How do financial advisors get paid? It should be an easy question to answer. Unfortunately, that’s not the case much of the time. This post will answer that question. It will also provides an awesome chart to see exactly where conflicts of interest exist in all of the most common financial advisory models!

This post was written by Justin Harvey, a fee-only financial planner who specializes in working with physicians. His wife is a resident physician in anesthesiology.

I met Justin at FinCon18 in Orlando. Since that time, we have discussed many of our beliefs about the financial industry. Specifically, one of our ongoing conversations has revolved around fee-models for financial advisors.

Many people fall prey to the conflicts of interest that runs rampant in the world of physician financial advice. So, dig in as Justin gives a financial planner’s perspective on the conflicts of interest found in the financial advisory industry.

Disclosure: Justin is a fee-only financial planner at Quantifi Planning and he is a paid advertiser on this site.

Where does my advisor have conflicts of interest?

This question has never been more important, especially for physicians.

When it comes to picking a financial advisor, there’s no such thing as conflict-free advice. Sadly, even the word “fiduciary”(the highest standard of ethical obligation for a financial advisor) doesn’t mean what it used to, as there is little uniform enforcement and understanding of this term today. India, Australia, the UK and others have created a much more transparent and consumer-centric environment for financial advice with a series of reforms that have “been built around the idea that advisors giving advice shouldn’t also be earning commissions” on that advice.

The US continues to lag behind other nations in reforming the financial advice industry. It also continues to be very difficult for a consumer to discern when an advisor is dispensing fiduciary advice and when they are acting as a commissioned product salesperson.

While congress continues to try to sort out appropriate rules for financial services in America (the recent legislation in early June left much to be desired), it’s important for you to understand where advisor conflicts exist and to what extent they may impact the advice you receive.

Knowledge Is Power

Finance is an industry where massive informational asymmetries persist between advisors and clients. Physicians are often on the wrong end of this information see-saw when compared to the financial institutions with whom they work.

At the poker table of life, financial companies frequently hold all the cards. I’ve seen that many doctors don’t know what they’re getting when they hire a “financial advisor” (most residencies give only barebones direction on this important topic, if any) and are financially vulnerable because of this asymmetry.

Would you ask a pharma drug rep for medical advice? Or would you get legal counsel from an attorney who also represents the opposing party? Probably not. The same consideration should be given when hiring an advisor.

Now, I believe that the overwhelming majority of financial advisors deeply desire to serve their clients well. However, many operate in business models that require them to, at times, work against their own financial interests to do this. To be an informed consumer, you should understand your advisor’s business model and understand where these conflicts exist. Conflicts of interest may substantively change the recommendations you receive, and not for the better.

Choosing a Good Financial Planner

There has been a considerable amount written on this blog and others about how to choose a financial planner. I propose that for my physician friends who want to hire an advisor, a good advisor will:

- Have requisite technical competency (experience with cases like yours, plus a rigorous certification like the CFP®).

- Operate in a fee only model (strict separation of advice and product, i.e. no commissions)

- Charge a fair and transparent price for advice rendered.

Note that I didn’t bother including “fiduciary” on the above list. This is for two reasons. First, advisors don’t agree about how and when this term applies. So, the term fiduciary can be misleading. Second, all fee-only advisors are fiduciaries in the purest sense (no commissions allowed!). So, the term is duplicative.

How Your Advisor Gets Paid & Your Advisor’s Incentive

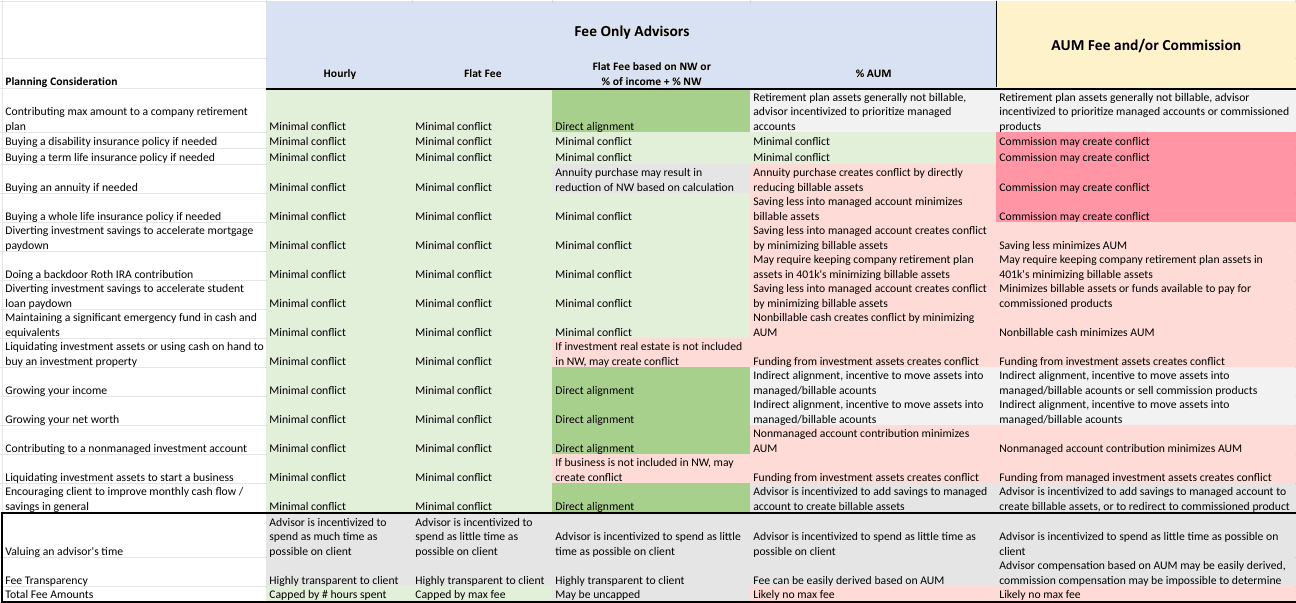

EVERY model has conflicts of interest. Yet, they vary in number and degree. Some are much less conflicted than others. It is helpful to understand the conflicts of interest across all of the different business models. The fact is, your advisor makes MORE if they tell you to do one thing, and LESS if they tell you to do another.

In a perfect world, an advisor gets paid more over time to have you do things that are aligned with your longer term goals (like growing your net worth), rather than getting paid more to, say, have you sign on the dotted line to purchase a financial product.

The below chart outlines some common financial planning actions/considerations and attempts to disclose conflicts of interest as they exist. I define a conflict of interest as a situation in which the advisor has to recommend something that takes money out of her own pocket in order to give you the right advice.

The Basics of Financial Advisory Models

First, let’s define some terms with some of the most popular fee models, listed below:

- Hourly – paid by the hour at a flat hourly rate. (i.e. Hours x Rate = total fee)

- Flat Fee – all financial planning and investment management provided for one flat fee that does not go up or down based on assets managed (i.e. $10,000 per year for all services)

- Flat Fee Based On Net Worth – a tiered variant of the flat fee model, where a higher net worth equals a higher fee. Fee goes up with an increasing net worth.

- % income + % Net Worth – a tiered variant of the flat fee model, incorporating both income and net worth. Fee goes up with an increasing income or net worth.

- % of Assets Under Management (AUM) – a model where the advisory fee goes up as assets directly managed by the advisor goes up.

- % AUM + Commission – A variant of the above where the advisor may also earn commissions on certain investment products or insurance policies in addition to a fee on managed assets.

Some Things Are Worth Mentioning Twice

- If you’re looking for financial planning and investment help, you should start by looking at fee only planners (check out NAPFA or XYPN for lists of fee-only advisors). This fee model simply has way less conflicts of interest because they can’t earn commissions.

- The vast majority of advisors are NOT FEE ONLY. At the end of 2018 there were over 311,000 professionals in America calling themselves a financial advisor. It’s unclear how many of these are truly fee only, but NAPFA membership (a readily available proxy for the fee only planner population) counts about 3,000 members at the end of 2018. This is about 1% of all planners. It’s clear that fee only planners are a tiny minority.

- The above list is not exhaustive from a fee-model standpoint (there are over a dozen). For any advisor you hire, make sure you understand all of the ways in which they may receive compensation and how this may impact the advice they render.

- Many financial products currently can’t be accessed without a commission. Any time you get a life insurance, disability insurance, annuity, or some other financial products, a commission will be involved. This isn’t a bad thing (it’s the way the industry has functioned for decades) but having a fee-only advisor facilitate the purchase of these types of products is a way to get an objective second look.

- There are many great advisors out there in fee + commission business models, who operate ethically and appropriately and serve their clients well. It is not my intention to demonize the +95% of advisors in America who operate in this model, but rather to help consumers be informed about potential conflicts.

Eventually regulators might force advisors to make a clean break between advice and commissioned sales – I hope they do. Until then, be an informed consumer and follow the money.

TPP’s Thoughts

The fact that the word “fiduciary” even exists bothers me. Can you imagine a doctor who wasn’t trained to put the patient first? Would such a training program ever exist? As Justin points out, the definition of the word is debated. When it comes to money, though, the need for a financial advisor operating as a fiduciary is not.

Justin’s last point is spot on. In fact, that is the advice I give to people who want to hire a financial advisor. I teach them to ask “How do you get paid?” This is a very different question from “How do I pay you?” This will help you understand how your financial advisor gets paid. If you “follow the money” you can sort out of a lot of the conflicts of interest.

What did you think about Justin’s post? Do you understand better how your financial advisor gets paid? What conflicts have you noticed in the models you have worked with? Leave a comment below.

As there are good and bad doctors in every specialty I am sure there are good and bad advisors in every fee model.

For me the flat fee model seems the most appealing if I had to go with one as it removes a lot of conflict of interest issues that are inherent with other types of models. For example in the AUM model, would an advisor recommend paying down debt? (because if he or she did, that would be less $ under management and less income earned for the advisor even if it could be better for the client to do so).

My one experience with a financial advisor was not a great one, later found out I was placed into a high expense front loaded mutual fund which I am sure meant he got a commission from it. When I had my financial awakening I promptly sold these funds and put them into index funds.

Bravo Justin! This is the best work I’ve seen advocating the net worth compensation model and your table is game changing and should be reproduced widely!

For those of us who have thought deeply about conflicts of interest and perverse incentives: insurance salesmen and brokers are not true financial advisors. Sorry, this needs to be said clearly and with force.

For the fewer who recognize the limitations of AUM even among fee-only advisors, there is a bigger hill to climb.

Legislation is not likely to help and there is a really long way to go. Physicians need to vote with their feet and break the chains of drug-rep style advice from financial professionals mired in conflict.

I agree FiPhysician. This was a great piece. Really helpful, particularly that spreadsheet with all of the conflicts. Justin and I have had many conversations about fee-schedules, and I think that a flat fee based on Net Worth is my favorite. It gets rid of many (almost all?) of the conflicts except working on a client’s planning as little as possible since they are not paid by time/hour.

TPP

@xrayvsn re: As there are good and bad doctors in every specialty I am sure there are good and bad advisors in every fee model. <<<100% agree — many advisors who have been in the biz for decades have functioned in AUM or AUM + Commission models when that was really the only way that existed, and inertia has kept them there. Many have deep expertise and provide a great value for their clients and that warrants reiterating.

I enjoyed your article, Justin. I’m a firm believer that this is a message that needs to continue to be delivered time and time again. You also lay out a nice framework for choosing a financial advisor, and I think that you deal kindly to members of our profession whose fee models aren’t as aligned to their clients’ interests, but still provide meaningful advice and are ethical people. They certainly do exist.

Where we might respectfully differ in opinion (and this could be something we discuss in St. Louis in September if you’re going to the XYPN Live Conference) is the premise that “[i]n a perfect world, an advisor gets paid more over time to have you do things that are aligned with your longer term goals (like growing your net worth) . . ..”

My perspective would be that the advisor provides a service, and while a valuable one, it shouldn’t change based on the net worth of the client.

I’m also interested in the chart that was provided. Based on your definition of a conflict of interest as “a situation in which the advisor has to recommend something that takes money out of her own pocket in order to give you the right advice,” what are the “minimal conflicts” for the planning considerations for hourly and flat fee only financial advisors? It isn’t obvious to me what those minimal conflicts might be for many (if not most) of the planning considerations.

I’d love to hear your thoughts.

I agree with you Donooan. Portfolio management does not seem to become more complicated as people have a higher net worth. I know that liability for the financial advisor goes up, but not enough to justify the substantially higher costs.

The conflicts I see in the hourly models include working on the portfolio as often as you can to increase billable hours. This problem doesn’t exist in flat fee models based on other metrics (net worth or total assets)… but in those models, the advisor has the opposite conflict… to work on the planning/portfolio as little as possible.

I’d be interested to see what Justin says, too.

I see your point for the hourly model having a conflict to work on the portfolio more in order to increase billable hours. I think that if I were someone looking for portfolio management, the hourly rate model wouldn’t be the one I’d select. It seems like the hourly model is well-equipped for DIYers who are looking for a professional opinion just to make sure that they’re on the right track, or for those who have a specific problem that they want solved. Unless there’s an agreement to how much time the advisor will spend on the portfolio, the hourly rate doesn’t seem to be the best model for those looking for portfolio management.

I guess I’m still not sold on the idea that the advisor is somehow entitled to greater compensation as one’s net worth increases. If the advisor is providing a service, and excluding an increase in complexity, why should the price increase?

Hey Donovan,

In this paradigm (and in my opinion) net worth is a proxy for complexity. Greater net worth = greater complexity. In a perfect world an advisor would be able to fully comprehend the nuance of all of the needs of a client prior to engaging, but since this is impracticable we use NW (or AUM) as one of the ways to estimate complexity and price (it’s admittedly a bad proxy at times but generally and on average it works just fine). With increased complexity comes increased price. If I’m wrong, I’m happy to be proven thus by the forces of economic darwinism, and I fully encourage you to pursue whichever model your conscience dictates! 🙂

“minimal conflicts” in this case means “hardly any worth mentioning”. It’s conceivable that there could be a very minor conflict in any of these, and I don’t like to say “zero” unless the answer is literally “zero”, and that’s rare.

Also the great thing about any of these models is that a fully informed buyer and seller can agree on a fair price and free markets will do the rest. If something is “too expensive”, then my price will necessarily have to come down for me to stay in business. Who’s to say what something is “worth”? You need look no further than the last market transaction between a willing buyer and seller. Of course, for this to work then the buyer should know what they’re buying — a goal to which this article seeks to contribute.

I personally know advisors that charge 10k, 20k, 50k, and more, and they are worth every penny (and multiples more) so honestly I don’t get too hung up on the fee number in general if the client deems it worthwhile.

Nice to hear from you, Justin. I think there’s always something to learn from one another, so I appreciate your follow up and expressing your thinking here.

While I think that we’ll differ in our opinion about the viability of net worth as a proxy for complexity in many circumstances, or about advisors being worth multiples of $20K or $50K, I think your article does a great job raising awareness about a very important topic.

Keep up the great work, and I wish you every success.

Kindly,

Donovan