What is Timing the Market?

“Did you see that the S&P500 dropped over 10% last week? I think I’m going to go to cash until this thing settles out! I’m selling everything.” Or, maybe you’ve heard people say something like this, “Hey, I found this new stock. It’s dropped 20%, because of XYZ. Surely, that’s the bottom, though. The stock price definitely come back up. I talked to my financial guy, and I’m going to buy $10,000 of that stock.” These are examples of attmpting to time the market, which is when people try to buy low and sell high. When the market hits the next bottom, they “time” the market and purchase stocks on sale. When the market rises to great heights (and before it comes tumbling back down), they then time the market again and sell those assets for a pretty penny. It’s simple, right? No, it’s not. Here are 5 reasons that timing the market is financially stupid. In order to do this, you have to know when the market has reached the next peak or valley. The idea may be simple, but unfortunately, my crystal ball is broken from my last trip to Vegas when it didn’t work there either. I bet your crystal ball (and the one that all of the media talking heads use) is broken, too.1. You Have To Time the Market Twice (Over and Over)

You have to time the buy and the sell. Given that corrections (a drop of 10% from the recent high) happen every 1.5 years on average, you’ll have to continue to get these two time points right. Over and over again. No one can do that. As J.L. Collins puts it in his book “The Simple Path to Wealth”“Nobody can [time the market]. Not really. Not in any consistently useful way. Believing in Santa Claus is more profitable. Breeding unicorns is more likely.” ~JL CollinsCollins goes on to say that if this could actually be done, then someone out there (the person with the mystical ability to time the market) would be far richer than Warren Buffet. This is hard to swallow, becuase the idea of being able to time the market would be that lucrative. This potential success makes it appealing. It’s sexy. Yet, it’s also not possible.

2. Missing the Best Days is Really Bad

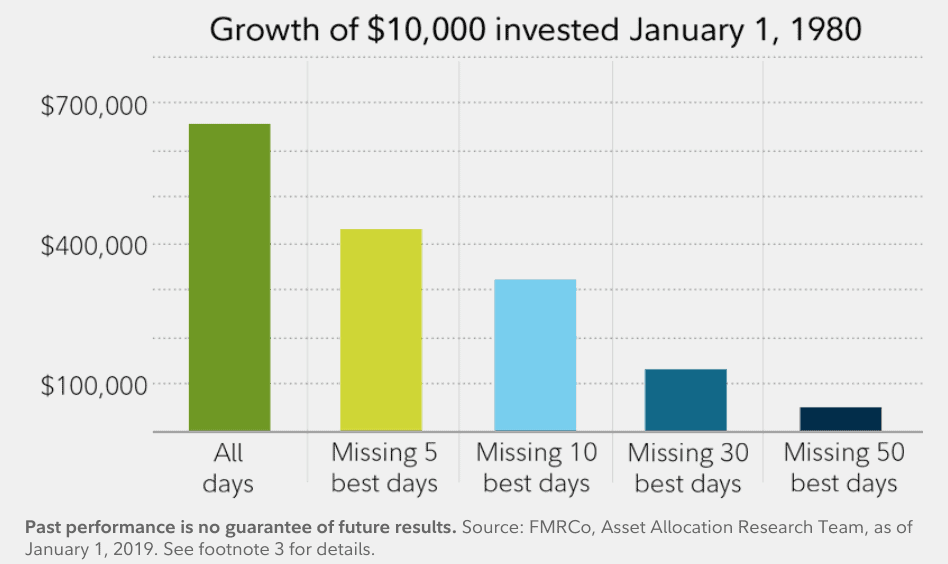

This is likely the most important reason that timing the market is a fool’s errand. During the period where you have cash on the side waiting to time the market, you may miss some of the best investment days. Missing five or ten of the best days cannot be that important, though, right? Let’s look at some examples of what happens when you miss a cerain number of the “best” days in the market. This research from Fidelity shows how big of an impact it can be: This research on missing the best days in the market has been performed many times over. If you don’t like Fidelity’s example, check out others, too. Here are two other examples from Business Insider and Marketwatch.

Regardless of the source of the research, the point remains the same: accrued time in the market is a MUCH better idea than timing the market.

Actually, staying the course with your investing plan may prove to be the most important investing principle. In fact – as long as you have a reasonable asset allocation – the amount of time in the market (note: not “timing” the market) and staying the course are likely more important than which index fund portfolio you choose.

This research on missing the best days in the market has been performed many times over. If you don’t like Fidelity’s example, check out others, too. Here are two other examples from Business Insider and Marketwatch.

Regardless of the source of the research, the point remains the same: accrued time in the market is a MUCH better idea than timing the market.

Actually, staying the course with your investing plan may prove to be the most important investing principle. In fact – as long as you have a reasonable asset allocation – the amount of time in the market (note: not “timing” the market) and staying the course are likely more important than which index fund portfolio you choose.

3. Market Timing Takes More Time (and doesn’t work anyway)

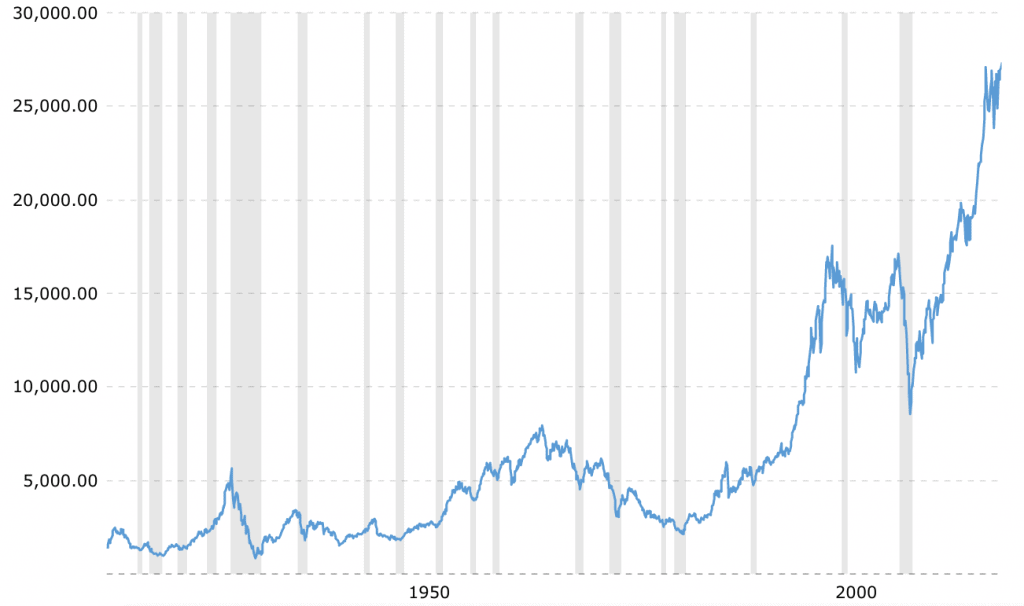

With the relentless upward trend of the market, people have been calling for a bear market for years now. The talking heads on major news networks talk about the overvaluation of stocks, and say “it is just a matter of time”. Of course, when they get it wrong, everyone forgets and moves on to their next talking head. When someone finally gets it right, they get all of the attention. Regardless, the focus on valuations, picking stocks, and timing the market… all consume time. Instead, if you automatically invested in index funds and ignored the market, you would end up better off down the road. [Particularly if you are early in your investment career (read: the accumulation phase).] And, it would take much less time! If you don’t believe me, look at the trend of the Dow Jones over the last 100 years (inflation adjusted): At any one of those recessions (1929, 2000, 2008/2009), if you had jumped out of the market in order to time things on the way back up, you would have missed the opportunity to “buy stocks on sale” and to see their value climb as the market began it’s assent. Since your crystal ball is as broken as mine, you likely would’t have gotten this right anyway (see point 1 above).

This all results in more work, and a lower rate of success.

An automatic and passive investing process takes less time. And it will do better in the end. This is one of those rare opportunities in life where you really can work smarter instead of harder by avoiding timing the market.

At any one of those recessions (1929, 2000, 2008/2009), if you had jumped out of the market in order to time things on the way back up, you would have missed the opportunity to “buy stocks on sale” and to see their value climb as the market began it’s assent. Since your crystal ball is as broken as mine, you likely would’t have gotten this right anyway (see point 1 above).

This all results in more work, and a lower rate of success.

An automatic and passive investing process takes less time. And it will do better in the end. This is one of those rare opportunities in life where you really can work smarter instead of harder by avoiding timing the market.

4. Timing the Market Encourages Bad Behaviors

Long time readers will know that how we think about money is much more important than knowing the “what to do” portion of money management. And, when it comes to behavioral finance, timing the market encourages several bad habits. First, timing the market means you must pay more attention to the market. Inevitably, this will lead you to check your investments more often. And studies suggest that checking your portfolio more often leads to worse results, because you are more likely to make a change and get worse returns in the long run (hint: staying the course wins again). Second, attempting to time the market encourages you to speculate with emotional decisions. In a world where the best investors are those who can keep a logical head about them when the market is making no sense, investing with our emotions is a surefire way to lose money. How will you handle the next recession or bear market if you think you are a great market timer? Probably not nearly as good as you think. And you are working with broken information anyway…5. Stock Markets are Not Logical

When an oil tanker sinks as a result of a freak accident and kills a lot of birds, this can drive down the price of a company’s stock. Even if the oil is just as good as it ever was, the CEO is strong, and their P/E ratio is solid…the stock price may still slide. The truth is that stock prices fluctuate from completely unrelated events like presidential elections, seasons, and natural disasters. You can’t predict these events any better than you can predict the superbowl winner each year (remember, even the New York Giants have won two recent super bowls despite being big underdogs!). You could rely on technial analysis and reading charts, but this has been shown to be a bunch of hogwash, too. Whether you are reading patterns or using your common sese, just because you can make logical sense of your decision to buy or sell does not mean that it will pan out in the end. Timing the market assumes that you can make accurate predictions, which just doesn’t happen consistently enough to make it worth it. If you want to gamble, just go waste some cash in Vegas.Take Home: Timing the Market

It turns out that timing the market is not only impossible, but it is a fool’s errand. Unfortunately, there are people who will fight this ideology vehemently. Whether timing the market or gambling in Vegas, winning feels good. However, if you want to win at investing, you need to simply stay the course with a passive index fund investment strategy. It’s simple, boring, and wildly successful for all of the reasons mentioned above.Have you ever been tempted to time the market? Do you think you have the mystical powers to time the market (why are you still working, then)? Leave a comment below.

Proper investing is boring. Timing the market takes it to speculating/gambling. Granted it feels good when you do get a certain stock right but most of the time you come out behind. People often brag about their great picks but rarely discuss their misses so it sort of propagates the misconception that timing is the way to go.

Agree 100%