The cost of medical education

While any high-income earner can build wealth if they go about it the right way, not every physician obtains this. In fact, many do not. It is a common assumption that doctors are “rich,” but those making these assumptions often do not know the whole story. We start with what feels like insurmountable debt:The median cost of a private medical education is more than $314,000.

When I finished training, the interest rate for graduate student loans was 6.8%. Let me say that $300,000 accumulating at 6.8% interest can be devastating. Particularly if one has chosen a lesser earning field in medicine (family medicine, pediatrics, general internist, etc).Should I go to medical school?

A recent study published in the AMC journal of Academic Medicine looked into the cost of medical school. It compared various ways of paying for the cost (Public Service Loan Forgiveness, Military scholarships, self-paid, federally guaranteed loans, etc). It further separated the study into four different fields of medicine with wide ranging income levels. The four fields that they chose were general internal medicine (assumed income ~$175,000), Opthalmology (~$215,000), general surgery (~$300,000), and orthopedic surgery (~$409,000). Through this study, utilizing what is called Net Present Value (NPV) analysis, they determined at what point people who took on $180,000 in loans started to catch up to (and pass) students who took on a national service scholarship. For those that entered a high paying specialty ($300-400,000), this took between 4 and 11 years. For those that entered into primary care…it never happened. You read that right. This is where the question of “Should I go to medical school” becomes difficult to answer financially. It really does depend on how much debt you have and what specialty you are able to (or decide to) go into. Choosing a specialty is somewhat self-determined if you are a competitive applicant; other less competitive applicants who are limited by USMLE scores, poor letters, or poor academic performance in medical school do not necessarily have a variety of choices to choose from.Does it make more sense to go into another field?

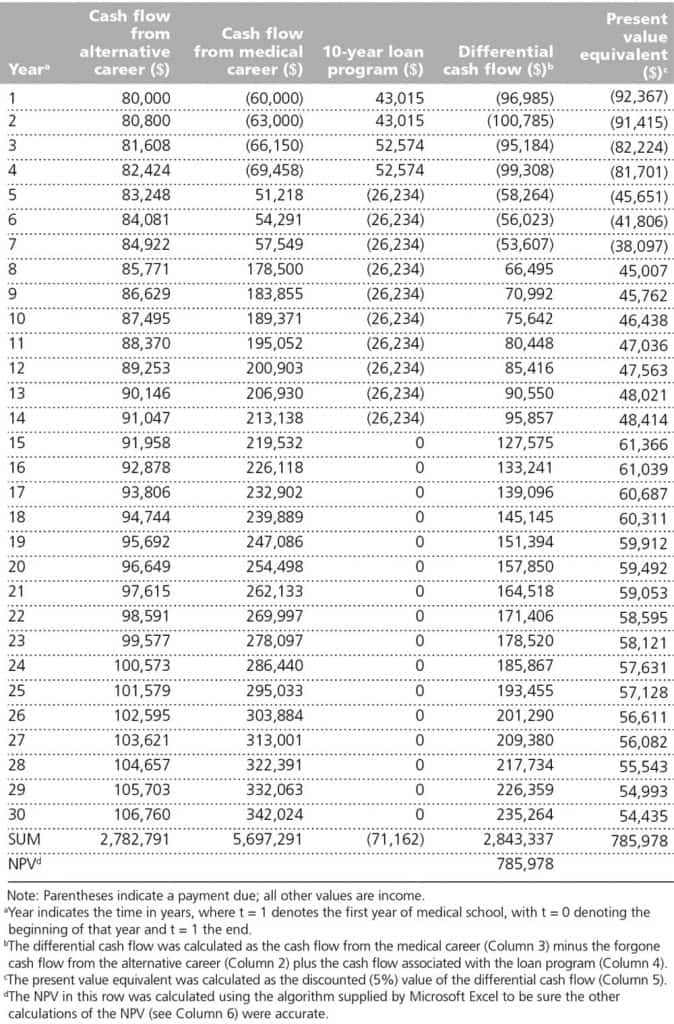

Utilizing the similar NPV method mentioned above, another study (or actually, a commentary) published in the same journal looked into whether people would be better off going into an alternative field rather than going into medicine. From that study comes the following table comparing two different careers:

Assumptions First

- The salary of the alternative field is shown in the second column (Starting at $80,000). This number can obviously vary depending on the alternative job.

- This chart shows a student taking on the typical debt of medical school (~$190,000) as a negative value shown in parenthesis in column 3. This is then followed by three years of residency and what looks like a salary on par with most internal medicine physicians.

- The student loan accumulation at end of medical school in the example above is a little more than $190,000

- In the student loan column, it appears that the resident was paying back around $26,000 in student loans during their 3 year residency, which is not typical.

What does this mean?

This means that if you can find a non-medical job providing more than the income listed above or if you are going to choose a low-earning medical specialty (pediatrics, family medicine, etc), it may not make financial sense to become a physician.

However, if you have a way to minimize your debt (self-paid, family paid, scholarship, military) or you are going into a high-earning specialty (>$250,000) then the decision to pursue medicine makes plenty of financial sense.

There are, of course, many other parts to this decision. Potentially delaying your life while in medical school. The psychosocial aspect of going into medicine. The presumption by everyone that you are loaded when you are really paying off boat loads of debt. Financially, though, the above line of reasoning probably holds.People often ask, “Should I go to medical school?” What do you think? Is going into medicine a financially wise decision? Or would you recommend someone choose a different path?

TPP

This isn’t the most accurate. Many Family Medicine jobs start with a $200-220 gaurantee and can easily surpass that once established. That being said it’s not wise to go into medicine for the money. That will just lead to disappointment.

I agree that the numbers given in that study are not exactly accurate for each speciality but liked the fact that it gave a range of incomes. While family medicine may not be accurate the lowest income they gave is substantially more than a pediatrician makes.

Money should not be the sole determining factor about choosing to go into medicine, but thinking about this before it’s too late is the point of this post. I have colleagues that have 400,000 in debt because they chose to go a private medical education route instead of going to state school and regret it deeply.

That isn’t the case for everyone, obviously. This provides good food for fodder.

Not sure how old this blog entry is but as a parent of a son beginning med school in a few months it was interesting reading. My son worked in banking for 2 years when he decided he hated it and wanted to go into medicine . My husband is an anesthesiologist so my son had grown up around medicine as a career. After going to a post baca program ($35,000) to take all the science classes he was accept into a very good private school. In our state the medical school is about $10,000 less than the school he is attending. So really the 4 year difference isn’t that much and his school has a better reputation . Anyway I ran the numbers comparing the numbers of a 40 year career in commercial banking versus s 30 year career in medicine. Then subtracted $300,000 for 4 years and he still comes out ahead by about double in lifetime earnings! I mad assumptions of course butvplugged in average income for Middlr earning specialty. The big difference is WE are paying gor his tuition. But we can afford to and he’ll be doing something he likes.

Hey Ellen,

Thanks for the comment! The post isn’t that old (this website has only been up for about 7 months at this point). Feel free to share it with your son, the topics we cover on this site are – unfortunately – left out of the curriculum of the vast majority of medical schools.

The numbers that are normally missing in your sort of calculation is a savings rate of 20% put into the market averaging 6-8%. Given the career your son is taking, he is now going to make no income for four years. Make the median income (Where many residents find it hard to save) for 3-5 more. Plus a possible additional fellowship. What this results in is 7-12 years where there is no saving in the first four years, and only about $10,000 – at best – being saved for the following 3-8 years.

The fact that you are paying for his tuition will save him a lot of pain. 80% of medical students do not have that happen for them, and so your son will greatly appreciate that head start. That will be a large part of his success as most of us have to pay off those loans over 2-5 years after finishing before we can save substantial amounts of money.

Either way, good job Mom on looking out for your son! Check in on him from time to time as the going gets tough in the years ahead.

TPP