Teaching doctors how to live life on their terms through money and mindset

with Best-Selling Author and Podcaster –

Jimmy Turner, MD

Teaching doctors how to live life on their terms through money and mindset

with Jimmy Turner, MD

Are you living the dream? Or do you feel stuck or trapped in medicine?

As physicians, we sacrifice ourselves for the greater good. But at some point, we realize that when we say “Yes” to the committees, book-chapters, meetings, late nights, and leadership tasks, we’re saying “No” to our families and work-life balance. It doesn’t have to be this way.

Get Your Time Back

Overwhelmed by your personal and professional responsibilities? My free guide ‘5 Steps to Get Your Time Back: A Doctor’s Guide to Defeating Overwhelm ‘ can help.

Start a Side-Gig

Have you thought about creating a non-clinical income side-gig? My free guide ‘The ultimate guide to online physician income’ will help you expand your income options.

AS SEEN IN

I’m Jimmy Turner, MD.

A practicing anesthesiologist, physician entrepreneur, and coach for doctors.

As a physician, husband, father, and entrepreneur, I know what it’s like to feel like there is never time to take a deep breath and end up on the road to burnout.

I felt undervalued, unappreciated, and trapped. I was stuck in medicine.

But rather than step back and find balance in my personal and professional life, I carried on, sure that my ‘next’ accomplishment would get me off the road to burnout and make me happy.

I couldn’t have been more wrong.

Through coaching, I regained power and control over my thoughts. Then, I created the financial freedom I needed to find fulfillment and balance in my life. I even rediscovered a love for medicine. Now I help other doctors do the same.

Get the help you need

Whether you are looking for financial education or coaching,

we’ve got you covered:

The comprehensive financial platform doctors can trust.

Determined Physician Coaching will help you achieve real fulfillment

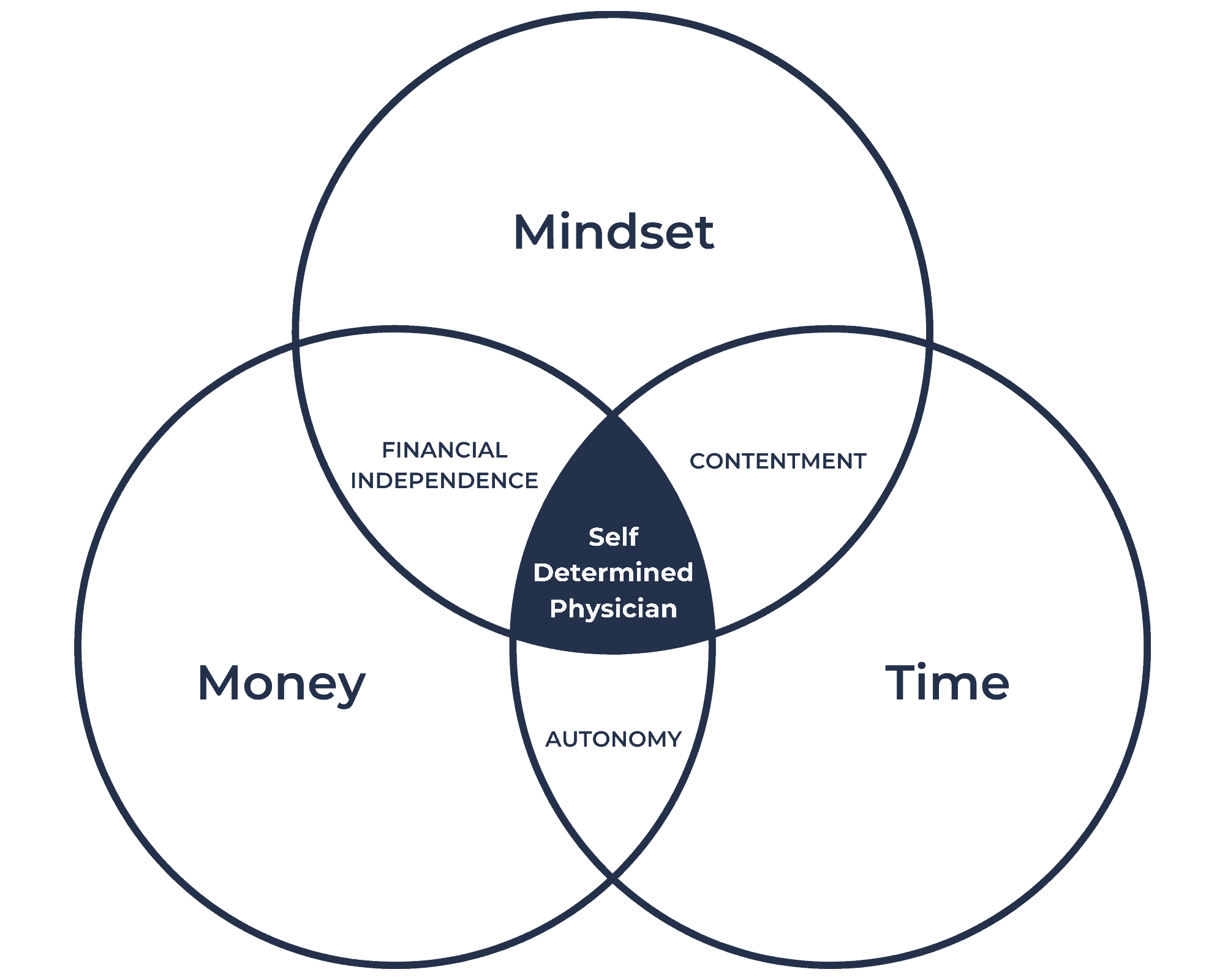

Fulfilment isn’t a pipe dream. It’s a state of being that we help physicians (just like you) achieve every day.

A Fulfilled Physician lives life on their terms and wakes up every day living the dream and enjoying the journey.

They practice medicine as much or as little as they want. Their journey is powered by financial freedom through non-clinical income and a healthy savings rate. When they do practice medicine, they do it with contentment in their heart and control over their thoughts. They live a life of abundance and growth where Imposter Syndrome and Burnout have been defeated.

What people say

“I am so glad I that I took the leap because it has been a truly transformational experience!”

Dr. Michael Runyon, MD

Emergency Medicine

Family Medicine

“Jimmy could charge 3 to 4 times the amount and it would still be worth it. This will undoubtedly buy extra years in my career.”

Pediatrics

Podcasts

An uncurated and unapologetic look into physician life.

The personal finance topics you wish you’d learned in medical school.

Recommended tools

Only the best of the best make the list of recommendations specific to a Physician’s needs.

Do you need disability insurance? (The answer is "yes")

I only recommend a small number of insurance agents – the ones that, as a physician, you can actually trust.

Do you want the 9-step process to creating financial freedom?

Make sure to check out Medical Degree Financial University!

Latest podcasts & articles

Check out my latest physician-focused coaching podcasts and articles – made with you in mind.

TPP #69: Money and Mindset with the Prudent Plastic Surgeon

In this episode, the Prudent Plastic Surgeon and I discuss money and mindset. We dive into his burnout experience following his fellowship, how his mindset shifted when he established a financial plan, and his equation for reaching nearly $1 million in assets. After all, money is a double-edged sword. It can be used as a weapon to bludgeon you into submission or to provide great freedom in your life.

Money Mistakes Doctors Make

Let’s be honest… we all love learning from other people’s financial mistakes. It is like a slow-motion car accident. You just can’t take your eyes away. Money mistakes are going to happen, and we are going to discuss a few common financial mistakes that doctors make. Come join Lisha and I as we discuss our share of financial mistakes, and some of them are very common and might resonate with you on episode this episode of Money Meets Medicine.

Why You Shouldn’t Trust the Financial Industry

Getting good financial advice can prove challenging. One reason? Trust. Here are are five reasons you should’nt trust the financial industry.

How My Investing Changed After Financial Independence

Editor: I’ve changed up the way I’ve invested additional money. I’d like to share how and why my investing has changed. Originally posted on Physician on Fire. For the first decade or so of my working career, I shoveled money into mutual funds and didn’t put much...

Are you ready to live a life you love?

© 2023 The Physician Philosopher™ | Website by The Good Alliance