If you are reading this site, then you have likely come across other websites geared towards high income earners. One of the most common questions is this, “Should I Invest Pre-Tax or Roth for my 401k?”

The vast majority of them will tell you to invest your 401k/403b money in a traditional (pre-tax) manner. The reasons for this are many, but let me lay out the opposite argument before I tell you why I prefer a ROTH contribution to my 403B as a way for building wealth.

The Argument for Pre-tax contributions

People often recommend pre-tax (standard) contributions to your 401K for the following reason:

- Your investment money is taxed at the marginal tax rate (marginal tax rate = the percentage of tax you might pay with additional money placed into your account after deductions, credits, etc have been taken into account. If curious what this is, add $100 to your tax software and see how much it changes. For example: If it changes by $25.00 your marginal tax is 25%).

- When you withdraw your money it is at the effective tax rate (the average of your tax burden when all tax brackets have been incorporated)

- Therefore, if your marginal rate now is higher than your effective rate in retirement, you will save money on the taxes you pay when you take the money out in retirement that you placed via traditional (pre-tax) contributions.

- For most high income earners this is exactly the case. If nothing changes (big IF), your effective rate should be substantially lower in retirement than your marginal tax rate now.

- You can convert some of your money into a ROTH in early retirement as long as your annual income does not go over the limit.

- You can convert $11,000 per year into ROTH utilizing the backdoor ROTH method for you and your spouse. This allows for tax diversification.

- Political reasons: Some hold that the tax code may change and ROTH contributions, which have been promised to not be taxed may be taxed in the future.

More Recommendations for Pre-tax contributions

These are the general guidelines from the Bogelheads Wiki page:

- If your current marginal tax rate is 15% or less, prefer a Roth.[note 1]

- After determining your marginal tax rate, if you expect to have higher marginal rates than your current marginal rate for most of your career, prefer a Roth.

- If you will have a traditional account or a pension large enough to meet your expected retirement expenses (and you expect to take that pension shortly after retiring), prefer a Roth.[3]

- Otherwise, prefer a traditional account.

So, why do I put my money in my 403B via ROTH?

At the end of the day, if you are maxing out your 401k/403b, this is all academic to some extent, BUT your employer makes you click one box or the other.

So, why not think about it?

RMD and the Stretch Roth IRA

I plan to leave a legacy for my kids.

In addition to that, I plan to leave my estate, including a Stretch Roth IRA (explained below). This may be the biggest reason for me to invest in a ROTH. If all my investments were via the traditional (pre-tax) method, my kids would still have a required minimum distribution when they inherit my money, and it would be taxed.

What’s a required minimum distribution?

Glad you asked.

When you turn 70.5 you must make a required minimum distributions (RMD) from your accounts from any traditional (pre-tax) investments. This is dependent on a calculator to determine how much you owe, which is dependent on the amount in your account and your life expectancy. The more you have, the more you owe.

With a traditional (pre-tax account): When I die, my children would still owe RMD’s based on my pre-tax contributions.

I want my kids to be able to afford to spend as much time here as they like. Roth contributions will make this easier for them.

RMD’s Aren’t The Same for Everyone

However, RMD’s do not apply to ROTH money during my life, though, my kids would have to take them out, but…

There is a catch to this! RMD’s do not apply to the person who owned the Roth account (and died), but they do apply to the beneficiary (if it was not the spouse).

The person obtaining this then has two choices:

1) Take the money out over the next five years

2) Or do what is called by some the “Stretch Roth IRA” option. In this option the person takes the RMD’s that are required based on IRS calculations Tax-Free (remember, you’ve already paid the tax!) each year and whatever money is left in the account continues to grow tax-free because the tax was already paid when the original owner put the money in.

So, they get to take tax-free money and let the rest grow, you guessed it, tax free.

Now, if that’s not a sweet deal for an inheritance, I am not sure what is! Catch is that the decision must be made on December 31st of the year after the original owner died. If not, then the five year option is defaulted into and the money must be taken out.

One Additional note:

Many people retiring well have a large enough sum of pre-tax retirement savings that they are placed into higher tax brackets even in retirement by their RMD.

The larger the RMD, the higher the tax bracket you are placed into, the more tax you pay which renders your pre-tax contribution somewhat less useful compared to a Roth which won’t be taxed (and wouldn’t have been forced into the RMD anyway).

Tax diversification with an unpredictable future

At my place of employment I have vested money and matching money. So, of the $47,000 I can save through my job each year (this is my employer’s max currently), only $18k of that is from me as a Roth investment. The other $29,000 are pre-tax contributions from my employer. My wife’s contributions at her work (another $18000 into governmental 457 is not matched) are also pre-tax contributions.

Given that I do not plan to start taking part in the backdoor Roth until my medical school debt is paid off, this is my way of obtaining tax diversification. Of the $130,000 I know I will be investing (hope to invest more) over the next two years, $36,000 of that (or 27.7% of that) will be via Roth contributions.

So, regardless of what happens politically in the future (will taxes increase? Decrease? Will roth rules change?) I will have money on both sides of the equation.

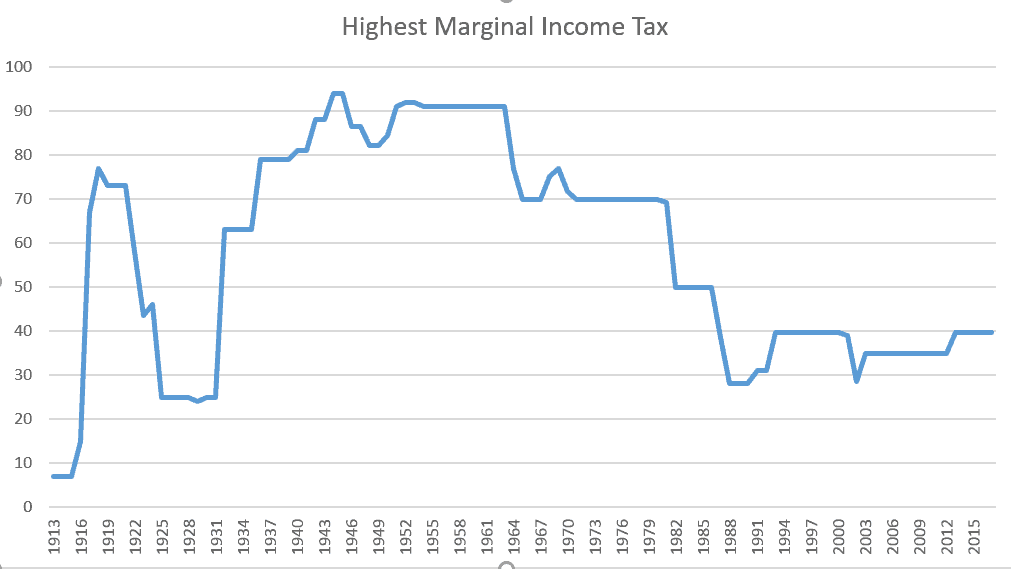

Highest Effective Tax Rate % on y-axis, year on x-axis. Though this is the highest tax rate, this serves to point out that we do not know what our tax rate will be 20 or 30 years from now. It has varied a lot.

Account Size

The larger your account size will ultimately be, the more beneficial Roth money ends up being. If between all of your accounts (403B, 457, solo401k, taxable account, social security) you have a substantial amount of money (say >$4,000,000 at age 71), then you will likely have money to leave behind when you die. The RMD at age 71 for an account of 4,000,000 is ~$146,000.

I plan on living on about $150,000 per year (post-tax money) at that point. So, this sets me up to where I want to be.

Larger contribution

Pre-tax contributions of $18,000 even at a later lower effective tax-rate (say 20% for this example) is really worth $14,000. If my account is substantially larger or political climates change as national debts continue to mount and my effective tax rate is high (say 35%) that $18,000 is really worth $11,700.

The Roth money I put into my account at $18,000 is worth the whole $18,000. I’ve already paid the piper, and won’t have to pay him again (unless, again, political turmoil results in over-taxation).

The point is that the Roth money is worth more compounding than my pre-tax money.

Roth Conversion

I can still convert other money at early retirement into Roth money and provide myself the benefit of everything mentioned above. This benefit doesn’t go away simply because I invest my portion of the 403B contribution via Roth. I can have my cake and eat it, too!

Should I Invest Pre-Tax Or ROTH for my 401k?

I think that if you are putting money away and maxing it out, you are doing a good thing. We often split hairs on this subject. Given that I am getting a pre-tax match from my employer a roth contribution makes more sense for me.

Does it make more sense for you, too? I am not sure. That’s up for you to determine.

Should I Invest Pre-Tax Or ROTH for my 401k? What do you think? Am I crazy for promoting Roth over traditional 403B contributions? Will you have enough to leave an inheritance?

TPP

Something else to consider. Roth Conversion money will be counted as income so in early retirement you need to get your conversions done by age 63 or your Medicare Part B and D premiums rapidly escalate.

That’s new to me. Haven’t gotten close enough to retirement yet to have crossed that bridge mentally! Good to know. Thanks for teaching me!

I dunno, TPP. I have to say I disagree with the premise that you’re withdrawing at your effective tax rate in retirement, rather than the marginal tax rate.

You’ll have other income streams (dividends, other passive income, social security eventually). Whatever amount you decide to withdraw or convert from the IRA / 401(k) (or are forced to take as an RMD) is taxed at the marginal tax rate.

For example, for married filing jointly, if you have $50,000 in passive income, you’re withdrawing from a pre-tax account at a 12% rate. If $165,000 in other income sources, you’re withdrawing at the 24% rate. If you exceed $315,000 in taxable income and take more from the pre-tax account, you’re now withdrawing at the 32% rate, and so on.

The only Roth contributions I make are via the Backdoor.

Best,

-PoF

I hear ya, POF. I think you are also a fan of ladder conversions for Roth in early retirement right? I think that’s a great idea.

I am going to cut back to 70% by mid 40s but probably work to 50. I think I’ll have a good 4 or 5 million by that point. If I only take out 2% that’s 80 to 100k per year. It’ll continue to grow.

I think the biggest reason I contribute Roth is that I really want to leave a stretch IRA for my kids and grandkids.

This year (starting 1/18) is my first full year at attending pay. Maybe I’ll change my mind, though I think with how much the new tax changes are going to save me, I probably won’t. Pure speculation, but I bet taxes are higher ten or twenty years from now given that the current plan runs out in 2025.

Also, I think this post is really good to highlight how a Roth is beneficial overall and the merits it has over pre tax contributions. If you can convert in early retirement, that’s awesome.