RCTs show that with only 6 coaching calls physicians can reduce burnout and increase career satisfaction.

What's stopping you from creating a career you love through Determined Physician Coaching?

There is a reason that medicine doesn't feel like the promised land you thought it would... It is called an Arrival Fallacy.

Each step along the way we tell ourselves we will be happier once we "arrive".

"When I finish medical school, that is when I will be happy!"

"When I finally become an attending, this will all be worth it!"

"If I changed jobs, I bet that would make it better."

Or maybe....

You are thinking about which job to take, but don't know which one will make you happy...

...so you don't make a decision at all, because you are afraid you'll get it wrong (and maybe you have before!)

You have a hard time making it to your kid's tee-ball games, recitals, and band performances...

...so you have thought about going part-time or changing jobs.

You finally "made it" as an attending, yet you keep wondering why you aren't happy...

...and all of the things you have tried like buying the house, the car, or even getting a new job haven't made it better.

You don't have the money you need to walk away from medicine or go part-time...

...so you keep showing up, even though you dread the next shift.

You feel stuck because of student loan debt, non-competes in your contract, and having no leverage.

...so you have thought about a side-gig, but you don't know where to start.

If ANY of that resonates with you,

you are the victim of a broken medical system.

But it doesn't have to be this way!

Imagine if you became a Self-Determined Physician who...

-

Created the time to make it to your kids' tennis practice and tee ball games!

-

Built the Financial Freedom you need to actually live a life you love!

-

Looked forward to your next shift at the hospital or clinic.

-

Knew how to negotiate for the change you need at your job!

-

Were present at home as a spouse, parent, AND physician!

-

Left work at work.

-

Had help thinking through your career transition and burnout.

-

Had a community of self-determined doctors on the same journey as you.

-

Knew exactly what you needed to do to fix your career.

-

Became the best version of yourself (or found the old you).

These are the words of doctors just like you who became Self-Determined Physcians through...

Determined Physician Coaching

Here is what you get inside of DPC:

Our Exclusive Step-by-Step System to Physician Freedom

Our step-by-step system to creating the necessary time, financial freedom, and mindset shifts to live a life you love.

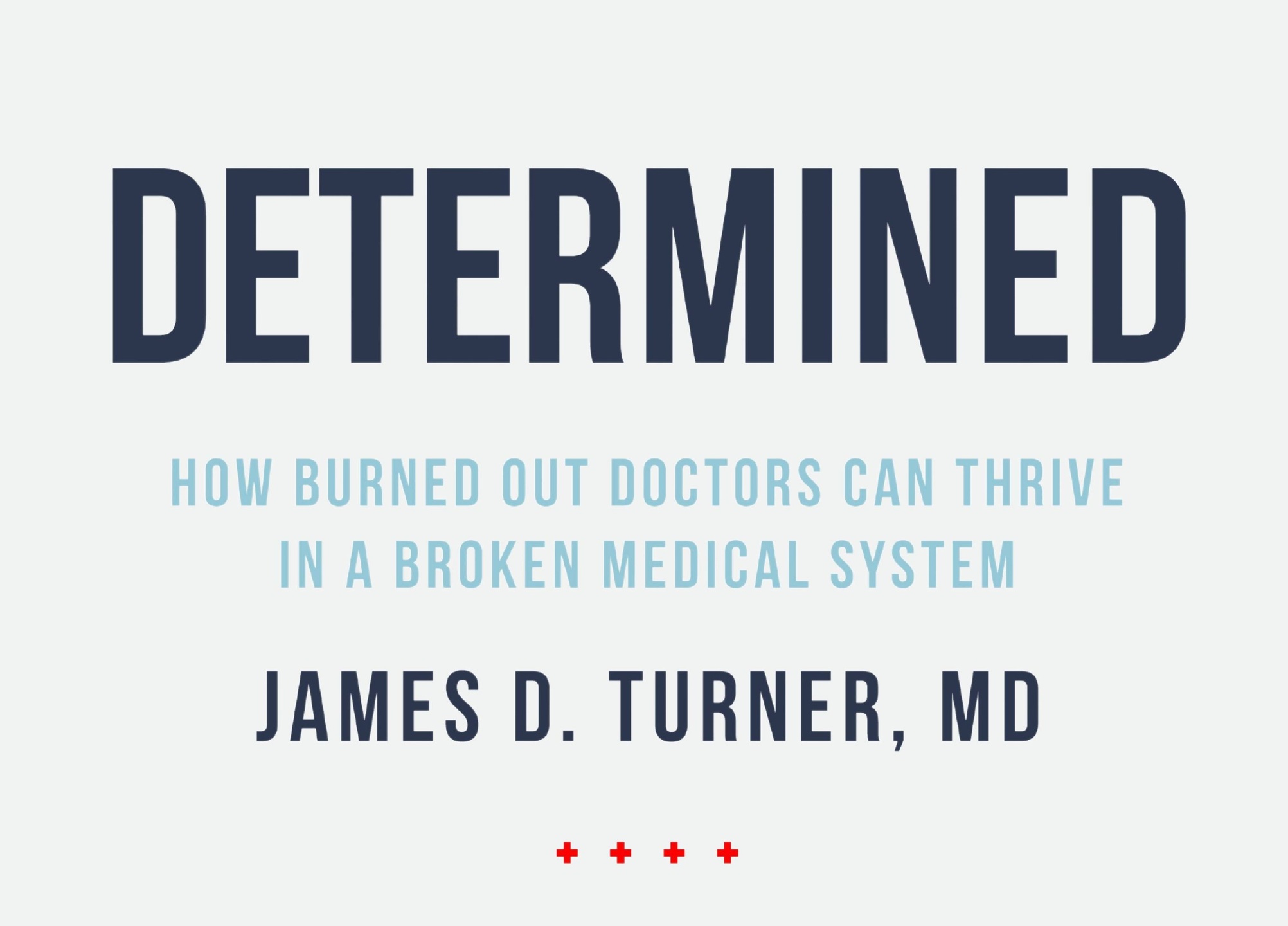

Jimmy's audiobook Determined: How Burned-Out Doctors Can Thrive in a Broken Medical System

Learn how to become a Self-Determined Physician! And you can do it all while driving to work with our new audiobook!

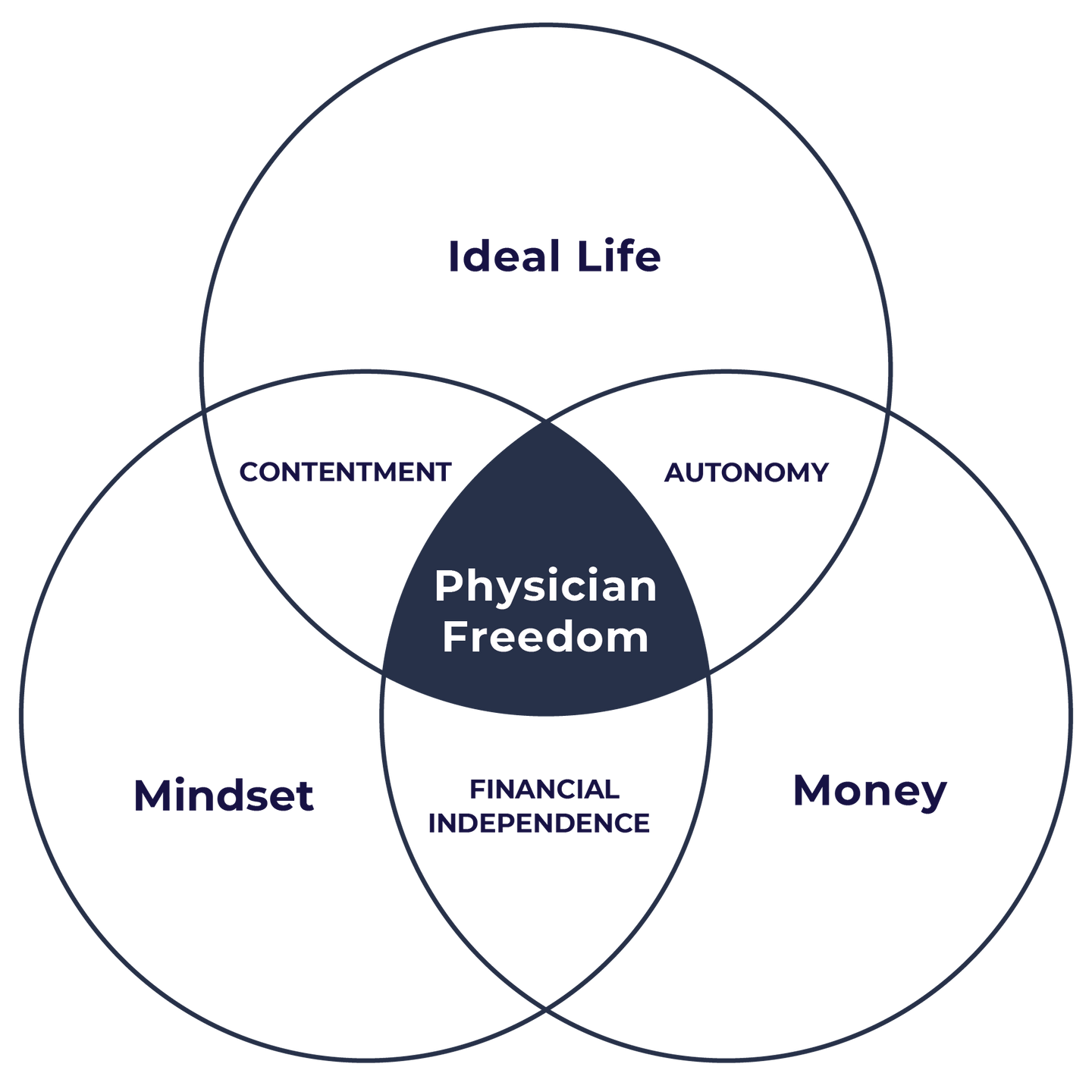

The 3 Freedoms You Will

Master Inside of ACE:

Financial Freedom

Like gas for the car of work-life balance, money is what allows us to practice medicine on our terms. iIn ACE, we teach you how to create financial freedom so that you can live a life you love.

Freedom of Time (Work-Life Balance)

We teach you how to get your time back so that you can spend it doing what you want with those who matter most in your life.

Mindset

Need help thinking through a career transition? Looking to stop letting your job control how you feel? Do you want to learn how to say "no" to anything that doesn't make you say "Hell Yes?" That's all about mindset.

Because when you create the financial freedom, time, and mindset shifts you need… THAT is when you can take back the autonomy and control over your life.

What is Included in Determined Coaching?

Top features

Physician Client Stories:

Jen McAllaster, MD

General & Bariatic Surgeon

"I wish I would have found physician coaching and the Alpha Coaching Experience at the very beginning of my career."

Carlos E. Pineda, MD

Vascular Surgeon

"My only regret is not having done this sooner"

Megan Ringle, MD MPH

Neonatologist

"Alpha Coaching has helped me work toward the big picture. I wish I had found it sooner...and I would recommend it to anyone!"

Joseph Mahon, MD

Reconstructive Urologist

"The ROI is off the charts!"

What if you had all the tools you need to find the freedom to practice medicine however you want?

- To leave work at work, and be home when you are home.

- To say "no" to the online modules, patient inbox messages, and endless email requests.

- To stop feeling trapped by non-competes, conflict of interest policies, and student loan debt.

- To no longer feel like there is not enough time in the day to get everything done...

- To put yourself first so you can show up as the best version of yourself.

-

To have the freedom to practice medicine because you want to and not because you have to...

Today, there is hope.

Right now, there are answers.

DPC can help you!

Dr. Michael Runyon, MD

Emergency Medicine

"I have to admit that I was a bit of a coaching skeptic, but I am so glad I that I took the leap because the [Determined Physician] Coaching program has been a truly transformational experience!

This has helped free me from the anxiety of my to-do list and empowered me to live in the present, secure in the fact that I am exactly where I need to be at any given moment in time...

and that I have an intentional plan for managing my other responsibilities. I highly recommend the Alpha Coaching program to anyone who wants to live a more content and intentional life.

Coaching is the Solution:

A Transformational Experience that helps doctors who feel stuck, trapped, and burned out in medicine create a life they love.

Maybe you aren't burned out in medicine ...

but still want coaching...

There are many reasons doctors join Determined Physician Coaching.

- You are looking for a transition of some kind (a new job, how to go part-time, etc), but you don't know exactly how to take the next step.

- You want to learn how to negotiate for the change that you need.

- You have seen the amazing impact coaching has had on other doctors, and want to try it for yourself.

- Those who want a like-minded community of physicians who are tired of the status-quo

- You are struggling with imposter syndrome.

But coaching costs too much!!!

Or Does it?

Don't take it from me...

take it from one of our clients (a Hem/Onc doc) who said,

"I wanted to thank you again for your help with negotiation.

My bonus for contract year #2 came in and worked out to be a $293,000 (63%) raise year from year.

Crazy to think how much money would have been missed out on if I chose to avoid the discomfort of the negotiation. I wouldn't have been able to do it without you."

Even if there weren't a financial ROI, how much is it worth to you to create work-life balance? Or to look forward to your next shift?

You and your family can't afford NOT to invest in you finding the freedom to live life on your own terms!

Joining DPC and Learning The 3 Pillars to Physician Freedom is an investment in you.

After all, if you don't take care of yourself first, how can you properly take care of anyone else in your life?

It is like oxygen on a plane. If the plane starts going down, you are instructed to put your oxygen on first.

Why? So that you can help other people next.

We are no good to our families or our patients if we are worn out, anxious, fatigued, or overwhelmed.

You deserve to be happy. And we want to help!

By the end of Determined Physician Coaching, you will be able to:

- Create a life that actually makes you happy.

- Create a path to financial independence through The Hybrid FI Model.

- Put an end to burnout, imposter syndrome.

- Know how to get started on that non-clinical business you've always wanted.

- Create the work-life balance you've chased but has been out of reach.

- Find "your people" who surround you with a community of support.

Serena H. Chen, MD

Reproductive Endocrinology

"The coaching has been invaluable to me... I can't say enough about the experience."

Drew Cronyn, MD

Pediatrics

"When I started I thought the price was high...It was well worth it. I would probably say he could charge 3 to 4 times the amount and it would be worth it. This will undoubtedly buy extra years in my career."

If You Want to Practice Medicine Because You Want To

( and NOT Because You Have To)...

You have two choices:

1) Stay Exactly Where You Are, and...

- Remain burned out in medicine until you've finally saved enough to walk away (if you can learn how to save in the first place).

- Keep feeling like an unappreciated cog-in-the-wheel at work.

- Continue sacrificing yourself while they take advantage of your altruism.

- Make excuses about why you missed the practice, game, or recital (again).

- Constantly feel overwhelmed and stressed.

- Experience the constant stress from busy clinics, OR schedules, or shifts.

2) Start your 30-day free trial inside of DPC, and ...

- Create work-life balance so that you can be present at home and at work.

- Generate the financial freedom you need to make medicine optional.

- Leave work at work.

- Finally find contentment.

- Eliminate burnout.

- Stop feeling overwhelmed.

- Become the captain of your ship.

- Become the best spouse, parent, and physician that you can be.

What does the evidence say about physician coaching?

Professional Coaching has been shown to improve quality of life and decrease burnout in working physicians (JAMA 2019).

This was with just ~8 coaching calls (from non-physicians). And in DPC we give you MUCH more value than 8 calls, all for the about same cost they paid in the study!

Meet one of our coaches -

Lil Surprenant MD

More Physician Client Success Stories:

Ryan Stringer D.O.

Emergency Medicine

"It's incredible to see the difference this course has made not only in my professional life, but my personal life at home."

Dr. Andrew Hart

Hematology/Oncology

"I know in the future as I learn more and get coached more it's only going to keep getting better and better."

You may be thinking...

"How will I find the time for a coaching program? I'm already overwhelmed!"

You aren't alone!

Most hard-working doctors feel like there is never enough time in the day (which causes them to feel overwhelmed - sound familiar?).

THAT is why we offer the perfect amount of one-on-one coaching for busy doctors (the exact number shown to improve career satisfaction and burnout)

PLUS... we teach our clients how to become time-management gurus through our Hell Yes Policy and A Priori Planning processes inside ACE.

Because, at the end of the day, it isn't really about not having enough time, is it? We all get 24 hours in the day no matter who we are.

Why not make the most of the time you get?

Testimonials

Sourendra Raut, MD, CM

Orthopedic Surgeon

" This coaching experience is an excellent combination of one-on-one and group sessions that allows you to generate insights into many of the common issues that we as physicians struggle with on a regular basis.

Through the guidance of Jimmy and his coaching colleagues, I have been able to modify my behaviors to effectuate positive changes in my life. I would wholeheartedly recommend this course for any healthcare providers who want to start approaching their careers and lives in a more sustainable manner and need some guidance and support to get this accomplished."

Dr. Adam S.

Emergency Medicine

"Joining this group has been the best professional decision I've made all year.

Life, career, finance - nothing is off limits and this program has taught me how to be more intentional in all aspects of life.

I cannot speak highly enough about this coaching program. It's something I recommend to friends and co-workers regularly - no matter what career stage you are in, this will be well worth your time!"

Dr. David

Hem/Onc

"I just wanted to thank you again for your help with negotiation.My bonus for contract year #2 came in and worked out to be a $293,000 (63%) raise year from year.I'm now working on negotiation on behalf of all 8 docs.Crazy to think how much money would have been missed out on if I chose to avoid the discomfort of the negotiation. Wouldn't have been able to do it without you.

Meet Our Amazing Alpha Coach Team

Lil Surprenant, MD

Internal Medicine Hospitalist

My name is Lil Surprenant and I've worked as an IM hospitalist for many years. I'm originally from South Carolina, trained in Utah and traveled here and there before landing back home. I've worked in multiple hospital systems both big and small and have travelled the road from serious burnout to real satisfaction at work.

On the personal side, this many years on the planet has allowed for a lot of experiences that give me perspective as a coach...divorce, bankruptcy (yes, I'm telling you this on a bio!), remarriage, sprinkle on a sustained 75 lb weight loss and lots of living in between. I'm the person that you can bring your stuff to, no matter what it is or how you feel about it now. I've got you.

Daniel Presutti, MD

Anesthesiologist

Originally from Connecticut, Dan is currently an academic anesthesiologist in North Carolina. Interestingly, his path into medicine was not the result of 20+ straight years of academics.

Dan earned his Bachelor of Science from the United States Military Academy at West Point. Post college graduation, Dan served as an Army Officer for 5 years, including deployment in support of Operation Iraqi Freedom (2003). It was during this time of service when he made the decision to change career paths and pursue medicine.

Dan’s wife, Jenna, is a CRNA and there’s never a dull moment with 3 kids, a Saint Bernard, and a Bernese Mountain Dog! Dan brings a variety of life experiences, including a divorce, that have helped shape his views on life. He coaches physicians in areas of interpersonal relationships, life balance, and building self-worth and goal orientation.

Krystal Sodaitis, MD, MPH

Pediatrician

Welcome! I am a board-certified pediatrician, fellowship-trained in academic general pediatrics. I transitioned from academic medicine to working for a health insurance company 7 years ago and I am currently a Senior Director.

I am a coach, pediatrician, wife, mother, health care executive and, life long learner. Externally I seemed to “have it all figured out” yet was filled with doubt, self-hatred and Imposter Syndrome. All that changed when she found coaching. I coach myself every day and use it as a leadership tool for my team and to nurture the leader in me.

Why do I love coaching gifted people? Because the smarter someone is the more likely they are to have an area that are NOT good at. This fact often causes a lot of stress, pain and anxiety. This is even more likely if they have a diagnosis that affects their ability to focus or learn. If this sounds like you, I’m your coach.

Elizabeth Chiang, MD, PhD

Opthalmologist/Oculoplastic Surgeon

Call me Elisa, short for Elizabeth. I am a board-certified ophthalmologist and fellowship-trained oculoplastic surgeon who has worked both in private practice as well as for a bureaucratic hospital system.

The hospital system, along with taking 24-7 call, resulted in burnout. Although I had the financial piece of the three pillars figured out, it took coaching and working on my mindset to overcome burnout. I dove into the world of personal finance and investing when I was in the grad school years of the MSTP (combined MD/PhD program) and set my mind toward FIRE before the term became popularized. I started investing in stocks and mutual funds as a graduate student. After reading Rich Dad, Poor Dad, I tackled real estate investing and flipped two houses before graduating medical school. I continue to invest in real estate both actively with rental property I self-manage and passively with syndications and real estate funds.

I can help you overcome burnout, get out of the trap of arrival fallacy, and build your path to financial independence while enjoying the journey to get there. I can’t wait to work on your money mindset or help you toward whatever goal you want to accomplish.

Pete Baum, DO

Family Medicine

I am a husband, father, outdoor enthusiast, life coach, and Family Medicine Physician in the greater San Diego, CA area.

Like many doctors, I burned out early on and wasn’t happy. Life coaching helped me to regain control of my life, one thought at a time. Yes, it’s that simple…

I can help you to work through and overcome burnout, self-doubt, and imposter “syndrome.” I will help you discover insights into your relationships and empower you to change so you can start showing up as you want to be. Whether it's money mindset, your financial goals, or starting a side-gig - we can tackle it! Every topic is coachable. Let’s get started!

Who is the creator of Determined Physician Coaching?

Jimmy's background as a husband, father, academic physician, and side-hustle extraordinaire led him through a dark and lonely road through burnout (and Grave's disease).

His drug of choice to help him get through it all was an arrival fallacy - the idea that the "next" accomplishment, purchase, or accolade would finally make him happy.

Through financial freedom and a shift in his mindset, Jimmy was able to create work-life balance and practice medicine on his terms (yes, he still practices medicine).

He now loves the journey (and the life he and his family live), and now helps other doctors do the same.

Jimmy is the host of The Physician Philosopher podcast and the author of two best-selling books -

- Determined: How Burned-Out Doctors Can Thrive in a Broken Medical System; and

- The Physician Philosopher's Guide to Personal Finance.

When not practicing anesthesia, Jimmy enjoys golf (don't confuse this for being "good" at golf!) and hanging out with Kristen, and playing chess, sports, and video games with his kids.

Jimmy Turner, MD

I would highly encourage anyone considering this course to take a leap of faith and enroll now. The value that you will receive will far exceed the time and money that you will spend on this course. Participating in this coahcing experience may be one of the best decisions I have ever made.

M.H., MD - Emergency Medicine