donation policy. I signed up for the beta version of your subscriber list. One comment is that the book is also useful for current advisers so they can have a checklist for their clients and a reference to give them. I am looking forward to the debt destroyer email course. Your book summary on this topic was perfect!

Thanks! Let me know what you think of the email course. I always love hearing good feedback.

If you click on the link at the bottom to purchase the White Coat Investor book, that is an Amazon Associates affiliate link (I’ll get some very small percentage of it).

Either way, thanks for buying my book, too!

Jimmy / TPP