I can’t count the number of times I came home during residency to see my kids before bed time, and then promptly fell asleep in the middle of reading a book to one of them. My wife has some great pictures of this happening on multiple occasions. Your job in training is to learn how to be good at your job. It’s busy and we rarely have time to focus on things outside of the craft we are learning. This includes the importance of doctors investing during residency.

Despite that, I hope you learn a little bit about personal finance decisions, including how you should be minimizing debt during residency. It really is not just a drop in the bucket. In this post, we will discuss why it is so important to save what you can during residency.

Note: If you have high interest debt (defined as interest > 8%), it is wise to use any extra money you have during training toward your debt.

What’s a Good Investing Goal During Residency?

We all need goals to strive toward. A reasonable goal in residency is to fill up your Roth contributions each year.

In 2023, the max Roth IRA contribution is $6,500. According to the 2022 Medscape Residency & Debt Report of more than 1300 residents, the average salary during residency is $64,200. This means that filling up a Roth IRA produces a ~10% savings, which is a great goal during training.

Note: If you have access to matching – when you put a dollar in, your employer gives you a dollar – we recommend you utilize this prior to using a Roth IRA. Don’t leave part of your matching salary on the table!

That said, saving anything in residency is a worthwhile goal. Even if you need to limit it to less than 10% of your gross income. I encourage you to set a goal. Making a budget/track your spending will help you get there.

Still struggling to see why you should save money in residency? Let’s discuss 6 reasons, including how much saving during residency will impact your future finances.

Should I Invest in Residency: 6 Reasons

Number 1: It will matter in the end

Many physicians in training say things like, “I will be able to save so much more money as an attending that it probably isn’t worth saving money as a resident.” Let’s put this to bed right away.

Let’s make some assumptions and look at the math: You have a four-year residency and save $6,500 via a Roth IRA each year. Assuming 6% interest growth over those four years you will have saved/earned ~$30,000.

Remember, when you take money out at retirement there are a lot of reasons why you want to save your Roth money for last. So, lets look at how much money that $30,000 will turn into – without adding another dime to it – at the end of retirement (50 years later)assuming you gain 8% in interest.

The answer… is $1,400,000. Yes, as in $1.4 million dollars. That all comes from just four years of saving $6,500 each year during residency. Do you still think it is not worth it?

Number 2: You may be able to get a tax deduction

While contributing to a Roth while in a lower tax bracket is often advisable, contributing to a Traditional IRA (TIRA) comes with a potential benefit, too. You get a tax deduction. In addition to this, you should know that any decrease in your AGI produces a lower monthly payment for anyone enrolled in an Income Driven Repayment (IDR) program.

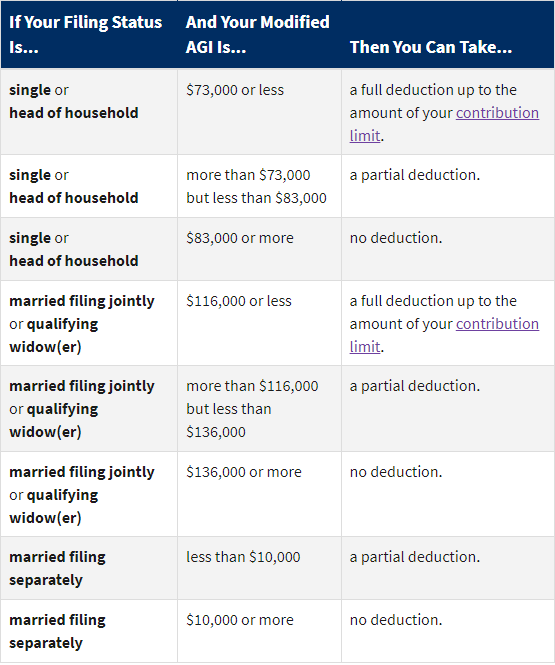

In 2023, if your modified gross income (MAGI) is below the thresholds shown below you can participate in the deduction for your traditional IRA contributions. These numbers are specifically for in situations where someone is covered by a retirement plan at work:

Note: “Your deduction is allowed in full if you (and your spouse, if you are married) aren’t covered by a retirement plan at work.”

If you don’t have an employer plan, you can basically take the deduction so long as your income is less than $193,000 regardless of whether you are married or single.

Number 3: Roth IRA investors may get a tax credit

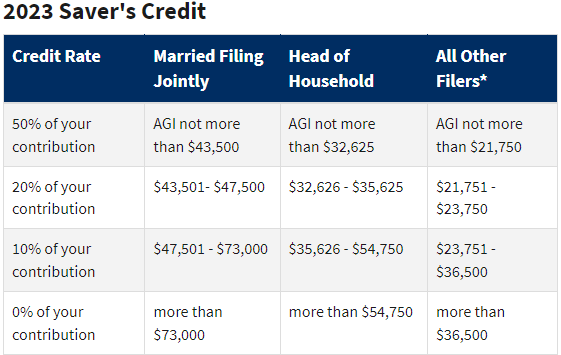

You may be able to take part in the 2023 Saver’s Credit even when contributing to a Roth IRA depending on your MAGI. Particularly if you are a married resident.

According to the IRS:

Depending on your adjusted gross income reported on your Form 1040 series return, the amount of the credit is 50%, 20% or 10% of:

- contributions you make to a traditional or Roth IRA,

- elective salary deferral contributions to a 401(k), 403(b), governmental 457(b), SARSEP, or SIMPLE plan,

- voluntary after-tax employee contributions made to a qualified retirement plan (including the federal Thrift Savings Plan) or 403(b) plan,

- contributions to a 501(c)(18)(D) plan, or

- contributions made to an ABLE account for which you are the designated beneficiary (beginning in 2018).

Roth IRA Case for Saving During Residency

Let’s say you are a married resident. Your partner does not work, and you make the average resident salary of $64,200. Subtracting the standard deduction for 2023 of $27,700 your MAGI would be $36,500. Since your MAGI is below the IRS threshold (shown below), you’d be able to receive a tax credit on 50% of your contributions.

Remember, a “credit” is a dollar-for-dollar reduction on your taxes. So, if you were set to receive a $1,000 refund, your tax refund would become $3,250 if you invested $6,500 into a Roth IRA.

For reference, here are the 2023 Saver’s Credit MAGI limits depending on your tax filing status:

Number 4: Behavioral Finance Part 1

The psychology of money is one of the more important reasons to save money during residency.

If you teach yourself to save a percentage of your take-home pay as a resident, then saving as an attending will be easier. It will not be a huge transition where you now no longer spend 100% of what you bring home.

I cannot overstate the importance of this. Building your financial muscles while making little money will only make it easier to continue to save once you are further along in your career.

Most people take that huge pay bump as an attending physician and spend it. Because you have learned how to save during residency, you’ll keep saving as an attending. It’s part of life.

Number 5: Behavioral Finance Part 2

This will also teach you to pay your future self first, which is one of the most important principles in personal finance.

The idea is that you make sure to complete your savings goal first before you ever see it in your bank account. Your savings is “swept” out of your paycheck before you ever see it. This way, it is out of sight, out of mind.

Otherwise, you’ll spend every dime.

Trust me when I say that if you spend all that you earn now, you are likely to do the same when you start earning “the big bucks”. It’s the same phenomenon that happens in sports. People spend what they see in their checking account.

Number 6. Roth contributions are not as valuable as an attending physician

You will not be able to contribute to a Roth IRA when you are an attending in a standard fashion. You will have to perform a Backdoor Roth IRA. While this is perfectly acceptable, it has some added steps.

This will be straightforward for you, because you will already have a Roth IRA by this point. Just open a traditional account, put money in, and then convert it to your Roth. Done.

Also, Roth contributions are more valuable in lower-income earning years. The reason is that you put this money into the Roth account likely at a lower tax bracket than when you take it out in retirement. This makes Roth the vehicle of choice during non-peak earning years.

Note: A common mnemonic is that Residents should prefer Roth (R = R) investments and those in Peak-earning years should prefer Pre-tax investments (P = P). The reason is due to what you expect your taxes to be during retirement. As a resident, they are likely lower than retirement – so pay the tax now. In your peak earning years, the opposite is true.

Take Home: Should I Invest in Residency?

Investing in residency is really important.

Whether you are taking advantage of the tax break from a TIRA or the credit earned by performing a Roth IRA contribution, time in the market is paramount to investing success.

If you don’t get matching from your employer, pick a good investment company and open up a Roth IRA. Pick a diversified low-cost index fund (a target date fund is often good enough) and get back to your training. Don’t think twice about it.

If you were, like me, completely oblivious to this stuff as a resident and you are now an attending, don’t sweat it. The best day to start investing is yesterday; today is a close second.

I really wish I came across this advice when I was a resident. I truly regret not taking advantage of all that ROTH space I had available to me. The contributed money would have been taxed at likely the lowest rate I would ever see until I retire and then allowed to grow tax free for as long as I wanted.

You are right that there is a mentality that you can just do it later when you make more money but skipping ROTH during residency is a hard one to make up for as, like you mentioned, even backdoor Roths come with a higher price tag, mainly a higher tax bracket bite.

Yeah, I didn’t take advantage either. A lot of my writing is a “do what I say, not what I did”… Because no one taught me differently.

I want that to be different for our future physicians and medical professionals.

I was very lucky to get second hand advice (a father advised his son, who was my co-intern) to save for retirement in residency. It’s hard to look back now, because of several years of Backdoor IRA contributions, but it looks like those residency contributions are now worth 5x what I put in.

Good advice is good advice. Regardless of where it comes from. Glad that you were fortunate enough to be in that situation!

If I wrote the blog post…I would have to title this,”things I wish I did in residency and (if you are in residency) you should do them too”. Nice post!

Haha… probably should have been the title for mine, too.

I remember the resident salary being pretty low. Think the hardest part was having the discipline to invest. Being young, there are a lot of wants (instead of needs) that we see. Especially when you don’t have kids yet. We spent a lot of money on food and entertainment at the time. Good reminder post!

Thanks!

We were the same way. We spent money on a lot of unnecessary stuff. At the time, we didn’t know any better. Trying to fix that problem for others going forward.

Can you expand a bit on what you comment in regards for those pursuing PSLF? If we are considering PSLF should we not put our money in an IRA?

If pursuing PSLF, your goal is to maximize your forgiveness and to minimize the money you pay back (because it will be forgiven).

So, you should absolutely consider putting extra money into a Roth IRA if you plan on pursuing PSLF.

TPP

Great advice. I agree that perhaps the behavioral aspect is the most important. I am midway through my PGY2 year and am currently saving pretty aggressively by maxing out a HSA and contributing to a Roth 457(b). One thing that really aggravates me is that residents are often exempt from employer matching into retirement accounts (at least at the two hospitals I have been a resident and many others I have looked at). Matching might help convince more residents to save. Anyhow, I currently have around $30k in retirement savings and hope to have around $75k by the end of my residency assuming decent market returns for the next few years (certainly no guarantee of that!). Perhaps not a huge chunk compared to what an attending will/can save, but I’m certain that my future self will benefit a lot from a little sacrificing here and there now.

Don’t diminish your amazing accomplishment! That’s truly impressive as a resident. You should be proud.

As for resident matching, we have the same issue where I work. It seems that it has something to do with staff status and “forcing” residents to contribute when they don’t “make much”. I think it is lost on many that the resident income is the median income for our country. This may be something I attack in the future as my personal finance curriculum gets bigger, which may provide more of an opportunity to make this change for my residents. Time will tell.

Keep setting a great example!

TPP