Money Meets Medicine Podcast

MMM 89: Personal Finance Masochism & Physician Self-Compassion

Have you ever felt the tension between needing to save more money (or pay down debt) and the human need to enjoy today? There is a phenomenon that happens in both coaching and personal finance, people learn the tools and then use the tools against themselves. So today we are discussing why you should make that big purchase you have been depriving yourself of and how to make sure you do it in a financially smart way.

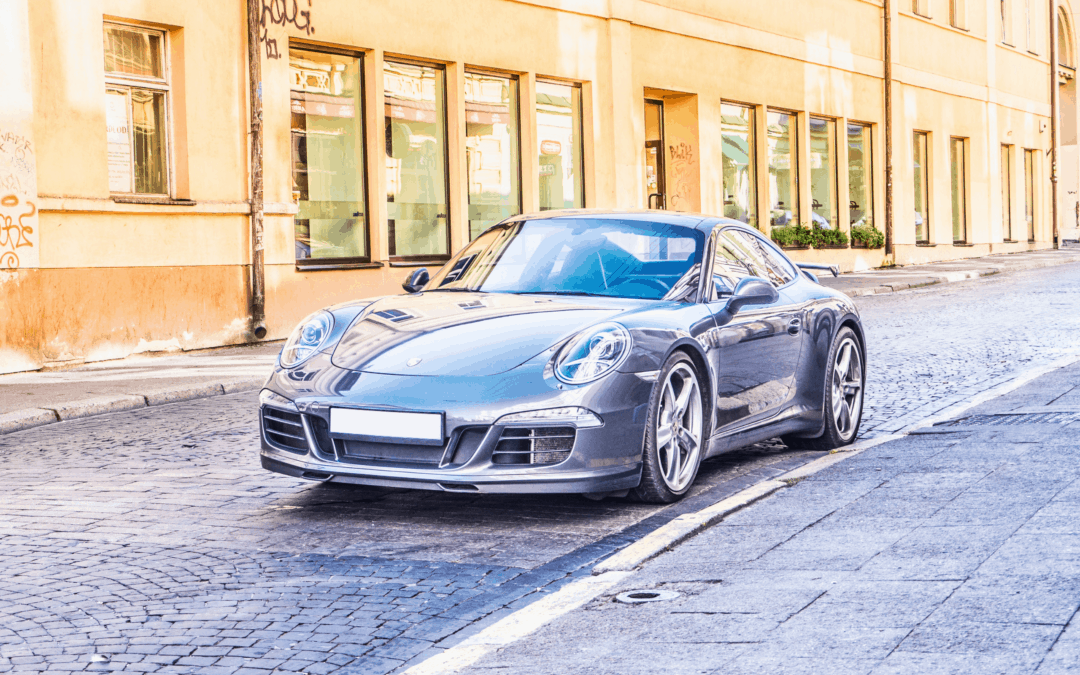

Today I want to talk about that Porsche 981 Cayman S, house, or that expensive vacation you want, and how to get it. Learn how you can save for tomorrow while you also enjoying today.

Personal Finance Vs. Physician Self-Compassion

There is a phenomenon that happens in both coaching and personal finance. Once physicians, doctors (and really anyone) learns the tools they need to better themselves (or finances), they then use the tools against themselves.

Both Ryan and I see it all the time in the personal finance and coaching world.

That is exactly what inspired this show actually.

I was on a recent coaching call with one of our clients in the Alpha Coaching Experience (ACE). This doctor in ACE was beating herself up for having an expensive apartment in a big northeastern city.

Because she had a good understanding of personal finance, she was scrutinizing the dollars she was spending that could have been building wealth instead. She was telling herself that she should move to a less expensive apartment because it was the “right” thing to do.

But is it really? That’s the question I want to answer and discuss today.

Personal Finance And Physician Guilt

Is there a purchase you’ve been thinking about?

Maybe a Porsche 981 Cayman S like me? Or maybe you are thinking about buying a bigger, nicer home? Or as travel is finally open again, you might be looking at an expensive vacation for the family?

Or maybe you are like this doctor in ACE and have thought about getting rid of something you currently spend money on because you feel that money could be building wealth?

However, there is one big obstacle in your way – guilt. Because you are a part of the physician finance community, you feel guilty or bad about those decisions.

The answer isn’t all or nothing. You need to learn to find that balance between saving for tomorrow while also using money as the tool that it is to enjoy today. Let’s get into how.

Money is a TOOL

Did you ever watch the show Ducktails growing up? (Might be aging myself there). In the show, Scrooge swims in his gold coins often. That is NOT what life is about. That is not why we save or make smart financial decisions.

Money is not the end itself. It is not the goal. Money is a tool that allows you to reach maximum happiness. It is the means to an end, not the end itself.

What makes you happy? Those things are your goals and that is what you are using your money for. What you are saving for. Why you are investing. It might be something in the short term that makes you happy or something in the long term.

You need to build a plan that will allow you to reach your financial goals when you want.

Dial down in the areas that don’t matter as much to you, so you can dial up on the things that do.

Spend Money Without Guilt

Once you are meeting your financial goals, you should spend money without guilt and regret.

Ryan had a client saving $15,000 a month based on the changes she made in her life in terms of personal finance. And even though she was doing really well, she felt like she couldn’t have a cup of Starbucks coffee because of the tools she learned in personal finance. She was hitting her finance goals, but she couldn’t separate the rules of personal finance from the things she really wants and can afford.

For me, it’s a car. And I use to think, “I teach physician finance to students every day, how can I have a really nice and expensive car?” But it’s because I was also able to meet the other financial goals Kristen and I had. So why think, “I can’t have this,” when I am meeting my financial goals.

Personal Finance is Personal

Numbers in personal finance are completely arbitrary in nature. What you think you should be saving or making is all made up. You can base it on others and what they say you should be saving, but again that is completely arbitrary.

I always ask, “who gets to decide what is enough or a little?” The answer is YOU. There is always more money you can make and more you can save. But at what cost?

You need to approach your personal finance with compassion for yourself. Whenever you find yourself putting the would “should” into your statement, you are already bringing self-judgment into the conversation with yourself. Judgment is not going to serve you.

Get More Physician Finance Support

If you need and want more guidance on how to use the tools you are learning in the personal finance space in a compassionate way for yourself, I recommend checking out Ryan’s podcast episode on his Personal Finance Rules here and checking out my episode on my personal finance rules.

In these two episodes, we discuss things like The 10% Rule, The 50% Raise, and suggest amounts of money to save as a barometer. These episodes will give you a good foundation for reach your personal finance goals. Just remember that these goals should be based on what makes you happy and not an arbitrary number. And as you move forward, do it with compassion for yourself. Don’t use these tools against yourself, only to move you forward.

What is one thing you can take away from this? Do you find yourself using the personal finance tools you learn against yourself?

2 Comments

Submit a Comment

You might also be interested in…

Following the Financial Crowd

Have you ever left a sporting event, following the crowd, and suddenly realized you were walking the wrong way? What if I told you this phenomenon has a name, and it impacts your money, too?

Understanding our own behavior when it comes to finance is essential because it helps us mitigate wrong-for-us decision making around money. Unless you know these roadblocks exist, you can’t do much to stop them from derailing your financial goals.

Last week, we shared why human behavior matters for our financial lives by taking a look at the first 5 out of 10 psychological phenomena that can (and do) affect your personal finance goals: greed, fear, ego/overconfidence, loss aversion, and analysis paralysis.

This week, we’re diving back into behavioral finance (one of our favorite topics) to share five more types of unchecked human behavior that can sabotage your journey to building the wealth you want.

Greed, FOMO, and Bad Investments

Despite our best intentions, certain emotions can keep us from building wealth. After many years arming physicians with the information they need to achieve financial wellness, I had a significant realization.

Information is one thing – behavior is another.

As the saying goes, money is 80% behavior and only 20% math.

Not only do I want to share important information about personal finance, I also want to help you recognize how certain behaviors can (and do) affect your finances.

Drawing from one of the classic books about investing, let’s go over five common behaviors that could be keeping you from achieving your financial goals.

How Doctors Can Get Good Financial Advice

Many doctors and high-income professionals hire financial advisors for any number of reasons. Either they’re too busy to handle their finances themselves, they don’t really know how to invest, or they want an expert on their side to make sure they’re on the right track.

So allow me to say from the start: I’m not against financial advisors, but I am against doctors (or anyone, really) being overcharged for bad advice.

There’s no shame in asking for help – you just want to get the help you need at a fair price.

You should be equipped enough to vet and evaluate your financial advisor so you’ll know whether they’re working well on your behalf. How can you be as confident as possible they’re acting in your best interest? This episode will help you find out.

Are you ready to live a life you love?

© 2021 The Physician Philosopher | Website by The Good Alliance

Nice read, mid 30s and we struggle with this balance as well. We save 40-50% of gross and are supposed to be able to spend the rest guilty free. The problem is it still seems extravagant to do expensive activities or buy expensive things even though we clearly can afford it. We are getting better, slowly. Did you get the Cayman? Last year, after much mental debating and seeing that we would meet our savings goals, I purchased a 993 911 Carrera 4S (in cash) to better enjoy the now while still saving for the future. It’s my weekend car and totally unnecessary but it makes me happy and is a keeper. No regrets.

I have not gotten the Caymen, yet. Still chewing on it, but as prices soar, it is a hard time to bite that bullet. Maybe in a year or so once things calm down.

The 911 is a sweet ride, and have thought about that, too, since I have 3 kids and 2 that are still small enough to go in the backseat for a Sunday drive. Enjoy it!