Budgeting has earned quite the bad wrap. It is often viewed negatively whereas “tracking spending” is viewed as the positive term. Today we will look into the top four false assumptions regarding budgeting, and discuss why it may be a necessary and beneficial endeavor.

However, before we go into the top five reasons we must first discuss two important thing:

1) Budgeting simply doesn’t work if you don’t have a goal in mind! It is necessary to set both short term and long term financial goals that allow you to keep your “eye on the prize” when it comes to budgeting. Otherwise, you will forget why you are doing what you are doing and budgeting will fail. You can find my goals in my Physician Philosopher Manifesto Post.

2) The goal of budgeting is to use the power it provides to allow you to know where your money is going. That way you can redirect it to allow you to spend money on things that bring you joy and wellness (investing being one of them!) and destroying debt.

False Assumption #1. Budgeting isn’t necessary for high-income earners!

This is the false assumption I always laugh at the most. It is, as if, high-income earners cease being human when they make a lot of money (what is that number by the way that qualifies as a high-income earner?). The tendency to spend too much and to not track your spending goes away the more money you make, right? The answer is no.

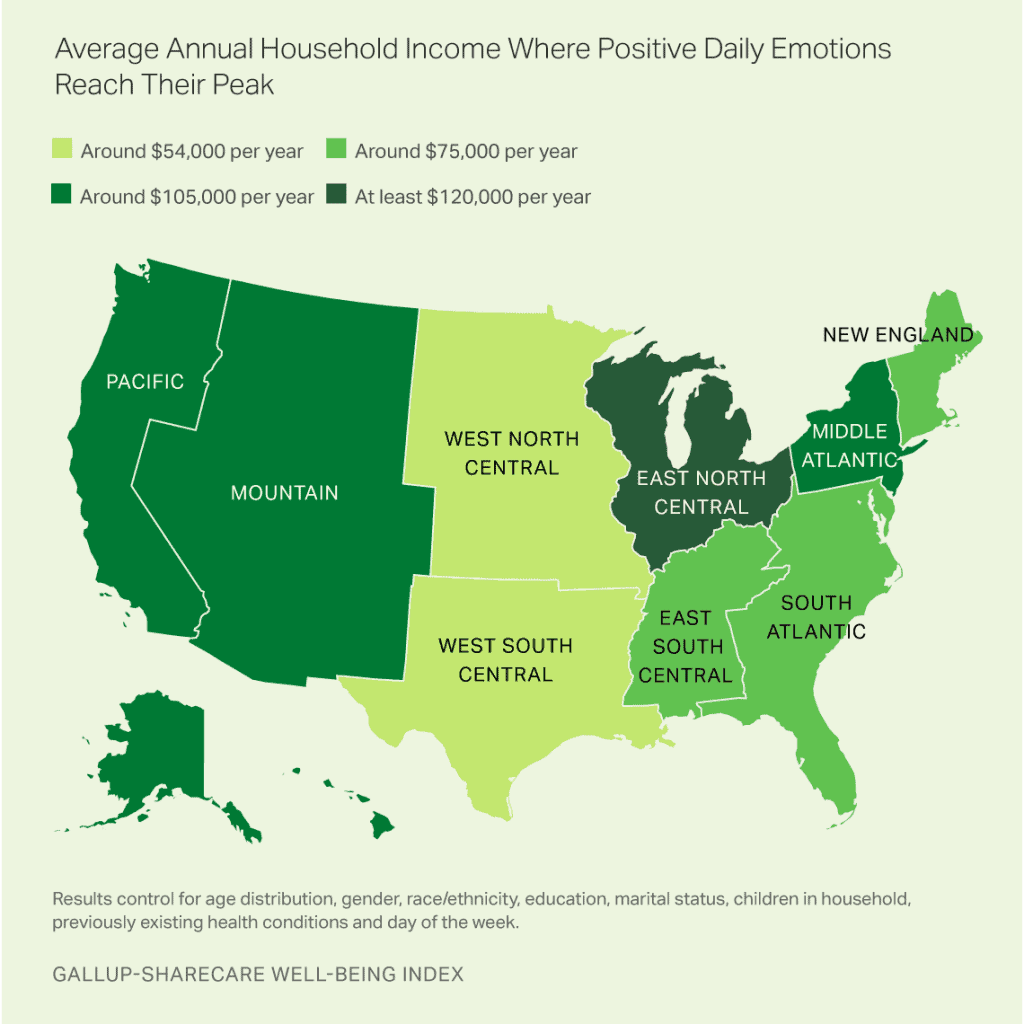

Interestingly, humans are going to be human no matter how much they make. For example, a recent Gallup poll showed that income was linked to happiness, but in most regions your happiness didn’t increase above a certain income level once basic needs were met. What was that number? Check out the following map based on where you live:

The point is that humans are human, even if they make a substantially higher income. If budgeting is helpful in obtaining financial goals at lower income levels, it certainly can be helpful at higher income levels, too!

False Assumption #2. It takes too long!

I will concede on this one! There is some upfront work required in budgeting, but fortunately with online software, such as MINT.com or personal capital this takes much less time. This is an easy three step process, though:

- The easiest way to start out is to just sign up for mint and set up all of your accounts.

- For the next two months, simply spend the way that you normally do and check in once per week to make sure everything is categorized appropriately (restaurant food goes into restaurant food and not groceries, etc). For the most part, MINT does a pretty good job of sorting things out using the software.

- After you’ve tracked your spending for a couple of months, then you should sit down with your family and discuss the budget. Tracking your spending this way can be eye opening! It was for us. We found out we spend a substantial amount of money on Amazon shopping without thinking. Apparently that “one-click” purchasing does have a psychological effect!

Once you’ve allowed two months of tracked spending and set your budget, you only need to check in once per month to make sure you are heading the right direction. Of course, you can check more often, but this isn’t necessary!

Follow our TPP three step process, and it doesn’t take long after that!

False Assumption #3. Budgeting is like dieting, it just doesn’t work for long!

This is simply not true. Budgeting is less like dieting and more like exercising. The more you use the muscle, the more it grows. The more you are able to say no to unnecessary spending, the easier that becomes! Budgeting allows you to diagnose the problem so that you can apply the appropriate treatment.

Once you’ve gone through the three step process above in setting up your budgeting account, it only really involves the occasional check-in once or twice per month to maintain. However, the muscle it builds daily when you decide to walk to the physician lounge for the free coffee from the Keurig instead of going to Starbucks can become impressive.

So, while I am a full on advocate of being moderately frugal, I also recognize that when you save $500 per month on unnecessary spending that does not provide wellness, this money will build and allow you to save more aggressively or destroy debt!

Flex that budgeting muscle so you can spend money on things that build wellness and on destroying debt!

False Assumption #4. You can’t have any fun while you budget, its a downer!

Budgeting can initially be a downer as you see how much money you are spending. It is absolutely vital to have constructive conversations with your family! It does not need to turn into, “You spent $50 on THIS!” You have to come together, realize everyone is human, and we all have work to do!

That said, it is a downer initially. It can also seem like there is not any hope at first while you watch yourselves over the past two months hemorrhage money, but as your budgeting muscles build you will notice gains over the next few months!

The TPP Challenge!

- Spend the first two months tracking spending.

- Set your budget.

- Spend the next four months adjusting and making changes.

- At the end of six months, reassess where you’re at and tell me if you aren’t surprised at the progress being made!

After you take the TPP Budgeting Challenge, let me know if you aren’t producing wellness along with your wealth as you choose where your money goes instead of haphazardly spending every dime you make!

What do you think? Do you budget? Do you think its a waste of time? Some advocate for “tracking spending,” are you in that camp? How does it differ?

TPP

Mint is essential. I use one credit card and one bank account. The credit card pays 2% cash back so I use it virtually 100% of the time and pay it off every month. The few things I write checks for come out of the other account. Before I retired my pay was also deposited. I think it’s closer to 6 months to get a real handle on spending since many things don’t run on a month to month schedule.

An investment account aggregator like Personal Capital is also essential. This program keeps track of investment accounts which will tend to multiply over time. We have 10 investment accounts both pre tax and post tax and you simply can not analyze your portfolio without everything laid out before you. THIS IS THE MOST IMPORTANT ADVICE I HAVE. Understanding your investments are the flip side of budgeting. Every dollar that is not either earmarked for some budgetary or debt service need MUST be put in the market. The power of investing is compounding and money put in earliest compounds the most.

Play with this FV calculator over 10 20 30 and 40 year horizons and you will soon understand http://www.calculator.net/future-value-calculator.html. Mint and Personal Capital give strong impetus to keep money invested as soon as possible. Investing in an IRA is fine but also Roth IRA and post tax investing are important so if you max out the 401K the Roth and the MSA put some money into BRK.B in a post tax account. BRK.B is essentially invisible to taxes until you sell it. Learn how to tax loss harvest in the post tax account. It is another form of budgeting since LT cap loss can be mixed with cap gains for a zero dollar tax bill. Consider opening a UGTM for your kid. Another form of budgeting. I opened one for my kids at age 3 and have used it to fund their lives throughout college. It pays for plane trips home cameras clothes computers cars without affecting my cash flow at all. Once again the power of compounding is the trick.

If you want to become wealthy you must budget IMHO

Cheers from another Gasman.

Gasem, I think you are spot on. Budgeting and tracking spending are vital tools to help make sure we are actually heading for (and achieving) our financial goals!

I have not opened a UGMA account, but I am working on the 529 for my three kids. As debt gets paid down and I have some more money available, I’ll likely be more aggressive and may look into alternative investments for them.

I completely agree with the six month window to really see how your finances are doing, particularly after training. I remember worrying after the first month because we weren’t right where we wanted to be. After four to six months, the picture cleared up and we are now heading towards exactly where we want to be heading.

Thanks for the comments!

I never budgeted but reached FI at a pretty early age. That said, I think most Americans need to budget. I was just blessed with behavioral traits and discipline that allowed me to succeed without it. That could sound like bragging but it was more likely luck.

Probably not. I work in frameworks and rules. For example, I respond to all comments as quickly as possible. Partly because it is good to engage people who were kind enough to read my posts as quickly as possible to say “thanks!”

Also because I have a horrendous memory to remember doing things a lot of the time. So if I respond now, I won’t forget 🙂

Budgeting is similar for me. It provides a framework in which to work. I don’t always depend on it to make decisions, but it does provide a guard rail for me so I don’t go off the tracks.

I’m a tracker, not a budgeter. Sorry.

The map does leave me confused, though. How does $54,000 in Minnesota make one equally as happy as $120,000 in Michigan? I’ve lived in both and I can assure you that Minnesota is more affluent, and Wikipedia bears that out (MN #12 and MI #33 in income).

Maybe it’s Chicago being included that skews the data, or maybe we’re just generally happier west of Wisconsin?

Cheers!

-PoF

I actually think tracking spending is just fine and just as good as budgeting. This post is more a defense for those of us who do budget. I also think that it is more natural to budget and then transition to tracking spending than to just jump right into tracking. Either is fine, in my opinion, though. I just don’t think budgeting deserves the bad wrap it gets sometimes.

Ill have to go back and look at how the data was gathered, but based on the clean lines on the map I bet it was done by region. So north and south dakota may have weighed down the number compared to Minnesota. I think it’s just a result of where they defined their regions.

Thanks for the comment, POF.