When the stock market hiccups, as it is known to do from time to time, you may have one of several common reactions.

The stock market is volatile, and it’s not unusual to see downward swings of 5% to 10% in a few days’ time. While seeing several years’ worth of spending erased from your balance sheet is less than awesome, you’re invested for the long haul.

I’m always looking for a silver lining, and I found one in not only having the ability to tax loss harvest a recent investment, but also in capturing the screen shots to share with my audience.

I have previously written about how I used tax loss harvesting to

, but this post represents the first time I had the forethought to save the images each step of the way. Note: This article was originally published in February of 2018 and was updated in December of 2018.

TLH is a way to capture a “paper loss” by selling an asset that has declined in value and subsequently purchasing a similar asset to avoid locking in an actual loss.

, also commonly referred to as a non-qualified brokerage account or simply brokerage account.

Note: it is not required that you purchase a similar fund. You can also choose to allow that money to sit out of the market for 31 days and buy back the fund you sold or you can invest in something completely different right away.

However, by waiting, you may miss out on a quick rebound and by investing in something unrelated, you’re altering your asset allocation. It’s best to

and stick with it.

In tax-advantaged retirement accounts, such as an IRA, 401(k), 403(b) or similar accounts, there are no tax implications when buying and selling within the account, and you cannot tax loss harvest to your benefit.

The amount of any tax loss harvested in a taxable account will first be used to offset any capital gains (if any) taken in the same calendar year. Remaining losses will be deducted from ordinary income when you file your income taxes, up to $3,000 per year, resulting in savings of $1,000 to $1,400 for the typical high-income professional.

Note: The $3,000 deduction can be taken by single filers and by married couples filing jointly. If you are married filing separately, the annual deduction can be up to $1,500 per return.

If Uncle Sam is willing to give me $1,000 or more per year for deciding to swap some shares of a Total Stock Market Fund for the S&P 500 index every once in a while, I’ll gladly take them up on that offer time and time again.

If “paper losses” exceed $3,000 in any given year, the excess losses can be carried over to subsequent years. In 2016, a year in which the market actually saw a double-digit gain, I tallied over $50,000 in losses early in the year, giving me over 15 years worth of $3,000 deductions from 2016 alone.

A handful of timely transactions in prior years have saved me thousands of dollars already. I also harvested about $30,000 in losses in 2015 and over $150,000 thus far in 2020, and those savings have the potential to continue to save me $1,300 or so per year for many decades as long as my income keeps me in the upper tax brackets.

Carryover losses can also be used to offset capital gains in the future in the event that I’d like to sell some funds to access cash from my investments in a taxable account. Every dollar of capital gains that would normally be taxed is offset by a dollar in tax losses previously harvested.

TLH partners are assets that are similar (have a high correlation) but are not “substantially identical.” That last phrase belongs to the IRS, and it hasn’t been defined precisely, but conventional wisdom is that a fund following a different index is different enough.

Funds that follow the same index, but are offered by different companies (i.e. Schwab’s SWTSX & Fidelity’s FSTVX, both total stock market funds) would be considered by most to be substantially identical, and are not a wise choice as partners. Both mirror the Dow Jones Total US Stock Market Index.

Vanguard’s VTSAX, however, follows the CRSP Total US Stock Market Index. While the index is similar to the index mirrored by the Schwab and Fidelity funds, it could be argued they are not substantially identical and therefore one could exchange a Vanguard total stock market fund for one from Schwab or Fidelity (and vice versa). This ould perhaps be considered a gray area that the IRS has not offered guidance for.

A similar argument could be made for trading back and forth between any of these funds and Fidelity’s no-fee Total Market Index Fund, FZROX.

I would not consider the ETF version of the mutual fund you’re selling at a loss (or vice versa) to be a valid partner. Look for assets that are following different indices.

A good partner is not only at least a tiny bit different, but also one you would not mind holding indefinitely. If you’re going to exchange or trade into the fund, you should be comfortable with that asset rising in value and remaining in your account for years.

A fund with a substantially higher expense ratio would be a poor choice. I would also advise against trading a tax-efficient passive index fund for an actively managed fund that might spin off excessive capital gains. The tax consequences of holding such a fund long-term could negate the benefit of the tax loss harvesting.

The following are some decent trading partners. I’ve used Vanguard mutual funds and ETFs from the likes of Fidelity, Schwab, iShares, and others.

- Total Stock Market / S&P 500 / Large Cap Index

- Total International / All-World Ex-US / Developed Market

- Small Cap Index / Mid Cap Index / Extended Market

I’ve only traded in the first two categories, as I keep my small and mid cap funds in tax-advantaged accounts. I have gone one step further in the international category, trading developed markets for European and Pacific indexes. Frankly, I was happy to see those drop further so I could jump back into a total international fund later on, so I wouldn’t necessarily recommend such a move, as it violates the principle I mentioned above about only exchanging into funds you’d be comfortable owning forever.

Of course, if you’re feeling charitable, you could always consider donating unwanted or suboptimal funds to a donor advised fund if they do eventually experience significant gains.

You could also look at harvesting losses in municipal bond funds (you shouldn’t hold tax-inefficient non-muni bond funds in taxable), but those don’t experience the wild price swings that stocks do, so it’s unlikely you’d see meaningful opportunities to harvest sizable losses with bonds unless you have a huge bond balance.

Tax Loss Harvesting Dangers

Perhaps danger is a strong word, but there are plenty of ways to screw this up, which is why many investors don’t bother with it or rely on a

Betterment‘s algorithm to

do the tax loss harvesting for them.

But really, the worst you can do is negate the tax benefit of your efforts, and most mishaps only partially reduce the amount of the loss you’ll take (assuming you choose to report the mistake).

What you want to avoid in the 30-day window before and after tax loss harvesting is a wash sale. A wash sale is a purchase of identical or “substantially identical” replacement shares of an asset you sold at a loss during that 61-day (30 days before and 30 days after, plus the day of the sale) timeframe.

You also want to be sure your cost basis determination is not set to First In First Out or Average Cost in your taxable account. You want each lot to be recorded with the purchase price, and you want the ability to sell each purchased lot individually.

With Vanguard, you do this by selecting

Specific Identification (SpecId) as your cost basis for all funds held in a taxable account.

I suppose another “danger” is missing an opportunity to TLH. Waiting for a loss to get bigger can be a fool’s errand. It makes sense to have a threshold dollar amount at which you’ll consider harvesting a loss. Perhaps it’s $500 or $1,000. Once that threshold is crossed, I would seize the opportunity. If the asset class continues to drop, you can TLH again into a third partner within 30 days, or back into your original position beyond 30 days.

How to Avoid a Wash Sale

The simple answer is to avoid buying replacement shares a month before and after tax loss harvesting. It sounds simple enough, but there are several ways to unwittingly foul this up.

The most likely way to inadvertently create a wash sale is with automated new investments and automated dividend reinvestments. Let’s look at each of these individually.

Automated investments often take place in a tax-advantaged account like a 401(k), 403(b), 457(b), or SEP or SIMPLE IRA. While investments in these accounts may not be noticed by your taxable brokerage account or the IRS, it’s best to avoid any gray areas, even if the impetus to report them may be on you.

Note that replacement shares purchased in a spouse’s accounts can also trigger a wash sale. Whether your finances are separate or combined, you’ll each have your own tax-advantaged accounts, and the IRS looks at your accounts as being under one umbrella when it comes to tax loss harvesting and wash sales.

How do you avoid automatically investing into a substantially identical asset in a tax-advantaged account shortly before or after tax loss harvesting in a taxable account?

The simplest way is by investing in different asset classes in your tax-advantaged accounts.

I accomplish this by investing in small cap, mid cap, and emerging market stock indices in my tax-advantaged accounts, while investing in large cap and total international / developed markets in taxable. See

my portfolio for full details.

Such a strategy doesn’t jive well with a simpler

three-fund portfolio, but I feel the benefits of tax loss harvesting outweigh the benefits of simplicity. I also like optimizing, even if it’s at the expense of simplifying.

How do you avoid reinvesting into a substantially identical asset class after tax loss harvesting?

This is straightforward. Avoid

automatically reinvesting your dividends.

Manually reinvest them four times a year (or however often your receive dividends). You may want to set up a calendar reminder — I consistently receive dividends from Vanguard late March, June, September, and December.

I have my taxable mutual funds set up to send all dividends to a Vanguard money market fund. In the fourth week of months 3, 6, 9 and 12, I manually reinvest the dividends. If I have recently taken advantage of a tax loss harvesting opportunity, I don’t buy into the fund I just sold.

If you’re afraid you won’t notice the dividends hit your money market fund, have them sent to your checking account where you’ll be more likely to see them, and reinvest from there.

If you do accidentally goof this up and create a wash sale, it’s not a huge deal. When you invest or reinvest into a fund that you sold at a loss within 30 days, you’re most likely purchasing a smaller amount than you sold.

For example, if you sell 100 shares at a loss and you automatically invested or reinvested in 10 shares, you can still take the loss on 90 of those 100 shares. This is known as a partial wash sale. If you purchase 100 or more substantially identical shares within the 30-day window before or after capturing a loss by selling 100 shares, the tax benefit of your efforts is indeed eliminated.

I have my investments set up in a way that a wash sale is very unlikely, but one of my favorite Bogleheads who goes by the moniker

livesoft, the resident TLH guru, has intentionally created a wash sale as a public service. See

his tutorial on what not to do, and how to file the appropriate tax forms if you do end up with a wash sale despite your best efforts.

Tax Loss Harvesting with Screenshots

So what does this look like in practice? Like I’ve done with my

Backdoor Roth maneuvers, I took screenshots to make this as straightforward as possible.

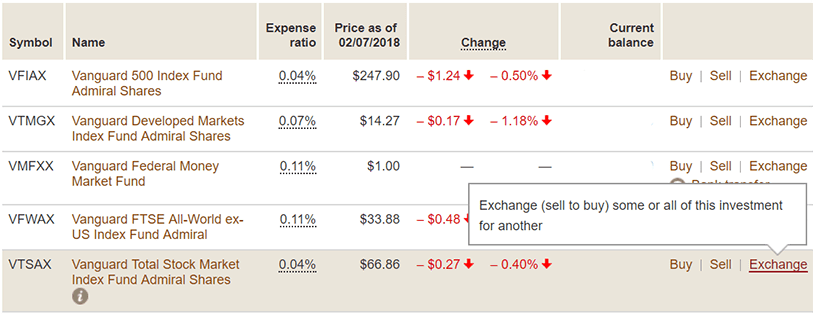

Step 1: Recognize a loss has occurred

You can’t harvest a loss that you don’t know about. I track my investments with

Personal Capital, and if you choose to do the same, you’ll help enhance this site’s

charitable mission.

I typically like to see a loss of at least $1,000, but TLH opportunities (for better or worse) were hard to come by for several years until March of 2020. This example came from a sharp drop after a relatively small investment, but I pulled the trigger to be able to capture the screen shots to share with you.

Note that I only held these shares for four trading days. Did I create a wash sale by selling shares of a mutual fund that I purchased a few days earlier, well within the 30-day window?

No. The shares I bought were not replacement shares for the ones I sold; they

were the ones I sold. If I had bought two lots and only sold one lot, then I’d have issues, but as long as you sell all shares purchased in the last 30 days, you won’t create a wash sale.

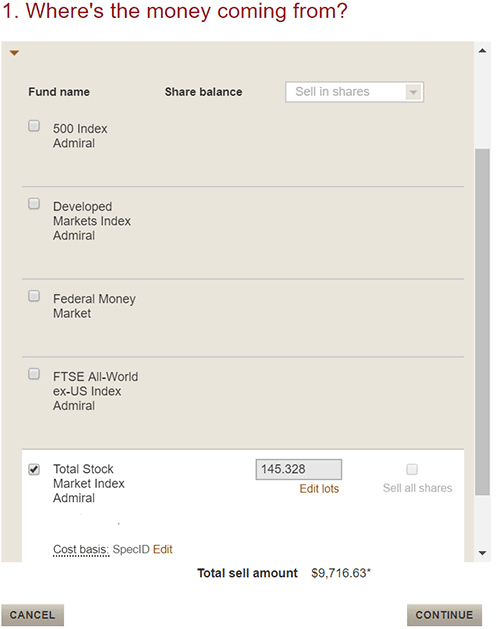

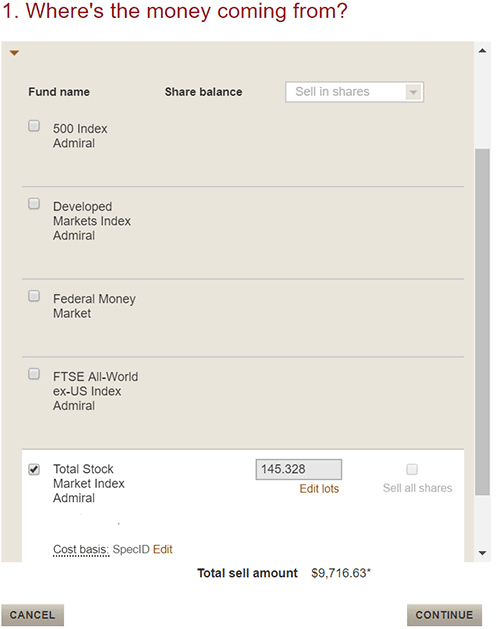

Step 2: Select the lot(s) to sell or exchange

Using mutual funds, I don’t have to bother with a settlement fund, and there’s no downtime where my money is not invested. I simply exchange from one mutual fund to another, and the swap takes place at the end of the trading day.

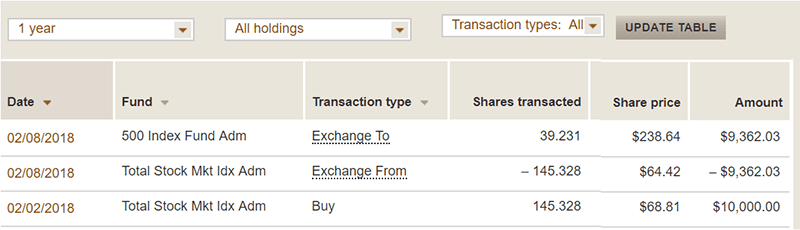

In this case, my $10,000 investment in Vanguard’s Total Market Stock Index (VTSAX) had lost a few hundred dollars in the first three trading days since I purchased the lot on February 2nd, and well into the fourth trading day, it was on track to lose a few hundred dollars more.

Taking advantage of this situation feels like being allowed to bet on the winner of a football game late in the fourth quarter when the home team’s up by three touchdowns. As long as the trade is entered before the market closes, the transaction will go through based on the closing price.

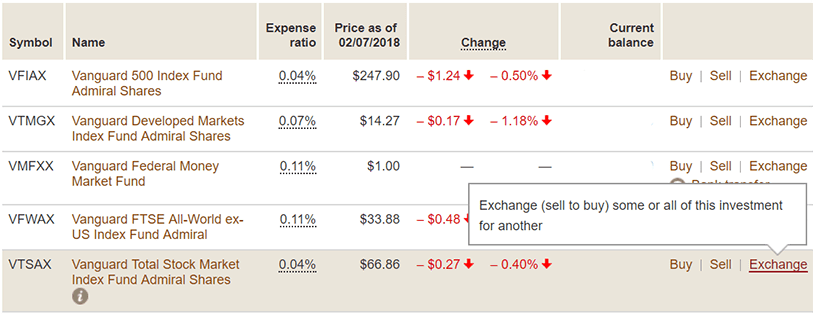

After logging into my taxable brokerage account at Vanguard, I click on “Exchange” in the mutual fund that has a loss.

I am then presented with a list of lots purchased, along with the gains or losses in each. Only the most recently purchased lot has a loss, and I select it.

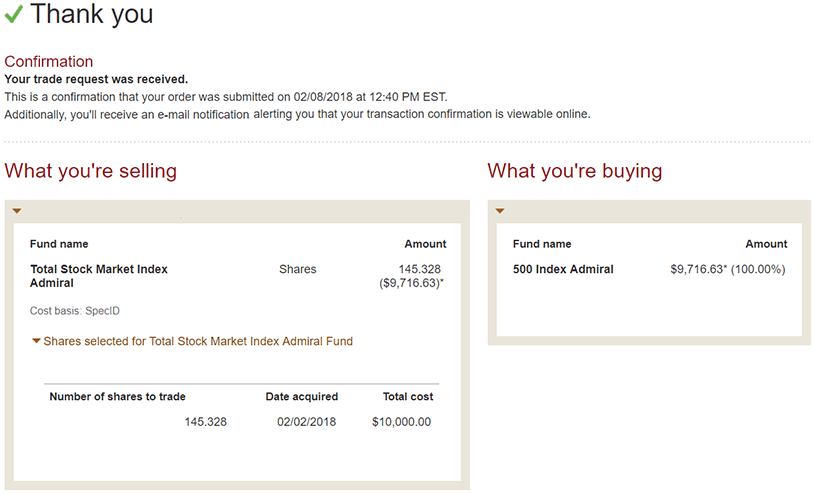

Step 3: Select the TLH Partner to Purchase

On the next screen, you’ll verify the fund you are selling on the left.

On the right, you’ll select the fund you’ll be purchasing with the proceeds of the sale you’re making at a loss. This will be your tax loss harvesting partner. If you don’t already own shares in the fund, you’ll be able to add it from this page. Each of the funds I own appear in the list, including my chosen TLH partner, the S&P 500 index fund.

Note that it looks like I’m only harvesting a loss of $283.37 ($10,000 – $9,716.63), but late in the trading day, the market was down another 4% or so, and I could count on a bigger loss barring a crazy last-minute Tom Brady-esque rally. Using ETFs, you could lock in the loss at the moment you choose to sell.

Step 4: Confirm the Tax Loss Harvest

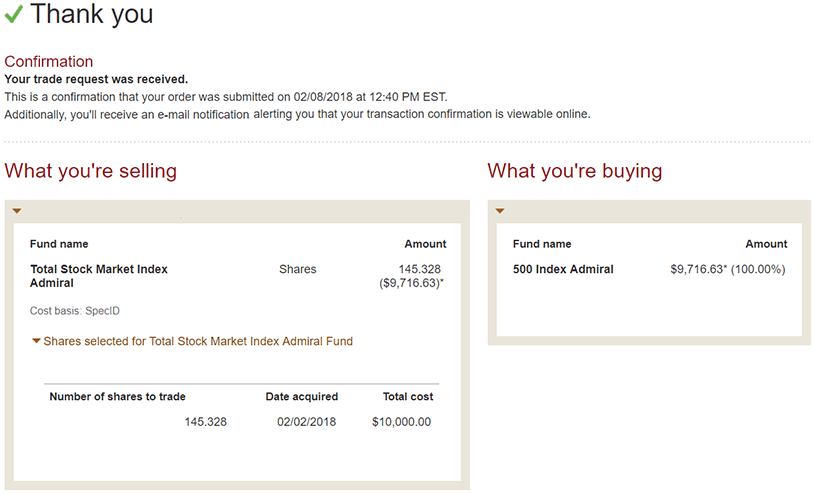

After pressing continue, you’re done. At that moment, you’ll be presented with a confirmation.

The amount you’re selling from one fund and buying into another is based on the prior day’s closing price and is not representative of the final trade. Hence, the asterisk.

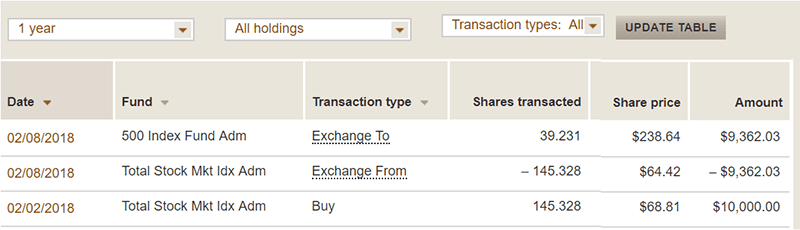

The next day, you can log in to see the true value of the paper loss you tax loss harvested.

The loss more than doubled in size from an estimated $283.37 to the actual

$637.97. I had a pretty good idea this would be the case, as the stock market was down big late in the trading day when I set up this exchange.

A day or two later, I received a confirmation of the trade, which is essentially the same information you see above in a different format, but with the closing price on the day you made the exchange, representing the true value of the paper loss.

Under “Notes:” I am told that Vanguard won’t let me buy back into this fund in the next 30 days to comply with their frequent-trading policy. That’s a good thing — the last thing I want to do is buy more VTSAX and create a wash sale. Vanguard is protecting me from making a bonehead move, and I appreciate that.

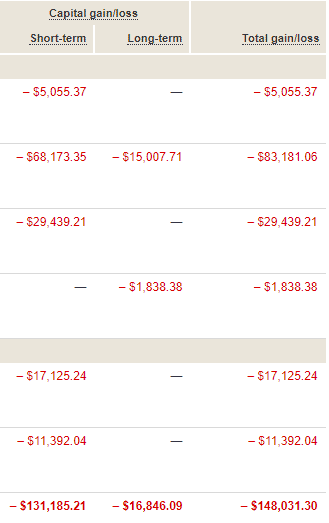

Tax Loss Harvesting Summary

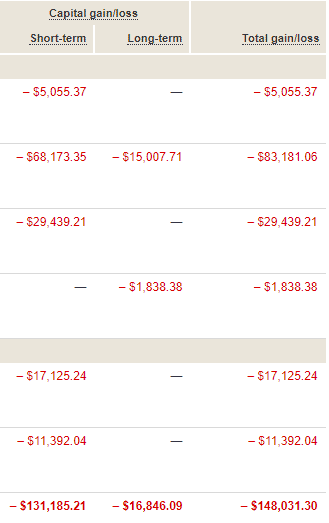

That’s all there is to it. Sell lot(s) that have lost money, buy something similar that’s not the same, and you’ll receive a 1099-B from your brokerage reporting a year’s worth of TLH efforts. Below is an excerpt of my Vanguard 1099-B from 2016 showing a total of

$45,449.15 in short-term losses and

$6,212.57 in long-term losses.

That saved me roughly $1,400 in taxes on my 2016 tax return, with another 16 years’ worth of carryover losses.

Note that you are not actually losing money when you tax loss harvest. You are selling one fund that has dropped in value and buying a similar (but not identical) fund that has similarly lost value. You are not out of the market for one minute when doing this with mutual funds. You are simply taking the loss against your tax burden and lowering your cost basis.

Over two weeks in March of 2020, I harvested an additional $148,000 in losses. While it would be better to have been out of the market completely rather than tax loss harvesting as the market plummeted, market performance can only be known in hindsight.

I’ll be using up a decent chunk of these harvested losses to offset gains from the sale of a microbrewery that I had invested in years ago. I also have some lakefront property for sale that could generate substantial long-term capital gains when sold. But now, I’ve got more than enough losses to offset those gains. Again, any leftover losses will be carried over to be used in future years and can offset $3,000 of ordinary income annually.

As daunting as the concept may at first seem, tax loss harvesting is not a difficult task. I hope I’ve made the benefits clear and the process approachable. For more tips on effective and simple tax loss harvesting, please read my

Top 5 Tax Loss Harvesting Tips.

If you happen to be a Fidelity user, I’ve got a step-by-step guide for you, as well.

Tax Loss Harvesting with Fidelity: A Step by Step Guide.

I hope you’ve learned enough to take advantage of this excellent and perfectly legal way to lower your tax burden. If you’d like to learn more from me, subscribe to receive my emails and I’ll send you a very useful spreadsheet to help you with your finances and help you reach financial independence!

I suppose another “danger” is missing an opportunity to TLH. Waiting for a loss to get bigger can be a fool’s errand. It makes sense to have a threshold dollar amount at which you’ll consider harvesting a loss. Perhaps it’s $500 or $1,000. Once that threshold is crossed, I would seize the opportunity. If the asset class continues to drop, you can TLH again into a third partner within 30 days, or back into your original position beyond 30 days.

I suppose another “danger” is missing an opportunity to TLH. Waiting for a loss to get bigger can be a fool’s errand. It makes sense to have a threshold dollar amount at which you’ll consider harvesting a loss. Perhaps it’s $500 or $1,000. Once that threshold is crossed, I would seize the opportunity. If the asset class continues to drop, you can TLH again into a third partner within 30 days, or back into your original position beyond 30 days.

After logging into my taxable brokerage account at Vanguard, I click on “Exchange” in the mutual fund that has a loss.

I am then presented with a list of lots purchased, along with the gains or losses in each. Only the most recently purchased lot has a loss, and I select it.

After logging into my taxable brokerage account at Vanguard, I click on “Exchange” in the mutual fund that has a loss.

I am then presented with a list of lots purchased, along with the gains or losses in each. Only the most recently purchased lot has a loss, and I select it.

On the right, you’ll select the fund you’ll be purchasing with the proceeds of the sale you’re making at a loss. This will be your tax loss harvesting partner. If you don’t already own shares in the fund, you’ll be able to add it from this page. Each of the funds I own appear in the list, including my chosen TLH partner, the S&P 500 index fund.

On the right, you’ll select the fund you’ll be purchasing with the proceeds of the sale you’re making at a loss. This will be your tax loss harvesting partner. If you don’t already own shares in the fund, you’ll be able to add it from this page. Each of the funds I own appear in the list, including my chosen TLH partner, the S&P 500 index fund.

Note that it looks like I’m only harvesting a loss of $283.37 ($10,000 – $9,716.63), but late in the trading day, the market was down another 4% or so, and I could count on a bigger loss barring a crazy last-minute Tom Brady-esque rally. Using ETFs, you could lock in the loss at the moment you choose to sell.

Note that it looks like I’m only harvesting a loss of $283.37 ($10,000 – $9,716.63), but late in the trading day, the market was down another 4% or so, and I could count on a bigger loss barring a crazy last-minute Tom Brady-esque rally. Using ETFs, you could lock in the loss at the moment you choose to sell.

The amount you’re selling from one fund and buying into another is based on the prior day’s closing price and is not representative of the final trade. Hence, the asterisk.

The next day, you can log in to see the true value of the paper loss you tax loss harvested.

The amount you’re selling from one fund and buying into another is based on the prior day’s closing price and is not representative of the final trade. Hence, the asterisk.

The next day, you can log in to see the true value of the paper loss you tax loss harvested.

The loss more than doubled in size from an estimated $283.37 to the actual $637.97. I had a pretty good idea this would be the case, as the stock market was down big late in the trading day when I set up this exchange.

A day or two later, I received a confirmation of the trade, which is essentially the same information you see above in a different format, but with the closing price on the day you made the exchange, representing the true value of the paper loss.

The loss more than doubled in size from an estimated $283.37 to the actual $637.97. I had a pretty good idea this would be the case, as the stock market was down big late in the trading day when I set up this exchange.

A day or two later, I received a confirmation of the trade, which is essentially the same information you see above in a different format, but with the closing price on the day you made the exchange, representing the true value of the paper loss.

Under “Notes:” I am told that Vanguard won’t let me buy back into this fund in the next 30 days to comply with their frequent-trading policy. That’s a good thing — the last thing I want to do is buy more VTSAX and create a wash sale. Vanguard is protecting me from making a bonehead move, and I appreciate that.

Under “Notes:” I am told that Vanguard won’t let me buy back into this fund in the next 30 days to comply with their frequent-trading policy. That’s a good thing — the last thing I want to do is buy more VTSAX and create a wash sale. Vanguard is protecting me from making a bonehead move, and I appreciate that.

Over two weeks in March of 2020, I harvested an additional $148,000 in losses. While it would be better to have been out of the market completely rather than tax loss harvesting as the market plummeted, market performance can only be known in hindsight.

Over two weeks in March of 2020, I harvested an additional $148,000 in losses. While it would be better to have been out of the market completely rather than tax loss harvesting as the market plummeted, market performance can only be known in hindsight.

I’ll be using up a decent chunk of these harvested losses to offset gains from the sale of a microbrewery that I had invested in years ago. I also have some lakefront property for sale that could generate substantial long-term capital gains when sold. But now, I’ve got more than enough losses to offset those gains. Again, any leftover losses will be carried over to be used in future years and can offset $3,000 of ordinary income annually.

As daunting as the concept may at first seem, tax loss harvesting is not a difficult task. I hope I’ve made the benefits clear and the process approachable. For more tips on effective and simple tax loss harvesting, please read my Top 5 Tax Loss Harvesting Tips.

If you happen to be a Fidelity user, I’ve got a step-by-step guide for you, as well. Tax Loss Harvesting with Fidelity: A Step by Step Guide.

I hope you’ve learned enough to take advantage of this excellent and perfectly legal way to lower your tax burden. If you’d like to learn more from me, subscribe to receive my emails and I’ll send you a very useful spreadsheet to help you with your finances and help you reach financial independence!

I’ll be using up a decent chunk of these harvested losses to offset gains from the sale of a microbrewery that I had invested in years ago. I also have some lakefront property for sale that could generate substantial long-term capital gains when sold. But now, I’ve got more than enough losses to offset those gains. Again, any leftover losses will be carried over to be used in future years and can offset $3,000 of ordinary income annually.

As daunting as the concept may at first seem, tax loss harvesting is not a difficult task. I hope I’ve made the benefits clear and the process approachable. For more tips on effective and simple tax loss harvesting, please read my Top 5 Tax Loss Harvesting Tips.

If you happen to be a Fidelity user, I’ve got a step-by-step guide for you, as well. Tax Loss Harvesting with Fidelity: A Step by Step Guide.

I hope you’ve learned enough to take advantage of this excellent and perfectly legal way to lower your tax burden. If you’d like to learn more from me, subscribe to receive my emails and I’ll send you a very useful spreadsheet to help you with your finances and help you reach financial independence!

That was great, thanks. Do you have a spreadsheet to keep track of total amount harvested, and amount used each year to offset gains or income? Is there an easy way to organize and track this over a long period of time?

Your tax return (IRS 1040) will have a capital loss carryover worksheet. That’s what you or your CPA will refer to in future years to continue to use those losses over the years.

Cheers!

-PoF