Teaching doctors how to live life on their terms through money and mindset

with Best-Selling Author and Podcaster –

Jimmy Turner, MD

Teaching doctors how to live life on their terms.

with Jimmy Turner, MD

Are you living the dream? Or do you feel stuck or trapped in medicine?

As physicians, we sacrifice ourselves for the greater good. But at some point, we realize that when we say “Yes” to the committees, book-chapters, meetings, late nights, and leadership tasks, we’re saying “No” to our families and work-life balance. It doesn’t have to be this way.

Get Your Time Back

Overwhelmed by your personal and professional responsibilities? My free guide ‘5 Steps to Get Your Time Back: A Doctor’s Guide to Defeating Overwhelm ‘ can help.

Start a Side-Gig

Have you thought about creating a non-clinical income side-gig? My free guide ‘The ultimate guide to online physician income’ will help you expand your income options.

AS SEEN IN

I’m Jimmy Turner, MD.

A practicing anesthesiologist, physician entrepreneur, and coach for doctors.

As a physician, husband, father, and entrepreneur, I know what it’s like to feel like there is never time to take a deep breath and end up on the road to burnout.

I felt undervalued, unappreciated, and trapped. I was stuck in medicine.

But rather than step back and find balance in my personal and professional life, I carried on, sure that my ‘next’ accomplishment would get me off the road to burnout and make me happy.

I couldn’t have been more wrong.

Through coaching, I regained power and control over my thoughts. Then, I created the financial freedom I needed to find fulfillment and balance in my life. I even rediscovered a love for medicine. Now I help other doctors do the same.

Get the help you need

Whether you are looking for financial education or coaching,

we’ve got you covered:

The comprehensive financial platform doctors can trust.

Determined Physician Coaching will help you achieve real fulfillment

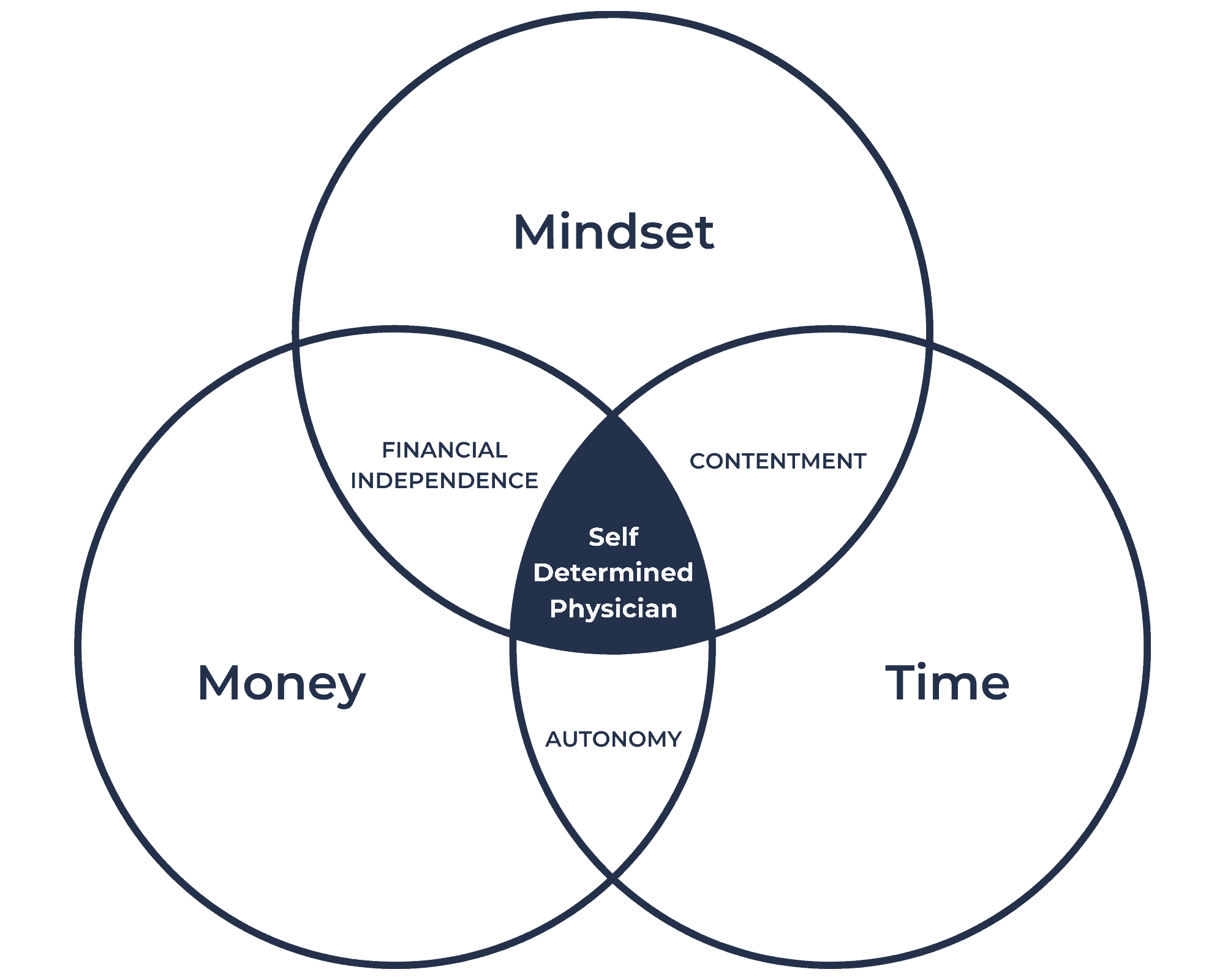

Fulfilment isn’t a pipe dream. It’s a state of being that we help physicians (just like you) achieve every day.

A Fulfilled Physician lives life on their terms and wakes up every day living the dream and enjoying the journey.

They practice medicine as much or as little as they want. Their journey is powered by financial freedom through non-clinical income and a healthy savings rate. When they do practice medicine, they do it with contentment in their heart and control over their thoughts. They live a life of abundance and growth where Imposter Syndrome and Burnout have been defeated.

What people say

“I am so glad I that I took the leap because it has been a truly transformational experience!”

Dr. Michael Runyon, MD

Emergency Medicine

Family Medicine

“Jimmy could charge 3 to 4 times the amount and it would still be worth it. This will undoubtedly buy extra years in my career.”

Pediatrics

Podcasts

An uncurated and unapologetic look into physician life.

The personal finance topics you wish you’d learned in medical school.

Recommended tools

Only the best of the best make the list of recommendations specific to a Physician’s needs.

Do you need disability insurance? (The answer is "yes")

I only recommend a small number of insurance agents – the ones that, as a physician, you can actually trust.

Do you want the 9-step process to creating financial freedom?

Make sure to check out Medical Degree Financial University!

Latest podcasts & articles

Check out my latest physician-focused coaching podcasts and articles – made with you in mind.

TPP #64: The Importance of Financial Freedom and Mindset with Dr. Daniel Shin

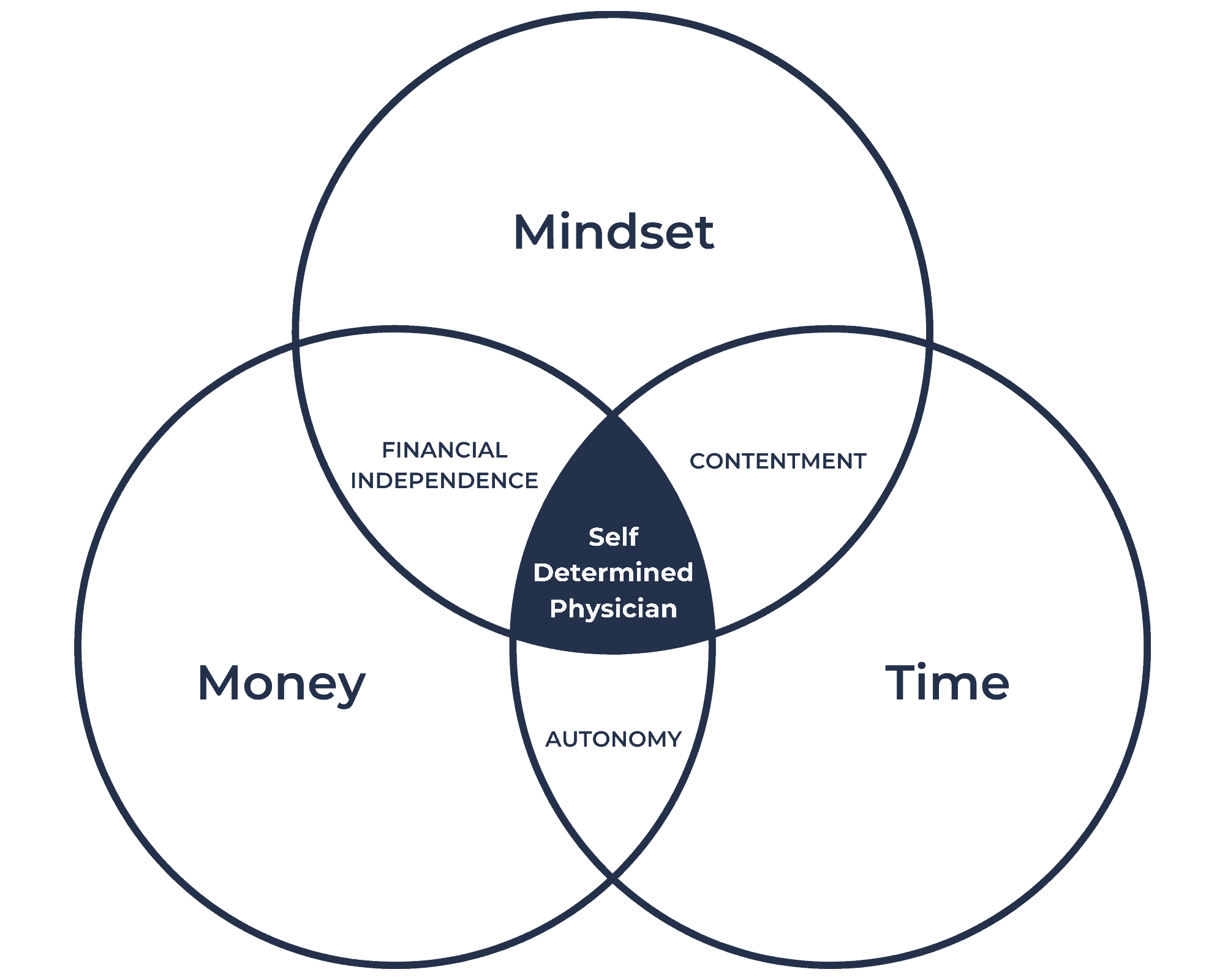

Dr. Daniel Shin, the Darwinian Doctor, is a practicing urologic surgeon. He’s also a really experienced investor, in particular, in real estate. Daniel is not only successful in the financial realm, but he’s also a prior client of the Alpha Coaching Experience. He has lived and experienced how doctors can really tie together the three things that we focus on the most- your mindset, your money, and your time.

MMM 89: Personal Finance Masochism & Physician Self-Compassion

Is there a purchase you’ve been thinking about, but are afraid you should be spending your money in “better ways?” Listen along today as we talk about that Porsche 981 Cayman S, house, or expensive vacation you want, and how to get it. Learn how you can save for tomorrow while you also enjoy today.

The Bogleheads’ Guide to the Three-Fund Portfolio

The Bogleheads’ Guide to the Three-Fund Portfolio teaches a simple and effective way to invest so you can move on with your life.

How I used the 10% Rule to Increase Our Net Worth $250K in 1 Year

Today is the third installment of the quarterly net worth update, but it is actually a full year out (I wasn’t blogging during the first quarter) from training at this point. My goal for this time point was to have $100,000 in assets at this point. Two years out I planned to have a positive net worth. To find out how I did, keep reading.

Are you ready to live a life you love?

© 2023 The Physician Philosopher™ | Website by The Good Alliance