Don’t we all remember the money saving tip we got at the beginning of medical school? You know. It goes something like this: If you just brew your coffee (or tea) at home while you are a medical student and resident instead of going to Starbucks, you could save thousands upon thousands of dollars on your medical school debt. It is important to know how to limit lifestyle decisions so that your debt doesn’t accumulate unnecessarily. Unfortunately, that is where my education on student loans stopped in my medical school training. Nothing else was explained to me about student loans. In particular, very little was explained to me about student loan refinancing. So, today’s post is going to focus on the Four W’s (What, When, Where, Why) on refinancing your student loans.

This is Part 1 of this series to answer the what, when, where, and why of PSLF (Public Service Loan Forgiveness) and the two most commont Income Driven Repayment options (PAYE and REPAYE). If the PSLF options below don’t fit for you and your interests, then Part 2 is going to be up your alley. Or you could go ahead and visit my Student Loan Refinancing Page for the private options.

If you need a real life example of PSLF forgiveness, you can read Big Law Investor’s interview with someone. There is proof out there.

What’s the big deal?

Anyone else feel like the road to paying off your debt is a long one? Making a plan can make it a little shorter!

When I went through training, none of the private resident refinancing programs existed. I started with about $130,000 that ballooned to $190,000 by the end of training as I did what no one should do. I went into forbearance. So, all of that debt accumulated at 6.8% interest. Don’t be me. At least not me from back then; loads of bad financial decisions! (I’ve learned. I want you to learn, too. Hence, the creation of this website).

The turned into a big deal because I didn’t make an intentional plan. Forbearance and deferment are not options. (Yes, I realize that they are technically options, but it’s not one you should choose). It’s easy to fill out the paperwork and to not have to make a decision, but it’s going to cost you a bunch of money. How much money exactly will it cost? Let’s take a look.

The average medical student comes out with approximately $190,000 in debt. Let’s take a look at how much this person would have at the end of a five year residency if they refinanced their loans versus forbearance at 6.8% interest.

$190,000 at 6.8% interest over five years. Using the future value function in excel we can determine how much you will owe at the end of your 5 year residency, which will be $254,635. This amounts to $64,635 in just interest. That’s a lot of money. Anything you can do to decrease that number is a good thing.

What if you refinanced your student loans to 5% during residency for the first 4 years, and then refinanced to an attending rate once you had a contract in hand during your last year? The total accumulated interest for your original $190,000 is now $46,006 assuming you made NO PAYMENTS during that time. Because you refinanced your loans you will be saving yourself $18,629 compared to if you didn’t refinance at all.

If you have more debt than the average trainee (which, if my math is right, should be 50% of you reading this), you’ll save yourself even more. If you want to find some of the best cash back bonuses (at no additional cost to you), you can find them on my Student Loan Refinance Page. I’ve spent hours working out great deals for you (often at little to no referral fees for me so that I could give you the biggest bonus back).

When Should I refinance?

If you decide not to pursue PSLF, then check out then click on the image for the Student Loan Refinance Page. Some of the best bonuses options available.

This is a more difficult question to answer. The easy answer is you should refinance ASAP either through PSLF (more below) or through a private refinancing option (described in more detail in Part 2 of this series on 3/12/18). The sooner your interest rate drops or you take part in a forgiveness plan the better.

That said, the most important initial question to answer is whether you are going to participate in Public Service Loan Forgiveness or not. Through the PSLF program, you are promised to be forgiven any remaining debt you have after accomplishing three things: 1) certifying in PSLF every single year; 2) making 120 monthly payments over 10 years; and 3) you must work for a non-profit 501(c)3 organization during those ten years of payments.

This begs the question of who should look into PSLF?

In my opinion, you should consider doing PSLF if you meet the following criteria:

- You have a high student loan to income earning potential ratio. If your debt is higher than your income, then you should consider PSLF. A debt to income ratio > 2 (i.e. $400,000 in debt with $200,000 annual income), pretty much mandates giving PSLF some serious thought.

- If you have a long training period. The longer time spent in training, the lower your monthly payments are and the more interest you will accrue. This makes PSLF more and more attractive each year. However, those long training years only matter if you sign up for PSLF at the beginning to take full advantage. The payment during training is often zero dollars the first year or two because it is based off of your previous year’s income (which is zero dollars for many fourth year medical students).

- If you know (or think you are pretty sure) you will be working for a non-profit 501(c)3 organization. This includes most academic hospitals.

If you meet the above criteria, then the PSLF program is likely right for you. You should certify each year and make the minimum required payments. All of the programs discussed below fall under the umbrella of Income Driven Repayments (IDR).

Where and why: REPAYE program

If you are single or married to a non-working spouse (or very low income spouse) then the REPAYE program is likely the right one for you. All direct, stafford, and graduate plus loans are eligible. If you have Parent PLUS loans, including consolidated loans with Parent Plus loans; these are not eligible. If you do qualify, here are the major benefits of the REPAYE program:

- It caps your monthly payment at 10% of your discretionary spending (recalculated each year) which is calculated as follows.

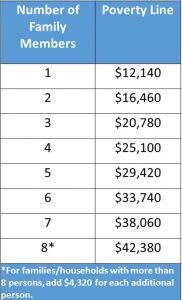

Discretionary Spending = Your Adjusted Gross Income (AGI) – 150% of the poverty line.

*This is advantageous because most medical students earn 0 dollars in their fourth year of medical school. This means your first year’s payment is $0 per month during your internship. The next year you only earn income on 6 months of that year. So, your second year residency payment will still be very low. See the adjacent table to calculate what your monthly payment would be. - The next big benefit of the REPAYE program is that after your monthly payment has been paid, the government pays any remaining interest above your payment for three years. Thereafter, 50% of whatever interest is remaining that was not paid by your monthly payment is paid by the government. In essence, this decreases your interest rate. This is a big benefit.

However, one big thing to note is that while the payment is capped at 10% of your discretionary spending, there is no cap on what that payment can be.

For example, if your AGI is $400,000 per year and have a family of four, your discretionary spending if 400,000-(150% x $25,100) = 362,350. 10% of that number is 36,235, which comes out to a monthly payment of $3,019.58.

If you are trying to pay the least monthly payment to be able to partake in PSLF, then you can see why this high monthly payment is not ideal.

Where and Why: PAYE (Pay As You Earn)

Before REPAYE, there was PAYE. This program has some similarities to REPAYE with some major differences as well.

As for the similarities:

- PAYE also has a cap on your monhtly payment (10% of discretionary income).

- Certain loans exclude you from qualifying for PAYE: Direct PLUS loans and parent PLUS loans.

Here are the major differences worth speaking about:

- Unlike the REPAYE program, PAYE has a cap on how high your monthly payment can get. It cannot exceed a standard repayment plan monthly payment. This makes it a great option for higher-income earners finished with training.

- Because of the cap on the PAYE payment, you have to show that you cannot afford to make the standard payment plan to qualify. REPAYE does not have this requirement. (For more on this, read “The Catch” below).

- You must have taken out a direct loan on or after October 1, 2011. If you have a direct loan prior to this, you don’t qualify.

- The remaining interest after your monthly payment continues to accumulate. Unlike REPAYE where 50% of this is paid by the government, you get to keep the whole shebang in the PAYE program.

The Catch

You may have inferred from the above conversation that, if you decide to pursue PSLF, it is wise to enter into the REPAYE program during training (lower payments) and then to enter PAYE when your income is going to increase (capped payment).

However, once your income increases dramatically, it may be hard to get approved for PAYE because it requires you to show financial hardship to qualify (i.e. that you cannot afford the 10 year standard repayment plan). So, the best thing to do for the smart resident is to switch to PAYE just before leaving training. That way, you just continue in the program when your income increases.

Any questions that were not answered above? Leave them in the comments and I’ll do the research to answer your question if I don’t know off the top of my head. Stick around for part 2 on the new private options a week from this post (3/12/18).

TPP

0 Comments