I still loved driving my Chevy SS. The roar of the naturally aspirated V-8 as I churned through the gears on my manual transmission was intoxicating. Yet, the lack of practicality eventually got to me. So, I traded in my Chevy SS for a Ram 1500 and saved 25% off of the retail price in the process. With the help of an inside-industry source, I’ve learned a few things that I want to pass onto others. When is the best time to buy a new car? Well, this post will walk you through a step by step process on how to buy a car, how to get the best deal on a new car (including how to negotiate new cars), the best time to buy a car, and much more!

We’ll cover all of this so that you can walk away with the least consumer regret!

Best Time to Buy a Car & 8 Other Steps on How to Get the Best Deal on a Car

Though I encourage each and everyone of you to read and understand the literature that is out there on buying “things,” I would be a hypocrite if I didn’t tell you that buying physical items isn’t something I do. In fact, buying a new car is my one fatal flaw when it comes to personal finance. I suspect if you are reading this, then you are a car person, too.

Below I include some of the details from my recent experience when I traded in my Chevy SS for a Ram 1500 truck. Through this experience (and some inside-intel from a close friend in the business), I’ve learned the best time to buy a new car and how to get the best deal on a new car.

Here is the step by step process for negotiating a new car to the best price!

1. Get the Best Deal on Your Car (Trade-In)

First things are first. Many people will be trading in an old car when they go to get the best deal on a new car. If this isn’t your situation, then skip to the next step!

In order to get the best deal on your current car, you need to know the value. The best way that I’ve found to do this involves using two different tools.

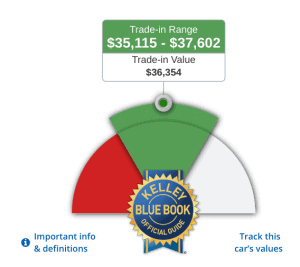

First, using the Kelly Blue Book website, you can punch in all of the characteristics about your car. This will then produce a value range for your car based on the condition, miles, and options you have on your car.

In my situation, I was trading in my 2017 Chevrolet SS. After punching in the details on my car, this was the Kelly Blue Book value:

From the outset, I was not going to sell my used car for less than $37,500. Given that this is at the top of the trade-in range, was I being unreasonable? No, because I used a second tool to determine the value of my used car trade.

The second tool involves going to a few used car websites (Cars.com, autotrader.com, etc). Using the same details that you placed into Kelly Blue Book, try and locate some cars that are just like your own to see the listing value for your car.

The purpose behind this next step is to see how much money the dealership plans to make from selling your used car. In my situation, there isn’t a used 2017 Chevy SS with a manual transmission selling for less than $39,000 in the continental U.S.

This is how I determined that the lowest acceptable trade-in value for my car was $37,500. Even at this number, the dealership would make money from my trade.

2. Know What You Want And Be Flexible

While it is important to know exactly what to expect for your trade-in, it is equally important to know what you are looking for. Recognize that more bells and whistles do not equate with increased happiness.

Make sure to do your research in order to determine which vehicle best suits your needs. Once you arrive at the make and model, it is time to be flexible on a few of the other items.

For example – in order to find the best time to buy a new car – you may need to be flexible on the timing of your purchase, the year of the car, and the color of the vehicle.

In my situation, I was looking for a Ram 1500 Crew Cab (I needed to comfortably fit three children in the back) with Four Wheel Drive (yes, it snows in North Carolina) and certain safety features (i.e. parking sensors so I don’t hit things when parking). Since the 2020 Rams were now out, I could get a better deal on a 2019 model. And I wasn’t stuck on a certain color, because I know that the color isn’t going to be the “end all, be all” for my happiness. So, I was happy to get a dark blue, grey, or silver truck.

In addition to this, I wasn’t in a rush to buy a new truck. I told each and every dealer I could wait. I love driving my Chevy SS. The truck purchase was happening for practicality, and not because of need.

This flexibility offered me options in finding the best time to buy a new car at the best deal.

3. Best Time to Buy a New Car

Now that you are armed with the right information on your trade-in value and you’ve researched exactly what you want, you can start the buying process. Yet, you shouldn’t go buy a car at just any time of the month or year. Regardless of what you’ve heard, there is definitely a best time to buy a new car.

In fact, there are specific times that you should (and shouldn’t) go looking for a new car.

The first tip here is that the end of the month is much more likely to produce a good deal than the beginning. The reason for this is that manufacturer’s set sales goals for dealerships each month that involve large bonuses to the dealerships for making their target. As the month comes to a close, if these quotas aren’t met, the dealer will start to offer much better deals.

This should make sense, right? If you were a dealer, would you be okay with losing a couple thousand dollars on a car in order to get a $50,000 or $100,000 monthly bonus? You bet.

Dealerships also have financial quarter and yearly sales goals. This is the best time to buy a new car.

If you approach a dealership at the end of the month that is also at the end of a financial quarter (or the fiscal year), you might find the very best deal. These months occur in March, June, September, and December. The fiscal year for some car manufacturers ends in March while others end in December.

However, if they have already met their goals, you might find a worse deal! This is the reason for the next step, which helped me save 25% off my new truck.

4. Involve Multiple Dealerships

Three days before the end of the month, I called into multiple dealerships and offered them my trade-in information and told them about the new truck I was looking to buy. This is when the negotiation for my new car started, but it didn’t stop for another 72 hours.

Why did I contact multiple dealerships over a three day span? Because of the sales goals I mentioned earlier. Every single dealership is in a different sales situation. Some of them have already hit their number. These dealerships are unlikely to hand out a good deal. Others are only a few cars away from hitting their goal, and may be willing to offer a sacrificial lamb to you in order to make their goal.

As the month started to come to a close, the dealerships that were having a hard time meeting their goals started to call. Some of them even told me the exact number of trucks that they needed to sell in order to make it.

This is when I started to hustle hard to negotiate to the best deal.

5. Always Walk Out After a Test Drive

As the dealerships who needed my sale the most started to come to the surface, I started test driving trucks. I would walk in and inquire about a specific truck while they valued my trade. All the while, I planned to leave the dealership regardless of what they offered me. Even if it was exactly what I wanted!

Why would I walk out regardless of how good the deal was? Because it saved me $2,000 every single time.

It’s simple. Dealerships know that people who walk out of their store after test driving a car are very unlikely to buy a new car without getting the best deal.

Every single time I walked into to test drive a truck, I would leave. Within the next 24 hours, every single dealership I walked away from called me and offered a better deal. Most of them offered me a low-ball offer on my Chevy SS (usually around $35,000) the first time. Each time I left, they would call back and offer me the $37,500 I wanted.

By walking out of the dealer, I saved an extra $2,000 on my trade-in. This happened with three different dealers who pretended to be unable to negotiate on my car trade-in value.

What then is the best way to compare the prices at each different dealership? By knowing how much each dealership is offering OTD.

6. Use Out The Door (OTD) Prices for Comparison

There are a lot of numbers that get tossed around when buying a car. There is the MSRP (Manufacturer Suggested Retail Price) and the trade-in value of your car. And then there are the rebates and discounts, dealership fees, and taxes.

Every dealership has a different way of calculating these numbers. So, how then can you compare cars to make sure you know how to negotiate the car to the best deal?

First, use the MSRP to compare the value of the car as determined by the manufacturer. Then, place your entire focus on the Out The Door (OTD) price.

The OTD tells you exactly what you’ll be paying to take the car home. This includes all of the numbers involved in the purchase of the new car. So, it is a great way to compare the offers provided by each dealership.

I used the OTD number against two different dealerships to land my best deal after I had the same exact truck traded from one dealership to another.

7. Best Time to Buy a New Car Varies (Dealer Trades)

I found several trucks that met my criteria. After letting the dealerships call me for 48 hours, I settled on a few that I thought were legitimate targets.

In the end, I purchased the silver Ram 1500 shown below. Yet, I didn’t purchase it from the dealer that I originally contact about this truck. I had it traded to another dealership that would offer me a better deal on the same truck.

You mean dealerships trade trucks? Yep. That was one of my biggest keys to negotiating my my new car.

The first dealer offered me $5,900 OTD for the same exact truck that I ended up buying from a different dealership for $3,500 OTD.

My New Ram 1500 Big Horn that I got for 25% off MSRP

I did this by asking the second dealership if they could trade for the truck, and told them that I would offer my trade-in plus $3,500 OTD. They called the first dealership, acquired the truck, and I saved another $2,400 in the process because the second dealership needed the sale more than the first.

When I told the guy selling me the truck that the first dealership wouldn’t budge from their $5,900 OTD number he was floored that I got $2,400 off the same truck I’d be buying from them.

By knowing my number, I got the best deal I could all while negotiating for my new car.

8. Know Your Number

I read and write about personal finance every single day. I’ve even authored a book on personal finance for doctors.

So, you better believe that I wasn’t going to spend a dollar more than I wanted when I started this new car buying process. I was going to get the best deal I could for exactly how much I wanted to spend.

Early on, I decided that I would not spend more than $2,000 out of my pocket for the exact truck I wanted. If I could get a better truck at a higher trim or with more options, I wasn’t going to break $3,500.

Since I was buying the truck at the end of the month in order to negotiate on a new car, many dealerships were out of the exact trim and options I wanted. So, I ended up spending the higher number ($3,500 OTD) on the truck.

For this, my new truck had some additional features that I didn’t need, but were still nice to have like LED headlamps, automatic lights, and an improved audio system which is great since I am a bit of an audiophile.

9. Pay Cash When Buying a New Car

One other benefit that I had when negotiating my new car was that I wasn’t going to finance the vehicle. This allowed the dealerships that I was working with to know that I wasn’t going to budge on my number and that the OTD price was a great tool for comparing prices.

In addition to this, they had an incentive at the dealership for those who bought vehicles with cash.

Having the leverage in the deal allowed me to get the best deal on my new car.

This is a life lesson in accomplishing your financial goals! Because my wife and I are debt-free outside of our mortgage, we had additional leverage that I haven’t had in times past when buying a new car.

Take Home: Negotiating a New Car

Whether you are trying to find the best time to buy a new car, learning how to obtain the best deal, or learning how to negotiate a car – I hope this post proved helpful.

The truth is that you have to have the discipline it takes (and the time) to go through this process if you want to achieve your goals.

I promise you, though, that there is a lot more room for negotiation than you think when buying a new car. You simply have to know the truth and have the patience and discipline to get what you want!

Have you negotiated a new car? What tips do you have based on your experience? Did you apply some of the steps mentioned above successfully? Leave a comment below.

TPP

Wow! That was some awesome information Jimmy and you are right that cash buyers have a lot of power (especially if you can swing buying a home with cash you can always get a discount compared to someone who has to finance (sellers factor in potential snafus like mortgage issues causing the deal to fail and thus give a premium discount to all cash offers).

I’m currently not in the market for a car but will certainly keep these tips in mind when I am.

Thanks, X-ray! I thought it was an experience worth recording. It proved helpful knowing someone in the business, too.

I’ve bought several new cars in my life and I agree for the most part with your steps. I’d add a few things to your list:

1. If possible try and purchase the outgoing model of a car if there’s a major design change. Many people are looking at the next model but if you prefer the older one you can get a deal.

2. I’ve used truecar for my last 3 new cars to get prices and I’ve found them to be good. I’ve heard they may not be the ABSOLUTE best price since there is a little kickback from the dealers to true car but I feel like it’s pretty good and the charts tell you the purchase prices others have paid.

3. If you don’t like to wheel and deal consider using a broker. There are brokers who charge a few hundred dollar fee to find you the car you want. If you’re too busy or do not like haggling consider using one of these folks.

4. Separate the driving phase from the buying phase. I go in for test drives always explaining I’m trying to shop around and no way I can buy. If you feel like you might be pressured just say, look how can I buy this Acura, when I need to test drive these 3 other cars, etc.

5. It’s not always about getting the to the dollar lowest price. If a dealer is an ass to me or is shady I’d rather pay a hundred more and give my business to someone who puts in the good faith effort. If you negotiate well they’re only getting like 200-300 on the car. Also, for newer cars where you’re taking them to the dealer for service it’s nice to have a relationship with a near by dealer. That may be worth 100-200 bucks vs buying a car say 2 states away.

6. Dealers try to trick you with math. They’ll give you above market value for your trade but then give you a crappy deal on the price of the car. Always focus on out the door price + trade. If you’re trading in I wouldn’t mention it until you firm up the price on the car and then discuss the trade. Just google 4 square car dealers. I bought my last car in 2017 and dealers are STILL using this ploy!

7. While cash is king I do think there are some situations where you get a lower price if you take the financing (then just pay off quickly).

8. I realize Bill Cosby is persona non grata these days, but there’s a classic scene from his show where he goes to buy a car wearing old clothes incognito. Definitely never say you’re a doc when buying a car…. https://www.youtube.com/watch?v=bKMlx5p6n8k

Good luck with the new ride!

I love these… Particularly that last one. I told the guy I sold it to what I did after I had already agreed to a deal, but certainly not before!

These are some really great tips jimmy.

I really wanted a hassle free car experience for my spouses next car. We enlisted the services of a car broker. He charged $400 for the service. He negotiated a pretty good trade in offer for our BMW that had been in an accident and a decent price for our preowned Toyota RAV4.

Maybe not the most deal saving but definitely a hassle cutter for sure.

Our time is worth something, and so I don’t fault anyone who would go that route… So long as they could promise me to get the best deal out there (if I am paying for this … I would want that).

I half thought that the dealerships earned a kickback for the financing and so cash only wasn’t always the best. But I am not very knowledgeable about these things.

Jimmy-

I especially love #9. It seems like this is one of the hardest ones to get across to people, including people seeking FI. In my years of doing personal financial coaching, I’ve had dozens of clients that had ridiculous car payments and couldn’t understand how that was keeping them from reaching their financial goals. I was working with someone once who had $25,000 in debt on a 1 year old Mustang. He blanched when I told him I owned a 10 year old Hyundai Elantra outright. The value of having cash when negotiating big purchases (house, car, etc.) can’t be overestimated. It also prevents you from buying something you don’t definitely need.

-Brent

http://www.TheScopeOfPractice.com

100%… If you can’t pay cash, you can’t afford it.

Bummer you sold your Chevy SS! I drive a similar car, a 2003 BMW M5, so I know the appeal of a naturally aspirated V8, six speed manual, and rear wheel drive. Hope you enjoy your Ram.

Thank you for all these excellent tips on car buying! My wife and I will use them when we shop for a Mazda CX-9 in the next few years.

Yeah that e39 chasis on that car is no joke. They say the predecessor to your car was the Chevy SS. I loved driving it, but ultimately it just didn’t make sense.

I’m loving the truck, but the SS was just different. I miss throwing it around corners, but I still think it was the right move.

Keep me posted on the CX-9 purchase!

Great tips. I recently used a similar system for a new Honda Odessey for the Mrs. Emailed about 6 dealers that had the one we wanted in stock, and just said give me your OTD price. Then I went through multiple rounds of “well X dealer is at $$ price…” until I was a solid $5k below first offers and had free oil changes, services, etc. One dealer even offered to deliver it to door from an hour away, never even setting foot in their dealership. Amazing how much you can save when you know how to ask and are willing to walk away. Most personal finance articles save big picture long term money, this one will save a few people real cash in hand soon – great work!!

I would disagree with many of your methods.

One, the buying and selling of the car are two totally separate purchases. When you go into the dealership if they ask you about a trade-in lie to them, and tell them you do not have one. Evaluate it like you did online with Carmax. Once you get the best deal for your new car then you tell them you have a trade-in. They will actually respect you for doing this as they know this is the way it should be done.

2)Being a cash buyer is absolutely the worst for the dealership! They get kickbacks from either the auto company that’s doing the loan or the bank. Negotiate your best deal and then ask them if they have a special. The last Ford truck I bought had a $500 rebate through Ford credit. We finance the car for one month and then paid it off in cash and kept the difference.

1) I think going to carmax is fine…. Except that they offered me a lower deal than many of the dealerships got to. I also knew the MSRP of the various trucks and how much I was getting for each OTD. I don’t agree that they need to be separated.

2) this one depends. While it is true that I could have gotten a rebate for financing the car, they said that I had to finance the car around 4% for at least one month on a minimum amount of money (I want to say it was $3000-5000). Seemed like a giant hassle to get $500 off, lose $120-$200 in interest and deal with a bank. That just wasn’t worth my time, and I got a money towards oil changes (which are not optional anyway) because I purchased in cash. Every dealership is different on this one, though it is 100% true that dealers make money from financing cars through banks they have deals with.

Knowing the value of your old car is super important, but if you’re trading in you’ve already started the process by leaving money on the table! ALWAYS sell to a private buyer and maximize what you’re getting for your old car. Dealerships will never ever pay what a private buyer will.

Financing through the manufacturer almost always provides better deals. If the financing rate is 0% or 0.9% it is better to go with financing, even if you have cash in hand. Get the better deal with financing and pay off the whole loan in a month or so. Or keep the 0% loan for the life of the loan and earn interest on your cash.

I agree that if you want to maximize your deal, selling privately will certainly do that. It is also much more annoying to do in my opinion. I needed the cash from the trade to buy the truck. So, selling privately first would have required me to buy a rental car while I did my negotiating. And I didn’t want to drive a rental for a month if I didn’t get the deal I was looking for the weekend I sold the car.

It is about finding the optimal deal for both your time and money, in my opinion. I would say your view maximizes the money, the view others have espoused where they get someone else to do it for them maximizes time, and mine (at least in my mind) tries to do both but to a slightly lesser degree.

When you say, “pay cash,” do literally walk in with thousands of dollars? Or do you write a check? Or have your bank issue a check? What is the actual transaction?

In my case I traded my car plus put whatever they would let me on my credit card (to get miles for traveling) and wrote a check for the rest.

Obviously, if you trade your car separately (may get more for it, but it is a bigger hassle), then it may depend on what your bank will allow for personal checks. I know mine calls me for any check I sign over a couple thousand dollars.

I have a 48 year old car: Bought it new, kept it well maintained, purrs like a kitten, no rattles or noises, starts on the first crank, and has no mechanical issues. Just needs a new paint job and minor body work. My suggestion: Buy a well made, high end new car and take good care of it. Of course as one’s needs change, some alterations in my suggestion may be necessary.

Good tips, TPP. I’m in the throws of this process at the moment. How do you figure you saved 25% on the retail price of the Ram? That sounds like it would be more than $10K of savings given the trade in value + OTD price you mentioned, which is hard to believe.

I think the MSRP was around 54,000. I traded in my SS for 38,500 +3500 out the OTD but part of that includes taxes and title (~$1,000-$1,500 where I live)

So, I got 13-14k off of a 54,000 truck, which comes out to 24-25% off MSRP

Thanks for the clarification. That’s a heck of discount on that $54K, well done.

I’m grateful for your advice on how the end of the month is the best time to get a good deal on a new car. My wife and I would like to purchase a minivan that has more storage space in the back so that we can store more of our kids’ things. These tips you shared will help prevent us from breaking the bank on a new vehicle.

That’s great! Did you end up buying this month?