Teaching doctors how to live life on their terms through money and mindset

with Best-Selling Author and Podcaster –

Jimmy Turner, MD

Teaching doctors how to live life on their terms.

with Jimmy Turner, MD

Are you living the dream? Or do you feel stuck or trapped in medicine?

As physicians, we sacrifice ourselves for the greater good. But at some point, we realize that when we say “Yes” to the committees, book-chapters, meetings, late nights, and leadership tasks, we’re saying “No” to our families and work-life balance. It doesn’t have to be this way.

Get Your Time Back

Overwhelmed by your personal and professional responsibilities? My free guide ‘5 Steps to Get Your Time Back: A Doctor’s Guide to Defeating Overwhelm ‘ can help.

Start a Side-Gig

Have you thought about creating a non-clinical income side-gig? My free guide ‘The ultimate guide to online physician income’ will help you expand your income options.

AS SEEN IN

I’m Jimmy Turner, MD.

A practicing anesthesiologist, physician entrepreneur, and coach for doctors.

As a physician, husband, father, and entrepreneur, I know what it’s like to feel like there is never time to take a deep breath and end up on the road to burnout.

I felt undervalued, unappreciated, and trapped. I was stuck in medicine.

But rather than step back and find balance in my personal and professional life, I carried on, sure that my ‘next’ accomplishment would get me off the road to burnout and make me happy.

I couldn’t have been more wrong.

Through coaching, I regained power and control over my thoughts. Then, I created the financial freedom I needed to find fulfillment and balance in my life. I even rediscovered a love for medicine. Now I help other doctors do the same.

Get the help you need

Whether you are looking for financial education or coaching,

we’ve got you covered:

The comprehensive financial platform doctors can trust.

Determined Physician Coaching will help you achieve real fulfillment

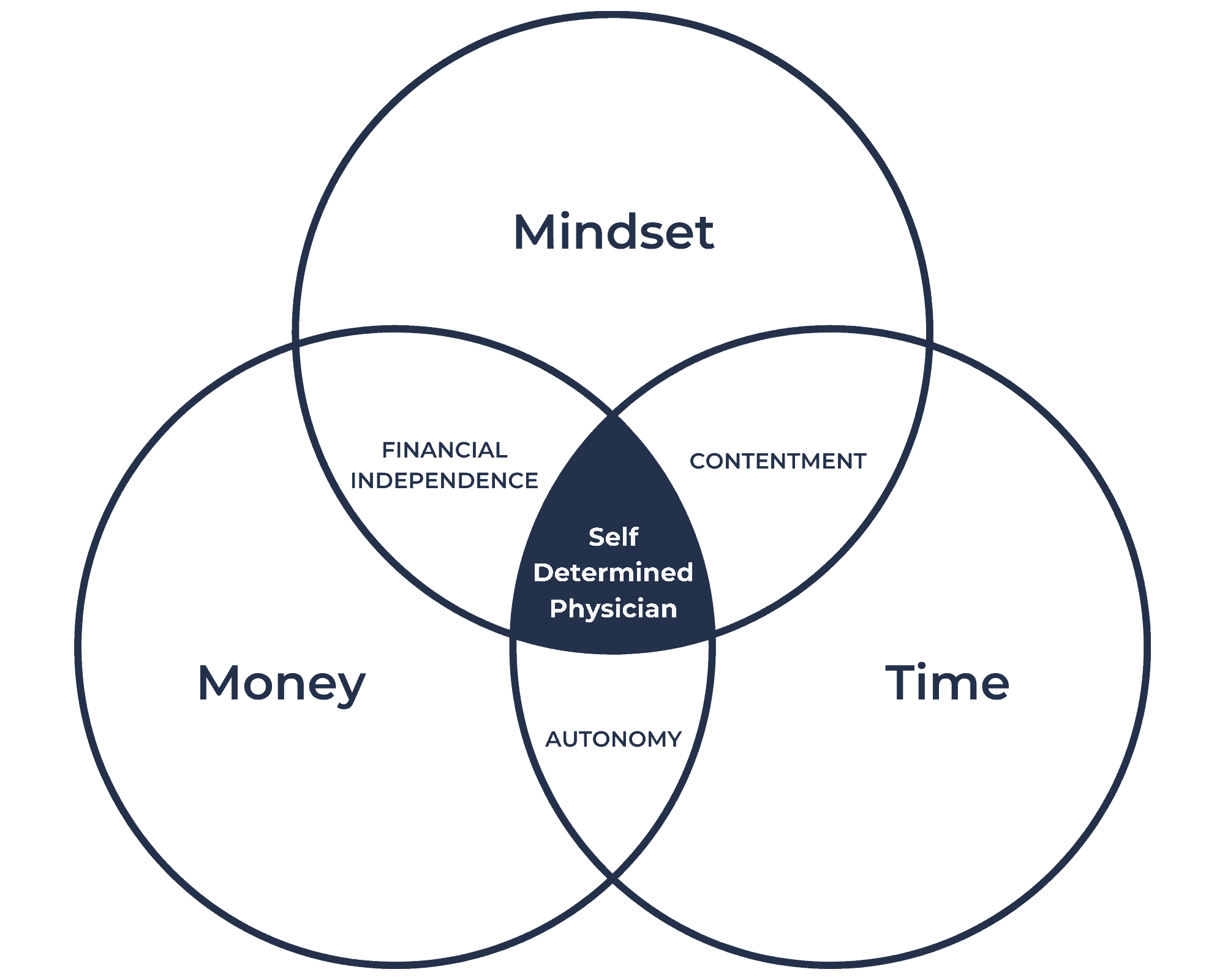

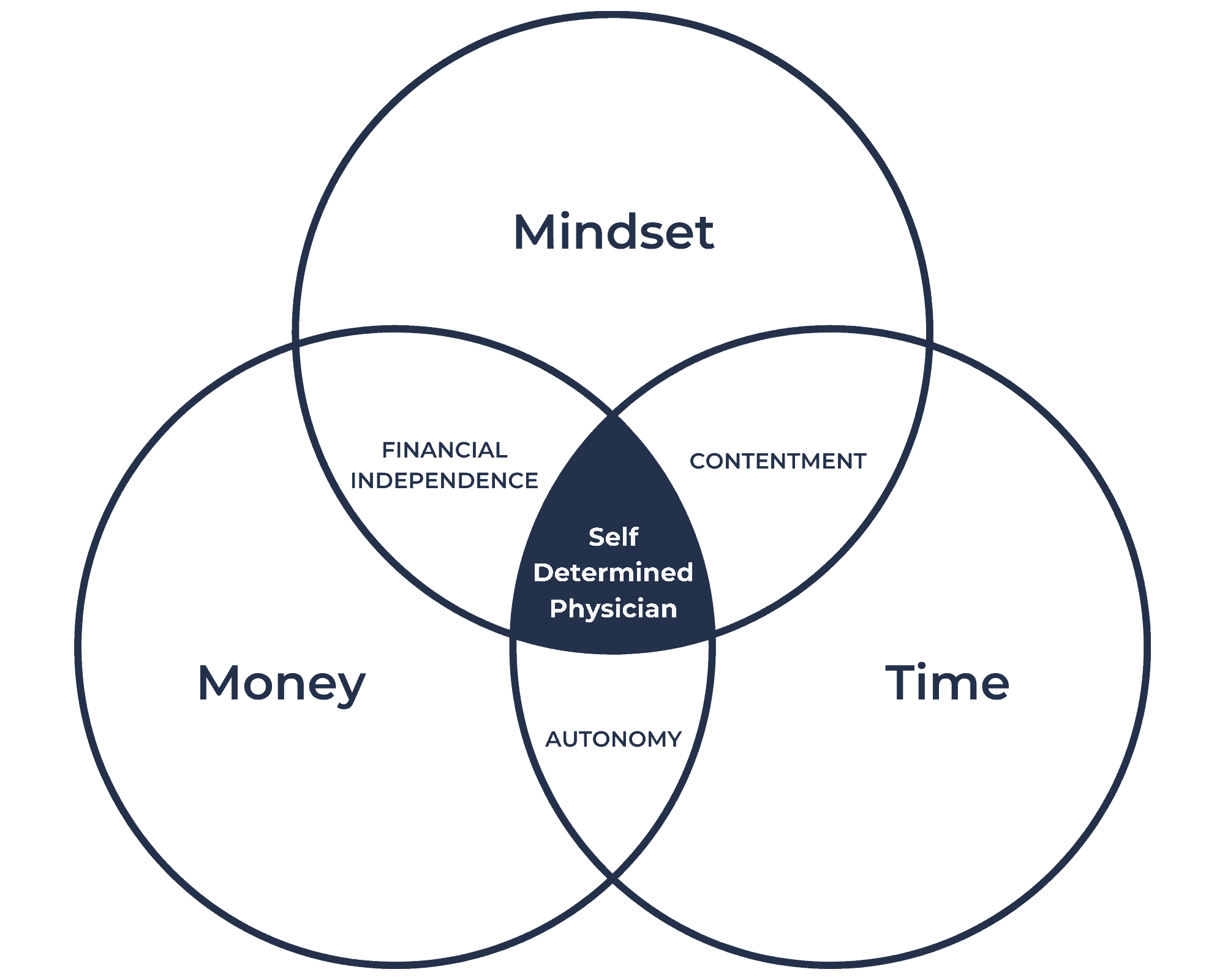

Fulfilment isn’t a pipe dream. It’s a state of being that we help physicians (just like you) achieve every day.

A Fulfilled Physician lives life on their terms and wakes up every day living the dream and enjoying the journey.

They practice medicine as much or as little as they want. Their journey is powered by financial freedom through non-clinical income and a healthy savings rate. When they do practice medicine, they do it with contentment in their heart and control over their thoughts. They live a life of abundance and growth where Imposter Syndrome and Burnout have been defeated.

What people say

“I am so glad I that I took the leap because it has been a truly transformational experience!”

Dr. Michael Runyon, MD

Emergency Medicine

Family Medicine

“Jimmy could charge 3 to 4 times the amount and it would still be worth it. This will undoubtedly buy extra years in my career.”

Pediatrics

Podcasts

An uncurated and unapologetic look into physician life.

The personal finance topics you wish you’d learned in medical school.

Recommended tools

Only the best of the best make the list of recommendations specific to a Physician’s needs.

Do you need disability insurance? (The answer is "yes")

I only recommend a small number of insurance agents – the ones that, as a physician, you can actually trust.

Do you want the 9-step process to creating financial freedom?

Make sure to check out Medical Degree Financial University!

Latest podcasts & articles

Check out my latest physician-focused coaching podcasts and articles – made with you in mind.

TPP 37: How To Start Before You’re Ready (Getting “Unstuck”)

The Physician Philosopher PodcastTPP 37: How to Start Before You’re Ready (Getting “Unstuck”) There are various decisions to make in life and it can be hard to get started. I have people reaching out to me all the time regarding these big decisions. It may be buying a...

MMM 78: These 5 People Determine A Physician’s Financial Success

You might think that the only person that influences your financial success in the short term and the long term is you. The truth is you can have little to do with how successful you are in planning out your finances and investing. This is because there are certain people in your life that influence what decisions you make and how. These people ultimately determine your success.

The 5 Most Important Money Lessons I Give My Residents

How to avoid costly financial mistakes and ultimately go through life with less weight on your shoulders after residency. Here is some of the best advice I can give any resident.

How I Lost 10 Pounds in 24 Days (and What That Has To Do With Personal Finance)

In an effort to avoid the “Dad bod,” I decided to lose some weight. Read how the Physician on Fire lost 10 pounds in 24 days and what that has to do with personal finance.

Are you ready to live a life you love?

© 2023 The Physician Philosopher™ | Website by The Good Alliance